In July 2012, Arturo di Modica who created the original "Charging Bull" on Wall Street in 1989, secretly placed a replica of the original at Beursplein, Amsterdam to send a message of optimism amid Europe’s financial downturn.

Most people don’t know but The Netherlands gave birth to the modern financial system by establishing the world’s first stock exchange in Amsterdam in 1602, alongside the Dutch East India Company, pioneering the concepts of publicly traded shares and global capital markets.

Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial + $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist or Weekly Compilation.

Editor’s Pick:

[News] Google not required to sell Chrome in antitrust remedy ruling; GOOG, AAPL jump

Shares in Alphabet rose after hours -- (NASDAQ:GOOG) +5.7%, (NASDAQ:GOOGL) +5.8% -- following news that Google won't be forced to sell its flagship Chrome Web browser in a closely watched antitrust case.

Judge Amit Mehta has ruled that Google must open up competition in online search by sharing more data with competitors, and said that the company could not enter exclusive contracts for search but could still pay for search engine inclusion, news that could affect Apple's (NASDAQ:AAPL) $20B annual payment from Google for default search deals; Apple stock (NASDAQ:AAPL) rose 3% after hours. But Mehta's ruling fell short of prosecutors' push to make Google divest the browser, the world's top browser by market share.

That followed Mehta's ruling last year that Google held an illegal monopoly in online search and search-tied advertising.

In any case, Google will appeal the ruling, meaning that any remedies could come years in the future.

CEO Sundar Pichai has argued that sharing substantial data with rivals opens up the possibility of competitors reverse-engineering its technology.

The case is just one antitrust front on which Google is defending itself. A September trial will take on a Justice Dept. case charging Google with illegal monopolies in advertising technology, while the company will keep fighting a ruling it lost against Epic Games addressing required changes to its Play app store.

Link to Seeking Alpha News Article - Sep. 02, 2025

SPY 0.00%↑ TLT 0.00%↑ UUP 0.00%↑ FXI 0.00%↑ EPI 0.00%↑

[News] American trade policy and the rise of the Shanghai Cooperation Organization

A push towards a new world order was on full display over the weekend during a meeting of the Shanghai Cooperation Organization in Tianjin. Taking the spotlight was a get-together between China's Xi Jinping and Russia's Vladimir Putin, whose ties have been growing significantly to counter the power and economic strength of the U.S. and its allies. Perhaps more importantly, India's Narendra Modi joined the leaders hand-in-hand at the summit, putting aside its border strains with China to signal "close cooperation" as trade tensions rise with the United States.

Thought bubble: It's a big deal that is on the radar of the White House. President Trump's flagship diplomatic tool and projection of American might has been coercive trade policy, with tariffs and other restrictions being leveled on friends and foes alike. That may work well on countries that are dependent on the U.S. - whether economically, geopolitically or militarily - but for the others, the soft power drive can push them to alternative spheres of influence.

It's all the more important as Washington turns its attention to the Asia-Pacific region. In terms of size, the Shanghai Cooperation Organization is one of the world's largest regional organizations, covering nearly 60% of the area of Eurasia and about 25% of global GDP. "We must continue to take a clear stand against hegemonism and power politics, and practice true multilateralism," Xi told the gathering, calling on the SCO to "oppose the Cold War mentality, block confrontation and bullying practices."

Outlook: Partnerships in areas like energy, as well as the establishment of an SCO Development Bank, will go a long way in uniting economies that represent nearly half the world's population. However, some limitations of the new axis were present, with the Indian delegation keeping their distance from Pakistani representatives and leaving the summit before the "Victory Day" event, which will mark 80 years since the defeat of Imperial Japan in WWII. The military parade aims to project China's growing global influence, with North Korea's Kim Jong Un and Iran's Masoud Pezeshkian also in attendance.

Link to Seeking Alpha News Article - Sep. 02, 2025

SPY 0.00%↑ TLT 0.00%↑ UUP 0.00%↑

[News] Trump urges Supreme Court to fast-track appeal to keep his tariffs intact

Trump is asking the Supreme Court to hear arguments on his appeal in early November and issue a final decision on the legality of the disputed tariffs soon afterward, according to filings obtained by NBC News from the plaintiffs in the case.

Filings by Trump also say that “delaying a ruling until June 2026 could result in a scenario in which $750 billion-$1 trillion in tariffs have already been collected, and unwinding them could cause significant disruption.”

Link to Seeking Alpha News Article - Sep. 04, 2025

[News] Tesla robotaxi app now open to public riders

The company’s Tesla Robotaxi account on X announced late Wednesday that the rideshare app is “now available to all,” after months of being restricted mainly to investors and social media influencers.

The app’s terms of service include provisions for California users, though it remains unclear if the autonomous service is currently available in both Austin and the Bay Area.

