Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial & $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist.

Editor’s Pick:

UPS 0.00%↑ NVDA 0.00%↑ #Figure02 #FigureAI

[News] United Parcel Service eyes using humanoid robots for the first time with startup Figure AI Inc.

Sources told Bloomberg that UPS (NYSE:UPS) and Figure first began having discussions about a partnership last year and restarted the talks in recent months.

UPS (NYSE:UPS) and FedEx (FDX) both use robots in their operations, but neither company currently uses humanoid robots.

Figure 02 is Figure AI's next-generation model that was introduced in August 2024.

Figure 02 features integrated cabling, a torso battery, and enhanced computing power using Nvidia (NVDA) RTX GPU-based modules.

It includes 6 RGB cameras, microphones, speakers, and a custom AI model developed with OpenAI for conversational abilities.

The redesigned hands have 16 degrees of freedom and can carry objects up to 25kg.

Figure 02 has been tested in real-world industrial settings, such as a BMW (OTC:BMWKY) plant.

Link to Seeking Alpha News Article - Apr. 28, 2025

AMZN 0.00%↑ #ProjectKuiper #Starlink

[News] Amazon successfully launches first set of internet satellites to rival Starlink

A United Launch Alliance rocket deployed the 27 operational broadband satellites in low-Earth orbit on Monday, after the launch was delayed for nearly three weeks due to inclement weather.

The satellites "are operating as expected," Amazon (NASDAQ:AMZN) CEO Andy Jassy announced on social media.

Amazon's (AMZN) first-generation internet-from-space constellation will include more than 3,200 satellites, with more than 80 launches planned for deployment. Launch partners include United Launch Alliance, Blue Origin (BORGN) and SpaceX (SPACE).

Link to Seeking Alpha News Article - Apr. 29, 2025

GOOG 0.00%↑ TM 0.00%↑ TSLA 0.00%↑ #Waymo #CyberCab

[News] Waymo, Toyota to collaborate on self-driving tech for personal cars

Alphabet's (NASDAQ:GOOG) (NASDAQ:GOOGL) Waymo and Toyota Motor (NYSE:TM) announced a preliminary deal to jointly explore developing a new autonomous vehicle platform and ways to enhance next-generation personally owned vehicles.

Toyota's (NYSE:TM) autonomous driving technology unit Woven by Toyota will also join the potential collaboration, contributing its strengths in advanced software and mobility innovation.

Last week, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) CEO Sundar Pichai had signaled the possibility of personal ownership of Waymo robotaxis in the future, setting it up for a direct competition with Tesla’s Cybercab.

Link to Seeking Alpha News Article - Apr. 30, 2025

[News] Taiwan Semiconductor breaks ground on third fab in Arizona as US footprint expands

Taiwan Semiconductor Manufacturing (NYSE:TSM) held a groundbreaking ceremony for its third fab in Arizona, as the world's most prolific chipmaker continues to build out its footprint in the U.S.

TSMC's first Arizona fab started production during the fourth quarter of 2024. It utilizes N4 process technology. The second fab, which utilizes 3-nanomenter process technology, is complete and is expected to begin production soon. The third, and eventual fourth fab, which is slated to break ground later this year, will utilize N2 and A16 process technologies. The Taiwan-based company then plans to build a fifth and sixth fab in the U.S., which Wei said will use "more advanced technologies."

"We also plan to build two new advanced packaging facilities and establish an R&D center in Arizona to complete the AI supply chain," Wei added. "Our expansion plan will enable TSMC to scale up to a giga-fab cluster to support the needs of our leading-edge customers in smartphone, AI and HPC applications."

Link to Seeking Alpha News Article - Apr. 30, 2025

MSOS 0.00%↑ $GTBIF

[News] Trump’s DEA pick to prioritize cannabis rescheduling review if confirmed

President Donald Trump’s nominee to lead the U.S. Drug Enforcement Agency (DEA), Terrance Cole, on Wednesday, said once confirmed, he would prioritize an ongoing review at the agency to reclassify marijuana as a less dangerous drug under the Controlled Substances Act.

However, he refused to comment on his views on the proposal, which, if approved, will categorize marijuana under Schedule III alongside medications such as ketamine from its current position in Schedule I, reserved for drugs such as heroin.

Facing his confirmation hearing before the Senate Judiciary Committee, Cole noted, “I need to understand more where [agencies] are and look at the science behind it and listen to the experts and really understand where they are in the process.”

In response to a question from Sen. Alex Padilla (D-CA), the former DEA official added, “I’m not familiar exactly where we are, but I know the process has been delayed numerous times—and it’s time to move forward.”

“If confirmed, it’ll be one of my first priorities when I arrive at DEA to see where we are in the administrative process,” Cole said in regards to cannabis rescheduling.

Link to Seeking Alpha News Article - Apr. 30, 2025

[News] Aurora Innovation launches the first commercial self-driving truck service in the U.S.

Aurora Innovation (NASDAQ:AUR) began regular driverless customer deliveries between Dallas and Houston this week after completing its safety case. To date, the Aurora Driver has completed over 1,200 miles without a driver. The milestone makes Aurora the first company to operate a commercial self-driving service with heavy-duty trucks on public roads.

Aurora's (NASDAQ:AUR) flagship product, the Aurora Driver, is an SAE L4 self-driving system that is first being deployed in long-haul trucking. The launch customers are Uber Freight (UBER) and Hirschbach Motor Lines.

Looking ahead, Aurora (AUR) plans to expand its driverless service to El Paso, Texas and Phoenix, Arizona by the end of 2025.

