Still here!

Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial + $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist & Weekly Compilation.

Editor’s Pick:

[News] Nvidia's Jetson Thor robot offering now available, company says

Nvidia (NASDAQ:NVDA) said its Blackwell-powered Jetson AGX Thor developer kit and production modules are now generally available, as the company looks to robotics to boost growth.

The developer kit, which costs $3,499, is powered by an Nvidia Blackwell GPU and comes with 128GB of memory to help robotics companies run the latest artificial intelligence models. It offers up to 7.5 times higher AI compute and 3.5 times greater energy efficiency than its predecessor, the Nvidia Jetson Orin, the company added.

Companies that have already infused Nvidia's Jetson Thor into their offerings include Figure, Amazon (AMZN) and Caterpillar (CAT).

Link to Seeking Alpha News Article - Aug. 25, 2025

BMNR 0.00%↑ #ETH

[News] BitMine Immersion raises ether holdings by 33% in past week

BitMine Immersion Technologies (NYSE:BMNR) boosted its ether (ETH-USD) holdings by about 33% to $8.8B in the past week, it disclosed on Monday, reigning as the largest ether treasury company.

At Aug. 24, the company's crypto holdings comprised 1.71M ETH at $4,808 per coin, 192 bitcoin (BTC-USD) and unencumbered cash of $562M.

Its crypto and cash net asset value per share was $39.84 at Aug. 24, up from $22.84 on July 27. Crypto NAV is calculated as crypto and cash asset value divided by shares outstanding.

Link to Seeking Alpha News Article - Aug. 25, 2025

TLT 0.00%↑ UUP 0.00%↑ SPY 0.00%↑

[News] Yields, Dollar drop after Trump removes Fed Governor Lisa Cook

Treasury yields and the U.S. dollar (DXY) fell on Tuesday after President Donald Trump fired Federal Reserve Governor Lisa Cook Monday amid mortgage fraud allegations.

The move raises more concerns about the independence of the U.S. central bank.

S&P futures (SPX), Nasdaq 100 futures (US100:IND) and Dow futures (INDU) came under pressure too.

Two-year yields (US2Y) fell after Trump took the unprecedented step, on speculation that the Fed will cut interest rates as soon as next month. The yield on the 30-year meanwhile climbed on concern that looser monetary policy would risk fueling inflation.

The announcement came days after Cook said she wouldn’t leave her post despite Trump previously calling for her to resign. The Fed's board has seven members, meaning Trump's move could have deep economic and political ramifications.

Trump said in announcing the move that he had the constitutional authority to remove Cook, but doing so will raise questions about control of the Fed as an independent entity.

The firing is likely to touch off a legal battle and Cook could be allowed to remain in her seat while the case plays out. Cook would have to fight the legal battle herself, as the injured party, rather than the Fed.

Link to Seeking Alpha News Article - Aug. 26, 2025

Link to Seeking Alpha News Article - Aug. 26, 2025

[News] IBM and AMD team up on quantum supercomputing

IBM (NYSE:IBM) and AMD (NASDAQ:AMD) agreed to come together to develop next-generation computing architectures based on the combination of quantum computers and high-performance computing, known as quantum-centric supercomputing.

In a quantum-centric supercomputing architecture, quantum computers work in tandem with powerful high-performance computing and AI infrastructure, which are typically supported by CPUs, GPUs and other compute engines. In this hybrid approach, different components of a problem are tackled by the paradigm best suited to solve them. For example, in the future, quantum computers could simulate the behavior of atoms and molecules, while classical supercomputers powered by AI could handle massive data analysis. Together, these technologies could tackle real-world problems at unprecedented speed and scale.

AMD and IBM are exploring how to integrate AMD CPUs, GPUs, and FPGAs with IBM quantum computers to efficiently accelerate a new class of emerging algorithms, which are outside the current reach of either paradigm working independently. The proposed effort could also help progress IBM's vision to deliver fault-tolerant quantum computers by the end of this decade. AMD technologies offer promise for providing real-time error correction capabilities, a key element of fault-tolerant quantum computing.

The teams are planning an initial demonstration later this year to show how IBM quantum computers can work in tandem with AMD technologies to deploy hybrid quantum-classical workflows.

Link to Seeking Alpha News Article - Aug. 26, 2025

Link to Seeking Alpha News Article - Aug. 26, 2025

[News] NextEra Energy wins FERC approval for nuclear restart of Iowa's Duane Arnold plant

The Federal Energy Regulatory Commission this week approved NextEra Energy's (NYSE:NEE) application to restart the Duane Arnold nuclear power plant in Iowa by year-end 2029, UtilityDive.com reported Wednesday.

NextEra (NYSE:NEE) shuttered the 600 MW plant in 2020 because it could not compete financially, as natural gas and renewable energy were cheaper sources of electricity generation, but nuclear has become more valuable thanks to surging power demand and large new tax breaks from the federal government.

The company could bring Duane Arnold back online by the end of 2028, but it asked FERC for an additional year for the plant to return to service in the event of delays in obtaining equipment or repairs at the plant.

The company, which expects to spend $50M-$100M this year to recommission Duane Arnold, said it is talking with potential customers that could buy production from the restarted plant.

Link to Seeking Alpha News Article - Aug. 27, 2025

[News] Redwire awarded $25M single award IDIQ contract by NASA

Redwire (NYSE:RDW) on Thursday said it has been awarded a NASA single award, indefinite-delivery/indefinite-quantity (IDIQ) contract with a $25 million ceiling for a five-year period to fulfill future task orders for biotechnology facilities, on-orbit operations support, mission integration, and related services for the agency on the International Space Station.