Link to Seeking Alpha News Article - Sep. 04, 2025

SPY 0.00%↑ QQQ 0.00%↑ DIA 0.00%↑

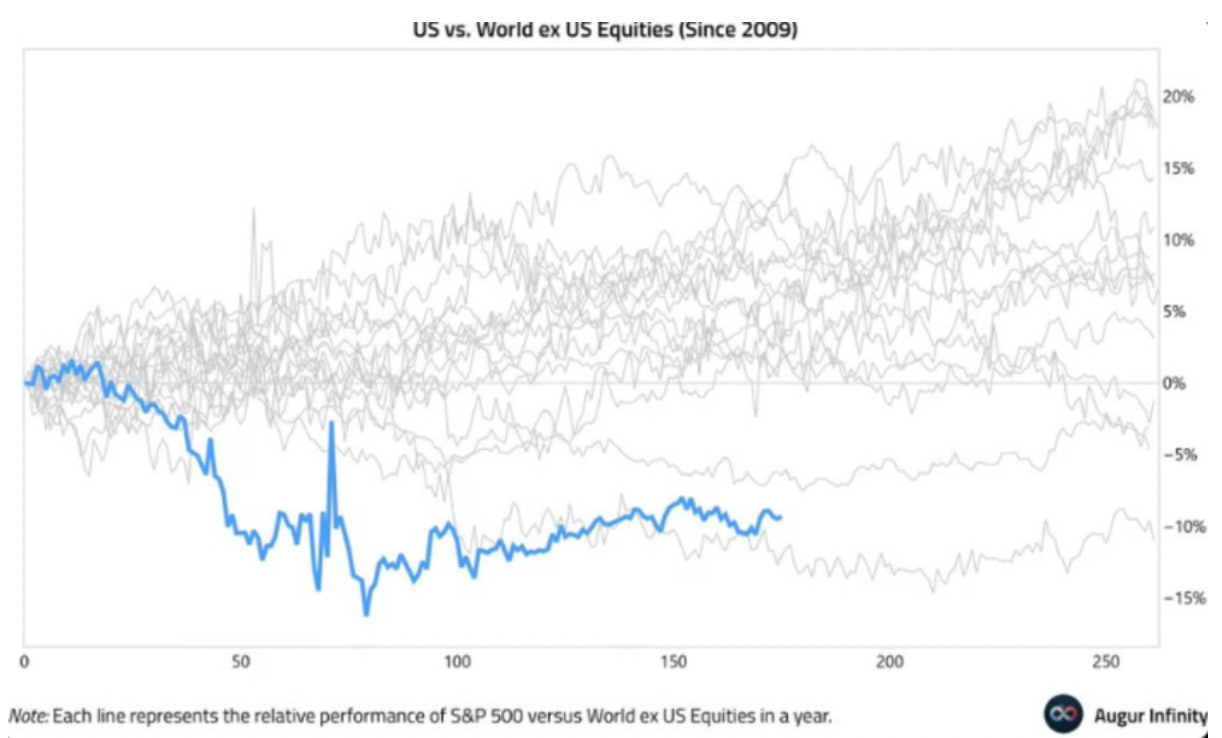

[News/Chart] U.S. equities tracking worst year vs. world since 2009

U.S. equities are on track to record their worst year as compared to the rest of the world since the aftermath of the financial crisis.

The S&P 500 has trailed global equities by nearly 10%, marking the sharpest underperformance since 2009 if the trend holds through year-end.

The U.S. stocks have seen several years of outperformance relative to the rest of the world. The robust performance of the U.S. stock market was driven by megacap technology names, strong corporate results and supportive monetary policy.

However, 2025 has been more dominated by a weak dollar, uncertainty driven by tariff policies and other macroeconomic challenges.

Link to Seeking Alpha News Article - Sep. 04, 2025

AMZN 0.00%↑ NVDA 0.00%↑ AVGO 0.00%↑

[News] Amazon perks up as Anthropic partnership drives data center buildout, Trainium ramp

Amazon (NASDAQ:AMZN) shares perked up 3% during Thursday trading as its relationship with the artificial intelligence startup Anthropic is helping to drive its data center buildout and the upcoming ramp of its in-house Trainium chip.

SemiAnalysis reported Amazon Web Services is currently building three data center campuses for Anthropic, which will total 1.3 gigawatts of capacity. These centers are expected to primarily utilize Amazon's Trainium chips. Amazon's data centers will hold the largest cluster of non-Nvidia (NVDA) AI chips, with nearly 1M Trainium2 chips in its biggest campus.

Although the chips do not possess the power of Nvidia's most powerful processors, Anthropic was involved in the design process, meaning these chips deliver specifically what Anthropic needs to run its large language models, the report said.

Barclays analyst Ross Sandler also identified the potential for an acceleration in Amazon's revenue in the quarters ahead due in part to contributions from Anthropic.

Anthropic's primary revenue driver stems from high-value enterprise deals, which contrasts with competitor OpenAI's individual consumer approach through ChatGPT subscriptions.

Link to Seeking Alpha News Article - Sep. 04, 2025

AVGO 0.00%↑ NVDA 0.00%↑ #OpenAI

OpenAI to launch its first AI chip with Broadcom: report

OpenAI is set to produce its first artificial intelligence chip next year in partnership with U.S. semiconductor company Broadcom (NASDAQ:AVGO), the Financial Times reported on Thursday, citing people familiar with the matter.

According to the report, OpenAI plans to put the chip to use internally rather than make it available to external customers.

Link to Seeking Alpha News Article - Sep. 05, 2025

Tesla rises after board proposes new $1T pay package for Musk

Tesla (NASDAQ:TSLA) has asked shareholders to approve a new performance-based pay package for CEO Elon Musk, potentially worth around $1 trillion, according to a Friday filing.

The 10-year plan ties Musk’s payout to ambitious targets, including scaling Tesla’s robotaxi business and boosting the company’s market value from about $1 trillion to $8.5 trillion. If fully awarded, the additional shares would raise Musk’s ownership stake in Tesla to at least 25%.

The proposal includes 12 tranches of stock awards to be granted if the EV maker hits certain milestones over the next decade. It would also grant Musk greater voting control over the company and aspiring robotics titan, a demand he has voiced since early 2024.

To unlock the first tranche, Tesla must nearly double its valuation to $2 trillion and hit a cumulative 20 million vehicle production and deliveries milestone.

Additional goals for Musk to reach under the 2025 CEO Performance Award include delivering 20 million vehicles, achieving 10 million active FSD subscriptions, delivering 1 million Optimus bots, and having 1 million Robotaxis in commercial operation. On the financial front, the company must also hit aggressive adjusted EBITDA goals. Musk must remain CEO or otherwise fully engaged with Tesla (TSLA) for at least the next 7.5 to 10 years to trigger full vesting of all tranches.

"In 2018, Elon had to grow Tesla by billions; in 2025, he has to grow Tesla by trillions — to be exact, he must create nearly $7.5 trillion in value for shareholders for him to receive the full award," the filing read.

Chairwoman Robyn Denholm told CNBC that the plan is designed to keep Musk “motivated and focused on delivering for the company.” Musk remains politically entangled while juggling multiple ventures, including SpaceX, The Boring Company, Neuralink, and the AI startup xAI, which has merged with his social platform X.

In addition, the automaker is also seeking shareholder approval for a potential investment in xAI.

In its SEC filing, Tesla (NASDAQ:TSLA) highlighted that it is transforming into a leading artificial intelligence, robotics, and energy company, with its mission to advance technology for human benefit and advance sustainable energy.

Tesla sees investing in xAI as a way to strengthen its leadership in AI, robotics, and energy by gaining access to cutting-edge technology, talent, and collaboration opportunities that could enhance its products and deliver long-term financial and strategic benefits.

Link to Seeking Alpha News Article - Sep. 05, 2025

Link to Seeking Alpha News Article - Sep. 05, 2025

Link to Seeking Alpha News Article - Sep. 05, 2025

[YouTube/Steve Eisman] Google Wins Antitrust Case, Is AI The Next Bubble? | The Friday Market Wrap!

In this episode of The Weekly Wrap, Steve Eisman breaks down the latest on Trump’s tariffs being rejected by the US Court of Appeals, Google’s win in the antitrust case, and the current state of Apple. He also discusses Kraft Heinz splitting into two, the impact of AI on tech software, and if he’s worried about an AI bubble.

