Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial + $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist & Weekly Compilation.

Editor’s Pick:

[News] Joby confirms buying Blade’s urban air mobility passenger business for $125M

This acquisition includes Blade's US and European passenger operations, lounges, terminals, and the Blade brand.

Blade's medical division is excluded from the deal and will remain a separate public company, rebranding as Strata Critical Medical, which will maintain a long-term partnership with Joby. As part of the transaction, Joby will also become the preferred VTOL partner to Blade's organ transport business.

The transaction is expected to close in the coming weeks.

Under the terms of the agreement, Joby (NYSE:JOBY) will pay Blade (BLDE) stock or cash, at Joby’s election, up to $125 million, subject to customary indemnity provisions and inclusive of $35 million of holdbacks, which will be released subject to the achievement of certain performance milestones and retention of certain key employees.

By utilizing Blade's (BLDE) existing infrastructure and gradually transitioning a large loyal base of passengers from conventional helicopters to next-generation Joby aircraft, Joby Aviation (JOBY) expects to be able to accelerate its commercialization while reducing infrastructure investment requirements and customer acquisition costs. In addition to unlocking immediate market access and infrastructure across key urban corridors in New York City and Southern Europe, the acquisition is anticipated to allow Joby (JOBY) to combine its best-in-class technology with Blade's (BLDE) decade of experience delivering premium customer transportation at scale.

Link to Seeking Alpha News Article - Aug. 04, 2025

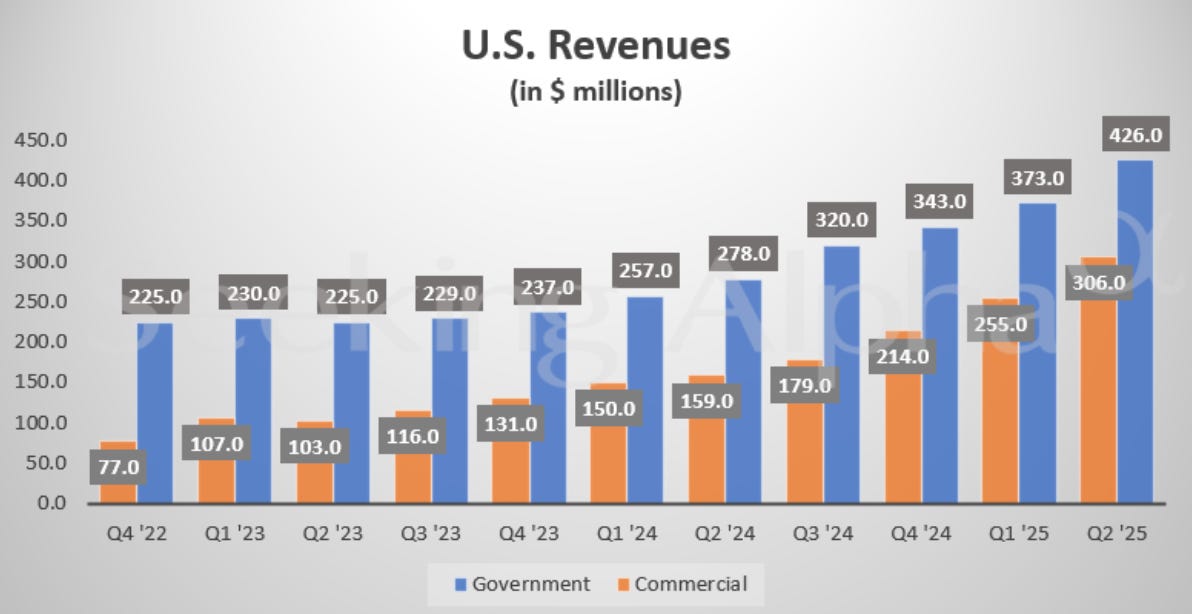

[News] Palantir Q2 revenue surges 48% to strike $1B

For the quarter ended June 30, the Denver-based data analytics and AI software company reported adjusted earnings per share of $0.16, which was more than the consensus estimate of $0.14. GAAP EPS came in at $0.13 compared to the consensus of $0.08.

Revenue for the quarter totaled $1B, which represented a 48% year-over-year increase and was more than the estimate of $939.47M.

"We continue to see the astonishing impact of AI leverage," said Palantir CEO and co-founder Alex Karp. "Our Rule of 40 score was 94%, once again obliterating the metric. Year-over-year growth in our U.S. business surged to 68%, and year-over-year growth in U.S. commercial climbed to 93%. We are guiding to the highest sequential quarterly revenue growth in our company's history, representing 50% year-over-year growth."

Morgan Stanley analysts led by Sanjit Singh said the second quarter marked eight straight quarters of revenue growth acceleration coupled with significant margin expansion. Strength was driven by U.S. commercial which accelerated again to +93% from +71% in the first quarter and government which accelerated to +49% from +45%.

The analysts added that the third quarter revenue guidance targets +50% year-over-year growth while 2025 revenue growth guidance raised by 9 points to +45% from +36% prior, with operating margin of 46% are best-in-class and underscores status as one of the clear AI winners, the analysts noted.

Singh and his team noted that the only pocket of weakness remains the international commercial business which declined -3% year-over-year after falling -5% in the first quarter.

Link to Seeking Alpha News Article - Aug. 04, 2025

Link to Seeking Alpha News Article - Aug. 05, 2025

Link to Seeking Alpha News Article - Aug. 04, 2025

[News] BWX Technology soars to all-time high, leading nuclear stocks as Trump targets moon reactor

BWX Technologies (NYSE:BWXT) reached a record high Tuesday, closing +17.8% to lead nuclear-related stocks following reports that U.S. Secretary of Transportation and acting NASA administrator Sean Duffy is set to announce expedited plans to put a nuclear reactor on the moon.

But BWX Technologies (NYSE:BWXT) led the way because the company already is the U.S. Navy's main nuclear reactor supplier and is no stranger to NASA, working since 2017 on nuclear thermal propulsion design with NASA and the U.S. Department of Energy.

William Blair analyst Jed Dorsheimer wrote that BWX Technologies' (BWXT) strong earnings report shows "why it is our most robust pure play in nuclear" and that the company should be seen by investors as a "core holding" in the nuclear energy space.

Link to Seeking Alpha News Article - Aug. 05, 2025

[News] Redwire Launches SpaceMD to Grow Life-Saving Drugs in Orbit.

Redwire Corporation (NYSE: RDW), a global leader in space and defense technology solutions, today announced that it has formed a new entity, SpaceMD, which will focus on growing seed crystals in orbit that will be used on Earth to create new and reformulated pharmaceuticals.

SpaceMD will take advantage of the unique microgravity environment in space through the use of Redwire’s innovative and flight-proven Pharmaceutical In-Space Laboratory (PIL-BOX) technology to grow the seed crystals. 28 PIL-BOX systems have already flown in space and have successfully crystalized 17 compounds on the ISS, including insulin and other critical molecules. SpaceMD will sell or license these seed crystals to companies that can use them to create reformulated versions of existing drugs or entirely new therapeutics.

As part of this launch, SpaceMD announced a trailblazing licensing agreement with ExesaLibero Pharma, Inc., an innovative pharmaceutical company developing new small molecule drugs to treat bone disease. Under the terms of the agreement, ExesaLibero Pharma will work with SpaceMD to advance and enhance its groundbreaking small-molecule drug ELP-004 and other relevant compounds via the PIL-BOX system. This drug could hold the key to controlling the insidious bone erosion that numerous debilitating diseases cause, such as rheumatoid arthritis, multiple myeloma, diabetes, periodontal disease, and tuberculosis.

Through this first-of-its-kind agreement, SpaceMD will receive royalties from any commercial sales of resulting pharmaceutical products.

Link to Redwire Press Release - Aug. 04, 2025

CRSP 0.00%↑ TWST 0.00%↑ DNA 0.00%↑

[News] M&M's maker Mars taps CRISPR tech to improve cocoa production

Mars, maker of M&M's and Skittles, is turning to CRISPR gene editing to develop more resilient cacao plants, with the aim of strengthening cocoa production by tackling agricultural challenges.

The candy maker has licensed agricultural gene editing firm Pairwise's Fulcrum platform to develop cacao plants with desirable traits. The platform includes CRISPR tools, enzymes and trait libraries.

CRISPR gene editing, which selectively modifies DNA sequences, in agriculture aims to help crops better adapt to climate challenges, resource constraints, disease pressures and pests.

This is especially important in light of recent cocoa shortages in West Africa, which accounts for about 70% of global cocoa supply. This was a result of adverse weather conditions and increased disease incidence, which pushed cocoa prices (CC1:COM) to record highs of around $12,000/tonne last year.

Link to Seeking Alpha News Article - Aug. 07, 2025

[News] Archer Aviation makes two acquisitions as it shifts the business more toward military applications

One of the acquisitions is of a patent portfolio and hiring of key talent from Overair, a spin-off of Karem Aircraft. The other is the acquisition of key composite manufacturing assets and a ~60,000 square foot manufacturing facility from Mission-Critical Composites, a specialized defense composite manufacturer in Southern California.

Financial terms of the deals were not disclosed.

The company, which was originally focused on building electric air taxis for urban mobility, noted that it has shifted substantial resources toward military applications as geopolitical tensions rise and U.S. defense strategy prioritizes rapid adoption of new technologies such as AI, drones, and hybrid aircraft.