Link to Seeking Alpha News Article - Aug. 28, 2025

[News] AI adoption linked to 13% decline in jobs for young U.S. workers, Stanford study reveals

The study analyzed payroll records from millions of American workers, generated by ADP, the largest payroll software firm in the U.S.

The report found “early, large-scale evidence consistent with the hypothesis that the AI revolution is beginning to have a significant and disproportionate impact on entry-level workers in the American labor market.”

Most notably, the findings revealed that workers between the ages of 22 and 25 in jobs most exposed to AI — such as customer service, accounting and software development — have seen a 13% decline in employment since 2022.

By contrast, employment for more experienced workers in the same fields, and for workers of all ages in less-exposed occupations such as nursing aides, has stayed steady or grown.

Young workers were said to be especially vulnerable because AI can replace “codified knowledge,” or “book-learning” that comes from formal education. On the other hand, AI may be less capable of replacing knowledge that comes from years of experience.

The researchers also noted that not all uses of AI are associated with declines in employment. In occupations where AI complements work and is used to help with efficiency, there have been muted changes in employment rates.

Link to Stanford Study - Aug, 2025

VRT 0.00%↑ ETN 0.00%↑ ROK 0.00%↑ EMR 0.00%↑ JCI 0.00%↑ GEV 0.00%↑ CEG 0.00%↑

[YouTube/The Real Eisman Playbook] Industrial Sector Explained: Data Center Growth & Rise of Vertiv | Ep. 21

In this episode of The Real Eisman Playbook, Steve is joined by Steve Tusa from JP Morgan to discuss the industrial sector.

They discuss the sector’s history and current themes, the rapid growth of data centers, the rise of Vertiv, and the lessons to learn from Honeywell and GE.

Some of my biggest stock picks from this conversation:

Data Center Cooling and Electrical Supply: $VRT $ETN

Reshoring, Factories and Automation: $ROK $EMR

HVAC: $JCI

I also wrote an article in February this year about electricity which covers a lot of the stocks discussed in this podcast.

Link to Full Video (56:20 Mins) - Aug 19, 2025

GEV 0.00%↑ CEG 0.00%↑ NEE 0.00%↑

[YouTube/The Real Eisman Playbook] Trump vs The Fed, U.S. Takes 10% Stake in Intel, Cracker Barrel Cracks | The Friday Market Wrap!

In this week’s episode of The Weekly Wrap, Steve Eisman breaks down the latest on Trump’s firing of Lisa Cook and his battle with the Fed, Intel’s new deal with the U.S. government, a deep dive into the stock year so far, and the recent Cracker Barrel controversy.

Some of my favorite bits from this video are:

Utility Supplier buy Gas Turbines to generate electricity from: $GEV

For Nuclear : $CEG

Large exposure to Wind and Solar: $NEE

Tesla Vs Waymo

Link to Full Video (34:09 Mins) - Aug 30, 2025

News, Facts, Analyst & Market Commentary - Short Reads:

AI could create nearly $1T in annual value for S&P 500 companies – MS

Morgan Stanley’s analysts believe that artificial intelligence adoption could create approximately $920B in long-term economic value annually for S&P 500 (SP500) companies, representing about 28% of their expected 2026 pretax earnings.

The total potential value creation from AI adoption “could unlock entirely new sources of growth, productivity, and innovation across sectors,” said Stephen C. Byrd, Morgan Stanley's global head of Sustainability Research.

The potential impact is nearly evenly split between two forms of AI, with agentic AI projected to deliver about $490B in annual value, equal to roughly 15% of the S&P 500’s (SP500) consensus 2026 pretax income.

Embodied AI, focusing primarily on AI-enhanced humanoid robotics (ROBO), (BOTZ), (BATS:ARKQ), could generate approximately $430B in annual economic value for S&P 500 (SP500) companies, representing about 13% of projected 2026 pretax income.

This type of AI appears to “impact a narrower set of occupations, but with a higher likelihood of automation and job displacement where it does apply.” The analysis estimates the cost to deploy these AI-enhanced robots at approximately $5 per hour.

Several sectors show extraordinary potential for AI-driven value creation, with consumer staples (XLP), distribution and retail (XRT), (RTH), (IBUY), real estate management and development (RWO), (IFGL), (IYR), and transportation (XTN), (IYT), (FTXR) all showing potential savings above 100% of their 2026 consensus pretax earnings.

Findings also reveal that “many sectors have potential savings (pretax, net of indicative implementation costs) above 50% of 2026 consensus pretax earnings,” while technology hardware and equipment (XLK), (IYW), (VGT), and semiconductors (SOXX), (SMH) demonstrate comparatively lower impacts.

Morgan Stanley’s U.S. Equity Strategy team has integrated these findings into an overall AI value creation heat map, identifying healthcare equipment and services (IYH), (IXJ), (XLV), (IHF), (IDNA), (HTEC), transportation (IYT), (XTN), consumer services, software (NYSEARCA:IGPT), (XSW), capital goods, automobiles and components (DRIV), and staples distribution and retail (XRT), (RTH), (IBUY) as sectors with significant AI-driven value creation potential.

“We think industrials is an underappreciated structural beneficiary based on this analysis, which is supportive of our overweight stance,” Byrd emphasized.

Link to Seeking Alpha News Article - Aug. 18, 2025

#DNNGY

Trump stops Ørsted wind project offshore Rhode Island in latest blow to industry

The Trump administration said Friday that Denmark's Ørsted (OTCPK:DNNGY) must halt all activities related to its Revolution Wind project off the coast of Rhode Island, which is under construction and was expected to become operational next year.