Link to Seeking Alpha News Article - May 01, 2025

[News] Microsoft silences doubters with Q3 results, proves itself AI winner: analysts

"So far in FY25, AI services contributed 12% points of growth to Azure in Q1, 13% points in Q2, and now surging to 16% points in Q3. The Q3:25 3% sequential step-up in AI services growth contribution to Azure is the second highest in magnitude based on historical data available, only trailing the 4% sequential increase from 5% in Q1:24 to 9% in Q2:24,” J.P. Morgan analysts, led by Mark Murphy, said in a Thursday note.

Link to Seeking Alpha News Article - May 01, 2025

FXI 0.00%↑ SPY 0.00%↑ DIA 0.00%↑ QQQ 0.00%↑

[News] China says it's assessing U.S. initiative on trade talks

China said Friday it is evaluating proposals by the United States for tariff negotiations, aimed at resolving a trade war that has unsettled financial markets, but wanted Washington to show "sincerity".

Senior U.S. officials have reached out recently “through relevant parties multiple times,” hoping to start negotiations with China on tariffs, the commerce ministry said in a statement.

"What China wants to emphasize is that in any possible dialogue or talks, if the United States does not correct its wrong unilateral tariff measures," it means that the US has "no sincerity at all and will further damage the mutual trust between the two sides."

The Trump administration slapped tariffs of 145% on imported Chinese goods earlier this year, prompting Beijing to impose retaliatory levies of 125%.

Link to Seeking Alpha News Article - May 02, 2025

Every Recession Begins With a Slowdown | TCAF 190

On episode 190 of The Compound and Friends, Michael Batnick and Downtown Josh Brown are joined by Neil Dutta of RenMac to discuss: the risk of recession, what's really behind Trump's tariffs, the Fed's next move, the explosion of AI, and much more!

Are we past peak trade uncertainty? - Timestamped

Josh Brown does it again, calls how the tariff issue will resolve and I concour - Timestamped

What makes me bearish - Timestamped

Why shit hasn’t hit the fan yet - Timestamped

Why Neil thinks Trump is not bluffing - Timestamped

Link to Full Video (01:25 Hours) - May 02, 2025

News, Facts, Analyst & Market Commentary - Short Reads:

[Newsletter Exclusive] CrowdStrike unveils new AI agents for cybersecurity

CrowdStrike (NASDAQ:CRWD) unveiled Charlotte AI Agentic Response and Charlotte AI Agentic Workflows under its security operations center, SOC.

The company said that Charlotte AI unites intelligent automation with human cyber expertise, accelerating detection, investigation and response across the AI-native SOC.

In addition, CrowdStrike noted that the AI-native CrowdStrike Falcon platform is now cybersecurity’s intelligent reasoning AI platform, that draws conclusions without human prompts and takes action with bounded autonomy.

Link to Seeking Alpha News Article - Apr. 28, 2025

[Newsletter Exclusive] Taiwan Semiconductor sees bullish views at BofA after Technology Symposium event

The analysts noted that the main message was clear — "Al is still in its early stages, and TSMC is laying the groundwork to support the substantial semiconductor demand growth toward and beyond the US$1 trillion mark by 2030."

In addition, the analysts said that TSM reaffirmed that Al datacenter momentum remains strong into 2025, boosting leading edge nodes and advanced packaging. Edge Al is rising quickly, with XR goggles, wearables, IoT and radio frequency, or RF, shifting to FinFET-class logic.

Lin and his team said that the company also noted that Automotive, while soft in the short term, continues to grow structurally as semi content rises. Auto platform is upgrading toward N5A and N3A.

TSM also sees humanoid robotics, 6G, and WiFi 8 as long-term tailwinds.

The Taiwanese tech giant is widening tech portfolio from high-end to mass market. TSM is introducing A14 (set for 2028 production) and A16 (AI/HPC, second half of 2026), among other things, the analysts added.

Link to Seeking Alpha News Article - Apr. 28, 2025

GOOG 0.00%↑ #ChatGPT #OpenAI

OpenAI integrates shopping features into ChatGPT

Microsoft-backed (NASDAQ:MSFT) OpenAI is integrating shopping features into ChatGPT Search.

"We're experimenting with making shopping simpler and faster to find, compare, and buy products in ChatGPT," OpenAI said today in a post on X.

OpenAI said Search is becoming one of its most popular features, reaching 1B web searches over the past week.

The shopping feature is being added for Plus, Pro, Free and logged-out users. It will take a few days to complete the rollout.

OpenAI added a couple more updates to Search as well. They said they have improved citations, added trending searches and autocomplete suggestions. Search is also now available in WhatsApp, which is owned by Meta Platforms (META).

The new features might help OpenAI compete better with search giant Google (GOOG)(GOOGL) and fellow startup Perplexity AI.

Link to Seeking Alpha News Article - Apr. 28, 2025

[Newsletter Exclusive] Cadence Design's results, outlook showcase its 'resilience,' Morgan Stanley says

“Customers were noted as still pushing ahead with investments in next gen designs. The company also took the chance to reiterate that their software-based products are not subject to [tariffs] and that their hardware products have multiple manufacturing lines (via [the] USA, Taiwan, or Mexico, etc.) to help avoid the bulk of impact here too. That, together with the company’s ratable software model, strong backlog and high degree of recurring revenues, gives earnings resilience and provides the company with better visibility through this period of uncertainty,” Morgan Stanley nalyst Lee Simpson wrote in a note to clients.