Link to Seeking Alpha News Article - Aug. 07, 2025

News, Facts, Analyst & Market Commentary - Short Reads:

Former labor stats head picked by Trump says McEntarfer firing sets 'dangerous precedent'

U.S. President Donald Trump on Friday said he would fire Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer, a move that sets a "dangerous precedent," according to her immediate predecessor William Beach. The former BLS head also co-signed a broader statement that called for a Congress investigation into Trump's actions.

"The President seeks to blame someone for unwelcome economic news," the Friends of BLS said.

"(Trump's) rationale for firing Dr. McEntarfer is without merit and undermines the credibility of federal economic statistics that are a cornerstone of intelligent economic decision-making by businesses, families, and policymakers," the group said.

"U.S. official statistics are the gold standard globally. When leaders of other nations have politicized economic data, it has destroyed public trust in all official statistics and in government science," it added.

The Friends of BLS called on Congress to "investigate the factors that led to Commissioner McEntarfer's removal."

"Firing the Commissioner of Labor Statistics when the BLS revises jobs numbers down (as it routinely does) threatens to destroy trust in core American institutions, and all government statistics. I can't stress how damaging this is," said Arindrajit Dube, a professor focusing on labor economics at the University of Massachusetts Amherst.

Several people noted that Trump's action appeared anti-democratic.

"Add me to the list of people who think that the firing of the BLS commissioner is extremely worrying, reminding one of the actions of the worst dictators of the past," said Olivier Blanchard, Robert M. Solow professor of economics emeritus at the Massachusetts Institute of Technology.

Justin Wolfers, professor at the University of Michigan's economics department, weighed in as well: "Firing the BLS Commissioner — the wonk in charge of the statisticians who track economic reality — is an authoritarian four alarm fire. It will also backfire: You can't bend economic reality, but you can break the trust of markets. And biased data yields worse policy."

"Imagine you are the President of a democratically proud nation, you don't like the labor market data, you fire the head of your labor office as a result. This didn't happen in Turkey, no, not even in North Korea, but in the United States of America. Absolutely shocking!" said Marc-André Fongern, former Deutsche Bank and Goldman Sachs investment banker.

"On Friday morning, the Bureau of Labor Statistics released disappointing jobs numbers. A few hours later, President Trump announced that he was directing the administration to fire the commissioner responsible for this highly respected, nonpartisan agency, widely considered the producer of the best labor market data in the world," said Jason Furman, former deputy director of the U.S. National Economic Council.

"This is closer to what one expects from a banana republic that from a major democratic financial center," he added.

Joseph Brusuelas, principal and chief economist at RSM US LLP, noted that the response rate to the surveys used by the BLS for the monthly job report had slipped below 60% from a pre-pandemic rate of 70% and well below the typical 80% rate over a decade ago.

"Typically with a three month window the response rate for a single monthly survey time improves to 90% which is why there are ongoing rolling revisions that are rarely as large as the downward 258K revision in June. The numbers are not rigged and they are the gold standard internationally," Brusuelas said.

Link to Seeking Alpha News Article - Aug. 02, 2025

Link to Seeking Alpha News Article - Aug. 02, 2025

ADBE 0.00%↑ AMZN 0.00%↑ JCI 0.00%↑

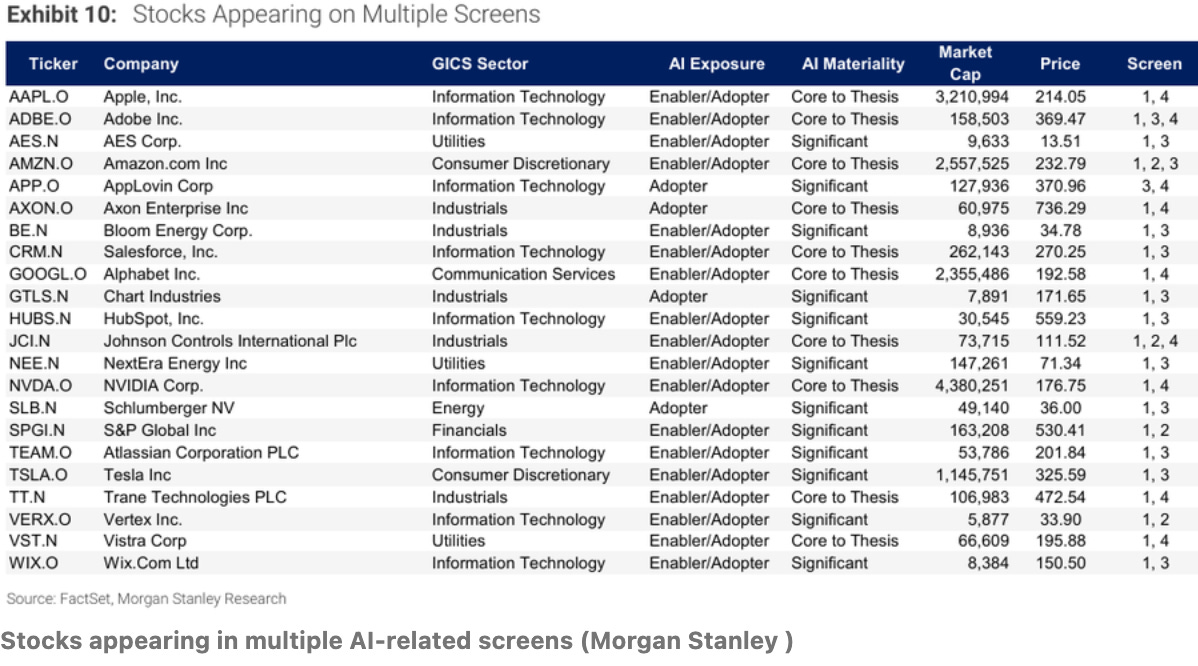

Adobe, Amazon and Johnson Controls stand out amid surge in AI adoption: Morgan Stanley

Among the companies appearing on multiple screens, three names stood out: Adobe (NASDAQ:ADBE), Amazon (NASDAQ:AMZN) and Johnson Controls International (NYSE:JCI). All were identified as high-quality, large-cap adopters with AI playing an increasingly central role in their business strategies.

Other large-scale adopters cited include Nvidia (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Meta Platforms (NASDAQ:META) and Tesla (NASDAQ:TSLA), all of which Morgan Stanley ranks “Overweight” due to their strong positioning as both AI enablers and adopters.

Link to Seeking Alpha News Article - Aug. 03, 2025

TSLA 0.00%↑ XPEV 0.00%↑ #BYDDY

Tesla’s China-made EV sales fall 8.4% in July; Europe slump persists

Tesla's (NASDAQ:TSLA) China-made electric vehicle sales fell 8.4% year-over-year in July amid mounting competition from lower-priced models launched by local rivals.

Deliveries of its Shanghai-made Model 3 and Model Y vehicles, including exports to Europe and other markets, reached 67,886 units last month, Reuters reported, citing data from the China Passenger Car Association (CPCA). That marked a 5.2% sequential decline in deliveries.

The performance still lags major Chinese rivals by a significant margin. Chinese rival BYD (OTCPK:BYDDF) (OTCPK:BYDDY) shipped 341,030 passenger vehicles in July 2025, compared to 340,799 units in July 2024. However the number was down from 377,628 in June 2025 — marking its first monthly decline this year.

Other local EV competitors, including NIO (NIO) and XPeng (XPEV) also reported higher sales on an annual basis. Nio’s July deliveries gained 2.5% Y/Y, while Xpeng (XPEV) set a new monthly record in July with 36,717 Smart EV deliveries, a 229% year-over-year surge.

Tesla (NASDAQ:TSLA) is also facing mounting pressure in Europe, with July registrations down 86% Y/Y in Sweden, 52% in Denmark, 27% in France, 62% in the Netherlands, and 58% in Belgium, as per official industry data.

Link to Seeking Alpha News Article - Aug. 04, 2025

Link to Seeking Alpha News Article - Aug. 04, 2025

India will keep buying Russian oil despite Trump threats - report

Trump had indicated additional penalties over Russian oil and arms purchases, alongside a new 25% tariff on Indian exports. Trump told reporters that he had heard that India would no longer be buying oil from Russia.

However, Indian sources had indicated that, “These are long-term oil contracts,” adding it's not feasible to halt purchases abruptly.

Another official argued that India's imports of discounted Russian oil have helped stabilize prices. Unlike Iranian or Venezuelan crude, Russian oil isn’t under direct sanctions, and India is buying it below the EU price cap. The Indian government has not issued any directive to oil companies to curb Russian imports.

India’s Ministry of External Affairs said "the very nations criticizing India are themselves indulging in trade with Russia," with the European Union buying energy, fertilizers, mining and other products, while the U.S. buys uranium hexafluoride for its nuclear industry, palladium for the electric vehicle industry, among others.

"Like any major economy, India will take all necessary measures to safeguard its national interests and economic security," the ministry said.

Russia now accounts for about 35% of India’s total oil imports, with India being the world’s third-largest oil importer and consumer.

The White House has not clarified what specific penalties might be imposed if India continues to ignore these warnings, while China and Turkey—other major buyers of Russian oil—have not faced similar threats from the U.S.