The Bureau of Ocean Energy Management issued an order requiring Ørsted (OTCPK:DNNGY) to halt ongoing activities on the project to address unspecified national security concerns that have arisen during a review of the project, and the company "may not resume activities until BOEM informs you that BOEM has completed its necessary review."

Earlier this week, the U.S. Commerce Department said it opened a Section 232 national security investigation into the import of wind turbines and components, and added the items to list of products that will face 50% tariffs on their aluminum and steel content.

The U.S. wind industry is heavily dependent on imports for parts such as blades, drivetrains and electrical systems, with roughly two-thirds of the value of a typical U.S. wind turbine imported, according to Wood Mackenzie.

The Revolution Wind project would provide power to 350K homes in Rhode Island and Connecticut.

U.S. energy projects worth $18.6B have been canceled so far this year, compared with just $827M in 2024, the Financial Times reported this week, citing Atlas Public Policy's Clean Economy Tracker.

Analysts say that while demand for energy to power the AI boom will only grow, the U.S. risks irrevocably damaging its renewables sector, which sometimes provides the cheapest and fastest source of energy to deploy.

Link to Seeking Alpha News Article - Aug. 23, 2025

#PerplexityAI

Perplexity AI to share revenue with publishers from AI searches – report

Perplexity AI has allocated $42.5 million to be distributed among publishers via this new program, reported Bloomberg. The fund will come from the revenue earned via Comet Plus, a new subscription for Comet browser.

As per the new program, publishers will earn money when their content appears in search queries of Perplexity’s Comet internet browser, receives web traffic on Comet and when it’s used to fulfill tasks by Comet’s AI assistant.

Perplexity Chief Executive Officer Aravind Srinivas told Bloomberg that AI is helping create a better internet, but publishers still need to get paid.

For $5 a month, customers will get access to a curated selection of content from publishers in this new program. Publishers will get 80% of the revenue, while Perplexity gets the rest, as per the report.

Link to Seeking Alpha News Article - Aug. 25, 2025

Stock exchanges write to regulators urging clampdown on tokenized equities - report

UK-based World Federation of Exchanges has written to three regulatory bodies, urging a clampdown on the so-called 'tokenized stocks', Reuters reported on Monday, citing the letter.

The letter is said to have been sent to the U.S SEC's Crypto Task Force, the European Securities and Markets Authority, and IOSCO's Fintech Task Force.

Tokenised equities are blockchain-based tokens created to represent shares in companies, but investors do not become shareholders in the underlying company, the newswire noted.

In June, Coinbase Global (COIN) was reportedly seeking permission to offer "tokenized equities" to its customers. The move would allow its customers to trade stocks on the blockchain.

Similarly, Robinhood Markets (HOOD) unveiled U.S. stock and ETF tokens in the European Union, enabling eligible users to trade more than 200 digital versions of real company shares and ETFs on the blockchain.

Later, OpenAI issued a statement denying any affiliation with the tokenized equity offered by Robinhood, emphasizing that the tokens do not represent real ownership or equity in the company.

The WFE noted that the companies whose stock is being mimicked could suffer reputational damage if the tokens fail, and regulators should apply securities rules to tokenised assets, according to Reuters.

Link to Seeking Alpha News Article - Aug. 25, 2025

Centrus Energy signs MoU with Korean firms for potential Ohio plant expansion

Centrus Energy (NYSE:LEU) +3.7% pre-market Tuesday after signing a memorandum of understanding with Korea Hydro & Nuclear Power and POSCO International (PKX) to explore potential investment to support expansion of Centrus' uranium enrichment plant in Piketon, Ohio.

Centrus (NYSE:LEU) and KHNP also agreed to increase the supply volume of low-enriched uranium under the contract the companies signed in February, which supported construction of new uranium enrichment capacity at Centrus' American Centrifuge Plant in Ohio.

Centrus (LEU) said the entire supply commitment, including the expanded volumes, depends upon receiving the necessary federal funding to build the new LEU production capacity.

KHNP is the world's third largest nuclear plant operator, with 26 nuclear reactors in operation and four under construction, and POSCO (PKX) is working to develop a next-generation high-temperature gas reactor powered by HALEU.

Link to Seeking Alpha News Article - Aug. 26, 2025

Energy Fuels signs MoU for rare earth oxides supply with Vulcan Elements

Energy Fuels (NYSE:UUUU) +2.8% pre-market Tuesday after saying it signed a memorandum of understanding to supply Vulcan Elements with high-purity light and heavy rare earth oxides for production of rare earth permanent magnets, using high-purity NdPr and Dy oxides refined in Utah from minerals produced in Georgia and Florida.

Energy Fuels (NYSE:UUUU) said it will supply initial quantities of the separated rare earth oxides to Vulcan in Q4; upon receipt, Vulcan will validate Energy Fuels' NdPr and Dy oxides for production of rare earth magnet applications, then the two companies expect to negotiate additional long-term supply agreements for NdPr and Dy oxides.

The NdPr and Dy oxides will be sourced exclusively from Energy Fuels' (UUUU) White Mesa Mill in Utah, which is the only operating U.S. facility capable of processing monazite mineral concentrates into separated rare earth oxides.

Link to Seeking Alpha News Article - Aug. 26, 2025

AMD upgraded to Buy as it attempts to chip into Nvidia's data center, AI market share: Truist

Advanced Micro Devices (NASDAQ:AMD) was upgraded to Buy from Hold by Truist Securities due in part to elevated data center and artificial intelligence demand.

Truist said some AI hyperscale customers are now seriously considering the switch from Nvidia (NASDAQ:NVDA) to AMD for processing power.

