Alpha Coverage #129

Free Weekly Stock Market Newsletter

Munich, Germany!

Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial + $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist or Weekly Compilation.

Editor’s Pick:

NVDA 0.00%↑ #OpenAI

[News] Nvidia plans to invest up to $100B in OpenAI progressively to build AI data centers

The companies entered a strategic partnership to deploy at least 10 gigawatts of Nvidia systems — representing millions of GPUs — for OpenAI’s next-generation AI infrastructure to train and run its next generation of models on the path to deploying superintelligence.

The first phase is targeted to come online in the second half of 2026 using Nvidia’s Vera Rubin platform.

In an interview with CNBC, Huang said Nvidia’s investment is “additive to everything that’s been announced and contracted.”

He indicated to CNBC that it’s in addition to anything the company has told Wall Street about its financial expectations.

OpenAI said it will work with Nvidia as a preferred strategic compute and networking partner for its AI factory growth plans. The companies will work together to co-optimize their roadmaps for OpenAI’s model and infrastructure software and Nvidia’s hardware and software.

The investment does not preclude Nvidia from investing with other generative AI companies, such as Anthropic or xAI, the source added.

Nvidia CEO Jensen Huang stated that the 10-gigawatt infrastructure project for OpenAI will require between 4 and 5 million of its AI chips, that is a doubling of Nvidia’s total shipments from last year, and roughly the same number of GPUs Nvidia plans to ship in all of 2025.

Link to Seeking Alpha News Article - Sep. 22, 2025

Link to CNBC News Article - Sep. 22, 2025

Link to Logistics Viewpoints News Article - Sep. 22, 2025

[News] Oklo extends rally after breaking ground on first Aurora powerhouse

Oklo (NYSE:OKLO) closed +3.7% on Monday, posting yet another all-time intraday high of $142.85, after the nuclear technology company held a groundbreaking event for its first Aurora power plant, the Aurora-INL, at Idaho National Laboratory, one of three projects awarded to the company under the U.S. Department of Energy’s newly established Reactor Pilot Program.

The company was awarded fuel for its first reactor in 2019, but it is awaiting authorization to fabricate its initial core at a facility that will also be constructed at INL.

Link to Seeking Alpha News Article - Sep. 22, 2025

[News] Lithium Americas skyrockets as Trump administration reportedly seeks equity stake

Lithium Americas (NYSE:LAC) +87.9% post-market Tuesday following a Reuters report that the Trump administration is seeking an equity stake of as much as 10% in the company as it renegotiates terms of the company’s $2.3 billion Department of Energy loan for its Thacker Pass lithium project.

The ~$3 billion Thacker Pass project was approved by Trump at the end of his first term, and the loan from the DoE’s Loan Programs Office was closed last year by the Biden administration.

Lithium Americas (NYSE:LAC) was scheduled to make its first draw on the loan earlier this month but Trump officials sought to renegotiate terms following concerns about the company’s ability to repay the loan given low lithium prices, according to the report.

This news comes a day after reporting that the Trump administration is re-evaluating the $2.3B loan awarded to Lithium Americas.

Link to Seeking Alpha News Article - Sep. 23, 2025

[News] Planet Labs to build factory in Berlin, doubling production of Pelican satellites

Planet Labs (NYSE:PL) on Thursday announced plans to establish a new satellite production facility in Berlin to meet rising demand for Earth observation and intelligence solutions in Europe.

The new site will manufacture next-generation Pelican satellites, a high-resolution imaging system designed for persistent monitoring. Planet (NYSE:PL) already produces spacecraft at its San Francisco headquarters, where its Pelican production line is fully operational. The Berlin plant will double the overall production capacity of the fleet, executives said.

“Europe needs its own eyes, and they need it now,” Will Marshall, co-founder and chief executive of Planet Labs (PL), said in the announcement. He cited Europe’s urgent need for autonomous intelligence capabilities, adding that the facility will enable faster deployment of satellites to support security and stability across the region.

The expansion follows strong growth for Planet (PL) in Europe, including a €240 million multi-year agreement with the German government and a separate contract with NATO.

Link to Seeking Alpha News Article - Sep. 25, 2025

[News] Centrus Energy launches multibillion dollar expansion of Ohio uranium plant

Centrus Energy (NYSE:LEU) +9.9% in Thursday’s trading after detailing plans for a multibillion dollar expansion of its uranium enrichment facility in Piketon, Ohio, boosting production of low enriched uranium and high assay low enriched uranium production.