Link to Seeking Alpha News Article - Aug. 04, 2025

Link to Seeking Alpha News Article - Aug. 04, 2025

[Newsletter Exclusive] Tesla approves a restricted stock award to Elon Musk of 96 million shares

The 2025 CEO Interim Award will vest upon the second anniversary of August 3, 2025, subject to Musk remaining in continuous service as CEO or as an executive officer responsible for product development or operations. Musk must pay the company $23.34 per share of restricted stock that vests, which is equal to the exercise price per share of the 2018 CEO Award. The terms of the award indicate that Musk cannot sell, transfer, or dispose of the shares covered by the 2025 CEO Interim Award until after the fifth anniversary of the grant, except to satisfy taxes owed.

The CEO compensation package will be placed before a shareholder vote at the company's annual meeting on November 6.

The interim stock award comes after a prior compensation package valued exceeding $50 billion was struck down by a judge in a decision that is being appealed to the Delaware Supreme Court.

Link to Seeking Alpha News Article - Aug. 04, 2025

BMNR 0.00%↑ #ETH

BitMine exceeds $2.9B in Ethereum holdings

BitMine Immersion Technologies (NYSE:BMNR) has become the largest ETH (ETH-USD) treasury in the world. As of August 3, the company's ETH holdings totaled 833,137 at $3,491.86 per ETH (Bloomberg), making BitMine the largest ETH Treasury in the world.

At over $2.9 billion in ETH and crypto holdings, BitMine is said to rank as the third largest crypto treasury in the world, behind only Microstrategy and Mara Blockchain.

Link to Seeking Alpha News Article - Aug. 04, 2025

#OpenAI

OpenAI's ChatGPT nears 700M weekly users as GPT-5 launch approaches

"This week, ChatGPT is on track to reach 700M weekly active users — up from 500M at the end of March and 4× since last year," said Nick Turley, OpenAI's head of product, in a post on X Monday.

OpenAI's annual recurring revenue has also hit $13B and is on track to crack $20B by the end of the year.

OpenAI CEO Sam Altman has also indicated GPT-5 will be released "soon," with some industry insiders suspecting it will launch this month.

Link to Seeking Alpha News Article - Aug. 04, 2025

J.P. Morgan raises concerns over abrupt dismissal of BLS commissioner

J.P. Morgan raised concerns over the sudden dismissal of Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer, adding that it could pose serious risks, including on the conduct of monetary policy, to financial stability, and to the economic outlook.

"Potential politicization of the Fed has been much discussed over the past several months, but the risk of politicizing the data collection process should not be overlooked. To borrow from the soft-landing analogy, having a flawed instrument panel can be just as dangerous as having an obediently partisan pilot," J.P. Morgan said.

President Donald Trump on Friday said he would fire Bureau of Labor Statistics (BLS) Commissioner Erika McEntarfer, a move that sets a "dangerous precedent," according to her immediate predecessor William Beach.

Link to Seeking Alpha News Article - Aug. 04, 2025

XPEV 0.00%↑ NIO 0.00%↑ ZK 0.00%↑ PSNY 0.00%↑ #MBGAF

European demand for Chinese electric vehicle brands is stronger than anticipated

In the first half of 2025, Chinese brands accounted for 5.1% of new vehicle registrations across 28 European countries, nearly doubling their share from the previous year and reaching parity with Mercedes-Benz (OTCPK:MBGAF).

The new popularity of Chinese brands reflects dramatic changes in perceptions, according to Nikkei Asian Review. While a decade ago Chinese cars were seen as inferior or unsafe, in the current market they are winning top marks in major Swedish auto publications, and companies like XPeng (NYSE:XPEV), Nio (NYSE:NIO), and Geely's Zeekr Automotive (NYSE:ZK) and Polestar (PSNY) have flagship locations in Stockholm. In Norway, Chinese electric vehicles now claim around 10% of the market, and in Denmark, market share has climbed to 5.5%. Even in Switzerland, traditionally dominated by German luxury brands, Chinese EVs are gaining an impressive foothold.

Analysts noted that Chinese EVs have done better than expected in Europe due to a combination of aggressive pricing, rapid product innovation, and state-backed industrial policies that support battery and electronics supply chains.

While recent surveys indicate that a substantial number of European consumers are open to Chinese EVs, some concerns about quality and unfamiliarity with the brands still persist. The general expectation is that Chinese brands will solidify their presence in lower-priced vehicle segments, while European brands are likely to remain dominant in luxury and premium categories.

Link to Seeking Alpha News Article - Aug. 04, 2025

TransMedics rises as FDA greenlights OCS heart trial

Shares of TransMedics Group (NASDAQ:TMDX) traded higher on Friday after the U.S. Food and Drug Administration (FDA) conditionally approved a clinical trial for its OCS Heart organ preservation system.

The regulator issued a conditional approval for the company’s Investigational Device Exemption (IDE), paving the way for its Next-Generation OCS ENHANCE Heart trial, TransMedics (NASDAQ:TMDX) said in a press release.

The two-part trial is expected to enroll more than 650 patients, making it the biggest ever heart preservation for transplant trial globally, according to the company.

Part A of the trial is designed to evaluate long-term heart perfusion using the OCS Heart System. Part B is expected to assess whether OCS Heart perfusion performs superior to static cold storage methods in donation after brain death (DBD) cases.

Link to Seeking Alpha News Article - Aug. 04, 2025

RKLB 0.00%↑ VOYG 0.00%↑ #SpaceX

U.S. said to fast-track plan for nuclear reactor on the moon

U.S. Transportation Secretary and acting NASA director Sean Duffy will unveil accelerated plans this week to build a nuclear reactor on the moon, Politico reported late Monday.

NASA has discussed building a reactor that could be used on the moon, but the move would set a more definitive timeline and come just as the agency faces a massive budget cut, the report said.

The directive reportedly orders the agency to solicit industry proposals for a 100 kw nuclear reactor to launch by 2030, a key consideration for astronauts' return to the lunar surface, after NASA previously funded research into a 40 kw reactor for use on the moon, with plans to have a reactor ready for launch by the early 2030s.

The first country to have a reactor could "declare a keep-out zone which would significantly inhibit the United States," the directive reportedly states, a sign of the Trump administration's concern about a joint project China and Russia have launched.

Duffy also offered a directive to more quickly replace the International Space Station, according to the report, two moves that could help spark U.S. efforts to reach the moon and Mars - a goal that China also is pursuing.

Link to Seeking Alpha News Article - Aug. 04, 2025

Tesla's market share in the UK falls below 1% in July after demand weakens

Tesla's (NASDAQ:TSLA) new car sales in Britain fell almost 60% in July on a year-over-year comparison to just 987 units, according to tracking from the Society of Motor Manufacturers and Traders. Overall, new car registrations in Britain fell about 5% during the month to 140,154 units.

Tesla's (NASDAQ:TSLA) market share in the UK fell below 1% in July after being 1.7% in June.

Data last week showed registrations of new Tesla (TSLA) cars in several key European markets fell in July, despite the revamp to the Model Y. Analysts have pointed to potential backlash against CEO Elon Musk's political views, regulatory challenges, and rising competition, including from Chinese EV brands.

Link to Seeking Alpha News Article - Aug. 05, 2025

Tesla German July auto sales cut in half

Tesla (NASDAQ:TSLA) new car registrations dropped by more than half in Germany last month despite a 58% increase in registrations of electric vehicles, according to data compiled by the country’s Federal Motor Transport Authority (KBA).

By contrast, Chinese competitor BYD (OTCPK:BYDDF) (OTCPK:BYDDY) saw a 389% surge in new car registrations to 1,126 vehicles, XPeng (XPEV) up 1,562% to 266 vehicles, Vietnam’s Vinfast (VFS) with a 150% increase to 10, Lucid (LCID) with a 475% increase to 46 vehicles, and NIO (NIO) up 47% to 47 vehicles.

For the year-to-date ending in July, Tesla (NASDAQ:TSLA) sold 10,000 vehicles, 57.8% less than the same period in 2024.

Link to Seeking Alpha News Article - Aug. 05, 2025

GOOGL 0.00%↑ #OpenAI #Anthropic

Google, OpenAI, and Anthropic's AI services get US nod for potential use in government agencies

The U.S. General Services Administration has added AI services from Anthropic, Claude, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOG) unit Google’s Gemini, and OpenAI’s ChatGPT to its Multiple Award Schedule.

MAS are long-term government-wide contracts with commercial firms providing federal, state, and local government buyers access to commercial products and services at volume discount pricing.

The move will help the use of the AI services for use in the federal government.

The GSA provides centralized procurement and shared services for the federal government.

The agency noted that it welcomes all approved AI providers who are committed to responsible use and compliance with federal standards to pursue joining the GSA Schedule.

The GSA noted that the announcement directly supports America’s AI Action Plan and the administration’s priority to accelerate the availability of AI tools across government.

Link to Seeking Alpha News Article - Aug. 05, 2025

NB 0.00%↑ MP 0.00%↑ USAR 0.00%↑

NioCorp shares climb after Defense Department awards $10M for scandium supply

Shares of NioCorp Developments (NASDAQ:NB) rose 3.3% Tuesday morning after the U.S. Department of Defense announced it will provide $10 million in funding to support the development of a domestic scandium supply chain through NioCorp’s subsidiary, Elk Creek Resources.