AMD shares climbed 2% during pre-market trading on Tuesday.

"For the last several years, our industry contacts (component buyers/sellers) have told us that hyperscale customers deploying AI were experimenting with AMD's technology as a 'price check' to NVDA, nothing more," said Truist analyst William Stein in an investor note. "Over the last month or so, contacts have increasingly noted that hyperscalers are working with AMD in a partnership manner, expressing true interest in deploying AMD at scale."

Truist also increased its price target on AMD to $213 from $173. The investment firm believes AMD's MI355 GPU, which launched earlier this summer, should serve as a growth driver in the quarters ahead.

Link to Seeking Alpha News Article - Aug. 26, 2025

CRML 0.00%↑ #UURAF

Critical Metals, Ucore both rise on rare earths offtake agreement for Tanbreez project

Critical Metals (NASDAQ:CRML) +3.7% and Ucore Rare Metals (OTCQX:UURAF) +5.9% in volatile trading Tuesday after the companies said Critical Metals signed a letter of intent to supply heavy rare earth concentrate from its Tanbreez project in Greenland to Ucore's U.S. Department of Defense-funded processing facility in Louisiana.

Under the terms of the 10-year offtake arrangement, Critical Metals (NASDAQ:CRML) said it expects to supply as much as 10K metric tons/year of rare earth concentrate from Tanbreez, which represents ~10% of the project's initial projected production; after hydro-metallurgical processing, the concentrate will be used as feedstock for Ucore’s (OTCQX:UURAF) rare earth element processing facility, which broke ground in May in Louisiana.

Ucore's (OTCQX:UURAF) Louisiana facility previously received $18.4M from the DoD for the first of four phases of construction, and the company has said it aims to produce 2K metric tons/year of high-purity rare earth oxides next year, with capacity expected to be scaled up to 7,500 tons/year in 2028.

Link to Seeking Alpha News Article - Aug. 26, 2025

TLT 0.00%↑ UUP 0.00%↑ SPY 0.00%↑

Trump’s move to fire Fed Gov. Cook accelerates ‘Trumpification of the Fed’ - Evercore ISI

President Trump’s unprecedented attempt to fire Federal Reserve governor Lisa Cook “for cause” over alleged mortgage misrepresentation marks the first such intervention since the Fed’s founding in 1913, according to Evercore ISI.

Krishna Guha, vice chairman and head the Global Policy and Central Bank Strategy team at Evercore ISI, warned that this move “intensifies Trump’s efforts to gain more control over the Fed and the threat to its independence,” highlighting how markets (SP500), (COMP:IND), (DJI) have focused too narrowly on whether Trump might fire Powell while missing the broader implications of potential “Trumpification” of the Fed Board.

If Trump succeeds in removing Cook, Trump’s appointee would create a 4-3 majority of Trump-selected governors on the Fed Board and reshape the Fed's seven-member governing board for many years, as Fed governors typically serve 14-year terms; the board currently consists of six members, including Cook, with one seat vacant after Adriana Kugler resigned her position earlier this month.

This could potentially allow them to block the reappointment of certain Reserve Bank presidents during the normally routine five-yearly renewal process expected in February.

“This majority could be used to deny certain Reserve Bank presidents – possibly Goolsbee in Chicago, perhaps even Williams in New York – reappointment,” Guha said, suggesting a fundamental shift in Fed governance that could happen within months.

Guha specifically warned of “perhaps an asymmetrically activist approach to guarding against downside risk to the labor market relative to upside risk to inflation,” signaling a fundamental departure from established Fed practices.

He also cautioned that while equities might initially benefit from “any short-term boost to nominal GDP from dovish-skewed policy,” they remain “vulnerable to de-rating over time as institutional quality erodes and to a potential riot in the bond market at a moment that is very hard to predict.

”In conclusion, “asset markets are not properly priced for what increasingly seems likely to be a rupture in Fed independence and the policy reaction function in 2026.”

Link to Seeking Alpha News Article - Aug. 26, 2025

Link to Seeking Alpha News Article - Aug. 26, 2025

Oklo initiated Buy at BofA, citing largest visible pipeline with hyperscaler upside

Oklo (NYSE:OKLO) +3.9% in Tuesday's trading as Bank of America started coverage with a Buy rating and $92 price target, pointing to rising momentum for nuclear power, backed by both the U.S. Department of Energy and data center operators, with Oklo well positioned to meet the rising energy needs of AI.

BofA said Oklo (NYSE:OKLO) has the largest publicly disclosed customer pipeline of the small modular reactor developers it tracks, with more than 14 GW of MoUs, or ~30% of the global pipeline; for operators needing power today, Oklo plans to bridge the gap through its partnership with Liberty Energy, offering ~75 MW of gas-fired "prompt power," enabling earlier monetization and smoother path to SMR deployment.

The analysts see Oklo's (OKLO) vertically integrated build-own-operate model as best positioned to succeed in the early phase of the SMR market, and by taking balance sheet risk, the company can deliver fully wrapped, bankable power purchase agreements and capture the full IPP economics.

Oklo's (OKLO) reliance on HALEU fuel adds risk, but the company already has secured HALEU from Department of Energy stockpiles for its first project, de-risking early deployment, and Oklo also can draw on ~60 tons of excess weapon-grade plutonium, enough for 30–40 of its 75 MW units at 70%-80% lower cost than fresh HALEU, according to BofA.

Link to Seeking Alpha News Article - Aug. 26, 2025

Firefly flashes higher after FAA grants clearance to resume Alpha rocket launches

Firefly Aerospace (NASDAQ:FLY) +5% post-market Tuesday after disclosing it received clearance from the Federal Aviation Administration to resume Alpha rocket launches following the Flight 6 mishap on April 29.