Subject to being selected for funding by the U.S. Department of Energy, Centrus (NYSE:LEU) said its expansion plans call for a multibillion dollar public and private investment to add thousands of additional centrifuges at the American Centrifuge Plant, delivering large-scale production of both LEU and HALEU.

Link to Seeking Alpha News Article - Sep. 25, 2025

News, Facts, Analyst & Market Commentary - Short Reads:

Tesla granted regulatory nod to test autonomous robotaxis in Arizona

Tesla (NASDAQ:TSLA) has received approval from the Arizona Department of Transportation to begin testing its autonomous robotaxi vehicles in the state with a safety monitor, multiple news outlets reported late Friday.

In June, Tesla (NASDAQ:TSLA) launched a test of a limited version of its highly anticipated robotaxi service targeting a small group of company enthusiasts, investors, and social media influencers in Austin, Texas.

Earlier this month, its robotaxi ambitions got a further boost when Nevada’s Department of Motor Vehicles approved Tesla’s (NASDAQ:TSLA) plans to begin testing its autonomous vehicles in the state.

Link to Seeking Alpha News Article - Sep. 20, 2025

Amazon’s Whole Foods Market expands to Asia with store-brand launch in Singapore

Amazon’s (NASDAQ:AMZN) Whole Foods Market is bringing its store-brand products to Asia for the first time, starting with Singapore, as part of a broader plan to grow its global footprint.

Whole Foods Market is bringing several of its exclusive brands to Singapore, including products from 365 by Whole Foods Market, Whole Foods Market’s own label, and Whole Paws.

Sales of Whole Foods private-label products year-to-date have increased more than 50% from 2019, the company said.

Link to Seeking Alpha News Article - Sep. 22, 2025

WeRide, Grab unveil autonomous ride service in Singapore

WeRide (NASDAQ:WRD) said it will deploy its GXRs and Robobus vehicles in Singapore for Ai.R, Grab’s (NASDAQ:GRAB) first autonomous ride service for consumers in Singapore.

Ai.R, which stands for Autonomously Intelligent Ride, will be run by Grab in collaboration with WeRide. Chosen by Singapore’s Land Transport Authority for the city’s first autonomous shuttle service in a residential area, Ai.R will operate along two designated routes in Punggol.

The service will launch with a fleet of 11 vehicles and is the only service approved to run on both routes. Starting this month, Ai.R vehicles will begin an extensive “route familiarization” phase in Punggol with an onboard Safety Operator in the initial phase.

By early 2026, Ai.R is expected to start taking its first batch of passengers. The company noted that the first batch of passengers are by invite-only and include winners of SG60 lucky draw.

Both the five-seater WeRide GXR and eight-seater Robobus have passed Singapore’s stringent Milestone 1 assessment, making them the first autonomous vehicles designated for Punggol to attain this certification.

Link to Seeking Alpha News Article - Sep. 22, 2025

IREN 0.00%↑ NVDA 0.00%↑ AMD 0.00%↑

Nvidia, AMD in focus as IREN buys $670M worth of GPUs to boost AI cloud growth

Data center operator and bitcoin miner IREN Limited (NASDAQ:IREN) said on Monday that it had purchased roughly $670M worth of Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD) GPUs to boost growth in its artificial intelligence cloud unit.

Included in the purchase were 7,100 of Nvidia’s B300 GPUs, 4,200 of Nvidia’s B200 and 1,100 of AMD’s MI350Xs for approximately $674M, IREN said in a statement. That brings its total GPU capacity to approximately 23,000 IREN added.

Deliveries will be staged over the coming months at IREN’s Prince George campus and are expected to support the company’s target of more than $500M in AI cloud annual recurring revenue by the end of the first-quarter of 2026.

Link to Seeking Alpha News Article - Sep. 22, 2025

Teradyne jumps as Susquehanna ups price target, citing growth in 2026

“Recent checks in Taiwan with key players in the AI compute supply chain indicate TER is gaining meaningful traction at TSMC, particularly for GPU wafer sort testing,” analysts led by Mehdi Hosseini wrote in a note to clients. “TSMC is expecting to begin acquiring TER’s [system-on-a-chip] testers for this purpose, with additional units to be purchased and consigned to OSA partners in 2026. While we don’t anticipate a material incremental revenue contribution from this win xuntil 2026, TER’s growing presence across multiple test insertion points — wafer sort and potential adoption at System Level Test (SLT) — is a positive and incremental development that we believe is not entirely reflected in the current share price.”