Delving deeper, Simpson said Cadence has broadened its customer base and partnerships — including extended deals with Intel (INTC), MediaTek, Nvidia (NVDA) and Taiwan Semiconductor (TSM) — and its exposure to China is manageable. And the guidance that the company provided could wind up being conservative, “given the range of engagements in China for Cadence,” Simpson added.

In addition to the extended partnerships, Cadence also signed a new Agentic AI development deal with Nvidia, using the Llama Nemotron Reasoning model. This should allow Cadence to become one of the first adopters of Nvidia's Omniverse digital twins for data center simulation work.

Link to Seeking Alpha News Article - Apr. 29, 2025

[Newsletter Exclusive] Joby Aviation reaches key milestone with a piloted eVTOL transition flight

Joby Aviation (NYSE:JOBY) announced on Tuesday that it successfully completed piloted flights that fully transition from vertical takeoff to horizontal cruise and back - a critical capability for urban air mobility.

Looking ahead, the milestone paves the way for further FAA testing and supports Joby's (JOBY) plans to launch commercial service, with first passenger flights in Dubai expected after mid-2025.

Link to Seeking Alpha News Article - Apr. 29, 2025

Hims & Hers surges on partnership with Novo Nordisk for Wegovy

Per the terms of Novo’s (NVO) deal with HIMS, the pharma giant’s direct-to-consumer platform, NovoCare Pharmacy, will be accessible through the Hims & Hers site with a Hims & Hers membership and all dose strengths of Wegovy.

The companies identified the bundled offering to be launched this week on the Hims & Hers platform as a first step in a long-term collaboration.

Link to Seeking Alpha News Article - Apr. 29, 2025

[Newsletter Exclusive] American Battery receives LOI from EXIM Bank for $900 million financing

American Battery Technology (NASDAQ:ABAT) has received a letter of interest (LOI) from the Export-Import Bank of the United States for $900 million in financing to support the construction of the company's commercial-scale lithium mine and claystone-to-lithium hydroxide refinery near Tonopah, Nevada.

The EXIM funding, if realized, would support the construction of a domestic lithium mine and a 30,000 tonne lithium hydroxide per year refinery, located on the company’s Nevada Tonopah Flats Lithium Project site

Aligned with EXIM’s ‘Make More in America’ and its ‘China and Transformational Export Program’ initiatives that support beneficial financing for domestic manufacturing facilities of critical minerals.

The company has already demonstrated its technologies at pilot scale and manufactured battery-grade lithium hydroxide from claystone collected from its Tonopah Flats lithium resource, one of the largest known lithium deposits in the United States.

Link to Seeking Alpha News Article - Apr. 29, 2025

[Newsletter Exclusive] Apple's iPhone production starts at new Tata plant, Foxconn facility close behind in India - report

A new plant in India has begun operations to make Apple's (NASDAQ:AAPL) iPhone, while another will start shipments in May, Reuters reported, citing a person familiar with the matter.

The developments come amid Apple bolstering its manufacturing in India as it seeks to diversify its supply chain base beyond China, which is in a tech and tariff tussle with the U.S.

The Tata Electronics plant in Hosur in Tamil Nadu began operations in recent days to make older iPhone models on one assembly line. Another $2.6B plant run by Foxconn Technology (OTCPK:FXCOF) that is under construction in Bengaluru, in the Indian state of Karnataka will also start initial operations with one assembly line within days, the report added citing people with knowledge of the matter, including a government official.

About 300 to 500 iPhone units per hour can be made at the factory, where iPhone 16 and 16e models will be produced.

Link to Seeking Alpha News Article - Apr. 29, 2025

[Newsletter Exclusive] Rocket Lab attracts a bull rating from Needham due to its growing position as a SpaceX competitor

Analyst Ryan Koontz said Rocket Lab (NASDAQ:RKLB) is a disruptive company in the fast-evolving space sector.

"Their Space Systems business, supplying turn-key satellite buses and subsystems, is benefiting from strong growth in government and commercial LEO constellation launches. Profits from Space Systems fund the company's Launch business, already proven for small-lift with its Electron rocket, and is soon expected to enter medium-lift launch with Neutron."

A strategic focus on vertical integration is seen as significantly differentiating Rocket Lab (RKLB) from many of its peers, which rely heavily on subcontractor deliverables.

Koontz also highlighted that Rocket Lab (RKLB) is delivering on high revenue growth with 91% CAGR over the last three years, and that its backlog of around $1.1 billion is a strong indicator of continued growth. Looking ahead, a huge opportunity is seen with the Neutron rocket, and more contract wins are anticipated.

Needham assigned a price target of $28 to Rocket Lab (RKLB).

Link to Seeking Alpha News Article - Apr. 29, 2025

[Newsletter Exclusive] Intel Foundry, Synopsys team up for chip design on Intel's new manufacturing process

The partnership includes Synopsys' AI-driven digital and analog design flows for the Intel 18A process node and production-ready EDA flows for the Intel 18A-P process node with RibbonFET Gate-all-around, or GAA, transistor architecture and the industry's first commercial foundry implementation of PowerVia backside power delivery, according to the companies.

Intel's 18A process is the company's advanced semiconductor fabrication process. 18A stands for 18 Angström. The beleaguered chipmaker's foundry business intends to potentially compete with industry heavyweights such as Taiwan Semiconductor Manufacturing (TSM) through its new manufacturing technology.