The funds, awarded under the Defense Production Act, will help advance engineering work, drilling operations, and feasibility studies at the company’s Elk Creek critical minerals project in Nebraska.

The move marks another step in the U.S. government’s broader push to reduce dependence on China and other foreign sources for strategic materials. Scandium, a rare element primarily produced in China, Russia and Ukraine, has not been mined in the United States since 1969.

The Elk Creek initiative aligns with President Donald Trump’s 2025 executive order aimed at accelerating domestic production of critical minerals vital to national security and advanced manufacturing.

Scandium is a key component in high-performance aluminum alloys used in aerospace, hypersonic systems, and energy technologies. The announcement follows a similar strategic agreement last month, when MP Materials (MP) entered into a multibillion-dollar pact with the federal government to boost production of rare earth magnets.

Link to Seeking Alpha News Article - Aug. 05, 2025

USAR 0.00%↑ CRML 0.00%↑ MP 0.00%↑ #LYSDY #ILKAY #ARAFF

Australia considers critical minerals price floor to support new projects; Lynas surges

Australia is considering setting a price floor for critical minerals such as rare earths, to help shore up supply of commodities essential to defense and strategic technologies, Resources Minister Madeleine King said Tuesday, which sparked a rally in share prices for Australian-listed rare earths miners including Lynas Rare Earths (OTCPK:LYSCF) (OTCPK:LYSDY), Iluka Resources (OTCPK:ILKAF) (OTCPK:ILKAY), and Arafura Rare Earths (OTCPK:ARAFF), +5.2%, +8.6% and +8.5%, respectively.

The U.S. Department of Defense last month guaranteed a price floor for rare earth minerals produced by American supplier MP Materials (MP), and analysts speculated that other Western governments might follow suit; MP shares +3.4% in Tuesday's trading to an all-time intraday high of $68.36, and USA Rare Earth (USAR) +6.2%, Critical Metals (CRML) +1.3%.

The support comes as prices for some metals such as rare earths have been too low to fund processing capacity in Western countries, keeping China on top as remained the world's dominant supplier.

Link to Seeking Alpha News Article - Aug. 05, 2025

FSLR 0.00%↑ NXT 0.00%↑ TAN 0.00%↑

EPA moves to cancel $7B in grants for solar energy - NYT

The Trump administration is preparing to terminate $7B in federal grants intended to help low- and moderate-income families install solar panels on their homes, in an escalation of the Trump administration's attempts to claw back billions of dollars in climate grants awarded under President Biden, The New York Times reported Tuesday.

The Environmental Protection Agency is drafting termination letters to the 60 non-profit groups and state agencies that received the grants under the "Solar for All" program, with the goal of sending the letters by the end of this week, according to the report.

The EPA already has sought to cancel $20B out of the $27B in climate grants authorized by the Biden administration's Inflation Reduction Act; during Biden's presidency, the EPA awarded all $7B under the Solar for All program, although it is unclear how much of the money has been spent so far.

Link to Seeking Alpha News Article - Aug. 05, 2025

WMT 0.00%↑ AMZN 0.00%↑ UPS 0.00%↑ FDX 0.00%↑ GOOGL 0.00%↑

DOT to ease line of sight restrictions on commercial drone flights

In a potential boost for the drone industry, the Department of Transportation is considering easing restrictions on commercial drone flights—rules that have long curbed innovation and limited the adoption of drone-based deliveries.

The changes would eliminate case-by-case approvals for long-range drone flights and allow more commercial drones to fly beyond an operator’s line of sight, giving companies like Walmart (NYSE:WMT), Amazon (AMZN), UPS (UPS), and FedEx (FDX) the flexibility to expand its delivery options. The application could also expand the use of drones in other industries including manufacturing, farming, energy production, and healthcare.

The proposed rule – Beyond Visual Line of Sight (BVLOS) – would eliminate requirements for BVLOS operation and expand the use-case for drone technologies.

Other than e-commerce players, relaxing rules regulating the drone industry would also benefit specialized drone delivery names including Alphabet’s (GOOG) Wing, Draganfly (DPRO), AeroVironment (AVAV), as well as privately-owned Zipline Technologies, Matternet, and Flytrex.

Link to Seeking Alpha News Article - Aug. 05, 2025

Pizza delivery by robot: Little Caesars, Serve Robotics, and Uber partner on autonomous deliveries

Serve Robotics Inc. (NASDAQ:SERV) announced a partnership to deliver the Little Caesars Hot-N-Ready pizza product with the company's autonomous delivery robots. The orders will be set up through Uber Eats (UBER).

Little Caesars customers in Serve's (NASDAQ:SERV) Los Angeles delivery area may now receive their orders via autonomous sidewalk robots.

Serve Robotics (SERV) also has partnerships with Shake Shack (SHAK), 7-Eleven, as well as numerous local restaurants.

Link to Seeking Alpha News Article - Aug. 05, 2025

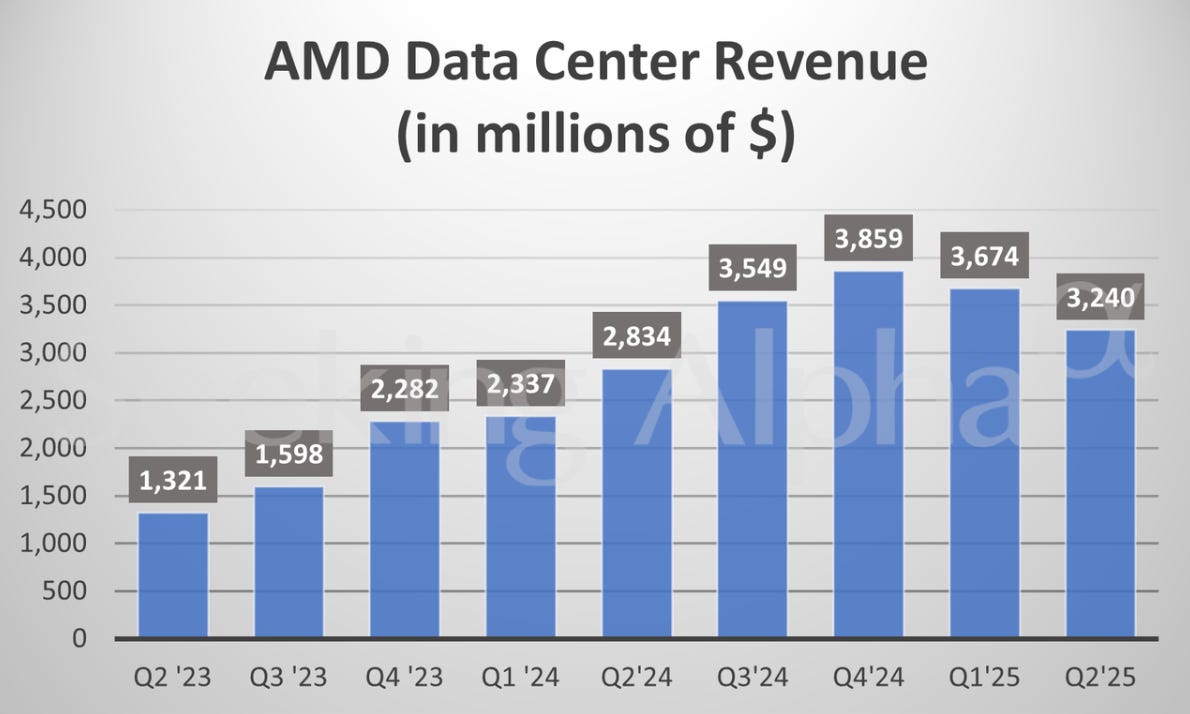

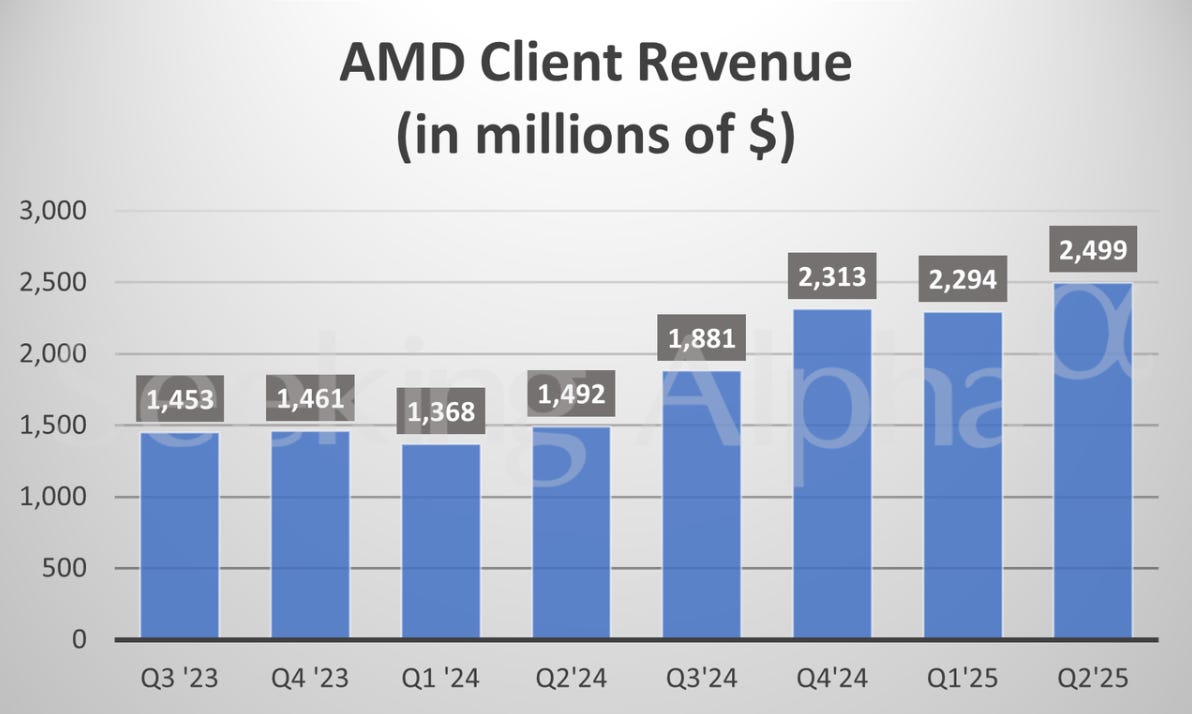

AMD dips after earnings; revenue beats expectations, but data center growth slows

For the quarter ended June 28, AMD reported adjusted earnings per share of $0.48, which matched the consensus estimate. Revenue for the quarter totaled $7.68B, which was a year-over-year increase of 32% and easily surpassed the estimate of $7.43B.