Susquehanna has a Positive rating on Teradyne and upped its price target to $200 from $133.

Link to Seeking Alpha News Article - Sep. 22, 2025

Firefly Aerospace Inc. GAAP EPS of -$5.78, revenue of $15.54M misses by $1.71M

Firefly Aerospace Inc. press release (NASDAQ:FLY): Q2 GAAP EPS of -$5.78

Revenue of $15.54M misses by $1.71M.

Firefly expects 2025 full-year revenue to be between $133 million and $145 million.

NASA awarded Blue Ghost Mission 4 contract worth $176.7 million for lunar payload delivery on July 29, 2025, increasing Firefly’s total backlog to approximately $1.3 billion.

As of September 22, 2025, reached 95 hot fire tests of the Miranda engine, which will power the debut launch of Eclipse which is expected to take place as early as next year.

FAA issued Return to Flight determination for Alpha on August 26, 2025, with Firefly working to determine the next available launch window for Alpha Flight 7.

NASA awarded $10 million contract addendum on September 22, 2025, for acquisition of additional lunar data collected beyond the initial contractual requirements for Blue Ghost Mission 1.

The deal covers additional science and operational data from Blue Ghost Mission 1.

Firefly collected 120 GB of data during a 45-day lunar transit and over 14 days of surface operations.

The mission provided first HD images of a solar eclipse and sunset from the Moon.

Data includes lunar dust behavior, horizon glow phenomena, and thermal performance insights.

Communications and propulsion data from S-band/X-band antennas and Spectre thrusters are included.

Link to Seeking Alpha News Article - Sep. 22, 2025

Link to Seeking Alpha News Article - Sep. 22, 2025

[Newsletter Exclusive] onsemi acquires Aura Semiconductor’s Vcore Power Technologies

The company stated the deal will accelerate its vision to manage the “complete power tree” in AI data center applications, from the grid all the way to the core.

With this acquisition, the company, which already has decades of experience in silicon and silicon carbide technologies, will now be able to provide comprehensive power solutions for AI data centers.

The company anticipates minimal impact on earnings in the first fiscal year, with future growth expected.

The transaction is expected to close in the fourth quarter of 2025.

Link to Seeking Alpha News Article - Sep. 23, 2025

Rocket Lab preps for missions to Mars

Rocket Lab Corporation (NASDAQ:RKLB) announced that it delivered two Explorer-class spacecraft to Kennedy Space Flight Center for NASA’s Escape and Plasma Acceleration and Dynamics Explorers mission, in partnership with the University of California, Berkeley’s Space Sciences Laboratory. Upon arrival at Kennedy Space Center, Rocket Lab (NASDAQ:RKLB) engineers will conduct post-transport inspections and functional tests in the cleanroom before propellant loading and vehicle integration.

The NASA Escape and Plasma Acceleration and Dynamics Explorers mission is a dual-spacecraft project set to study Mars’ magnetosphere and atmospheric escape by orbiting the planet and collecting real-time plasma and magnetic field data.

Last year, Rocket Lab (RKLB) completed the design, build, integration, and testing of the twin spacecraft, named Blue and Gold, in just three and a half years, an accelerated timeline for a Mars mission.

During a 22-month cruise to Mars, the Blue and Gold spacecraft will travel together before entering complementary elliptical orbits around the planet to conduct their science campaigns. The spacecraft will simultaneously capture data from two regions of Mars’ magnetosphere.

Link to Seeking Alpha News Article - Sep. 23, 2025

IonQ achieves photon conversion breakthrough for long-distance quantum networking

IonQ (NYSE:IONQ) shares popped over 2% premarket on Tuesday after the company announced the successful conversion of visible photons from its trapped-ion systems into telecom wavelengths.

The prototype demonstration, achieved with support from the Air Force Research Lab, paves the way for interconnecting quantum computers over vast distances using the current existing fiber optic infrastructure, bringing IonQ closer to its vision of a secure, distributed Quantum Internet.

Niccolo de Masi, chairman and CEO of IonQ, said “We will soon connect two quantum computers over standard wavelengths, opening the floodgates for broadly networked quantum devices using commercial fiber infrastructure.”