Link to Seeking Alpha News Article - Apr. 29, 2025

[Newsletter Exclusive] First Solar sinks on big Q1 earnings miss, weak guidance reflecting tariff impact

First Solar (NASDAQ:FSLR) -10.3% post-market Tuesday after reporting Q1 GAAP earnings that missed Wall Street expectations by a wide mark and issuing disappointing guidance for the full year to reflect the expected impact of the implementation of tariffs.

Q1 earnings fell to $1.95/share from $3.65/share in Q4 2024, and revenues of $844.6M were up 6.4% Y/Y but significantly below $1.5B in the previous quarter, primarily due to an anticipated seasonal reduction in the volume of modules sold; the company's average selling price of 30.5 cents per watt fell 2.6% from the year-ago quarter.

First Solar (NASDAQ:FSLR) also issued reduced guidance for FY 2025, now expecting EPS of $12.50-$17.50 compared to its previous outlook for $17.00-$20.00, below the $17.77 analyst consensus estimate, on full-year revenues of $4.5B-$5.5B vs. prior guidance of $5.3B-$5.8B and $5.46B consensus.

The company said it ended the quarter with a net cash balance of ~$400M, down from $1.2B at year-end 2024, citing capital spending for its Louisiana manufacturing facility and increased inventories as reasons for the decrease.

"Despite the near-term challenges presented by the new tariff regime, we believe that the long-term outlook for solar demand, particularly in our core U.S. market, remains strong, and that First Solar remains well-positioned to serve this demand," CEO Mark Widmar said.

Link to Seeking Alpha News Article - Apr. 29, 2025

[Newsletter Exclusive] First Solar CEO warns of 'significant economic headwind' from tariffs; analysts downgrade

CEO Mark Widmar said President Trump’s tariffs "create a significant economic headwind" for First Solar's (FSLR) plants in India, Malaysia and Vietnam, and the company may need to reduce or idle production at the Malaysia and Vietnam factories which exclusively serve the U.S. market.

The uncertainty about whether tariffs will remain at 10% or increase after President Trump's 90-day pause "has created a challenge to quantifying the precise tariff rate that would be applied to our module shipments into and beyond the second half of this year," the CEO said.

Analysts at KeyBanc, Oppenheimer and Jefferies downgraded First Solar (FSLR) shares in the wake of the report.

KeyBanc cut First Solar (FSLR) to Underweight from Sector Weight with a $100 price target, saying that while the company has sizable domestic manufacturing capacity that is used to serve

the U.S. market, "the impact of volumes imported from its facilities in Vietnam, Malaysia, and India appears to be greater than we thought, and not likely to be mitigated in the near term under the 10% global tariff regime or higher 'reciprocal' tariffs.

"This uncertainty is pancaked on top of broader anxiety over the fate of various IRA provisions, and we believe will put pressure on valuation in the near term," KeyBanc Sophie Karp wrote.

Link to Seeking Alpha News Article - Apr. 30, 2025

UBER 0.00%↑ LYFT 0.00%↑ #Empower

[Newsletter Exclusive] Rideshare upstart Empower faces headwinds as it looks to mount a challenge to Uber and Lyft

Rideshare technology company Empower continues to operate in the Washington, D.C. region even as it faces intense legal pressure for operating without registering as a transportation service, resulting in daily fines and the threat of shutdown.

Unlike traditional rideshare platforms, Empower does not act as a transportation provider, but instead offers a software platform that connects independent drivers with riders. The company's core innovation is a subscription-based model in which drivers pay a flat monthly fee to access the platform, set their own rates, and keep 100% of the fare, rather than surrendering a commission on each ride. The approach aims to give drivers more control over their earnings and business, while also enabling riders to pay, on average, 20% less than they would with Uber (NYSE:UBER) or Lyft (NASDAQ:LYFT).

The Virginia-based company has expanded from its initial launch in North Carolina to Washington, D.C., and New York, with plans to enter new markets, including Minneapolis. Empower's expansion has been largely fueled by word-of-mouth, driver and rider referrals, and targeted efforts to recruit dissatisfied Uber and Lyft drivers. The company has raised capital and reported nearing cash-flow profitability, with ambitions for broader national rollout. However, the ongoing legal battles and mounting fines pose significant headwinds.

Link to Seeking Alpha News Article - Apr. 30, 2025

TBLA 0.00%↑ $SSNLF

[Newsletter Exclusive] Taboola partners with Samsung to serve news recommendations on Samsung devices

Under this new multi-year relationship, Taboola (NASDAQ:TBLA) will power news recommendations on Samsung (OTCPK:SSNLF) News in markets across Europe and India.

Link to Seeking Alpha News Article - Apr. 30, 2025

[Newsletter Exclusive] U.S. pharmaceutical industry is heavily dependent on China, Apollo warns

As U.S. and China relations remain tense, concerns are growing over America’s deep reliance on China for critical pharmaceutical ingredients. According to Apollo Asset Management, the pharmaceutical sector is particularly vulnerable to geopolitical disruptions due to its heavy dependence on foreign-sourced inputs.

U.S. President Donald Trump has so far not issued any tariffs on pharmaceutical imports, but his administration is mulling over it.

“Estimates show that 90% of the inputs in prescription drugs consumed in the US are imported,” said Torsten Sløk, chief economist at Apollo. A significant portion of that comes from China, making it a major supply chain risk.

Link to Seeking Alpha News Article - Apr. 30, 2025

GOOG 0.00%↑ AAPL 0.00%↑ #GeminiAI

Google plans to reach Gemini AI agreement with Apple this year, CEO says

Alphabet's (NASDAQ:GOOG) (NASDAQ:GOOGL) Google expects to sign an agreement with Apple (NASDAQ:AAPL) by the middle of this year to include its AI service Gemini on new phones, CEO Sundar Pichai said on Wednesday, according to Reuters.

