Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial + $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist or Weekly Compilation.

Editor’s Pick:

AMD 0.00%↑ #OpenAI

[News] AMD surges 25% after AI infrastructure deal with OpenAI

The companies inked an agreement for OpenAI to deploy 6 gigawatts of AMD graphics processing units, or GPUs, over multiple years, and multi-generation agreement.

An initial 1 gigawatt OpenAI deployment of AMD Instinct MI450 Series GPUs is expected to begin in the second half of 2026, according to a statement.

AMD has issued OpenAI a warrant for up to 160 million shares, which will vest upon achievement of milestones.

The targets require AMD’s stock price to continue to increase in value and future exercise points include a tranche tied to a share price of $600, as per Bloomberg News.

Link to Seeking Alpha News Article - Oct. 06, 2025

Link to Seeking Alpha News Article - Oct. 06, 2025

FIG 0.00%↑ COUR 0.00%↑ EXPE 0.00%↑ #OpenAI

[News] OpenAI introduces apps such as Figma, Zillow into ChatGPT; also launches agent builder and Codex update

Microsoft-backed (NASDAQ:MSFT) OpenAI introduced a new way for users to interact with ChatGPT today with the launch of Apps SDK, which provides access to various apps within the ChatGPT dialogue window.

OpenAI CEO Sam Altman revealed Apps SDK during his keynote speech at DevDay 2025 on Monday in San Francisco. One of the first examples used was Figma (NYSE:FIG). Shares of Figma had jumped 10% by the end of the keynote.

Several apps are available today inside ChatGPT, including Figma, Canva, Zillow (NASDAQ:ZG)(NASDAQ:Z) and Coursera (NYSE:COUR). OpenAI plans to release more in the days and weeks ahead, such as Expedia (NASDAQ:EXPE), DoorDash (NASDAQ:DASH) and Booking.com (BKNG).

Any apps that meet the standards of OpenAI’s developer guidelines can be listed.

OpenAI also launched an agent builder and an updated Codex, further expanding ChatGPT’s developer and productivity capabilities.

Link to Seeking Alpha News Article - Oct. 06, 2025

GLD 0.00%↑ KGC 0.00%↑ AEM 0.00%↑

[News] Gold hits $4,000 for first time as economic jitters, shutdown fuel record rally

Bullion rose as much as 0.4% to $4,001.01 an ounce on Wednesday — a remarkable milestone for a metal that traded below $2,000 just two years ago, now delivering returns that have far outpaced equities this century.

Gold has climbed more than 50% this year amid uncertainties over global trade, questions about the Federal Reserve’s independence, and growing fiscal risks in the U.S. Rising geopolitical tensions have further driven demand for safe-haven assets, while central banks have continued to accumulate gold at a strong pace.

The latest surge gained added momentum as investors sought protection from potential market turbulence tied to Washington’s budget deadlock. The Fed’s recent pivot toward monetary easing has also benefited gold, which yields no interest. September saw bullion-backed ETFs post their largest monthly inflows in over three years as investors moved aggressively into the metal.

Bridgewater Associates founder Ray Dalio said investors should be allocating as much as 15% of their portfolios to gold (GLD), (XAUUSD:CUR).

Link to Seeking Alpha News Article - Oct. 08, 2025

Link to Seeking Alpha News Article - Oct. 08, 2025

NVDA 0.00%↑ #xAI

[News] Elon Musk’s xAI upsizes funding round to get $20B, anchored by Nvidia equity investment - report

Elon Musk’s artificial intelligence startup, xAI (X.AI) has been reportedly raising more financing than initially planned, aiming to bring its ongoing funding round to a massive $20 billion, Bloomberg News reported on Tuesday, citing informed sources.

Sources cited by Bloomberg indicate Nvidia (NASDAQ:NVDA) is providing up to $2 billion in the equity component of the deal. The total financing, which includes both equity and debt, is strategically linked to the Nvidia Graphics Processing Units (GPUs) that xAI plans to utilize in its advanced “Colossus 2” data center.