Link to Seeking Alpha News Article - Sep. 23, 2025

SoundHound stock rises on AI partnership with Red Lobster

SoundHound AI (NASDAQ:SOUN) shares rose 3.8% on Tuesday after the company and seafood restaurant chain Red Lobster announced a partnership to roll out an AI-powered phone ordering agent.

The system can handle “multiple calls simultaneously,” allowing for “seamless order placement, and provides instant answers to common guest questions about store hours, locations, menu items, and more,” according to the statement.

Link to Seeking Alpha News Article - Sep. 23, 2025

atai Life Sciences rises after promising data from depression trial

atai Life Sciences (NASDAQ:ATAI) stock rose after positive results from a mid-stage study exploring a two-dose treatment plan using BPL-003, a nasal spray form of mebufotenin benzoate, for patients suffering from depression.

The study tested a two-dose treatment approach with BPL-003, starting with an 8 mg dose followed by a 12 mg dose two weeks later.

The results showed that this treatment led to quick, significant, and lasting improvements in depression symptoms, with effects lasting up to three months.

The second dose of BPL-003 resulted in even greater reductions in depression scores compared to the initial measurements, suggesting that this two-step approach could provide better results than a single dose alone.

The stock is up about 10% so far today.

If the FDA provides positive feedback, the company plans to start a phase 3 clinical trial in the first half of 2026.

Link to Seeking Alpha News Article - Sep. 23, 2025

MS 0.00%↑ #BTC #ETH #SOL

Morgan Stanley teams up with Zerohash to offer crypto to E*Trade users - report

Morgan Stanley (NYSE:MS), which took part in Zerohash’s latest capital raise, is partnering with the stablecoin infrastructure platform to allow E*Trade users to trade in popular crypto tokens starting in H1 2026, according to a media report.

The offering will start with bitcoin (BTC-USD), ether (ETH-USD), and solana (SOL-USD), Bloomberg News reported on Tuesday.

Morgan Stanley (NYSE:MS) plans to introduce an asset-allocation strategy around crypto in coming weeks, Finn told Bloomberg, with allocations from zero to a few percentage points of a client’s portfolio.

Link to Seeking Alpha News Article - Sep. 23, 2025

#BTC #ETH #SOL

The European Central Bank said that it expects to launch a digital euro in 2029

The European Central Bank eyes 2029 as a realistic timeline for launching a digital euro, essentially an online payment wallet backed by the central bank, ECB board member Piero Cipollone said on Tuesday.

Cipollone added that the European Parliament, European Council and executive European Commission are likely to be able to start joint work on legislation for the digital currency in May. After that, the central bank will need between 2 1/2 to 3 years to launch it, according to Reuters.

Link to Seeking Alpha News Article - Sep. 23, 2025

Link to Reuters News Article - Sep. 23, 2025

GLD 0.00%↑ KGC 0.00%↑ AEM 0.00%↑

Gold rises to another record high; Deutsche Bank hikes forecast to $4,000

Gold futures climbed to nearly $3,800/oz and another record high Tuesday, maintaining strong safe-haven flows on expectations that the Federal Reserve will cut interest rates further this year.

In his latest comments, Fed Chair Powell appeared to allow for more rate cuts before the end of the year, saying the central bank faces a “challenging situation” with risks of faster than expected inflation while weak job growth raises concerns about the health of the labor market.

Traders continue to expect the Fed to reduce rates in October and December after cutting by 25 basis points earlier this month.

Deutsche Bank raised its gold price forecast and expects prices to average $4,000/oz in 2026, coming as gold already has reached its 2025 price target of $3,700/oz.

Link to Seeking Alpha News Article - Sep. 23, 2025

NVDA 0.00%↑ ORCL 0.00%↑ $SFTBY #OpenAI

OpenAI, Oracle reveal first Stargate data center in Texas: report

Stargate, a massive $500B joint venture between Microsoft-backed (NASDAQ:MSFT) OpenAI, Oracle (NYSE:ORCL) and SoftBank Group (OTCPK:SFTBY)(OTCPK:SFTBF), revealed the inner workings of its first large-scale data center, located in Abilene, Texas.