Pichai — who made the remarks at the tech giant's antitrust trial in Washington while being questioned by Department of Justice attorney Veronica Onyema — said he spoke with Apple CEO Tim Cook about the possibility, the news outlet reported.

A potential agreement would see Google's Gemini AI included within Apple's own AI service, Apple Intelligence, Pichai noted. Currently, Microsoft (MSFT)-backed OpenAI's ChatGPT is integrated across Apple platforms.

Link to Seeking Alpha News Article - Apr. 30, 2025

SPY 0.00%↑ DIA 0.00%↑ QQQ 0.00%↑

[Newsletter Exclusive] Trump says 'Biden’s Stock Market' after S&P's worst first 100 presidency days since Nixon

According to the U.S. Bureau of Economic Analysis, the Q1 GDP contraction primarily reflected a surge in imports - which show up as a subtraction in the calculation of GDP - and a fall in government spending.

"Core GDP — removing distortions from imports, inventories and government spending — was up +3% ... Gross Domestic Investment was a whopping 22%," Trump later said at a Cabinet meeting.

Link to Seeking Alpha News Article - Apr. 30, 2025

[Newsletter Exclusive] Robinhood Markets GAAP EPS of $0.37 beats by $0.04, revenue of $927M beats by $9.84M

Transaction-based revenues increased 77% year-over-year to $583 million, primarily driven by cryptocurrencies revenue of $252 million, up 100%, options revenue of $240 million, up 56%, and equities revenue of $56 million, up 44%.

Net interest revenues increased 14% year-over-year to $290 million.

Funded Customers increased by 1.9 million, or 8%, year-over-year to 25.8 million. ◦ Investment Accounts increased by 2.6 million, or 11%, year-over-year to 27.0 million.

Total Platform Assets1 increased 70% year-over-year to $221 billion, primarily driven by continued Net Deposits and the acquisition of TradePMR.

Average Revenue Per User (ARPU) increased 39% year-over-year to $145.

Robinhood Gold Subscribers increased by 1.5 million, or 90%, year-over-year to 3.2 million.

Board of directors increases share repurchase authorization by $500 million to $1.5 billion.

CEO Vlad Tenev noted the rapid adoption of Robinhood Strategies, which has over 40,000 customers and $100 million in assets. Additionally, the Robinhood Gold credit card doubled its cardholders to 200,000 in Q1, and retirement assets increased to $16 billion, a 20% rise since the start of the year.

Tenev stated that Robinhood Banking, revealed at the March "Lost City of Gold" event, is on track for a Q3 public rollout, targeting high-net-worth individuals.

Link to Seeking Alpha News Article - Apr. 30, 2025

Link to Seeking Alpha News Article - Apr. 30, 2025

[Newsletter Exclusive] Microsoft jumps as Q3 results show 33% Azure surge, outlook remains strong (update)

"Azure Q4 revenue growth is expected to be from 34% to 35% driven by strong demand from our portfolio of services," said Microsoft Chief Financial Officer Amy Hood, during the earnings call. "We expect capex to grow in fiscal year 2026. It will grow at a lower rate than fiscal 2025."

Azure, which is a metric closely followed by investors and analysts, and other cloud services revenue, surged 33%, and was more than the 31% estimate.

"Quarterly free cash flow dipped slightly year-over-year from $20.965 billion to $20.299 billion despite higher operating cash flow due to heavy infrastructure investments," Seeking Alpha analyst Investor's Compass said. "However, as CapEx growth slows after FY25, free cash flow should rise in Fiscal 2026."

Meta Platforms (META), which released its latest financial results on Wednesday, also pointed to continued demand and growth for data centers to support its AI efforts. It expects full year 2025 capex of $64B to $72B, which is up from its prior outlook of $60B to $65B.

Link to Seeking Alpha News Article - Apr. 30, 2025

[Newsletter Exclusive] Enovix outlines smartphone ramp and defense opportunities for 2025

CEO Raj Talluri highlighted the commencement of custom smartphone cell development for a major OEM, with plans to deliver qualification samples within Q2 2025. This marks a critical step toward launching the product commercially later in the year.

The company made strides in manufacturing: Fab2 in Malaysia achieved ISO 9001 certification, completed its first customer audit, and progressed toward mass production readiness. Additionally, a strategic acquisition of SolarEdge assets in South Korea expanded coating capacity and provided room for further manufacturing growth.

In the defense sector, Enovix secured new bookings and began shipping samples for military applications, which the company views as a significant growth opportunity.

The company also reported progress in the smart eyewear and handheld computing markets, with customer samples delivered and positive feedback received.

Management emphasized a focus on custom cell developments and customer qualifications throughout the remainder of the year, with a goal of solidifying demand for 2026 production.

The company expects to sample its next-generation EX-3M battery by the end of 2025, targeting higher energy densities and aligning with evolving customer requirements.

Ananda Baruah, Loop Capital: Asked about the timeline for smartphone customer qualifications and volume inclusion. CEO Talluri confirmed that samples will be delivered by June 2025, with testing and feedback expected to conclude by August.

William Peterson, JPMorgan: Questioned the competitive landscape and energy density benchmarks. CEO Talluri emphasized that Enovix’s 100% active silicon anode provides a material lead in energy density over competitors using silicon-doped graphite.