Data center segment revenue for the second quarter totaled $3.24B, which was a quarter-over-quarter decline of 11.8%. It represented a year-over-year gain of 14%. However, its first quarter data center revenue demonstrated a 57% year-over-year increase.

Looking ahead to the quarter in progress, AMD expects revenue ranging from $8.4B to $9B, with a midpoint of $8.7B well above the estimate of $8.37B.

"Our current outlook does not include any revenue from AMD Instinct MI308 shipments to China as our license applications are currently under review by the U.S. Government," AMD said.

Timothy Michael Arcuri, UBS: Queried about the Data Center GPU ramp. Su highlighted, “MI355... really is ramping as we go through this quarter and the third quarter... there's a strong desire to really use us at scale.”

Joshua Louis Buchalter, TD Cowen: Focused on lead times for MI350 and MI400. Su stated, “Think about it as somewhere between 8, 9 months...” and cited strong supply chain preparation.

Link to Seeking Alpha News Article - Aug. 05, 2025

Link to Seeking Alpha News Article - Aug. 05, 2025

Link to Seeking Alpha News Article - Aug. 05, 2025

More on NASA's Artemis program and why it's going nuclear

A modern-day space race is taking shape as the U.S. tries to upend plans by Russia and China to establish the first base on the Moon. The difference this time is that the race is going nuclear. In order to have a permanent presence, America is looking at the best way to get power up there by 2030, five years ahead of rival nations, and has settled on a nuclear fission microreactor that would have an output of 100 kW.

Snapshot: Other power sources like solar are not a good option, as the Moon is dark for two weeks straight each month, with extreme temperatures that can challenge arrays and equipment. "There's a certain part of the moon that everyone knows is the best; we have ice and sunlight there, and we want to get there first and claim that for America," NASA's Acting Administrator Sean Duffy declared. It's all part of the agency's Artemis program, which is aimed at sustaining life on the Moon to enable space exploration to expand to Mars.

Artemis II will launch in the first half of 2026, which will take four astronauts on a mission around the Moon before returning to Earth. In 2027, Artemis III hopes to pull off the first crewed Moon landing since 1972. If those are both successful, the U.S. will then begin shipping assets to the Moon's South Pole region via unmanned missions, which would later be assembled by astronauts to establish the first human lunar base.

Stock watch: The NASA program, called Fission Surface Power, is helping energize some nuclear names back on Earth. BWX Technology (NYSE:BWXT) soared nearly 18% on Tuesday to hit fresh record highs, and earnings momentum is also helping extend the gains in the premarket session.

Link to Seeking Alpha News Article - Aug. 06, 2025

[Newsletter Exclusive] WeRide launches 24/7 robotaxi testing in Beijing

WeRide (NASDAQ:WRD) has secured approval to conduct late-night robotaxi tests on public roads in Beijing’s autonomous driving zone from 10 p.m. to 7 a.m., marking a key step toward its goal of offering 24/7 autonomous ride-hailing services in the city.

To address potential visibility issues at night, WeRide's robotaxi is equipped with more than 20 sensors, including high-precision, high-dynamic cameras and high-line LiDARs across the vehicle.

Combined with its proprietary multi-sensor fusion algorithm and high-performance computing platform, the system achieves 360-degree blind-spot-free coverage of up to 200 meters detection range.

Link to Seeking Alpha News Article - Aug. 06, 2025

[Newsletter Exclusive] Emerson beats on earnings, misses on revenue; shares fall

Earnings jumped to $1.03 a share, up from $0.60 a year ago, as Emerson (NYSE:EMR) improved its pretax margin by 570 basis points.

Emerson (NYSE:EMR) in the past few years has reshaped its portfolio through a series of strategic acquisitions and divestitures aimed at positioning the company as a higher-margin, software-driven industrial automation leader. By exiting lower-growth segments like climate technologies and doubling down on digital automation, most notably with the acquisition of AspenTech, Emerson (NYSE:EMR) has sought a leaner, more profitable business mix.

Link to Seeking Alpha News Article - Aug. 06, 2025

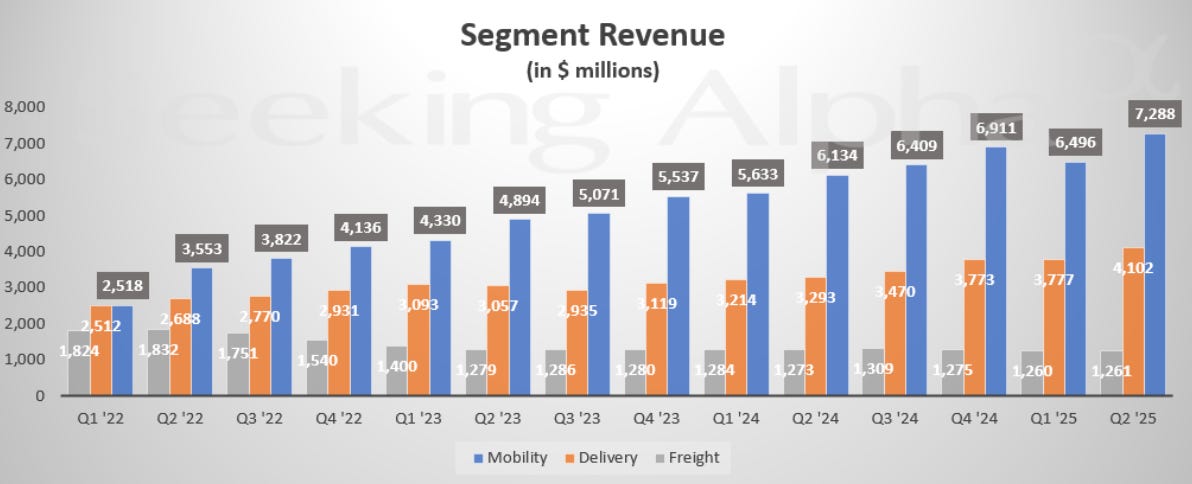

Uber sets $20B stock buyback plan

The ride-hailing company earned a profit of $0.63 per share, up from $0.47 a year ago, but $0.19 less than analysts’ lofty expectations.

On the top-line, revenue grew 18% to a better-than-expected $12.7B.

The new plan authorized the repurchase of up to an additional $20 billion of common stock.

Prashanth Mahendra-Rajah, CFO said, “Our trailing twelve month free cash flow hit a new all-time high of $8.5 billion and we remain committed to driving durable, profitable growth.”

CEO Dara Khosrowshahi detailed autonomous vehicle (AV) expansion: "We expanded our operating zones in Austin with Waymo and Abu Dhabi with WeRide, and we also launched exclusively with Waymo in Atlanta. We announced several new and expanded partnerships, including with Baidu, Lucid, Nuro and Wayve."

CFO Prashanth Mahendra-Rajah commented, "as we think about our investments in AV, you want to think about them in terms of where will we use capital to take equity positions in some of the software players or ecosystem players to help them kick start their development and where does Uber being part of their cap table sort of add to their credibility. We're going to continue to recycle some of the proceeds from the minority stakes that we have to fund some of those investments."

Link to Seeking Alpha News Article - Aug. 06, 2025

Link to Seeking Alpha News Article - Aug. 06, 2025

Link to Seeking Alpha News Article - Aug. 06, 2025

Link to Seeking Alpha News Article - Aug. 06, 2025

[Newsletter Exclusive] Trump imposes additional 25% tariff on India in measure aimed against Russia

The order is intended to punish India for buying oil and petroleum products from Russia.

The new tariff, to be added to the 25% tariff the Trump administration published last week, will take effect at 12:01 AM ET on Sept. 17, 2025, the order said.

Goods imported from India in 2024 totaled $87.3B, which rose 4.5% from the previous year, according to the Office of the United States Trade Representative. The U.S. goods trade deficit with India was $45.8B last year, which was 5.9% higher than 2023.

The Indian rupee (INR:USD) weakened 0.1% against the U.S. dollar in Wednesday morning trading. In the past three months, the rupee has declined 3.4% against the dollar.