According to the report, the xAI financing could include $12.5 billion in debt and $7.5 billion in equity, calling the arrangement “unique” as the deal would be “backed by the GPUs as opposed to the company.”

This debt component will be arranged via a special purpose vehicle ((SPV)). The SPV is specifically designated to purchase the Nvidia processors required for xAI’s operations. xAI will then rent these processors from the SPV over a period of five years, Bloomberg noted.

Link to Seeking Alpha News Article - Oct. 08, 2025

[News] US approves Nvidia chip exports to UAE in bilateral AI deal: Bloomberg

The United States has approved billions of dollars’ worth of Nvidia (NASDAQ:NVDA) AI chip exports to the United Arab Emirates (UAE), marking a significant step in implementing a high-profile bilateral artificial intelligence agreement, according to a Bloomberg report.

In exchange, the UAE has pledged to match chip imports with an equivalent level of investment in the U.S., part of a broader promise to invest $1.4 trillion over the next decade.

Link to Seeking Alpha News Article - Oct. 09, 2025

[News] Spot silver hits historic $50/oz as investors pile into precious metals

Spot silver (XAGUSD:CUR) prices have surged to historic highs on Thursday, drawing increased investor attention as momentum across the precious metals complex accelerates.

As of Thursday, silver trades at $51.10/oz, topping its highest level since April 2011.

So far in 2025, silver has gained an impressive 73.1%, climbing from $29.27/oz at the start of the year. Market observers attribute the rally to a combination of surging industrial demand, tightening global supply, and heightened economic uncertainty that has pushed investors toward tangible assets.

Link to Seeking Alpha News Article - Oct. 09, 2025

[News] Tech stocks tumble after Trump mulls ‘massive increase’ in tariffs on Chinese imports

Tech stocks tumbled on Friday after U.S. President Donald Trump said he was thinking of a “massive increase” in tariffs on Chinese products after China tightened its rare earth export rules on Thursday.

On Thursday, China tightened its rare earth export rules that could create issues for an array of companies involved in the semiconductor supply chain, as these elements are crucial in the manufacturing of many high-tech products.

Trump and his Chinese counterpart, Xi Jinping are slated to meet in the coming weeks. However, following China’s move, the meeting may not happen, according to Trump. “I was to meet President Xi in two weeks, at APEC, in South Korea, but now there seems to be no reason to do so.”

President Donald Trump said on Friday that the U.S. will impose a tariff of 100% on China. The President would also impose export controls on any and all critical software on November 1.

Rare earth minerals are crucial for electric vehicles because they are essential components in the powerful and efficient magnets used within EV propulsion motors. The magnets, typically composed of neodymium-iron-boron (NdFeB) or samarium-cobalt (SmCo), are the key to maximizing motor performance because they provide high-energy efficiency, compact size, and strong torque, which are all attributes vital for modern EV drivetrains.

To simplify the importance, rare earth magnets allow EVs to be smaller, lighter, and more energy-efficient compared to motors that use less powerful magnets.

Link to Seeking Alpha News Article - Oct. 10, 2025

Link to Seeking Alpha News Article - Oct. 10, 2025

Link to Seeking Alpha News Article - Oct. 10, 2025

News, Facts, Analyst & Market Commentary - Short Reads:

Tesla hints at possible new model ahead of October 7 reveal

Tesla (NASDAQ:TSLA) teased an upcoming event for October 7 on Sunday, fueling speculation about a lower-cost model that could help maintain its sales momentum.

In a ten-second video posted on the social media platform X, the Elon Musk-led automaker showed a vehicle with its headlights illuminated in a dark setting. The company hinted at an event scheduled for Tuesday in a separate video that had “10/7” at the end.

Shares of Archer Aviation (NYSE:ACHR) reached their highest level since July, fueled by speculation that the electric vertical take-off and landing ((eVTOL)) aircraft maker is involved in Tesla’s (TSLA) widely anticipated announcement on Tuesday.