I found the part about Software particularly interesting. I have made the case before to follow the distribution. If Figma can offer cheaper subscriptions then so can Adobe. Yes, the bottom line takes a hit but at some point the carnage stops and the business starts growing both top and bottom line again. Besides, I am far more bullish on the $IGV ETF. If Adobe does get eaten up by Figma and Canva, then Figma and Canva will be in $IGV eventually and Adobe will not.

Link to Full Video (15:28 Mins) - Sep. 05, 2025

News, Facts, Analyst & Market Commentary - Short Reads:

Meet Unitree Robotics: The star of the first-ever World Humanoid Robot Games

The inaugural World Humanoid Robot Games were held in Beijing earlier in the month. The event featured athletic challenges (such as track, football, and boxing), cognitive tests, and artistic performances, all designed to measure the agility, intelligence, and human-like traits of next-generation humanoid robots.

While the event showed the challenges of humanoid robotics in some viral moments, Unitree Robotics impressed industry watchers and largely dominated the headlines for its consistent performance in sporting events and dance. The company won 11 medals, including four golds. Its flagship H1 humanoid robot set records in the 400-meter dash, 1,500-meter race, 100-meter hurdles, and the 4×100-meter relay.

Link to Seeking Alpha News Article - Aug. 30, 2025

Silver surges past $40 for first time since 2011 on Fed rate cut expectations

The rally mirrors upward trends in other precious metals, including gold, platinum, and palladium.

Lower interest rates often boost gold’s appeal, as the metal’s lack of yield becomes less of a disadvantage when borrowing costs are low.

Link to Seeking Alpha News Article - Sep. 01, 2025

NVDA 0.00%↑ AMAT 0.00%↑ LRCX 0.00%↑ #HXSCF #SSNLF

SK Hynix, Samsung fall as U.S. makes it harder to produce chips in China

Shares of SK Hynix (OTCPK:HXSCF) and Samsung Electronics (OTCPK:SSNLF) fell on Monday after Washington revoked their authorizations to obtain U.S. semiconductor equipment for operations in China.

The move is set to go into effect in 120 days.

The U.S. Commerce Department had granted the firms waivers from broad 2022 export controls on sales of American semiconductor equipment to China. The companies will now be required to secure licenses to purchase equipment for their China operations. The federal filing also listed Intel (INTC) among those losing authorization, though the chipmaker completed the sale of its Dalian plant earlier this year.

According to the department, the U.S. plans to approve licenses for the firms to keep operating their existing plants in China, but will not allow expansions or technology upgrades.

Shares in SK Hynix fell nearly 5% in South Korea, while Samsung shed 2.6%. The South Korean chipmakers control the bulk of global memory chip output, accounting for roughly 70% of the DRAM market—crucial for data centers and AI—and 54% of the NAND market.

SK Hynix (OTCPK:HXSCF) stands as a major supplier of high-bandwidth memory chips to Nvidia (NVDA). Analysts estimate that 30%–40% of SK Hynix’s DRAM and NAND output comes from China. Samsung is expected to be less exposed, as only its NAND production is based there, though still significant at about one-third.

The licensing change will likely reduce sales to China by U.S. equipment makers KLA Corp (KLAC), Lam Research (LRCX) and Applied Materials (AMAT).

Link to Seeking Alpha News Article - Sep. 01, 2025

#OpenAI

OpenAI plans major AI data center in India as part of Stargate expansion, Bloomberg reports

The ChatGPT-maker is currently scouting local partners to set up a data center with at least 1-gigawatt capacity in the world’s most populous country, the report said.

OpenAI is currently on an expansion drive in India, its second-largest market in the world by users, and its chief, Sam Altman, is scheduled to visit India in September.

Link to Seeking Alpha News Article - Sep. 01, 2025

Tesla's registrations in Sweden plunge 84% in August

Tesla (NASDAQ:TSLA) registrations in Sweden plunged 84% in August from a year earlier, dropping to 210 vehicles from 1,348, Mobility Sweden data showed on Monday.

The Model Y led Tesla’s August sales in Sweden with 141 registrations, followed by 67 Model 3s. The results lagged far behind other automakers: Volvo (OTCPK:VLVLY) logged 2,718 registrations (+8% Y/Y), Volkswagen (OTCPK:VWAGY) 2,614 (+19.3%), and Toyota (TM) 2,245 (+35%).

The slump follows broader weakness in Europe, where Tesla’s sales fell 40% in July to 8,837 units—its seventh consecutive monthly drop—even as overall EV sales climbed, ACEA data showed.

Link to Seeking Alpha News Article - Sep. 01, 2025

Tesla falls short in India with about 600 orders since launch, Bloomberg News reports

Tesla (NASDAQ:TSLA) has reportedly received orders for just over 600 cars since launching sales in India in mid-July, a number that has fallen short of the Elon Musk-led electric vehicle maker's own expectations.

Deliveries are initially limited to Mumbai, Delhi, Pune, and Gurugram, the report said.

Tesla (NASDAQ:TSLA) officially entered the Indian market in July with the launch of its Model Y electric SUV, priced at around ₹6 million ($69,751).

Link to Seeking Alpha News Article - Sep. 02, 2025

Nvidia says supply constraint claims are 'categorically false'

In a reaction to media reports, Nvidia (NASDAQ:NVDA) attempted to set the record straight and declared there are no supply constraints for cloud access to its H100, H200 or Blackwell GPUs.

"We've seen erroneous chatter in the media claiming that NVIDIA is supply constrained and 'sold out' of H100/H200," Nvidia said in a post on X late Tuesday morning. "As we noted at earnings, our cloud partners can rent every H100/H200 they have online — but that doesn't mean we're unable to fulfill new orders."

"We have more than enough H100/H200 to satisfy every order without delay," Nvidia added. "The rumor that H20 reduced our supply of either H100/H200 or Blackwell is also categorically false — selling H20 has no impact on our ability to supply other NVIDIA products."

Link to Seeking Alpha News Article - Sep. 02, 2025

NuScale surges on partnership with TVA for 6 GW of small modular reactors

NuScale Power (NYSE:SMR) closed +7.6% on Tuesday after the Tennessee Valley Authority said it signed an agreement with ENTRA1 Energy - a strategic partner of NuScale - to develop up to 6 GW of new nuclear power on several sites throughout the utility's region, in the largest U.S. small modular reactor deployment program so far.

ENTRA1 said it plans to deploy small modular reactors developed by NuScale (NYSE:SMR) inside its energy plants, aiming to provide enough energy to power the equivalent of 4.5M homes or 60 new data centers; all power is expected to be sold to TVA under future power purchase agreements, although it is not known when ENTRA1 expects to have its plants operational.