Link to Seeking Alpha News Article - Aug. 06, 2025

Centrus Energy expands $3.6B backlog and advances HALEU production while awaiting DOE funding decision

Amir V. Vexler, President and CEO, asserted that Centrus has not faced significant operational disruption from macroeconomic or geopolitical turmoil, reiterating, "we continue to receive shipments of enriched uranium and our operations have not been significantly impacted by macroeconomic events."

Vexler reported a production milestone for HALEU, noting, "Centrus achieved the 900-kilogram production milestone for Phase 2, and to date has produced close to a metric ton of HALEU for the department." He also confirmed a contract extension with the DOE through June 2026.

Management indicated continued optimism about the DOE's pending allocation of $3.4 billion to jumpstart domestic nuclear fuel production. Vexler said, "Given the administration's urgency and focus on energy dominance, we remain optimistic that a decision will be made soon."

Link to Seeking Alpha News Article - Aug. 06, 2025

[Newsletter Exclusive] Apple stock extends gains, rises 3% postmarket after confirming new $100B U.S. investment

AAPL was last +3% in postmarket trade. In the regular session, AAPL ended +5.1%. The stock added $153.30B in market cap and notched its best intraday gain since May 12.

AAPL top boss Tim Cook, appearing in the Oval Office with President Trump, said the iPhone-maker would increase an earlier U.S. investment commitment by $100B to $600B overall, confirming reports from Bloomberg News, Reuters, and CNBC in the day.

Link to Seeking Alpha News Article - Aug. 06, 2025

Solid Power outlines 75 metric ton electrolyte capacity target while advancing BMW and SK On partnerships

John C. Van Scoter, CEO, highlighted a "significant achievement in our partnership with BMW, who introduced their i7 test vehicle powered by our cells and solid-state battery technology".

The company completed factory acceptance testing of the SK On pilot line, with Van Scoter stating, "Our collaboration with SK On supports their efforts to develop solid-state cells based on our technology and operate a solid-state pilot line that we designed to use our electrolyte."

Van Scoter noted progress on the electrolyte development road map, mentioning the start of detailed design for "planned installation of a continuous manufacturing pilot line for sulfide electrolyte production at SP2" with an expected capacity of 75 metric tons, supported by $3.3 million in reimbursements from the U.S. Department of Energy.

Van Scoter indicated the company is "on track for commissioning of the [sulfide electrolyte production] line in 2026."

Link to Seeking Alpha News Article - Aug. 06, 2025

AppLovin outlines 20–30% annual growth target

Adam Arash Foroughi, CEO, highlighted "continued strength in gaming advertising" as the key driver behind another strong quarter, citing improved technology, increased demand, and supply side expansion. He stated, "we are confident we can sustain 20% to 30% year-over-year growth driven by just gaming".

E-commerce onboarding was limited in Q2 to focus on product readiness, in contrast to Q1's accelerated ramp-up.

Foroughi acknowledged that limiting e-commerce advertiser onboarding in Q2 "constrained growth" and that future onboarding will be closely monitored through the referral program before global expansion.

Link to Seeking Alpha News Article - Aug. 06, 2025

IonQ outlines $1.6B cash position and targets 80,000 logical qubits by 2030 while expanding global quantum footprint

IonQ expanded its global footprint, including an MOU with Japan's AIST's G-QuAT and being named the primary quantum partner by South Korea's KISTI Institute. In the U.S., IonQ announced a $22 million deal to build the first commercial quantum computing and networking hub with EPB and continued partnerships with the U.S. government, including DARPA.

Strategic acquisitions included Lightsynq, Capella (closed in July), and the pending acquisition of Oxford Ionics. Niccolo de Masi, Chairman and CEO outlined, "The combination of IonQ hardware and software prowess, Oxford's implementation of an ion trap on a chip provides the team, IP technology momentum to achieve 800 logical qubits in 2027 and 80,000 logical qubits in 2030."

Jordan Shapiro, President and GM of Quantum Networking, highlighted IonQ's leadership in commercial-scale quantum networks, noting, "IonQ's QKD products are already manufactured at scale, fit into a 1-unit high rack mountable server and are used every day to protect information across the globe."

Frank Backes, CEO of Capella, stated, "Capella has already proven we can put production-grade satellites into orbit... IonQ will be expanding Capella's proliferated low earth orbit constellation to meet global demand."

Revenue for Q2 was $20.7 million. Adjusted EBITDA loss was $36.5 million. Total operating costs were $181.3 million, with research and development costs at $103.4 million, sales and marketing at $10.9 million, and general and administrative expenses at $48.1 million.

Link to Seeking Alpha News Article - Aug. 06, 2025

Joby Aviation outlines $1B Saudi aircraft sales opportunity and plans 100-aircraft Japan JV as certification nears

JoeBen Bevirt, CEO, highlighted significant milestones in certification, manufacturing, and commercialization, stating, "We're delivering at an exceptional level on all fronts, on certification, on manufacturing and on commercialization." He noted that Stage 4 of certification is now 70% complete on the Joby side and over 50% complete on the FAA side, marking a 10-point increase from last quarter. The first of five aircraft for TIA flight testing has entered final assembly.

Kristine T. Liwag, Morgan Stanley questioned Stage 4 certification progress. Bevirt clarified, "On the Joby side, we're 70% complete. And so the remaining 30% will come in over the next year or so...we do not need to be at 100% on Stage 4 prior to beginning the TIA work."

Bevirt emphasized the Dubai campaign, stating, "We completed a multiweek campaign in the UAE with 21 piloted flights...in temperatures nearing 110 degrees Fahrenheit."

Bevirt outlined three commercialization paths: owned and operated service, direct sales, and regional partnerships. He detailed plans for a joint venture with ANA to deploy over 100 aircraft in Japan and a distribution partnership with Abdul Latif Jameel to potentially sell up to 200 aircraft in Saudi Arabia, valued at approximately $1 billion.

Savanthi Nipunika Prelis-Syth, Raymond James: Asked about certification policy status. Bevirt stated, "We're substantially out of policy, if not completely out of policy. The real focus right now with the FAA is on finalizing all of our TIA flight test plans."

Amit Dayal, H.C. Wainwright: Asked about certification timing and Blade deal closure. Bevirt guided to TIA aircraft flying with Joby pilots later this year and FAA pilots early next year. Brumana said the Blade deal will take a few weeks to close.

Link to Seeking Alpha News Article - Aug. 06, 2025

Redwire GAAP EPS of -$1.41 misses by $1.24, revenue of $61.76M misses by $18.72M

Completed acquisition of Edge Autonomy on June 13, 2025, transforming Redwire (RDW) into an integrated space and defense tech company focused on advanced technologies

Stalker uncrewed aerial system added to Department of Defense’s Blue List of Approved Drones; in July 2025, awarded a prototype phase agreement by the U.S. Army to develop and deliver Stalker systems for the Long Range Reconnaissance program

Achieved key technical milestones, including a successful Roll-Out Solar Array deployment test for lunar Gateway and a Critical Design Review with NASA participation for Mason, our lunar and Martian manufacturing technology

Sequential increase in Book-to-Bill ratio to 1.47 as of the second quarter of 2025.

Redwire added: “Additionally, we are excited to announce the formation of SpaceMD, a new entity founded to commercialize on Redwire’s microgravity drug development breakthroughs, and the signing of a trailblazing royalty agreement with ExesaLibero Pharma, Inc., under which we expect to receive royalties from the commercial sales of resulting pharmaceutical products.”

Austin Moeller (Canaccord Genuity) questioned the impact of NASA’s LEO directive and Golden Dome opportunities. Cannito indicated Redwire is positioned as an “orbital outfitter” for space stations and is actively bidding on Golden Dome.

Link to Seeking Alpha News Article - Aug. 06, 2025

Link to Seeking Alpha News Article - Aug. 07, 2025

Amazon's Zoox robotaxis granted exemption from certain safety standards

Amazon's (NASDAQ:AMZN) Zoox (ZOOX) robotaxis have been granted demonstration exemption from federal safety requirements involving traditional manual driving controls such as steering wheels and brake pedals.

This marks the first exemption from the National Highway Traffic Safety Administration's Federal Motor Vehicle Safety Standards for American-built vehicles.

The exemption is only for demonstration use, and not for commercial purposes.

Link to Seeking Alpha News Article - Aug. 07, 2025

AppLovin surges as multiple catalysts appear following latest outlook: analysts

Oppenheimer reiterated its Outperform rating and $500 price target. It also considers the stock a "top pick" in its coverage universe.

"Management still expects e-commerce advertising to scale this year to over 10% of total advertising," said Oppenheimer analysts Martin Yang and Jason Helfstein, in a Thursday investor note. "Its confidence in achieving this seems incrementally higher now that it's confirmed AXON Ad Manager will be made available to a broader audience in the US and internationally, with a self-service portal, starting Oct. 1."

Meanwhile, Bank of America reiterated its Buy rating and hefty $580 price target.

"We raise our 4Q25/CY26 revenues to $1.69bn/$10bn from $1.65bn/$8.1bn to reflect (1) renewed onboarding of eCommerce advertisers due to APP’s large advertiser referral program, launching 1 October 2025, (2) increased avg. spend per advertiser by virtue of activating rest of world audiences for existing advertisers, and (3) general availability for SMBs in 1H26," said BofA analysts Omar Dessouky and Arthur Chu in an investor note.