Link to Seeking Alpha News Article - Apr. 30, 2025

[Newsletter Exclusive] Tesla's board reportedly started a CEO search process before Elon Musk pulled back from DOGE

Tesla (NASDAQ:TSLA) board members reached out to several executive search firms about a month ago to begin the formal process for finding the company's new CEO, sources told The Wall Street Journal.

While the board picked a major search firm to lead the CEO search process, it is unclear if the process has continued after Musk made his public statement on spending more time working on crucial initiatives for Tesla (TSLA).

Tesla's (NASDAQ:TSLA) board chair Robyn Denholm has refuted a media report that the automaker was looking for a new CEO to replace Elon Musk.

Denholm, however, called the news “absolutely false (and this was communicated to the media before the report was published).”

Link to Seeking Alpha News Article - Apr. 30, 2025

Link to Seeking Alpha News Article - Apr. 30, 2025

[Newsletter Exclusive] US judge rules Apple breached court order to reform App Store

A U.S. federal judge in California ruled that Apple (NASDAQ:AAPL) violated a court order that required the company to allow greater competition for app downloads and payment methods in its App Store and will be referred to federal prosecutors.

"Apple’s continued attempts to interfere with competition will not be tolerated," said the judge. "This is an injunction, not a negotiation. There are no do-overs once a party willfully disregards a court order," the judge added.

The judge noted that the court takes no position on whether a criminal prosecution is warranted or not, and the decision lies with the U.S. Attorney. "It will be for the executive branch to decide whether Apple should be deprived of the fruits of its violation, in addition to any penalty geared to deter future misconduct," said the judge.

Link to Seeking Alpha News Article - May 01, 2025

[Newsletter Exclusive] Palantir AI-backed Intelligence collecting truck among the best programs, says Army - report

Palantir Technologies (NASDAQ:PLTR) new mobile battlefield intelligence-gathering vehicle and trailer for the U.S. Army has been ranked by its leaders as among their top-performing programs, Bloomberg News reported citing a new review by the service.

An April report to Congress of the Army’s “Highest and Lowest Performing” programs lists the Denver-based company’s Tactical Intelligence Targeting Access Node, or Titan, truck and four other weapons systems among the best performers. No major systems were among the lowest-ranked, the report added.

Last year, in March the U.S. Army confirmed that the company won a two-year contract to begin phase 3 on its next-generation targeting system. TITAN is the army’s next-generation deep-sensing capability platform. It uses AI and machine learning to allow shooters in the field support beyond-line-of-sight targeting. The $178.4M agreement was for developing 10 TITAN prototypes.

Three Titan prototypes have been delivered, while four more are expected by Dec. 31 and three more are expected by March 30, 2026, as per Army spokesman Brandon Pollachek, the report added.

The Army “is assessing the number” it will purchase “as we exercise prototypes and evaluate where they will be needed,” said Pollachek.

The vehicles are slated to undergo combat-realistic operational testing and evaluation, a potential full-rate production decision and initial fielding in the 2027-2028 timeframe, added Pollachek, according to the report.

Link to Seeking Alpha News Article - May 01, 2025

Tesla sales are still slumping in Europe based on April demand reports

Tesla (NASDAQ:TSLA) sales plunged in France again in April, with the electric vehicle maker registering only 863 new vehicles in France last month, according to French industry association Plateforme Automobile. The registration tally was 59% below last year's total and the lowest mark in more than two years. Notably, France is the European Union's second-biggest electric vehicle market.

In Denmark, Tesla's new car sales were down 67.2% in April, according to registration data from Mobility Denmark. The decline was slightly worse than the 65.6% drop in March.

The electric vehicle company began to deliver the redesigned Model Y SUV in March, which was expected to boost sales. Analysts say the sharp decline carrying into April is an indication that consumer backlash against the Tesla (NASDAQ:TSLA) brand is a major factor.

Tesla's (TSLA) vehicle sales across Europe fell 37% in Q1, which was much worse than the overall European and global EV sales growth marks.

Link to Seeking Alpha News Article - May 01, 2025

U.S.-Ukraine mineral deal — what each side gets

Under the terms of the agreement, a new investment fund will be created, jointly managed by both countries. The U.S. will receive priority claims on revenue generated by this fund, which will also serve to offset future U.S. military assistance to Kyiv. Initially, Washington had demanded reimbursement for past aid, but Ukraine resisted, instead positioning the fund as a forward-looking partnership.

However, the agreement does not include formal security guarantees. Zelenskiy had pushed for such provisions, but the American side instead framed deepening economic ties as a means of ensuring long-term stability.

European leaders, concerned this approach may fall short in deterring future Russian aggression, have urged Washington to back a more direct military commitment -- such as supporting a potential EU-led troop deployment. So far, the Trump administration has declined to endorse such efforts.

Link to Seeking Alpha News Article - May 01, 2025

[Newsletter Exclusive] Apple App Store ruling suggests impact could range into billions, says BofA

Based on SensorTower data on developer revenues, the analysts estimate the App Store contributes about $31B of revenue for Apple per year. Of this, 9% comes from the EU, 35% from the U.S., 24% from China, and 32% from the Rest of the World, according to the analysts.

Mohan and his team said the ruling suggests that impacts could range into the billions. The analysts quoted the court order, which stated, “As a result, Apple estimated a revenue impact of hundreds of millions to billions under the no-commission model for customer adoption ranging from 10% to 25%."

Link to Seeking Alpha News Article - May 01, 2025

Trump administration weighs easing Nvidia exports to UAE: report

Ahead of President Trump's visit to the Middle East next month, his administration is discussing easing the number of artificial intelligence processors Nvidia (NASDAQ:NVDA) is allowed to export to the United Arab Emirates, Bloomberg reported.