The complex features eight buildings that will eventually house hundreds of thousands of Nvidia’s (NVDA) artificial intelligence chips. OpenAI and Oracle invited media and politicians to tour one of the buildings, which is already operational, according to a report by the Associated Press. It was filled with server racks housing Nvidia’s GB200 GPUs. The entire complex will require about 900 megawatts of power when it is complete.

Stargate eventually plans to build two more data centers in Texas, one in New Mexico, one in Ohio and another in a Midwest location.

Link to Seeking Alpha News Article - Sep. 23, 2025

[Newsletter Exclusive] BofA’s Subramanian: ‘The S&P 500 is trading like it’s the new risk-free rate’

The S&P 500 (SP500) is now trading as if it were the new risk-free rate, with valuation metrics reaching unprecedented levels, said Savita Subramanian, head of U.S. Equity Strategy and U.S. Quantitative Strategy at BofA.

The index trades rich on 19 out of 20 metrics, with four key measurements – market cap to GDP, price to book, price to operating cash flow and enterprise value to sales – hitting all-time highs, the senior strategist said, although she suggested also that historical averages may not be comparable to today’s transformed index.

The composition of the S&P 500 (SP500) has undergone significant changes since previous decades, potentially justifying a new valuation paradigm. The index now features companies with “a lower debt to equity ratio than prior decades,” reducing one traditional source of market risk, according to the research.

“Perhaps we should anchor to today’s multiples as the new normal rather than expecting mean reversion to a bygone era,” Subramanian suggested.

Earnings predictability has also improved substantially, she added, highlighting that “outlays are more predictable given an all but eradication of floating rate debt by S&P 500 (SP500) companies.”

Furthermore, the quality profile of the index has improved dramatically, with Subramanian pointing out that “companies with high S&P quality ranks make up more than 60% of the index, up from less than 50% in the 2000s.”

The S&P 500’s evolution toward more asset-light and labor-light business models has contributed to greater stability. “The S&P 500 has grown more asset-light, translating to lower fixed costs/margin stability,” she said, adding that automation has made businesses more predictable and scalable.

The next frontier for efficiency gains could come from “AI and de-regulation,” she suggested.

Future economic conditions might support current valuations through earnings growth rather than multiple expansion, Subramanian concluded.

With “major regions in easy fiscal mode, and with the Fed cutting against a backdrop of broadening and accelerating profits,” her research suggests robust growth may be ahead.

“It’s not hard to argue for a boom in EPS and GDP growth,” she said, providing a potential rationale for today’s seemingly elevated market valuations.

Link to Seeking Alpha News Article - Sep. 24, 2025

IonQ announces record algorithmic qubit score

IonQ (NYSE:IONQ), a quantum computing and networking company, announced on Thursday the achievement of a record algorithmic qubit score of #AQ 64.

The company said the score was achieved on an IonQ Tempo system, three months ahead of schedule. IonQ Tempo is the company’s fifth-generation quantum computer.

#AQ benchmarks measure a quantum system’s ability to run quantum algorithms of increasing complexity and size while maintaining high fidelity, the company said in a September 25 statement.

Link to Seeking Alpha News Article - Sep. 25, 2025

MP 0.00%↑ LAC 0.00%↑ NB 0.00%↑ USAR 0.00%↑ CRML 0.00%↑

Trump administration explores taking stakes in more critical minerals companies - report

The Trump administration is in talks to take equity stakes in multiple critical minerals companies, The Information reported Thursday, the latest in an unprecedented wave of dealmaking that could give the U.S. government stakes in several companies.

The negotiations largely involve Department of Energy grants and loans for companies that mine and process the metals and components used in batteries, according to the report, which cited consultants with clients in the talks.

The talks follow the July deal where the U.S. government received a 15% stake in rare earths producer MP Materials (NYSE:MP) in exchange for $400 million; MP shares +11.6% to as high as $82.23 in Thursday’s trading, near an all-time intraday high.

Among other potentially relevant stocks: Aclara Resources (OTCPK:ARAAF) +18.2%, NioCorp Developments (NB) +11.7%, Ucore Rare Metals (OTCQX:UURAF) +9.7%, USA Rare Earth (USAR) +8.8%, Critical Metals (CRML) +8.3%, TMC the metals company (TMC) +6.5%, Ramaco Resources (METC) +3.1%, Rare Element Resources (OTCQB:REEMF) +1.5%, Lynas Rare Earths (OTCPK:LYSCF) +1.3%.