The agreement is TVA's latest effort to bring as much new nuclear energy online as quickly as possible; it is working with Google and Kairos Power to connect 50 MW of small modular reactor capacity to the grid by 2030, and planning to build its own SMR at its Clinch River nuclear site in Tennessee.

Link to Seeking Alpha News Article - Sep. 02, 2025

Waymo eyes launching robotaxi service in Denver, Seattle

Waymo, Alphabet's (NASDAQ:GOOG) (NASDAQ:GOOGL) autonomous vehicle unit, is bringing its robotaxis to Denver, Colorado and Seattle, Washington State this week as it lays the groundwork for future commercial operations.

The company will arrive in Denver "with a mixed fleet of Jaguar I-PACE with the 5th-generation Waymo Driver and Zeekr RT vehicles equipped with our 6th-generation Waymo Driver," it said in a blog post.

In Washington State, Waymo began testing its vehicles in Bellevue back in 2022. "We've spent years getting to know the area - from communities around the Lake to its notoriously wet weather," it said in a blog post, adding that it's working towards bringing autonomous operations in the broader Seattle metropolitan area.

The vehicles will initially be driven manually, before Waymo starts testing its autonomous technology in both cities. The company said it hopes to start offering robotaxi rides in Denver next year and the Seattle metropolitan area "as soon as we're permitted to do so," TechCrunch reported.

Waymo currently offers paid robotaxi trips in Phoenix, San Francisco, Los Angeles, Austin, and Atlanta. It is planning to launch commercial services in Miami, Washington, D.C., and Dallas.

Link to Seeking Alpha News Article - Sep. 03, 2025

Joby Aviation remotely pilots Cessna in Pentagon push for autonomous aircraft

To meet the Air Force’s need for autonomously piloted light aircraft for high-risk deliveries in large operational theaters, Joby Aviation (NYSE:JOBY) completed a successful demonstration of its Superpilot flight technology by logging over 7,000 miles of autonomous flight over 40+ flight hours by flying a Cessna 208 aircraft remotely.

Joby’s (NYSE:JOBY) Superpilot integrated into the Cessna Caravan 208 platform completed a variety of missions including the ability to execute rapid cargo deliveries, operational versatility, and airlift capabilities. Superpilot flew the Cessna 7,342 miles over 43.7 hours, including a roundtrip ferry flight of 4,925 miles over the Pacific Ocean while being operated by ground control stations from bases as far away as 3,000 miles. A safety pilot was aboard to monitor the system’s performance.

The demonstration was part of the Resolute Force Pacific (REFORPAC), a Department-Level Exercise led by Pacific Air Forces (PACAF). The successful demonstration positions Joby Aviation (NYSE:JOBY) to bid on the Pentagon’s (requested) $9.4B budget to advance autonomous and hybrid aircraft. Additionally, the work with defense partners can advance the integration of autonomous capabilities into Joby’s (JOBY) commercial air taxi platform.

Superpilot technology was developed by Xwing, which Joby (JOBY) acquired in June 2024.

Link to Seeking Alpha News Article - Sep. 03, 2025

GLXY 0.00%↑ HOOD 0.00%↑ COIN 0.00%↑ #BRPHF #SOL

Galaxy Digital enables tokenization of its stock on Solana blockchain

Galaxy Digital Holdings (NASDAQ:GLXY) (OTCPK:BRPHF) is allowing its stockholders to tokenize their Class A common shares on the Solana (SOL-USD) network via blockchain firm Superstate's Opening Bell platform, it said on Wednesday.

The move gives Galaxy's (NASDAQ:GLXY) equity 24/7 market potential and near-instant settlement. The tokenized shares remain fully compliant and legally equivalent to traditional equity, it said.

Access will be limited to KYC-approved investors, who can hold and move the tokens directly in their crypto wallets.

This marks the first time a publicly-traded company has tokenized its SEC-registered equity directly on a blockchain, it noted.

In addition, Galaxy (NASDAQ:GLXY) and Superstate working on ways to let tokenized stocks trade through automated market markers (AMMs) while staying within regulatory purviews. Shares listed on Opening Bell, including Galaxy's own, could eventually circulate on AMMs and other decentralized finance (DeFi) platforms.

Equity tokenization turns shares of a company into tokens on a blockchain, and a number of financial firms have been exploring it, including retail trading app Robinhood Markets (HOOD) and crypto exchange Coinbase Global (COIN).

Link to Seeking Alpha News Article - Sep. 03, 2025

SPY 0.00%↑ TLT 0.00%↑ UUP 0.00%↑

U.S. consumers paid majority of tariffs by mid-June – Yale Budget Lab

Between 61% and 80% of the new 2025 tariffs have been passed through to consumer prices for core goods in June alone, according to a research report by The Budget Lab at Yale University.

Yale economists noted this pass-through rate falls “roughly in the middle of prior studies” examining consumer price effects of tariffs, representing a significant short-term economic impact as the U.S. experiences its highest statutory average tariff rates since the early 1930s.

Tariff revenues have risen substantially, with TBL estimating that the U.S. has collected $146B in total net customs duty revenues in calendar year 2025 so far through August.

The new 2025 tariffs specifically have generated approximately $88B in additional revenues, including about $23B in August alone when the average effective tariff rate reached an estimated 11-12%, according to the report. This revenue, amounting to roughly 0.8% of GDP monthly, provides “a meaningful amount of deficit reduction,” the TBL analysis stated.

However, consumer goods prices have shown clear evidence of tariff effects, breaking from previous trends. “Over the first six months of 2025, PCE core goods prices rose 1.5%, versus 0.3% over the first six months of 2024,” the report revealed.

The Budget Lab’s analysis found that several specific product categories showed statistically significant price increases above pre-2025 trends, with “video, audio, photographic, and information processing equipment prices 5.7% higher than pre-2025 trend in June,” while household appliances were 3.9% higher and furniture 3.1% higher.

Also, The Budget Lab’s regular modeling assumes the Federal Reserve “looks through tariff-driven price increases and maintains the same stance of policy,” though market expectations show a more complex picture.

These early indicators represent only initial effects, with TBL cautioning that impacts “may evolve and change over time as consumers, businesses, and policymakers respond.”

The Budget Lab noted that while some effects align with projections – such as higher revenues and accelerating goods prices – others run counter to expectations, including currency movements where “the dollar (DXY) is weaker, for example, while the currencies of many of the targets of our tariffs have appreciated,” demonstrating the complex economic interactions that will continue to unfold in response to the heightened tariff regime.