Tesla (NASDAQ:TSLA) is likely set to unveil a lower-cost version of its popular Model Y SUV on Tuesday in a bid to counter loss from EV tax credits, Bloomberg reported, citing people familiar with the matter.

The cheaper variant will lack certain features and use less premium materials to make up for the loss of the $7,500 federal tax credit that the U.S. stopped providing this month, the people said. Tesla likely reduced the Model Y’s cost partly by reengineering its battery pack and motor, the report added.

Link to Seeking Alpha News Article - Oct. 06, 2025

Link to Seeking Alpha News Article - Oct. 06, 2025

Link to Seeking Alpha News Article - Oct. 07, 2025

U.S. hyperscalers’ capex to almost triple to $1.4T by 2027, Goldman Sachs says

U.S. tech giants are expected to significantly increase their infrastructure investments, with total capital expenditure by hyperscalers seen to soar to almost $1.4 trillion between 2025 and 2027, according to Goldman Sachs Global Investment Research.

A chart compiled by Goldman Sachs Global Investment Research and posted by Mike Zaccardi on X showed that hyperscalers have spent a collective ~$485 billion in capex in between 2022 and 2024.

Link to Seeking Alpha News Article - Oct. 06, 2025

Global semiconductor sales surge 21.7% Y/Y in August

The Semiconductor Industry Association said global semiconductor sales surged 21.7% year-over-year in August to $64.9B.

Semiconductor sales climbed 4.4% month-over-month, when it amounted to $62.1B in July 2025.

Regionally, year-to-year in August sales were up in the Asia Pacific/All Other (43.1%), Americas (25.5%), China (12.4%), and Europe (4.4%), but fell in Japan (-6.9%).

Link to Seeking Alpha News Article - Oct. 06, 2025

Electrovaya expects record Q4 revenue

Electrovaya (NASDAQ:ELVA) estimates the revenue for the fiscal fourth quarter exceeded $20 million (consensus: $20.26M), representing a quarterly record for the company with ~72% year-over-year growth.

This revenue was mostly derived from deliveries of battery systems for the material handling sector but also included deliveries of battery modules for a major construction vehicle OEM in Japan and multiple robotic application customers.

For FY2025, the company expects revenue of ~$64 million (consensus: $63.61M), representing an annual record with ~43% Y/Y growth.

Electrovaya expects to release its full audited financial statements for fiscal 2025 in the first half of December 2025.

Link to Seeking Alpha News Article - Oct. 06, 2025

Serve Robotics deploys 1,000th autonomous delivery robot

Serve Robotics (NASDAQ:SERV) announced on Monday the deployment of its 1,000th third generation robot.

Over 380 third generation robots were deployed in September alone, throughout communities across the country.

Serve said it remains on track to hit its goal of deploying 2,000 robots by the end of 2025.

Link to Seeking Alpha News Article - Oct. 06, 2025

BitMine Immersion Technologies’ (NYSE:BMNR) crypto holdings reached $13.4 billion as of October 5.

That’s comprised of 2,830,151 ETH tokens (Bloomberg), 192 Bitcoin, $113 million stake in Eightco Holdings (ORBS), and unencumbered cash of $456 million.

Link to Seeking Alpha News Article - Oct. 06, 2025

TSLA 0.00%↑ #BYDDF

[Newsletter Exclusive] Tesla’s Germany sales slump over 9% in September - report

EV maker Tesla’s (NASDAQ:TSLA) sales reportedly fell by 9.4% in Germany in September, selling 3,404 cars as the company face pressure from growing competition and political backlash against its CEO Elon Musk.

So far this year, Tesla has sold 14,845 units in Germany, implying a year-over-year decline of over 50%, according to a Reuters report.

However, the German Road traffic agency KBA reportedly said on Monday that overall sales of battery electric vehicles rose by 31.9% year-on-year in September.

