Last week, I published an article talking about how a tiny bit of financial engineering can make you 20-30% richer in retirement. In this article, I am going to talk about how a little bit more financial engineering can more than double your retirement income.

I found out this week that vanguard is charging me 100s of dollars to manage my 401K. While that did surprise me and I will get into details later, it isn’t the discovery which is making me claim that you can more than double your retirement income.

I am referring to the returns vanguard funds have delivered over the years.

Vanguard Fee:

While talking to a vanguard representative last week, I learned that vanguard is charging me 0.04% PER MONTH for managing my money. I was shocked to learn this. This equates to 0.48% per year which is more expensive than most of the ETFs out there. $XLK is 0.10% and $SMH which is the best performing is at 0.35%, still lower than Vanguard managed fund.

While the management fee percentage goes down as your invested capital grows, you end up paying more each month. Even though your % fee is coming down, because (assuming) your base keeps growing, in dollar terms, you are paying more each month and will continue to do so until perpetuity.

If you have $100K invested, you are paying $80 a month to vanguard to manage your money. I would actually be fine with this, if the returns were anything close to worth it.

Vanguard Returns:

The fee alone made me want to manage my own money. But I was shocked when I compared the performance of Vanguard funds vs the funds that I recommended in my article: The Ideal US Equity ETF Portfolio.

Since July 2015 my retirement account has returned a total of 25.66%. I am up 2x+ that return in my brokerage account, THIS YEAR ALONE. However, since I wrote this article and shared this finding with a few friends, they were not as alarmed as I was. For me 25.66% over 8 years is not good enough.

Here is a screenshot of my Vanguard growth over the last 8 years:

Vanguard Vs WealthWise:

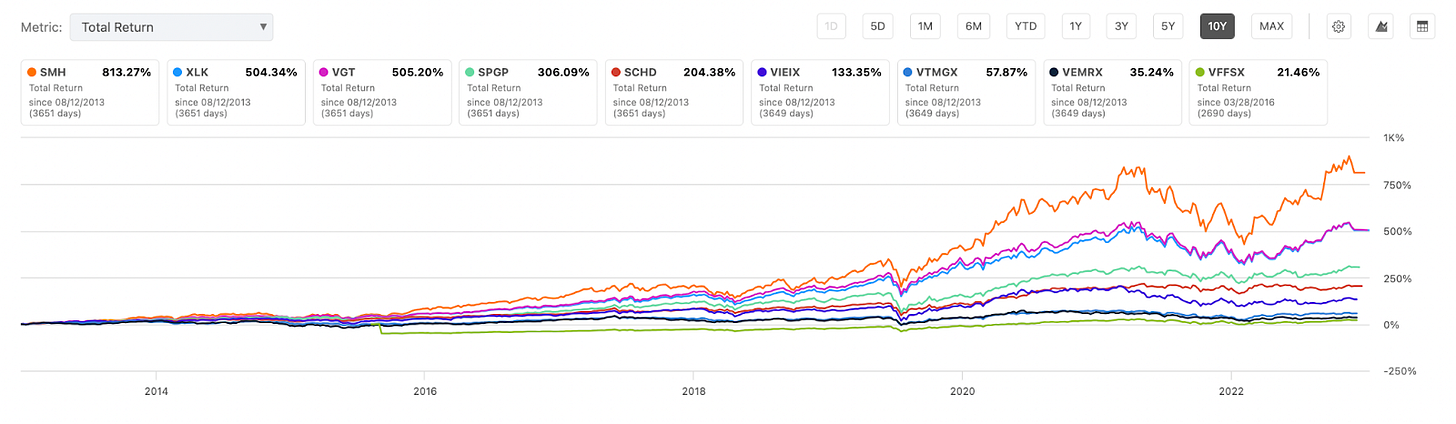

To get further insight, I did what I like to do best, compare Total Return across multiple time frames on Seeking Alpha. And here is the money shot:

Source: Seeking Alpha (Seeking Alpha Link to Compare)

Sidenote: $SMH was not in my previous article but I think it’ll make the cut, the next time I do this analysis. I cannot think of any other business more critical to the next decade than semiconductors.

As you can see, there is literally no comparison between the Vanguard Funds performance and the ETFs I recommended.

In the last 10 Years, the Total Return for some of the funds I recommended has been:

$XLK: 504.34%

$SPGP: 306.09%

$SCHD: 204.38%

The top 3 funds that Vanguard managers put me in had a total return in last 10 years of:

$VIEIX: 133.1%

$VTMGX: 56.91%

$VEMRX: 33.44%

My retirement portfolio is set to the highest risk setting and I have decades left in the market (I am nowhere close to retirement). So I don’t see any reason for me to want to be this defensive this early in my career.

I am disappointed in myself to have settled for 25.66% return over the last 8 years and it’s time to do something about it.

What I am Doing About It:

After I found out about this, within a week (last week), I moved my funds over to a self managed IRA account at Fidelity. This week I start layering into the ETFs mentioned in my article The Ideal US Equity ETF Portfolio. Given that this article was specifically focused on US exposure only, I will be adding some emerging markets and some alts to my retirement account. I will share the Ideal Retirement Portfolio once I’ve built it, subscribe to keep up.

Fidelity Vs Robinhood:

Initially I wanted to move my funds to Robinhood to secure that 1% match that Robinhood provides on direct rollovers. However, I eventually decided to go with Fidelity given that I already have a lot of exposure to Robinhood and if I moved my 401(k) over to Robinhood, then I would have all my eggs in one basket and the insurance Robinhood provides would not cover my entire balance with Robinhood.

Here are some links from Fidelity that I found very useful throughout the process:

What to do with an old 401(k) - 4 Options

How to move your old 401(k) into a rollover IRA - Step by Step Guide

How did you come down to Fidelity and Robbinghood? I have accounts with Fidelity and Schwab. If I could, I would transfer the Fidelity accounts to Schwab. Fidelity restricts trading on some shares and has generally been unimpressive when I needed to call them.

Better than Robbinghood, but still...

Enjoying your articles. Keep it up!