Lithium Americas shares nearly doubled on Wednesday following reports that the U.S. government may receive up to a 10% stake in the company.

Separately, G7 members and the European Union are considering price floors to promote rare earth production, as well as taxes on some Chinese exports to incentivize investment, Reuters reported.

Link to Seeking Alpha News Article - Sep. 25, 2025

SPY 0.00%↑ TLT 0.00%↑ UUP 0.00%↑ GLD 0.00%↑ SLV 0.00%↑

Fed cut was largely symbolic, Citadel’s Ken Griffin says

Citadel’s Ken Griffin said that the Federal Reserve’s recent rate cut was largely symbolic, to show that they are concerned about the labor market rather than inflation.

“The 25 basis point cut will not have a meaningful impact on capital investment or capital formation, but it is a signal from the Fed that they are now more focused on labor market strength than they are concerned about inflation. So do you see more cuts coming? I think they’re going to cut one time more this year, two on the outside,” Griffin told CNBC.

Griffin also expects that inflation will run in the 2.5%-3% range next year, above the Fed’s 2% goal. He, however, warned that the central bank should not lose their credibility and their ability to manage inflation. “The American voter is exhausted of inflation,” he said.

He also warned that slowing immigration can limit job creation, adding that a tighter labor supply could cap growth. “We do know is that U.S. population growth is much lower without the influx of immigrants, that’s going to bring our ability to create new jobs down,” he said.

Griffin also called tariffs a national sales tax in some sense and added that it is paid disproportionately by those who can least afford to pay it.

However, Griffin also said that corporate America is poised to benefit from a weaker dollar and investments in artificial intelligence capabilities.

U.S. Q2 GDP growth, at an annual rate, was revised up to +3.8% Q/Q in its third estimate from the prior estimate of +3.3%, mainly from an increase in consumer spending.

Link to Seeking Alpha News Article - Sep. 25, 2025

Firefly Aerospace is a catalyst call idea at Deutsche Bank on the expectation for a near-term rally

Yu and his team think a share price bounce would initially be triggered by an announcement of the launch date/window and signal technical readiness, which is seen as likely to boost market confidence.

Firefly Alpha FLAT007 will be the seventh launch of the company’s Alpha rocket. The mission will carry a tactical satellite (TacSat-Demo) for Lockheed Martin (LMT). The payload is a tactical satellite, intended to showcase new technology. The mission is the second under a multi-launch agreement for up to 25 missions between Firefly and Lockheed Martin (LMT).

Deutsche Bank assigned a price target of $45 to Firefly Aerospace (FLY).

Link to Seeking Alpha News Article - Sep. 26, 2025

Meta has discussions with Google about using Gemini to boost ad targeting: The Information

The conversations between the two companies, which compete in digital advertising, has been amongst certain staffers at Meta and employees at Google Cloud, the news outlet added, citing people with knowledge of the conversations. The talks have progressed and are the latest sign that Meta’s own AI models are behind its competitors, which have prompted the Mark Zuckerberg-led company to at least discuss using technology from competitors.

Some of Meta’s employees have posited tweaking Google’s Gemini and Gemma models using Meta’s ad data, a person told the news outlet. Another person told the news outlet that Meta is figuring out whether to use Gemini models to understand the content.

It was reported last month that Meta had signed a major six-year cloud computing deal with Google Cloud, valued at more than $10B.

Meta’s Communication Director, Andy Stone responded to the news and said Meta was doing regular work to evaluate third-party tools for the purpose of benchmarking. “We have always built our own industry-leading, proprietary ad targeting and recommendation systems — that’s a separate thing,” Stone wrote on Threads.

Link to Seeking Alpha News Article - Sep. 26, 2025

Xpeng increases expansion into new European markets

As part of a broader strategy to increase competition with its Chinese rivals and build its overseas markets to contribute 50% to sales within the next 10 years, Xpeng (NYSE:XPEV) will partner with Switzerland’s Hedin Group to launch the 2025 G6 and G9 SUV in the country, expanding into Austria, Hungary, Slovenia, and Croatia. The operations in Hungary, Slovenia, and Croatia will be managed through a joint venture with AutoWallis Group and Salvador Caetano Group.

The move further into Europe intends to mirror Xpeng’s (NYSE:XPEV) successful integration in Germany where the company operates 35 sales outlets across the country.