Chinese electric carmaker BYD’s (OTCPK:BYDDF) (OTCPK:BYDDY) September sales surged over 20-fold year-over-year to 3,255 units in Germany, with 11,810 units sold since the beginning of the year, according to KBA.

Link to Seeking Alpha News Article - Oct. 06, 2025

Paul Tudor Jones: ‘It feels like 1999’ as ingredients are in place for a dot-com bubble environment

During a CNBC interview, Tudor Jones said that while this comparison to the dot-com bubble period wasn’t made lightly, “all the ingredients are in place” for a similar market environment.

Tudor Jones said that investors should position themselves as if it’s October 1999.

“Remember, the Nasdaq (COMP:IND) doubled between October ‘99 and March 2000,” he said. “So, if it looks like a duck and quacks like a duck, it’s probably not a chicken.”

This perspective suggested both opportunity and caution. While acknowledging the potential for significant gains, Tudor Jones noted that participating in such a market requires “really happy feet” because “there will be a really, really bad end to it.”

He added that, unlike 1999, when the Federal Reserve was implementing rate hikes, today’s market is anticipating rate cuts. The contrast extends to fiscal policy as well. While 1999-2000 featured a budget surplus, today’s economy operates with a 6% budget deficit.

Tudor Jones describes this combination of expansionary fiscal and monetary policies as “a brew that we haven’t seen since.”

“We’re in a period that’s conducive for massive price appreciation in a variety of assets,” he said, but cautioned that such appreciation isn’t guaranteed and would require specific conditions to materialize.

Comparing leverage metrics between now and 1999, Jones noted that current levels might actually be higher than those preceding the dot-com bubble when factoring in leveraged ETFs alongside traditional margin debt. For prices to elevate further, Jones believes we would need “a speculative frenzy” driven by increased retail buying and institutional participation.

“It’s not going to go up without flows and without a story. The story’s there.”

His preferred combination includes “gold, crypto, probably the Nasdaq (COMP:IND),” adding that “whatever the fastest horse is at this point in time probably has a good chance of being that on Dec 31.”

Link to Seeking Alpha News Article - Oct. 06, 2025

SPY 0.00%↑ QQQ 0.00%↑ DIA 0.00%↑

[Newsletter Exclusive] Will valuations see a floor? – Morgan Stanley’s Mike Wilson

If nominal GDP and earnings growth accelerate due to higher inflation, stocks’ valuation may see a support ahead, according to Michael J. Wilson, chief U.S. equity strategist and chief investment officer for Morgan Stanley.

The primary risk for stocks (SP500), (COMP:IND), (DJI) in nominal terms may be that inflation decreases significantly, as this would indicate that earnings expectations are too optimistic, potentially making P/Es unsustainable, he said.

When comparing today’s market valuations to those of the late 1990s, the free cash flow yield for the median large cap stock (SP500) is significantly higher than it was in 1999, and the market multiple, when adjusted for profit margins, is trading at almost a 40% discount compared to that period. Today’s market is characterized by stronger free cash flow generation, operational efficiency, and robust profitability – all indicators of a higher quality index than what existed during the dot-com era, Wilson said.

Also, April 2024 appears to have marked the trough for the rolling recession that began in 2022, with a new economic cycle beginning at that time. This transition point typically coincides with significant P/E multiple expansion in anticipation of future earnings growth recovery, Wilson noted. The sharp V-shaped recovery in earnings revisions breadth strongly suggests that earnings expectations for next year will prove conservative, thereby justifying higher multiples.

Despite positive views on earnings and the cyclical impulse into 2026, the Federal Reserve is likely to continue cutting rates, primarily due to lagging labor data, Wilson added. The latest ADP report indicated continued weakness in the jobs market following the tariff-fueled sell-off earlier in the year. Moderately negative payroll data would likely be positive for equities, as it would keep the Fed cutting rates into next year.