The Alpha rocket suffered a technical problem while ascending into space on its sixth flight, causing a Lockheed Martin satellite it was supposed to place into orbit to crash into the Pacific Ocean.

Firefly (NASDAQ:FLY) said it conducted an independent review into the incident, along with the FAA's investigation, and "the findings confirmed Firefly's flight safety system performed nominally through all phases of flight. Both Alpha stages landed safely in the Pacific Ocean, and the launch posed no risk to public safety."

With FAA approval to return to flight and corrective actions implemented, Firefly (FLY) said it is now working to determine the next available launch window for Alpha Flight 7.

Four of six Alpha flights have failed since 2021, including April's mission, which also was the first under an agreement between Firefly (FLY) and Lockheed for as many as 25 flights through 2029.

Link to Seeking Alpha News Article - Aug. 26, 2025

AMZN 0.00%↑ #ProjectKuiper #SpaceX

Amazon plans to roll out Kuiper satellite services in Vietnam

Amazon (NASDAQ:AMZN) plans to roll out its Kuiper satellite services in Vietnam, Reuters reported, citing a statement from the country’s Ministry of Science and Technology.

The U.S. tech giant has committed to investing $570 million by 2030 to develop infrastructure, including up to six ground stations and terminal manufacturing in Bac Ninh province through local partnerships, the ministry said.

Link to Seeking Alpha News Article - Aug. 27, 2025

Serve Robotics rallies after attracting a bull call from Wedbush

"Serve is positioning itself within the industry by building multiple revenue streams, including delivery, software services, and advertising providing multiple avenues to generate stable top-line growth while capitalizing on increased enterprise desire to automate the commerce industry," updated Wedbush Securities analyst Dan Ives. "With plans to grow its autonomous robot fleet to 2,000 by the end of 2025, establish new partnerships, and launch operations in additional cities with favorable regulatory environments, Serve is strongly positioned to gain market share as demand rises for automation, operational efficiency, and sustainable delivery solutions," he added.

Wedbush assigned a price target of $15 to Serve Robotics (SERV).