The President could announce the start of a bilateral chip deal on his trip to the region, slated to occur between May 13 and 16, the news outlet added, citing people familiar with the matter. The President has asked advisors why the UAE — which is approved to buy F-35 fighter jets — has been limited in its access to AI chips, the news outlet added.

Link to Seeking Alpha News Article - May 01, 2025

[Newsletter Exclusive] Intuitive announces expanded FDA clearance for da Vinci Single Port system

Intuitive Surgical (NASDAQ:ISRG) announced Thursday that the U.S. FDA cleared its da Vinci Single Port (SP) Surgical System for transanal local excision/resection, extending its prior applications targeted at transabdominal, transoral, and urologic procedures.

Transanal local excision/resection is a minimally invasive operation conducted through a natural opening in the body so as to avoid abdominal surgical incisions required for certain surgical procedures.

Link to Seeking Alpha News Article - May 01, 2025

[Newsletter Exclusive] Airbnb targets 9%-11% revenue growth for Q2 2025 amid global expansion

CEO Brian Chesky revealed that Airbnb's next chapter involves offering more than just places to stay, supported by a rebuilt app technology stack. He confirmed that new business ventures will be unveiled in the 2025 Summer Release on May 13.

Justin Post, Bank of America: Asked about travel corridor changes and U.S. market share. CFO Ellie Mertz explained that foreign travelers to the U.S. have declined, particularly Canadians choosing alternatives like Mexico and Brazil.

Link to Seeking Alpha News Article - May 01, 2025

UBER 0.00%↑ #MayMobility

[Newsletter Exclusive] Uber signs deal with May Mobility to launch autonomous vehicles in Texas

Uber Technologies (NYSE:UBER) announced on Thursday that it struck a new multi-year strategic partnership with autonomous vehicle technology company May Mobility.

May Mobility aims to deploy thousands of autonomous vehicles on the Uber (NYSE:UBER) platform over the next few years, with an initial launch planned for Arlington, Texas, by the end of 2025.

Link to Seeking Alpha News Article - May 01, 2025

UBER 0.00%↑ #Momenta

[Newsletter Exclusive] Uber will partner with Momenta on robotaxis in Europe next year

Uber Technologies inked a deal with China based Momenta to introduce autonomous vehicles to the Uber (NYSE:UBER) platform in international markets outside the U.S. and China.

The first deployment for the partnership will take place in Europe at the beginning of 2026, with onboard safety operators.

In 2017, Mercedes-Benz Group (OTCPK:MBGAF) made its first-ever investment in a Chinese startup by backing Momenta. Notably, Momenta has established joint ventures and partnerships with major automotive players such as SAIC Motor, Toyota (TM), Bosch, BYD Company (OTCPK:BYDDF), and others to deploy its autonomous driving technologies at scale.

Link to Seeking Alpha News Article - May 02, 2025

EWJ 0.00%↑ DXJ 0.00%↑ SPY 0.00%↑ QQQ 0.00%↑ DIA 0.00%↑

Japan's $1T U.S. Treasury holdings could be a bargaining chip in trade talks

"We need to put all cards on the table in negotiations," Kato said in a TV Tokyo program, adding that Japan's Treasury stockpile "could be among such cards."

"Whether we use that card or not is a different matter," he noted. "We don't keep (the Treasuries) to support the U.S. We will intervene if our country is in trouble."

Japan is the largest foreign owner of U.S. Treasuries, with holdings worth nearly $1.13T as of February, according to Treasury Department data. Next is China, with holdings worth $784B, followed by the U.K. (at $750B).

Link to Seeking Alpha News Article - May 02, 2025

Nvidia discusses concerns about Huawei's AI capability with US lawmakers

"Regardless of how one feels about DeepSeek's open-source R1 model, it is a clear indication that innovation is moving rapidly around the world, with or without leading U.S. tech. If U.S. platforms are absent, companies will turn to strategic competitors like Huawei to fill the gap. This is why leadership in Al depends not just on what we restrict — but on what we enable," said Nvidia CEO Jensen Huang in a blog post on X.

"If DeepSeek R1 had been trained on (Huawei chips) or a future open-source Chinese model had been trained to be highly optimized to Huawei chips, that would risk creating a global market demand for Huawei chips," said a senior staff source, according to a report by Reuters.

Huang added that "Huawei is rapidly scaling efforts to build Al data centers in third countries as part of China’s Digital Silk Road—building global infrastructure and deploying applications that do not align with U.S. norms or values. Huawei is a formidable rival. Its rise in telecom and smartphones shows what happens when U.S. firms retreat from strategic technologies and strategic markets."

Huang noted that the U.S. semiconductor industry is being pushed out of China and on May 15, if the Al Diffusion Rule comes into effect without significant changes, the company will be forced to similarly retreat from the rest of the world.

On Sunday, it was reported that some Chinese tech companies have been approached by Huawei about testing the new Ascend 910D chip.

Link to Seeking Alpha News Article - May 02, 2025

[Newsletter Exclusive] Apple projects $95.4B revenue for Q2 2025 amid record services growth and U.S. investment plans

Tariffs are estimated to add $900 million to costs in the June quarter, assuming no changes in global tariff rates and policies.

Services revenue reached an all-time high of $26.6 billion, with double-digit growth in both developed and emerging markets.