Link to Seeking Alpha News Article - Sep. 03, 2025

[Newsletter Exclusive] Google's AI-based search rivals receive marginal benefit from Mehta's ruling: analysts

The key points of the data sharing order are search results syndication, synthetic queries and search index data. Search syndication requires Google to syndicate search results with current licensees.

"A key win for Google on the search syndication front was that competitors will not be able to use the search results to train their own systems, nor will they be able to generate 'synthetic' queries generated by algorithms rather than users," Rodelli noted.

Regarding the search index data, competitors will receive a "one-time dump" of a unique identifier for each document with a notation for duplicates, a URL, when it was last crawled and a spam score.

Google is also being forced to deliver the Glue and RankEmbed datasets to competitors.

"Glue includes the query itself, information about the user, the 10 blue links, any other features, clicks, hovers, and duration on the results page, and query interpretations and suggestions," Rodelli said. "This contains a huge treasure-trove that a good data analytics team—which GenAI companies definitely have—can use to make a search better. RankEmbed includes search logs and human-rated scores, which Google says has helped with long-tail queries."

However, these data sharing protocols will likely not materialize for years, as CFRA expects Google to win a stay on the remedy ruling. This will likely be followed by a case in the D.C. Circuit Court of Appeals and eventually a U.S. Supreme Court decision.

Link to Seeking Alpha News Article - Sep. 03, 2025

Trump set to block Avangrid wind projects off Massachusetts coast

The Trump administration is moving to withdraw a permit for Avangrid's planned New England Wind 1 and 2 wind projects offshore Massachusetts, according to a court filing dated Wednesday.

Attorneys for the Department of Justice said they would act by October 10 to vacate the U.S. Bureau of Ocean Energy Management's approval of the New England Wind construction and operations plan.

Avangrid subsidiary Iberdrola (OTCPK:IBDRY) (OTCPK:IBDSF) is developing New England Wind 1 and 2 off the coast of Nantucket, Massachusetts, that aims supply enough electricity to meet the needs of more than 900K homes in the state, according to the BOEM; the project was approved by the Biden administration in 2024.

Link to Seeking Alpha News Article - Sep. 03, 2025

Intuitive Surgical drops amid tariff concerns

At the Wells Fargo Healthcare Conference on Wednesday, CEO David Rosa and CFO Jamie Samath outlined the company’s strategic priorities for the next 5-10 years, and highlighted the impact of the Trump administration’s tariffs.

While the Sunnyvale, California-based MedTech said that its financial goals remain intact, it added that tariff headwinds for next year could exceed its Q2 projection for 2025, which stood at a 100 bps impact on revenue.

Link to Seeking Alpha News Article - Sep. 03, 2025

Florida to eliminate all state vaccine mandates, surgeon general says

Florida is poised to become the first U.S. state to eliminate all vaccine requirements, including those for children attending public schools.

The decision was announced Wednesday by State Surgeon General Joseph Ladapo, a longtime critic of immunization policies, who declared that every remaining mandate in Florida law will be repealed.

Currently, all 50 states require certain vaccinations for school attendance, though exemptions vary. Florida already allows parents to opt out on religious grounds, but eliminating mandates altogether could significantly reduce immunization rates.

Link to Seeking Alpha News Article - Sep. 03, 2025

Salesforce CEO: AI agents have replaced 4,000 customer support roles

"I was able to rebalance my headcount on my support," Benioff said on The Logan Bartlett Show. "I've reduced it from 9,000 heads to about 5,000 because I need less heads. But there's also an omnichannel supervisor now that's kind of helping those agents and those humans work together."

Benioff said because of this rebalancing, "I can now put those heads into sales, so I've increased my distribution capacity. And now, I'm also making sure that I have much more efficiency and productivity in my lead generation."

Link to Seeking Alpha News Article - Sep. 03, 2025

Salesforce's weak guidance shows AI is not helping enough yet: analysts

Wells Fargo analyst Michael Turrin wrote in a note to clients. “Remain balanced until greater signs of a catalyst emerge, w/ Agentforce uptake proving slower than anticipated (ARR disclosure not given).” Turrin has an Equal-Weight rating and $265 price target on Salesforce.

Similarly, Evercore ISI analyst Kirk Materne said investors are playing a “waiting game” with Salesforce, as they look for subscription revenue to stabilize.

“While we did not see this quarter as the ‘unlock’ for the bull case, at these levels, we believe stabilization in 2H c/c subs revenue is ‘good enough’ to start shifting sentiment in a more positive direction,” Materne wrote in a note to investors. “That said, seeing is believing and while we believe the risk/reward continues to skew to the upside if thinking out 3 to 4 months, shares are likely in a holding pattern until Dreamforce in mid-Oct.” Materne has an Outperform rating and $360 price target on Salesforce.

Morgan Stanley analyst Keith Weiss also acknowledged that the company is “positioning for the turn,” but was a bit more optimistic in that he believes the pieces are coming together soon.

“... Within the details of the quarter, one can see the pieces coming together for a more positive trajectory in growth and a solid catalyst path ahead for the shares,” Weiss wrote.

Link to Seeking Alpha News Article - Sep. 04, 2025

AAPL 0.00%↑ GOOGL 0.00%↑ #OpenAI #PerplexityAI

Apple eyes Siri overhaul with AI search engine to rival OpenAI - report

Apple (NASDAQ:AAPL) is said to be developing an artificial intelligence-driven web search feature called World Knowledge Answers, expected to launch in spring 2026 as part of a major Siri overhaul, intensifying its competition with OpenAI and Perplexity AI.

The company has also discussed eventually adding the technology to its Safari web browser and Spotlight, which is used to search from the iPhone home screen, Bloomberg reported.

The idea is to make Siri and Apple's (NASDAQ:AAPL) operating systems a place where users can look up information from across the internet — in a similar fashion to ChatGPT and AI Overviews in Google Search.

The approach will rely on large language models, or LLMs, a key technology underpinning generative AI.

The report further added that Apple is experimenting with Google’s (NASDAQ:GOOG) Gemini AI to power parts of the revamped Siri, while also evaluating Anthropic’s Claude and its own in-house models for various functions.

Link to Seeking Alpha News Article - Sep. 04, 2025

Nvidia's AI chips still wanted by Chinese firms despite Beijing's pressure to not buy: report

Alibaba (NYSE:BABA), ByteDance (BDNCE) and other Chinese tech companies remain interested in Nvidia's (NASDAQ:NVDA) AI chips despite regulators in China strongly discouraging them from such purchases, Reuters reported, citing people familiar with the procurement discussions.

They want reassurance that their orders of Nvidia's H20 chips, which the U.S. company in July regained permission to sell in China, are being processed. They are also monitoring Nvidia's plans for a more powerful chip, tentatively called B30A and based on its Blackwell architecture, the report added.