Link to Seeking Alpha News Article - Aug. 27, 2025

TLT 0.00%↑ UUP 0.00%↑ SPY 0.00%↑

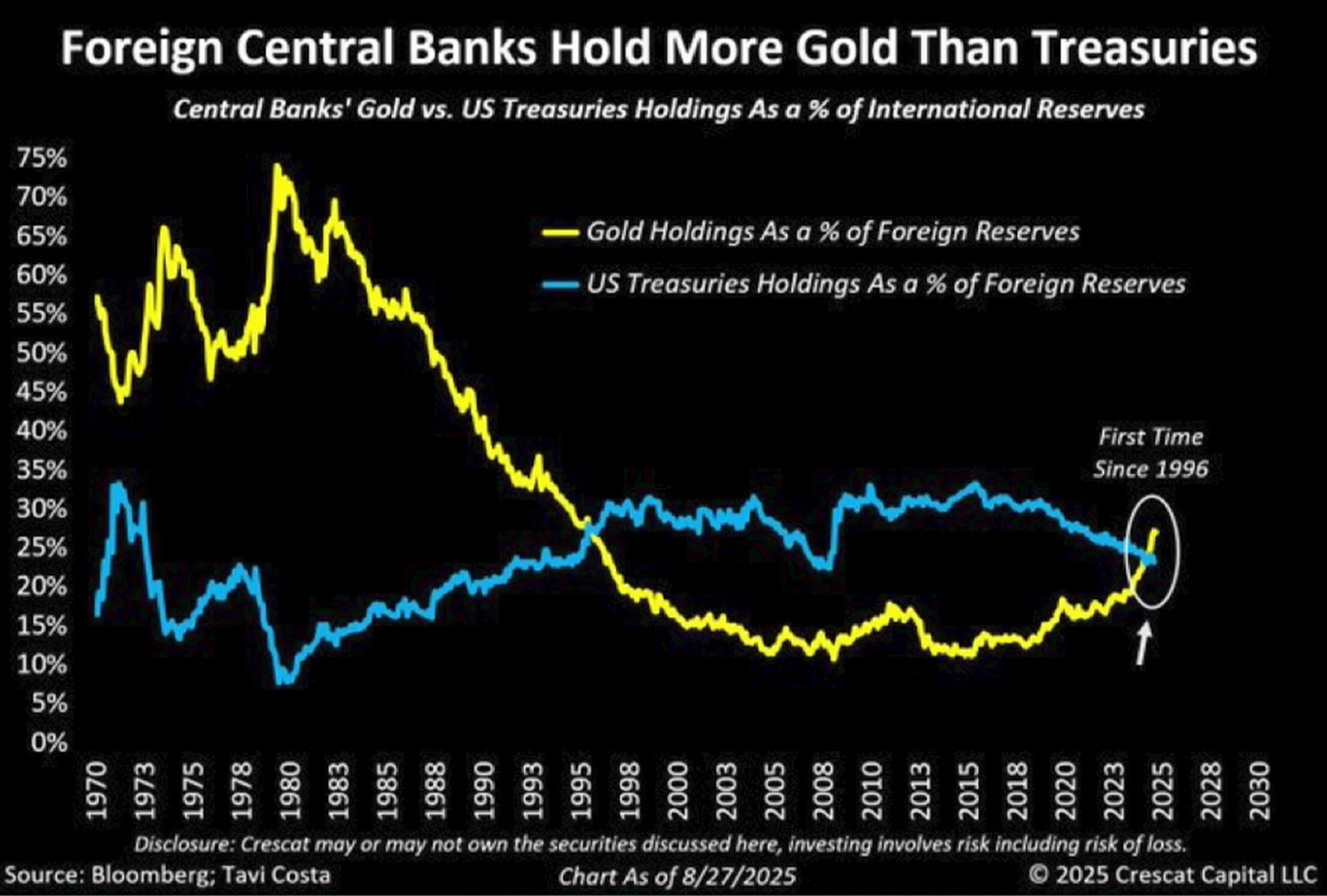

Trump's Fed challenge 'playing with fire,' adding to gold's safe haven appeal

"When you start to erode faith in monetary policy for the world's reserve currency, you are playing with fire," James St. Aubin, chief investment officer of Ocean Park Asset Management, said in an interview. "If the market believes the Fed is making policy in reaction to direct political influence, U.S. assets will become less attractive."

Link to Seeking Alpha News Article - Aug. 27, 2025

Nvidia CFO: Still waiting for Trump's 15% commission plan to be codified

Nvidia (NASDAQ:NVDA) is still waiting for the Trump administration to formalize its plan to charge a 15% commission on the company's AI chip sales to China, CFO Colette Kress said in an earnings call with analysts.

The U.S. government plans to "receive 15% of the revenue generated from licensed H20 sales, but to date, it has not published a regulation codifying such requirement," she noted.

Nvidia (NASDAQ:NVDA) should be able to proceed with H20 sales to China without paying the commission if the plan isn't codified, Kress told Bloomberg in an interview.

"We have been communicating. If nothing shows up, I've got licenses. I don't have to do this 15% until I see something that is a true regulatory document," she added.

It later agreed to grant H20 export licenses in exchange for a 15% cut of the sales. "… to date, we have not generated any revenue or shipped any H20 products under those licenses," Nvidia (NVDA) said in its quarterly report.

"Any request for a percentage of the revenue by the U.S. government may subject us to litigation, increase our costs, and harm our competitive position and benefit competitors that are not subject to such arrangements," it added.

Nvidia (NVDA) did not include H20 in its Q3 guidance given the uncertainty. "If geopolitical issues reside, we should ship $2B-$5B in H20 revenue in Q3."

During the conference call, Nvidia CEO Jensen Huang said "the China market, I've estimated to be about $50 billion of opportunity for us this year if we were able to address it with competitive products.”

Link to Seeking Alpha News Article - Aug. 28, 2025

Link to Seeking Alpha News Article - Aug. 28, 2025

NVDA 0.00%↑ #BYDDY

[Newsletter Exclusive] Tesla’s Europe sales slump 40% Y/Y in July

Tesla’s (NASDAQ:TSLA) European sales slumped 40% in July to 8,837 units, marking a seventh straight month of declines, even as overall EV sales rose, according to ACEA data.

Meanwhile, Chinese rival BYD (OTCPK:BYDDF) (OTCPK:BYDDY) surged 225% year-on-year to 13,503 registrations, reflecting its aggressive expansion across Europe with competitively priced models.

Link to Seeking Alpha News Article - Aug. 28, 2025

Oceaneering announces $180M of Subsea Robotics contracts with Petrobras

Oceaneering International (NYSE:OII) on Thursday said its Brazilian subsidiary, Marine Production Systems do Brasil LTDA was awarded multiple Subsea Robotics contracts by Petróleo Brasileiro ((Petrobras)) during the second quarter of 2025.

The anticipated aggregate revenue of the contracts is approximately $180 million.

Oceaneering will provide work class remotely operated vehicle (“ROV”) services, specialized tooling packages, and survey services onboard multiple anchor handling and ROV support vessels working on Petrobras projects offshore Brazil.

Link to Seeking Alpha News Article - Aug. 28, 2025

Nvidia is benefiting from 'clear' growth acceleration in AI, even with China uncertainties

“That guidance for $7B of incremental revenue — the first time that a company has guided for that dollar sequential growth — without China. That's in just one quarter, and based on the commentary we heard from management on the call — and what we continue to hear from [our] checks — continues to represent undershipment of true demand. The continued strength in Hopper is a testament to that, as compute shortages remain intense enough customers are still buying three-year-old Hoppers to serve some of that demand,” Morgan Stanley analyst Joseph Moore wrote in a note to clients.

Moore added that the company's position in China is “impossible” to forecast and Nvidia management were cautious on the earnings call.

“Broader demand outlook remains intact, underpinned by improving ROI dynamics with $3M investment in GPUs now generating up to $30M in token revenues, accelerating hyperscaler Capex, and Sovereign expected to make up $20B of revenue this year,” Jefferies analyst Blayne Curtis wrote in a note to clients. “Everything remains sold-out across both Hopper and Blackwell, with one non-restricted customer even buying H20s.

“With AI infrastructure investments continuing to grow with the company expecting between $3 trillion to $4 trillion in total AI infrastructure spend by the end of the decade, the chip landscape remains NVDA’s world with everybody else paying rent as more sovereigns and enterprises wait in line for the most advanced chips in the world,” Wedbush Securities analyst Dan Ives wrote in a note to clients.

Link to Seeking Alpha News Article - Aug. 28, 2025

Marvell targets 36% revenue growth for Q3 2026 amid $2.5B auto divestiture and expanding AI market share

Data center revenue is expected to be flat sequentially in Q3. Year-over-year data center revenue growth is projected in the mid-30% range.

Ross Clark Seymore, Deutsche Bank: Asked about lumpiness in custom business and Q3 headwinds. Murphy responded, "This is normal to see, particularly with the large hyperscale builds that happen and especially as you ramp them into production...you should expect a strong fourth quarter for custom."