Link to Seeking Alpha News Article - Oct. 06, 2025

Trump administration not weighing stake in Critical Metals Corp. - Bloomberg

The Trump administration is not considering a deal at this time in which it would take a stake in Critical Metals (NASDAQ:CRML), Bloomberg reported Monday, citing an unnamed White House official, after a report late Friday that the government was considering a position in the rare earths company sent the stock sharply higher.

The administration is in constant touch with the private sector and has received hundreds of deal proposals involving equity stakes, but it is not actively considering an agreement with Critical Metals (NASDAQ:CRML), the official said, according to the report.

Link to Seeking Alpha News Article - Oct. 06, 2025

AppLovin shares tumble following SEC probe report

AppLovin (NASDAQ:APP) shares tumbled 14% by the end of market trading on Monday following a report that the U.S. Securities and Exchange Commission was potentially probing the digital ad tech company over its data collection processes.

The commission is looking into allegations AppLovin violated service agreements with platform partners to send more targeted advertising to consumers, Bloomberg reported, citing people familiar with the issue.

“We regularly engage with regulators and if we get inquiries we address them in the ordinary course,” an AppLovin spokesperson said to Bloomberg. “Material developments, if any, would be disclosed through the appropriate public channels.”

The SEC has not accused AppLovin of committing any violations, the report said.

Link to Seeking Alpha News Article - Oct. 06, 2025

IEA halves forecast for U.S. renewables growth due to Trump policies

The International Energy Agency has halved its forecast for renewable energy growth in the U.S. by 2030, on account of the Trump administration’s recent policy changes, according to the agency’s “Renewables 2025” report released on Tuesday.

The U.S. is now expected to add almost 250 gigawatts of renewable energy capacity between 2025 and 2030, down from the IEA’s previous forecast of 500 GW.

The revision reflects several policy changes such as the earlier phase-out of federal tax credits, new import restrictions, the suspension of new offshore wind leasing, and restricting the permitting of onshore wind and solar projects on federal land.

To note, tax credits had been the main driver of renewables growth in the U.S. since their introduction in 1992.

Meanwhile, global renewable power capacity is expected to double by 2030, increasing by 4,600 GW. Solar would account for almost 80% of this increase, followed by wind.

The global forecast was revised lower by 5% from the IEA’s previous forecast, mainly due to policy changes in the U.S. and China.

“China’s shift from long-term fixed tariffs to an auction-based contract-for-difference system is a key uncertainty for global renewable capacity growth,” the IEA noted.

Under the previous policy, which ended on May 31, wind and solar projects had access to 15-20 years of stable, guaranteed revenues at coal benchmark prices. The new policy aims to achieve market-driven growth for renewables and facilitate their grid integration.

As a result of the policy shift, the IEA forecasts a more moderate increase in wind and solar installations in China in the second half of 2025, compared to the rapid pace of deployment in the first half.

Still, China continues to account for nearly 60% of global renewable capacity growth and is on track to reach its 2035 wind and solar target five years ahead of schedule, the agency added.

Link to Seeking Alpha News Article - Oct. 07, 2025

GLD 0.00%↑ KGC 0.00%↑ AEM 0.00%↑ SLV 0.00%↑ #BTC

Citadel’s Griffin says U.S. on ‘sugar high’ as investors rush to gold

Citadel’s Ken Griffin warned that investors are starting to consider gold as a safer asset than the dollar, calling the trend “really concerning.”

“We’re seeing substantial asset inflation away from the dollar as people look to de-dollarize or de-risk their portfolios against U.S. sovereign risk,” Griffin said in a Monday interview with Bloomberg.

This year, investors have flocked to gold, silver (XAGUSD:CUR), and Bitcoin (BTC-USD) in what’s been dubbed the “debasement trade.”

“The U.S. is experiencing fiscal and monetary stimulus more typical of a recession, which is stoking markets,” Griffin added. “We’re definitely on a bit of a sugar high in the U.S. economy right now.”