Tim Cook reiterated the shift in manufacturing for U.S. sales to India and Vietnam while maintaining China as the primary origin for global sales outside the U.S.

Link to Seeking Alpha News Article - May 02, 2025

AAPL 0.00%↑ #Anthropic #ClaudeSonnet

[Newsletter Exclusive] Apple partners with Anthropic to develop AI code-writing system: report

Apple (NASDAQ:AAPL) is reportedly teaming up with Anthropic to develop an artificial intelligence-powered platform which will assist developers in writing, editing and testing code, according to Bloomberg.

The new programming software will integrate Anthropic's Claude Sonnet large language model, according to the report, which cited people familiar with the matter. Apple plans to initially utilize the software internally before deciding whether to release it to the public.

Apple introduced an AI-powered coding assistant, Swift Assist, last year at its Worldwide Developers Conference. However, Apple engineers found issues with the system, finding that it would hallucinate and even hinder app development, according to the report. Consequently, it was never shipped out to developers.

Link to Seeking Alpha News Article - May 02, 2025

Nvidia resumes development of China-specific chips following U.S. export ban - The Information

Nvidia (NASDAQ:NVDA) has reportedly informed major Chinese clients—among them ByteDance (BDNCE), Alibaba Group (NYSE:BABA), and Tencent (OTCPK:TCEHY)—that it is modifying the design of its AI chips to comply with U.S. export restrictions while still making them available to Chinese companies.

Nvidia's continued efforts to develop new chips for the Chinese market, despite rising tensions between Washington and Beijing, highlight just how vital China remains to the Santa Clara, California–based semiconductor giant.

Chinese tech companies, including ByteDance (BDNCE), Alibaba (NYSE:BABA) and Tencent (OTCPK:TCTZF) ordered over $16 billion worth of the H20 chips in the first three months this year, The Information reported. It remains unclear how the recent ban will affect these orders.

Nvidia also told some of its Chinese customers it will need approval from the U.S. Commerce Department before it releases any new version to China, the report added.

The company generated $17.11B in sales (about 13% of its total revenue of $130.5B) from China in the fiscal year 2025 ended Jan. 26.

Link to Seeking Alpha News Article - May 02, 2025

Charts & Technicals:

Microsoft in charts: Intelligent Cloud revenue climbs 21% Y/Y

Link to Seeking Alpha News Article - Apr. 30, 2025

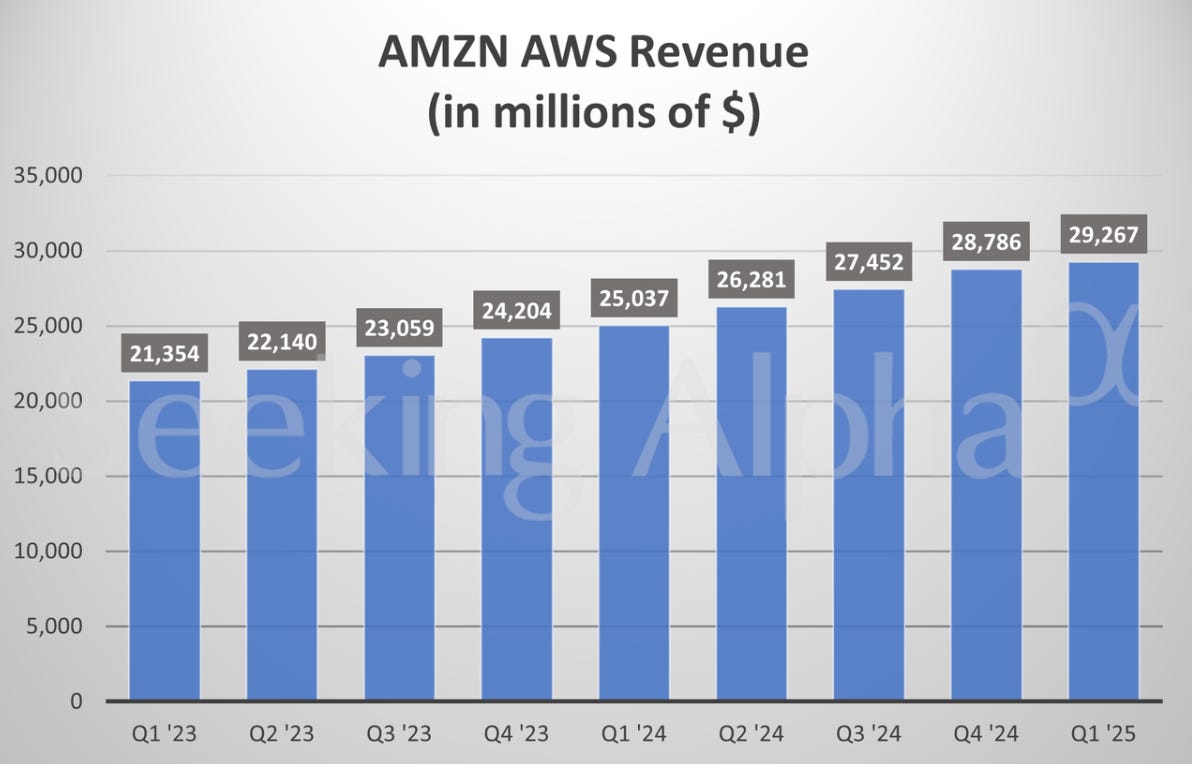

Amazon in charts: AWS revenue rises 17% Y/Y; North America sales up 8%

Link to Seeking Alpha News Article - May 01, 2025

Disclosure: We own positions in some/all of the tickers mentioned in this article.