Benchmark Equity Research also reiterated its Buy rating and $525 price target.

"With increasing advertiser confidence, Axon-driven performance gains, and geographic expansion, AppLovin is well positioned for sustained revenue and margin growth," said Benchmark analyst Mike Hickey, in an investor note.

Link to Seeking Alpha News Article - Aug. 07, 2025

[Newsletter Exclusive] IonQ draws mixed reactions from analysts following Q2 results

"IonQ raised its FY25 revenue guide to $82-100MM (vs. prior guidance of $75-95MM)," said Needham analysts, led by N. Quinn Bolton, in a Thursday investor note. "We believe the upside is being driven by two projects at existing customers across quantum computing and networking applications. While management increased revenue, they are also raising their EBITDA loss to reflect increased hiring and the pending acquisition of Oxford Ionics."

Needham reiterated its Buy rating and $60 price target as it considers the company one of the leaders in the quantum computing industry.

Benchmark Equity Research also reiterated its Buy rating and $55 price target.

"The company is seeing growing demand from sovereign nations for both ground and space-based quantum networking and computing solutions, positioning IonQ as a uniquely capable provider," said Benchmark analyst David Willismas, in a note.

However, D.A. Davidson downgraded IonQ to Neutral from Buy while maintaining its $35 price target on the stock.

"Having greater clarity on the path to getting to their medium-to-long term goals and a concrete timeline for getting there we believe is required," said D.A. Davidson analyst Alexander Platt in an investor note. "We would note that IonQ is building a holistic quantum platform with foundational pillars in computing, networking, and sensing, though we remain cautious around the company's recent acquisitive nature and its unclear implications on both growth and profitability."

Link to Seeking Alpha News Article - Aug. 07, 2025

#OpenAI

OpenAI launches its smartest AI system yet, GPT-5

The AI model has state-of-the-art performance across coding, math, writing, health, and visual perception, among other things, according to the AI startup.

GPT‑5 is a unified system with a smart, efficient model that answers most questions, a deeper reasoning model (GPT‑5 thinking) for harder problems, and a real‑time router that quickly decides which to use based on conversation type, complexity, tool needs, and explicit intent, the company added.

GPT‑5 is also the company's best model yet for health-related questions. The model scores significantly higher than any previous model on HealthBench, an evaluation measure the company published earlier this year based on realistic scenarios and physician-defined criteria.

In addition, the model excels at a range of multimodal benchmarks, spanning visual, video-based, spatial, and scientific reasoning, as per OpenAI.

OpenAI said GPT‑5 is rolling out on August 7 to all Plus, Pro, Team, and Free users, with access for Enterprise and Edu coming in one week.

Link to Seeking Alpha News Article - Aug. 07, 2025

Firefly Aerospace stuns in its IPO debut as its market cap tops $10B at the high point

Firefly Aerospace (NASDAQ:FLY) soared to as high as $73.85 within the first hour of its IPO debut Thursday on the Nasdaq Global Market.

Firefly (FLY) attracted considerable attention earlier this year when it became the first private company to successfully land and operate on the Moon with Blue Ghost Mission. The achievement marked the first fully successful U.S. lunar surface landing since the Apollo era over 50 years ago.

The company's SEC filing revealed that Firefly (FLY) saw a 10% revenue increase in 2024 to $60.8 million and posted $55.9 million in revenue for the first quarter of 2025. The company's contract backlog nearly doubled, fueled by new government and commercial deals, and its valuation reached $2 billion following a funding round in late 2024.

Despite its rapid growth, Firefly (FLY) continues to operate at a net loss, reporting a net loss of $60.1 million as of March 2025.

Link to Seeking Alpha News Article - Aug. 07, 2025

[Newsletter Exclusive] Ex-Treasury head Summers says Trump’s policies 'scarily reminiscent' of Argentina’s Perón

Juan Perón's government came to power in 1946 in Argentina at a time when the country was the fifth largest economy in the world at the beginning of the 20th century. Perón, wishing to make Argentina more self-sufficient, implemented trade protectionist policies such as high tariffs, which eventually led to an economic downfall, according to a 2023 analysis by think tank OMFIF.

“Over time, as the nationalism took hold, as economic success became more and more about who is friends with the government – and less and less about who was really good at producing products and competing with foreigners – Argentina’s economic performance became calamitous,” Summers said. “It’s a model that, if you think about it, is scarily reminiscent of what we are doing right now.”

Summers, speaking on Bloomberg TV’s Wall Street Week with David Westin, said that although the U.S. had “highly resilient institutions,” he saw parallels with Perón's government, including protectionism, “a cult of personality around the leader,” and attacks on the media, universities, and law firms.

Summers also expressed skepticism about some of Trump’s economic promises centered around tariffs. “You don’t know what they mean, because you don’t know what the baseline would have been,” he said, and added that there is going to be “a lot of investment that goes out, because we’re making ourselves such a more problematic hub for production when we’re raising the price of all the inputs.”

He added that the consequence of some of these trade policies may give way to a manufacturing sector “that is both quantitatively smaller and qualitatively inferior.”

“We are alienating the rest of the world; higher priced inputs, much more uncertainty for investors and alienating of customers can’t be the right strategy,” he concluded, adding that “there’s a winner here… His name is Xi Jinping.”

Link to Seeking Alpha News Article - Aug. 07, 2025

Serve Robotics Inc. Non-GAAP EPS of -$0.24 misses by $0.07, revenue of $0.64M beats by $0.02M

Guidance Reiterated: Projected annualized revenue run-rate of $60 to $80 million once our 2,000-robot fleet is fully deployed and reaches target utilization, which we anticipate will occur during 2026.

Guidance for Q3: With revenue growth between 170% and 215% year over year, we are projecting $600 to $700 thousand revenue in Q3.

Fleet Scale: We anticipate deployment acceleration in 2H that is expected to more than double our robot fleet in Q3.

In Q2 2025, Serve delivered over 120 new third-generation robots—marking an approximate 80% year-over-year increase in their fleet.

This brought the total active fleet to approximately 160 robots by the end of that quarter.

Link to Seeking Alpha News Article - Aug. 07, 2025

The trade desk outlines 14% Q3 revenue growth target amid rapid Kokai adoption and new leadership

Revenue for Q2 was $694 million, up 19% year-over-year. Adjusted EBITDA was $271 million, about 39% of revenue. Adjusted net income for the quarter was $203 million or $0.41 per diluted share.

Schenkein provided Q3 guidance: "we expect Q3 revenue to be at least $717 million, reflecting 14% year-over-year growth. Excluding the benefit of U.S. political ad spend in Q3 of 2024, our estimated growth rate in Q3 of this year would be approximately 18% on a year-over-year basis. We estimate adjusted EBITDA for Q3 to be approximately $277 million."

CTV led growth, with video representing a high 40s percentage share of business mix. North America accounted for about 86% of spend, international 14%. Free cash flow was $117 million, and the balance sheet held $1.7 billion in cash, cash equivalents, and short-term investments at quarter end.

Vasily Karasyov, Cannonball Research: Asked about tariff uncertainty and its impact on guidance. Green said, "the impact of tariffs and related policies on these businesses are very real... this is a short-term negative... but in volatile environments, these things have historically accelerated the move to programmatic."

Justin Tyler Patterson, KeyBanc: Asked about Kokai progress and AI capabilities. Green explained, "clients who've adopted Kokai are already seeing dramatic performance improvements... Kokai campaigns are outperforming legacy ones by more than 20 points on KPIs."

Mark Stephen F. Mahaney, Evercore: Asked about the sustainability and scale of Kokai's KPI improvements. Green replied, "I believe that, that is merely scratching the surface of what is possible over time... the unlock that AI can bring to campaign optimization is really just beginning."

Jessica Jean Reif Ehrlich Cohen, BofA: Questioned share shift between walled gardens and open internet. Green said, "it is only a matter of time before the majority of spend is on the open Internet and not inside of walled gardens."

Link to Seeking Alpha News Article - Aug. 07, 2025

Rocket Lab signals $145M–$155M Q3 revenue target while accelerating Neutron and Space Systems growth

Peter Beck, CEO revealed progress on the Neutron program, stating, "Launch Complex 3 is ready for its grand opening, and we've got the first rocket parts on their way to Virginia."

The CEO described the company's readiness to participate in the DoD's $175 billion Golden Dome program, underlining capability across the entire space ecosystem and sharing, "We've already won more than $0.5 billion contract with the SDA to build and operate a significant piece of their PSA network."

Adam C. Spice, CFO, stated, "Second quarter 2025 revenue was a record $144.5 million, which was above the high end of our prior guidance range and reflects significant year-over-year growth of 36%, driven by strong contribution from both business segments." Spice added, "GAAP gross margin for the second quarter was 32.1%, above our prior guidance range of 30% to 32%." He noted the launch backlog's increasing share and a healthy pipeline in multi-launch deals and satellite contracts.

Space Systems segment delivered $97.9 million in Q2 revenue, up 12.5% sequentially. Launch Services produced $6.6 million, increasing 31.1% quarter-on-quarter.

Michael David Leshock, KeyBanc: Asked about Archimedes engine performance and readiness. Beck responded, "from like a basic performance of the engine, we're very happy where it is... it's just a much more complicated qualification program to get through."