The B30A, if approved for sale by the U.S., could cost about double the H20, which currently sells in the range of $10,000 to $12,000, according to the report.

Chinese tech companies perceive the potential B30A pricing as a good deal. One person told the news agency that the B30A promises to be up to six times more powerful than the H20, the report noted.

Link to Seeking Alpha News Article - Sep. 04, 2025

[Newsletter Exclusive] Spire Global rises on securing $11.1 million NOAA contract for Spire Global (NYSE:SPIR) was awarded an $11,190,900 contract from the National Oceanic and Atmospheric Administration (NOAA) to provide global navigation satellite system radio occultation (RO) data for one year from September 18, 2025, to September 18, 2026.

The company's near-real-time GNSS-RO data consists of vertical profiles of atmospheric measurements, including pressure, humidity, and temperature, that can reach all points of the globe.

NOAA, together with NASA, the U.S. Air Force, and the U.S. Navy, will integrate Spire’s GNSS-RO data into their weather and space weather models, while additional U.S. and international agencies will leverage the data to strengthen forecasts and advance climate research.

Link to Seeking Alpha News Article - Sep. 04, 2025

[Newsletter Exclusive] Bit Digital reports Ethereum holdings worth ~$532.5M as of August end

Bit Digital (NASDAQ:BTBT) said on Thursday that it held ~121,252 Ethereum (ETH-USD) as of August 31, valued at about $532.5M.

The company's total staked Ethereum was ~105,031, or ~86.6% of its total holdings, as of August 31.

Staking operations generated ~249 ETH in rewards during the period.

Link to Seeking Alpha News Article - Sep. 04, 2025

GitLab sinks on second-half slowdown, but analysts remain positive on long-term setup

"Gitlab reported solid Q2 results with revenue growth accelerating to +29% y/y vs. +27% last qtr reflecting a 4.0% revenue beat vs. 0.7% last qtr," said RBC analysts, led by Matthew Hedberg, in a Thursday note.

Meanwhile, Bank of America reiterated its Buy rating and stout $72 price target.

BofA believes GitLab likely did not increase its fiscal 2026 revenue guidance due to conservatism and the recent turnover at the top.

"We continue to believe GitLab is a long-term share gainer in the DevSecOps category," said BofA analysts, led by Koji Ikeda, in a note.

Link to Seeking Alpha News Article - Sep. 04, 2025

[Newsletter Exclusive] Nasdaq tightens rules on firms hoarding tokens, sending crypto treasury stocks lower

Strategy (NASDAQ:MSTR), a pioneer in the crypto treasury strategy, dipped 2.7%, ether-focused Bitmine Immersion Technologies (NYSE:BMNR) gapped down -6.6% as of 11:22 a.m. ET.

The stock exchange is telling certain companies they can't sell new shares to fund crypto purchases without first getting the green light from shareholders, The Information reported, citing people familiar with the matter.

Link to Seeking Alpha News Article - Sep. 04, 2025

Quantum stocks rise amid news of Nvidia investment in Honeywell's Quantinuum

The venture capital unit of Nvidia (NASDAQ:NVDA) is investing in Honeywell's (NASDAQ:HON) Quantinuum quantum computing unit for the first time.

The investment is part of a $600M funding round that values the unit at $10B, Honeywell said in a statement. The new funding will help boost Quantinuum's advancement of quantum computing at scale and go towards the launch of Helios, Quantinuum's next-gen quantum computing system.

Nvidia's investment is notable given the company's mixed history with quantum computing. Earlier this year, Nvidia CEO Jensen Huang said that “very useful” quantum computers were somewhere between 15 and 30 years away, which resulted in shares of quantum computing companies to slump. Huang issued a mea culpa in March at the company's GTC event, which included its first ever quantum day. Huang further shifted his view and said in June that the quantum computing industry was now at an “inflection point.”

Separately, in June, Nvidia announced that it had teamed up with IonQ, Amazon Web Services and AstraZeneca to develop and show a quantum-accelerated computational chemistry workflow.

Link to Seeking Alpha News Article - Sep. 04, 2025

Oklo plans $1.7B Tennessee plant to recycle nuclear waste to fuel

Oklo (NYSE:OKLO) said Thursday it plans to design, build and operate a facility in Tennessee to convert nuclear waste into fuel to power its own advanced small modular reactors, a first-of-its-kind recycling plant in the U.S. it expects to cost $1.68B.

Oklo (NYSE:OKLO) said it has already completed a licensing project for the facility with the Nuclear Regulatory Commission, and is in the pre-application stage for bringing it into operation; it anticipates the plant will begin producing fuel for its SMRs by the early 2030s.

The company also said it is in talks with Tennessee Valley Authority to recycle waste from the utility's nuclear plants, and possibly to sell it electricity from its planned Aurora Powerhouse reactor.

More than 94K metric tons of used nuclear fuel are stored at U.S. power plants that could be recycled, and doing so would unlock the energy equivalent of 1.3T barrels of oil, the company said.

"Fuel is the single most important factor in bringing advanced nuclear energy to market," Oklo (OKLO) CEO Jacob DeWitte said. "By recycling used nuclear fuel at an industrial scale, we are turning waste into watts, cutting costs, and establishing a secure U.S. supply chain."

Link to Seeking Alpha News Article - Sep. 04, 2025

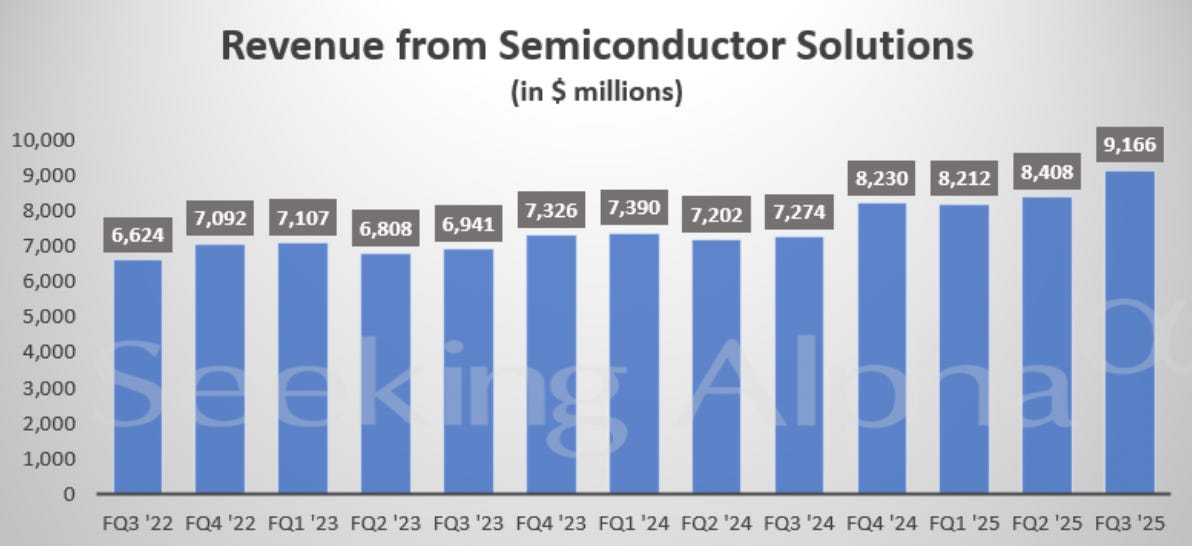

Broadcom forecasts $17.4B Q4 revenue as AI semiconductor momentum accelerates with new customer