Vivek Arya, BofA Securities: Asked about data center growth acceleration and alignment with industry growth rates. Murphy reiterated, "Custom would be up in the second half versus the first half...very strong recovery in the core business in enterprise networking and carrier."

Link to Seeking Alpha News Article - Aug. 28, 2025

Opendoor reports insider transaction worth ~$128K

Opendoor Technologies (NASDAQ:OPEN) said in an SEC filing that President Shrisha Radhakrishna acquired shares of common stock worth $128.34K.

The tech-focused real estate company had appointed Radhakrishna, chief technology and product officer, as president and interim leader earlier this month.

Radhakrishna purchased 28,400 shares at $4.27 and 1,600 shares at $4.42, bringing his total shares of direct ownership in the company to 4.28M.

Link to Seeking Alpha News Article - Aug. 29, 2025

BABA 0.00%↑ NVDA 0.00%↑ #Huawei

Alibaba develops new AI chip to help fill Nvidia's absence in China: report

China's Alibaba (NYSE:BABA) has developed a new chip that is more versatile than its older chips, the Wall Street Journal reported.

Alibaba’s new chip is designed for inference, not training, the report noted.

China’s weakness is training AI models, for which U.S. companies rely on the most powerful Nvidia products.

Previous cloud-computing chips developed by Alibaba have mostly been designed for particular applications. The new chip, which is now in testing, is meant to serve a broader range of AI inference tasks, the report added citing people with knowledge of the matter.

The chip is made by a Chinese company, compared to an earlier Alibaba AI processor which was fabricated by Taiwan Semiconductor Manufacturing (TSM). The U.S. has blocked TSM from manufacturing AI chips for China that use leading-edge technology, the report noted.

China's Huawei Technologies is also making AI chips. However, Huawei, which faces U.S. sanctions, did not design its chips to work with the Nvidia platform, while Alibaba’s new chip will be compatible with it. This means engineers can repurpose programs they wrote for Nvidia chips, the report added.

Chinese engineers have complained that some homegrown chips have issues when training AI, such as overheating and breaking down in the middle of training runs, the report noted.

Link to Seeking Alpha News Article - Aug. 29, 2025

Marvell tumbles as Wall Street worries over AI future

Bank of America analyst Vivek Arya said “At this point, we sense incrementally higher uncertainty around both: the timing of MRVL’s new (Microsoft Maia) project (could be more FY28/CY27E rather than 2HFY27/CY26E); and share in next-gen 3nm Amazon project,” Arya wrote in a note to clients. “In our view, a Neutral rating better reflects/balances MRVL’s opportunity/ breadth of IP with lumpiness in AI sales, customer [centric] risks, and strong competition for custom chip sockets.”

Needham analyst N. Quinn Bolton also lowered his price target and said “While the custom silicon business remains on track to grow in F2H26 vs. F1H26, the business is expected to decline meaningfully in F3Q26 (we model -15% Q/Q) before rebounding strongly in F4Q26,” Bolton wrote in a note to clients. “Timing of customer deliveries, presumably at its largest customer, and changes in the supply chain are driving this lumpiness.”

Link to Seeking Alpha News Article - Aug. 29, 2025

GOOGL 0.00%↑ META 0.00%↑ INQQ 0.00%↑

India’s Reliance teams up with Google, Meta to boost AI push

Under the partnership with Google, Reliance will use Google's cloud and AI services to boost innovation in sectors like energy, retail, telecommunications, and financial services.

Alphabet's CEO Sundar Pichai said the companies will set up a dedicated cloud region in India, powered by clean energy provided by Reliance Industries and connected through Jio’s network.

Separately, Ambani also announced a new AI joint venture with Meta to combine open models and tools with Reliance's execution in energy, retail, telecom, media and manufacturing and to deliver sovereign enterprise-ready AI for India.

The joint venture is aimed at developing enterprise AI solutions built on Llama for Indian enterprises.

Under the new joint venture, Reliance and Meta have pledged an initial investment of $100M to capitalize the unit in a ratio of 70% and 30% respectively, according to a report by CNBC.

Billionaire Chairman of Reliance, Mukesh Ambani also unveiled a new fully owned unit called Reliance Intelligence. He said the vision of the new unit is to house India's AI infrastructure; house global partnerships; build AI services for India; and house the talent for AI.

Reliance Intelligence will build gigawatt-scale AI data centers, according to Ambani.

Link to Seeking Alpha News Article - Aug. 29, 2025

MSOS 0.00%↑ #GTBIF

Democratic legislators file bill to legalize cannabis in the U.S.

A group of Congressional Democrats led by Rep. Jerrold Nadler (D-NY) on Friday filed the Marijuana Opportunity, Reinvestment, and Expungement (MORE) Act in a bid to legalize cannabis at the federal level.

The legislation seeks to end the prohibition by descheduling cannabis under the Controlled Substances Act (CSA) altogether, amid an ongoing review at the U.S. Drug Enforcement Administration to reschedule marijuana.

Previously, Nadler has filed the legislation in three congressional sessions, and this is his fourth consecutive attempt.

When Republicans were in the majority, the bill didn’t clear the House in the last session but did advance twice while Democrats were in control and Nadler was the chairman of the Judiciary Committee.

The latest version, backed by three dozen co-sponsors, includes provisions to promote equity and address social consequences of criminalization in addition to the descheduling proposal, the cannabis publication Marijuana Moment reported.

It comes after President Donald Trump said early this month that his administration is ready to make a final decision on the review over the next few weeks.