Leshock asked about prospects for a Rocket Lab-owned constellation. Beck indicated that while ambitions are clear, "until Neutron is finished and flying, that's a key element... So I wouldn't expect any huge announcements from us on constellations until the big piece of the puzzle... starts to absorb less of our focus."

Liwag queried cash consumption post-Neutron launch. Spice responded, "the business could consume -- continue to get some money through 2026. So I would say, more realistically for, I would say, positive free cash flow, 2026."

Link to Seeking Alpha News Article - Aug. 07, 2025

[Newsletter Exclusive] NuScale outlines OpEx increase and targets first U.S. SMR contract by end of 2025 as regulatory and supply chain tailwinds grow

John Lawrence Hopkins, CEO, indicated anticipation of an order for NuScale power modules in 2025, driven by growing interest from advanced data centers and AI systems.

Marc Bianchi, TD Cowen, asked about the OpEx increase and its relation to supply chain investments. Hamady responded that the increase is "in line with our efforts to continue to develop 12 modules and develop our supply chain...not...an intent to build more than 12 modules right now."

Sherif Elmaghrabi, BTIG, asked about Doosan's manufacturing capacity and triggers for further module orders. Hopkins stated, "Doosan has commented...they can make up to 20 modules per year...production ongoing."

Stine also asked about regulatory differentiation. Hopkins emphasized, "We are using conventional fuel that's readily available...We don't need high-assay HALEU fuel, which...is going to be an issue, I think, going forward."

Craig Shere, Tuohy Brothers, asked about supply chain flexibility and order scale. Hopkins stated, "We manufacture our models in a factory. They're fungible assets with the intent to have multiple projects going at any given time."

Link to Seeking Alpha News Article - Aug. 07, 2025

SoundHound AI raises 2025 revenue outlook to $160M-$178M as voice commerce momentum accelerates

Keyvan Mohajer, CEO, reported "our all-time strongest quarter in Q2 with $43 million in revenue, representing an increase of 217% year-over-year." He highlighted significant growth across automotive, AI customer service for enterprise, and AI and automation for restaurants. Mohajer described surpassing "another record processing more than 1 billion queries per month on our platform."

Recent customer highlights included expansions with Chipotle and Firehouse Subs, new wins with IHOP, Red Lobster, Peter Piper Pizza, and a renewal with MOD Pizza.

Link to Seeking Alpha News Article - Aug. 08, 2025

TSLA 0.00%↑ NVDA 0.00%↑ AMD 0.00%↑

Tesla dismantles Dojo supercomputer team in AI shakeup - report

Peter Bannon, who led the Dojo project, is leaving the company, while remaining team members will be reassigned to other data centers and compute initiatives within Tesla, according to the report. The disbanding follows the recent departure of around 20 Tesla employees who left to form a new AI startup, DensityAI.

The move marks a setback in Tesla’s push to build in-house chips for autonomous driving.

Responding to a user’s post about the report, CEO Elon Musk said on X, “It doesn’t make sense for Tesla to divide its resources and scale two quite different AI chip designs.” He added that all efforts will now be focused on Tesla’s upcoming AI5, AI6, and future chip architectures.

The decision to wind down Dojo marks a reversal for a project Musk has championed since 2019, calling it a key pillar of Tesla’s AI vision. He had touted Dojo’s ability to “process truly vast amounts of video data” as essential to achieving full self-driving capabilities.

According to Bloomberg, Tesla now plans to deepen its reliance on external partners like Nvidia (NVDA) and AMD (AMD) for compute power, and Samsung (OTCPK:SSNLF) for chip manufacturing. Last month, Tesla signed a $16.5 billion deal with Samsung to produce its upcoming AI6 inference chips, which are designed to scale across Tesla’s FSD platform, the Optimus humanoid robot, and high-performance AI data center.

Link to Seeking Alpha News Article - Aug. 08, 2025

ORCL 0.00%↑ NVDA 0.00%↑ #SFTBF #FXCOF #OpenAI

SoftBank acquires Foxconn’s Ohio EV facility to potentially boost Stargate project

SoftBank Group (OTCPK:SFTBY) (OTCPK:SFTBF) is the buyer taking ownership of Foxconn Technology's (OTCPK:FXCOF) electric vehicle plant in Ohio, a move intended to jump-start the company’s $500B Stargate data center project with OpenAI and Oracle (NYSE:ORCL), Bloomberg News reported.

SoftBank had approached the Apple (AAPL) supplier — which is formally known as Hon Hai Precision (OTCPK:HNHAF) (OTCPK:HNHPF) — with its plan to establish data centers and related infrastructure across the U.S., the report added, citing people with knowledge of the matter. The EV plant sale is a result of these efforts by the Japanese company.

The two companies formed a joint venture this year to establish a data center and manufacturing venture in the U.S., with each investing $735M. It is not clear if SoftBank’s investment in the venture includes the $375M for the EV plant, the report added.

On Thursday, SoftBank's CFO Yoshimitsu Goto said it was taking longer than expected to get the Stargate project off the ground, acknowledging for the first time that the $500B AI collaboration in the U.S. with OpenAI is slowing down.

Meanwhile, Microsoft (NASDAQ:MSFT)-backed OpenAI has proceeded with other data centers that use the Stargate brand. A project in Abilene, Texas, touted as Stargate’s first site, was on-track before Trump’s announcement or SoftBank’s involvement. The Japanese company was not involved in plans for a large Stargate data center in Norway, where OpenAI would be the anchor customer. OpenAI’s Stargate project also includes a 5-gigawatt data center complex in Abu Dhabi.

Link to Seeking Alpha News Article - Aug. 08, 2025

Tempus AI rises after Q2 beat, second guidance raise for 2025

Tempus AI (NASDAQ:TEM) gained ~9% in the pre-market on Friday after the company increased its 2025 revenue outlook for the second time this year, having recorded better-than-expected financials for the second quarter.

The Chicago, Illinois-based Health Tech generated $314.6M in revenue for the quarter, exceeding the consensus by $16.8M with ~90% YoY growth, as its genomics revenue more than doubled from the prior year period to $241.8M.

Tempus AI (NASDAQ:TEM) attributed the Genomics segment’s expansion to accelerating growth in cancer and hereditary testing products, while its Data and Services segment generated $72.8M with ~36% YoY growth.

TEM's non-GAAP net loss per share declined ~65% YoY to $0.22, topping Street forecasts by $0.03 as its adj. gross margin rose to ~62% from ~46% a year ago.

Looking ahead, Tempus AI (NASDAQ:TEM) increased its revenue outlook for 2025 to $1.26M ahead of the consensus, marking its second guidance raise for this year following the $1.25B revenue projected in May, which indicated a $10M addition to the company’s initial outlook.

Link to Seeking Alpha News Article - Aug. 08, 2025

Uber Eats starts deliveries from Dollar General

Uber Eats (NYSE:UBER) will begin making deliveries from 14,000 Dollar General (DG) and pOpshelf stores, with orders now available on the Uber Eats platform.

To celebrate the launch, Uber Eats (NYSE:UBER) is offering 40% off Dollar General (DG) and pOpshelf orders of $20 or more. Uber One (NYSE:UBER) members qualify for free delivery on eligible items.

The latest collaboration with Dollar General (DG) adds to Uber’s (NYSE:UBER) current stable of partnerships including Costco (COST), Starbucks (SBUX), Instacart (CART), and Domino’s (DPZ).

Link to Seeking Alpha News Article - Aug. 08, 2025

MP Materials jumps to record high on Q2 beat as rare earths production surges

MP Materials (NYSE:MP) +4.2% to an all-time high $79.36 in early trading Friday after reporting a smaller than expected Q2 adjusted loss on record production of a key rare earth oxide and forecasting further production gains.

MP Materials (NYSE:MP) booked an adjusted loss of $21.4M, or a loss of $0.13/share, compared to a loss of $28M, or a $0.17/share loss, in the same period in the year-earlier quarter, and revenues jumped 84% Y/Y to $57.4M.

The company produced a record amount of neodymium-praseodymium oxide in the quarter, up 119% Y/Y to 597 metric tons, while total rare earths concentrate production rose nearly 45% to 13,145 metric tons; NdPr is the main raw material in permanent magnets that are used in electric vehicle motors, robotics and electronics.

Link to Seeking Alpha News Article - Aug. 08, 2025

Tesla lands a key robotaxi license in Texas in an incremental step toward expanding the service

Tesla (NASDAQ:TSLA) traded higher on Friday after regulators in Texas officially listed Tesla Robotaxi LLC as a licensed entity on their website to mark forward progress in the company's autonomous vehicle plans in the state. The approval was highly anticipated.

The license in Texas is necessary under a new state law that takes effect on September 1 that regulates rideshare operations using autonomous vehicles the same as services using human drivers.

Looking ahead, the development could move Tesla (NASDAQ:TSLA) closer to launching a broad robotaxi service open to the public in other parts of Texas.

On August 3, the geofenced region for Tesla's (TSLA) robotaxis in Austin nearly doubled to cover roughly 80 square miles, or an area close to the coverage of competitor Waymo (GOOG) in the city. Next on the list, Tesla (TSLA) is expected to look at areas of Nevada, Arizona, California, and Florida to expand the robotaxi business.

Link to Seeking Alpha News Article - Aug. 08, 2025

Disclosure: We own positions in some/all of the tickers mentioned in this article.