Link to Seeking Alpha News Article - Sep. 26, 2025

GOOG 0.00%↑ #PerplexityAI

Perplexity unleashes Search API to challenge Google

Perplexity has launched Perplexity Search API, or search application programming interface, that provides developers access to the same global-scale infrastructure that powers Perplexity’s public answer engine.

The index includes hundreds of billions of web pages, updated in real time, which developers need to build new applications, especially in the age of artificial intelligence. It’s the first large-scale, competitive search engine developers could use in place of Google (NASDAQ:GOOG)(NASDAQ:GOOGL) or even Microsoft’s (MSFT) Bing in building applications.

Perplexity also released a new SDK, or software development kit, that shows how the startup designed, optimized, and evaluated its Search API.

Link to Seeking Alpha News Article - Sep. 26, 2025

Apple working on ChatGPT-like app to aid new version of Siri: report

Apple (NASDAQ:AAPL) is working on an internal app, akin to ChatGPT, to help the new version of its voice assistant Siri, set to be released next year, Bloomberg reported.

Known as Veritas, the app will not be released publicly and is only for internal use, the news outlet added, citing people familiar with the matter. The app is being used to test and evaluated features of the new version of Siri, including the ability to search through personal data.

In 2023, Apple also worked on an internal ChatGPT-like app, codenamed AppleGPT, which used the AJax generative AI framework.

The new version of Siri could be unveiled as soon as March 2026, the news outlet added.

Link to Seeking Alpha News Article - Sep. 26, 2025

Charts & Technicals:

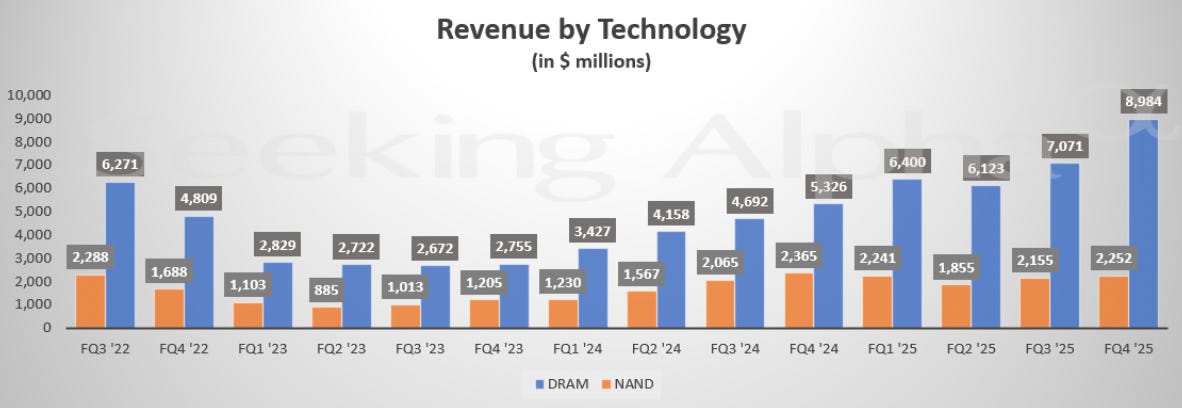

Micron in charts: NAND revenue falls nearly 5% year-on-year

For the quarter ended August 28, the memory and data storage company reported adjusted earnings per share of $3.03 compared to the consensus estimate of $2.86. GAAP EPS was $2.83 versus the consensus of $2.69.

Revenue totaled $11.32B, which was more than the estimate of $11.16B.

Looking ahead, Micron expects first quarter EPS to range from $3.60 to $3.90, which is much more than the $3.10 consensus. It projects revenue ranging from $12.2B to $12.8B, which also eclipses the market estimate of $11.91B.

Link to Seeking Alpha News Article - Sep. 23, 2025

Link to Seeking Alpha News Article - Sep. 23, 2025

Disclosure: We own positions in some/all of the tickers mentioned in this article.

Great curated news! The SoundHound Red Lobster rollout caught my eye. The 3.8% pop makes sense but seems pretty muted concidering this is a systemwide deployment across all Red Lobster locations, not just a pilot. The ability to handle multiple calls simultaneously is probly the killer feature here, especially for chains that get hammered during dinner rush. I've been watching SOUN try to break into the restaurant space for a while, and landing a nationwide chain like Red Lobster could open doors to other casual dining brands. Curious if they'll annouce revenue numbers from this deal in their next earnings.