Hock Tan, President and CEO stated that Q3 semiconductor revenue reached $9.2 billion, with AI semiconductor revenue of $5.2 billion, up 63% year-on-year, noting this marks "10 consecutive quarters" of robust AI growth.

"Bookings were extremely strong. And our current consolidated backlog for the company hit a record of $110 billion."

The CEO highlighted the addition of a fourth qualified XPU customer, with over $10 billion in AI rack orders secured. This leads to "the outlook for our fiscal 2026 AI revenue to improve significantly from what we had indicated last quarter."

Kirsten Spears, CFO, stated, "Gross margin was 78.4% of revenue in the quarter, better than we originally guided on higher software revenues and product mix within semiconductors."

Management guided Q4 consolidated revenue to $17.4 billion, with semiconductor revenue of about $10.7 billion and AI semiconductor revenue of $6.2 billion.

Vivek Arya, BofA: Sought quantification on 2026 AI growth. Tan replied, "we're seeing the growth rate accelerate as opposed to just remain steady...for 2026."

Stacy Rasgon, Bernstein: Asked about the $110 billion backlog. Tan clarified it's "largely driven by AI in terms of growth."

Tan announced an agreement with the Board to continue as CEO through 2030, calling this an "exciting time" for Broadcom.

Link to Seeking Alpha News Article - Sep. 04, 2025

Link to Seeking Alpha News Article - Sep. 04, 2025

Samsara outlines 26% FY26 revenue growth target while accelerating AI-driven customer adoption

CEO Sanjit Biswas highlighted that Samsara ended Q2 with $1.6 billion in ARR, reflecting 30% year-over-year growth. The company achieved a record by adding 17 customers with over $1 million in ARR, now representing more than 20% of total ARR. "Our $100,000-plus ARR customers now contribute close to $1 billion of ARR, up 35% year-over-year and now represent 59% of our total ARR," said Biswas. He emphasized the company’s strategic focus on large enterprises.

Biswas pointed out growing AI adoption among customers and noted a shift toward automation and unified platforms to manage complex operations.

Revenue for Q2 was $391 million, up 30% year-over-year. Non-GAAP gross margin reached 78% and non-GAAP operating margin was 15%, both showing year-over-year improvement. Free cash flow margin increased to 11% in Q2, up 7 percentage points year-over-year.

Link to Seeking Alpha News Article - Sep. 04, 2025

AAPL 0.00%↑ EPI 0.00%↑ INQQ 0.00%↑

[Newsletter Exclusive] Apple’s India sales reportedly hit record $9 billion

Apple's (NASDAQ:AAPL) annual sales in India hit a record of nearly $9 billion in the last fiscal year, as the company ramps up its retail footprint in the world's most populous country.

Revenue rose about 13% in the 12 months through March from $8 billion a year earlier, Bloomberg reported.

Apple’s (NASDAQ:AAPL) marquee iPhones accounted for most of the sales, and demand for MacBook computers also surged.

Link to Seeking Alpha News Article - Sep. 05, 2025

Chinese solar stocks surge amid hopes of industry rebound

Chinese solar stocks extended their rally on Friday, buoyed by growing optimism that the sector may be nearing a turning point.

Investor sentiment received a boost from government efforts to tackle overcapacity and bring an end to a bruising price war.

China's solar industry has "marked a clear bottom, and it is already recovering" after recent meetings with the government to address severe overcapacity, Daqo New Energy (NYSE:DQ) CFO Ming Yang told Bloomberg in an interview Thursday.

Major Chinese solar companies plan to establish a fund of at least 50B yuan (~$7B) this quarter to purchase and shut down more than 1M tons of capacity, a plan that Ming said is being discussed and moving forward with the support of the government, with details remaining including how to fund the initiative and at what price capacity marked for closure will be purchased.

Solar-grade polysilicon, a key material in panels, is currently priced ~50 yuan/kg, and Ming said a level of 50-60 yuan/kg is reasonable, given current production levels and costs.

Link to Seeking Alpha News Article - Sep. 05, 2025

Waymo receives permit to operate at San Jose airport

San Jose Mineta becomes the first commercial, international airport in California, and the second in the world, to welcome Waymo to its terminals. Rollout will happen in stages, beginning with fully-autonomous testing with Waymo employees, followed by a commercial launch for the public later this year.

The milestone follows years of attempts to secure airport access in its home state. Earlier this year, it secured a permit to begin manual mapping at the San Francisco International Airport, a precursor to eventually launching a commercial service there.

The company already operates at Phoenix Sky Harbor International, where it launched curbside service in late 2023 and expanded to 24/7 availability in August 2024.

Waymo’s fleet now exceeds 2,000 robotaxis nationwide, including about 800 in the Bay Area, 500 in Los Angeles, 400 in Phoenix, 100 in Austin, and smaller numbers in Atlanta. The company this week announced expansion plans to Denver and Seattle, with Dallas, Miami, and Washington, D.C. also on the horizon. It has additionally won approval to test in New York City.

Link to Seeking Alpha News Article - Sep. 05, 2025

Qualcomm and BMW launch new automated driving system

Qualcomm Technologies (NASDAQ:QCOM) and BMW Group introduced Snapdragon Ride Pilot on Friday, the companies’ new automated driving system resulting from a three-year collaborative effort.

The system supports features from basic driver assistance to advanced autopilot for highway and city driving.

Snapdragon Ride Pilot is now available to all global automakers and Tier-1 suppliers through Qualcomm Technologies.

Link to Seeking Alpha News Article - Sep. 05, 2025

Global chip equipment revenue tops $65B in H1 amid AI-fueled demand, SEMI says

SEMI, the global industry association for the semiconductor and electronics manufacturing supply chain, on Friday reported a 24% year-over-year increase in global semiconductor equipment billings, reaching $33.07 billion in the second quarter.