Link to Seeking Alpha News Article - Aug. 29, 2025

Nobel Laureate Lars Peter Hansen: Technology is more promising than global political consensus

Technological advancement in the climate space represents a potentially more promising path forward than waiting for global political cooperation, according to Lars Peter Hansen, professor at the University of Chicago.

During a CNBC interview, the Nobel laureate said that current methods for valuing climate policy impacts need significant improvement, particularly when dealing with long-term projections fraught with uncertainty.

Uncertainty must be central to global climate policy discussions, as “we need to make policy in the face of uncertainty, and we need to be open about it. We need to give up on the false pretense of knowledge.”

He said that global leadership on climate issues appears to be moving in the wrong direction, with populist politics fostering short-term economic thinking rather than long-term planning.

“It makes it very difficult to establish credible long term policy gains and goals,” Hansen noted, adding that political coordination on a global scale will be “incredibly challenging.”

Current political environments, particularly in the U.S., have created significant setbacks for climate initiatives with massive pullbacks in government-funded research, he said, and expressed serious concern about this trend, stating, “It’s not only money going into it, it’s also intellectual capital going into it. Smart people are not going to see great prospects here in terms of their short-term futures… and they’ll be looking to other ventures.”

Lastly, Hansen advocated for a “long game” strategy focused on investing in carbon capture technologies and potentially revolutionary energy sources like nuclear fusion, while acknowledging these solutions may be decades away.

Link to Seeking Alpha News Article - Aug. 29, 2025

TLT 0.00%↑ UUP 0.00%↑ SPY 0.00%↑

Federal appeals court strikes down most of Trump's tariffs

A U.S. appeals court ruled late Friday that most of President Trump's tariffs are illegal, determining the president exceeded his authority in his use of emergency powers to rewrite U.S. trade policy, but the tariffs were allowed to stay in place for now while the case was sent back to a lower court for further proceedings.

The decision from the U.S. Court of Appeals for the Federal Circuit in Washington, D.C., addressed the legality of Trump's "reciprocal" tariffs imposed in April, as well as a separate set of tariffs imposed in February against China, Canada and Mexico, but the ruling does not affect tariffs issued under other legal authority, such as those on steel and aluminum imports.

The court found the president overstepped his authority under a 1977 law known as the International Emergency Economic Powers Act.

The issue of the legality of Trump's has long been expected to end in the U.S. Supreme Court for a final decision.

Link to Seeking Alpha News Article - Aug. 29, 2025

Charts & Technicals:

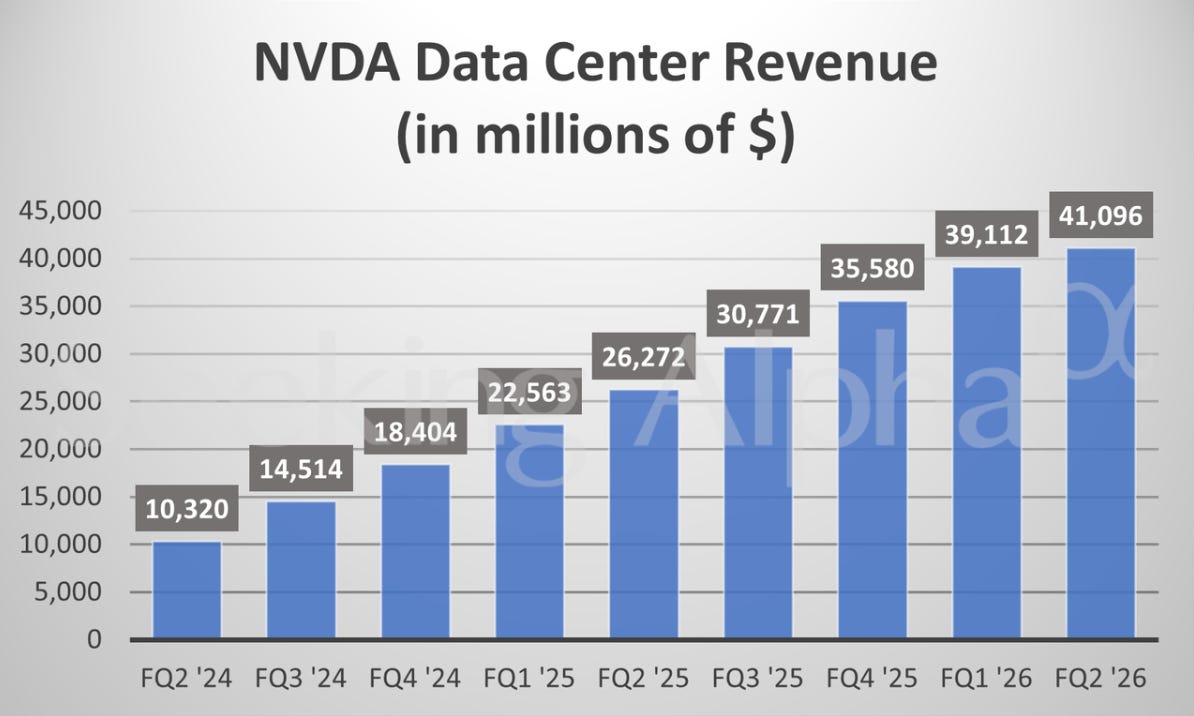

Nvidia in charts: Data Center revenue rises 56% from last year

Link to Seeking Alpha News Article - Aug. 27, 2025

KGC 0.00%↑ AEM 0.00%↑ GLD 0.00%↑

How to Make Money in the Bull Market for Electricity | TCAF 206

Link to The Compound & Friend YouTube Video (Timestamped) - Aug 29, 2025

Disclosure: We own positions in some/all of the tickers mentioned in this article.