Quarter-over-quarter, billings rose 3%, driven by strong demand for high-bandwidth memory (HBM)-related DRAM applications and increased shipments to Asia.

"The global semiconductor equipment market registered a strong first half of 2025 with more than $65 billion in revenue, building on the record billings of $117 billion in 2024," said Ajit Manocha, SEMI President and CEO.

Seeking Alpha analyst Julia Ostian, in a recent article, stated that AI, undoubtedly, has poured gasoline on the fire, "but it’s not the only reason for the growth. Edge computing, EV adoption, industrial automation, and data center buildouts are structural forces that aren’t going away."

Link to Seeking Alpha News Article - Sep. 05, 2025

Broadcom surges after Q3 results, new customer announcement makes analysts bullish

Shares of Broadcom (NASDAQ:AVGO) jumped about 12% premarket on Friday after fiscal third quarter results beat estimates, and the company revealed a new customer, which saw bullish reactions from analysts.

Analysts led by Blayne Curtis and his team noted that the fourth customer comes even faster than expected and ramps up quickly with a $10B ASIC order focused on inference for the second half of fiscal 2026 (just the first order for the platform), providing another step function higher in AI revenue in fiscal 2026 ($10B on top of the 60% growth already expected). High-level expectations continue to move higher with total backlog up to $110B and fiscal 2026 AI revenue now expected to materially outgrow fiscal 2025, with further acceleration into fiscal 2027. The total list of customers/prospects remains the same, but this is a significant proof point for ASICs.

On the gross margin side, Broadcom indicated ASIC gross margins will be lower (likely in the 50s), but gross profit is moving higher, the analysts added.

"Overall, we expect the size and speed of the 4th customer will add legitimacy to the ability to capture the remaining ASIC opportunity, making the F27 a reality sooner and putting some pressure on the GPU stories," said Curtis and his team.

Morgan Stanley maintained its Overweight rating and increased the price target on the stock to $382 from $357.

Wells Fargo kept its Equal Weight rating on Broadcom's shares but raised the price target to $345 from $255.

Link to Seeking Alpha News Article - Sep. 05, 2025

BioNTech rises as breast cancer drug shows positive phase 3 results

BioNTech SE (NASDAQ:BNTX) shares rose ~8% in premarket trading on Friday after the company and partner Duality Biologics reported positive Phase 3 trial results for their breast cancer treatment.

The drug, tested in China, showed it was more effective than an existing therapy at slowing disease progression in patients with advanced HER2-positive breast cancer.

This is the first positive Phase 3 data readout achieved in BioNTech’s and DualityBio’s strategic collaboration initiated in April 2023, and the collaboration aims to accelerate the development of differentiated ADC therapeutics for solid tumors.

Additional global Phase 3 DYNASTY-Breast02 trial evaluating trastuzumab pamirtecan in patients with metastatic HER2-low breast cancer is ongoing and on track, the companies said.

Link to Seeking Alpha News Article - Sep. 05, 2025

Hyperscaler capex helps AI boom, but some risks remain, Goldman Sach says

AI stocks have risen an additional 17% year-to-date, following their 32% rally in 2024, and a lot of that momentum comes from heavy infrastructure behind AI, especially from companies such as Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOGL)(GOOG), Meta (META), and Oracle (ORCL).

The companies have significantly increased capital expenditure, pushing their combined 2025 spending forecast to $368 billion, up $100 billion since January.

“The earnings and returns of firms involved in the build-out of this infrastructure—i.e., semiconductors, electrical equipment companies, technology hardware firms, and power suppliers—have benefited from these sizable capex investments,” Goldman Sachs said in a note.

However, Goldman Sachs warned that the eventual slowdown in capex growth could pressure valuations.

“Consensus estimates imply that the hyperscalers will maintain their pace of capex growth in 3Q 2025, likely extending the performance of AI Phase 2 stocks. However, analysts currently assume a sharp deceleration in 4Q 2025 and 2026,” analyst Ryan Hammond said.

Goldman Sachs also noted that from a productive perspective, firms still remained in the early days of the AI adoption.

Management commentary showed that many S&P 500 firms were starting to describe specific AI use cases in their businesses, with the largest share of companies discussing customer support/call centers (24%), coding and engineering (24%), and marketing (23%), Goldman Sachs noted.

Link to Seeking Alpha News Article - Sep. 05, 2025

ASML rises as UBS upgrades on belief risks are 'well understood'

Delving a little deeper, the analysts said that litho intensity is likely to start from 2027 on, with the key driver being the production ramp of the A14 node at Taiwan Semiconductor. As such, there could be an uptick in extreme lithography exposure for the A14 node. There's also a relief that the spending uncertainty surrounding Intel and Samsung (OTCPK:SSNLF) appear to be “fading,” either with the two companies coming back or Taiwan Semiconductor taking more share.

Other positives that ASML has going for it include further confidence on High NA, with an adoption of small number of layers going into production into 2028 and 2029.

“Our analysis of Low vs. High NA production ramp timelines and Intel's progress as a first mover suggests meaningful adoption in the next two years is highly likely,” the analysts explained. “We forecast 6/10 High NA shipments in 2027/28, representing [circa] 30% of group revenue growth in 2027-28E or 1-3 percentage points of share potential gain of [wafer fab equipment].”

Other catalysts include upcoming quarterly earnings results; commentary on high NA adoption; the launch of the new higher-priced low NA-EUV-F model in 2026; and new customer announcements from Intel and Samsung through next year.

Link to Seeking Alpha News Article - Sep. 05, 2025

Meta to invest 'at least' $600B on US data centers, infrastructure through 2028: report

Meta Platforms (NASDAQ:META) CEO Mark Zuckerberg told President Donald Trump this week that the tech behemoth plans to spend “something like at least $600B” through 2028 on data centers and other infrastructure in the U.S., The Information reported.

In July, Meta said it would spend between $66B and $72B in capital spending in 2025, up 68% from 2024 levels. The company also said it would spend a “similarly significant” amount in 2026, as it looks to grow its artificial intelligence efforts.

Link to Seeking Alpha News Article - Sep. 05, 2025

YouTube:

Rocket Lab | This is Neutron

Meet Neutron, Rocket Lab's new reusable medium-lift rocket that will deliver a cost-effective, reliable, and responsive launch service for missions to the International Space Station and low Earth orbit, as well as to explore beyond Earth and on to the Moon and Mars.

Link to Full Video (08:46 Mins) - Sep. 04, 2025

Disclosure: We own positions in some/all of the tickers mentioned in this article.