Link to Seeking Alpha News Article - Oct. 07, 2025

#OpenAI

OpenAI’s developer day wows Wall Street with partnerships, more

“We think the new launches raise competitive pressure on Google (GOOG), Meta (META), and Amazon (AMZN) to accelerate their own AI platform strategies,” Bank of America analyst Justin Post wrote in a note to clients.

Post also said the app integration into ChatGPT could be the “app store for the Gen AI era”, as it introduced an Apps software development kit that allows developers to build interactive, conversational apps accessed via ChatGPT.

“The new Apps SDK could turn ChatGPT into an app ecosystem, evolving ChatGPT a central hub for GenAI applications, similar to how Google Play and the Apple (AAPL) App Store defined the mobile era,” Post added.

He was also positive on the AgentKit announcement, which will allow developers to have a “unified suite” to develop and deploy AI agents, and ChatKit, a tool that will allow for customized chat-based agents inside apps or websites.

J.P. Morgan analyst Doug Anmuth also expressed optimism on the event, stating the app integration brings ChatGPT “closer to transactional commerce.” Examples that were mentioned at the event include Figma (FIG), Booking.com (BKNG), DoorDash (DASH), Expedia (EXPE) and more.

“We believe this is critical to long-term monetization—including advertising—as it should increase the percentage of queries on ChatGPT that have commercial intent,” Anmuth wrote.

Link to Seeking Alpha News Article - Oct. 07, 2025

AAPL 0.00%↑ #OpenAI

Ive rebukes smartphones, vows to create ‘happy’ AI devices with OpenAI

Jony Ive offered a rebuke of smartphones and tablets, claiming they have led us to have an “uncomfortable relationship with our technology”.

“When I said we have an uncomfortable relationship with our technology, I mean, that’s the most obscene understatement,” Ive said, according to various reports, as the chat was not livestreamed.

“We have a chance to not just redress that but absolutely change the situation that we find ourselves in,” Ive said, according to Business Insider. “That we don’t accept this has to be the norm.”

In turn, Ive said his team has come up with 15 to 20 AI-powered product ideas for the Microsoft-backed (NASDAQ:MSFT) OpenAI.

He said the new devices should “make us happy and fulfilled, and more peaceful and less disconnected.”

Link to Seeking Alpha News Article - Oct. 07, 2025

HSBC starts bullish coverage on Google parent Alphabet

HSBC said it likes Alphabet’s full-stack AI strategy through Gemini development, Ironwood chips, and gold-standard datasets, which they expect would benefit growth across Search and Cloud, its two most valuable businesses.

The research firm said Google Search’s AI Overviews and AI Mode in the browser powered by Gemini should help the company maintain its ~90% share of the traditional query market.

They, however, acknowledged that the company has lost the in-app frontier model race to ChatGPT, which holds an ~81% market share versus Gemini’s ~2%.

On Cloud, HSBC said the generative AI offering should help the company gain more customers through the lock-in effect of new AI processes with Gemini.

They also expect continued subscriber gains within YouTube Music/Premium and a continuation of a sectoral shift to connected TV away from traditional broadcast/cable, in which YouTube is ~50% larger than its nearest U.S. peer.

Link to Seeking Alpha News Article - Oct. 07, 2025

GLD 0.00%↑ SLV 0.00%↑ KGC 0.00%↑ AEM 0.00%↑ #BTC

Gold glitters, bitcoin booms: Deutsche Bank highlights shift away from dollar dependence

Deutsche Bank’s investment research team highlighted a notable shift in global asset preferences, as both gold (XAUUSD:CUR) and bitcoin (BTC-USD) increasingly attract investor attention amid waning confidence in the U.S. dollar’s (DXY) long-standing safe-haven status.

The bank noted that both assets share key characteristics — limited supply, low correlation with traditional markets, and roles as hedges against inflation and geopolitical uncertainty.

“Assessing volatility, liquidity, strategic value and trust, we find that both assets will likely feature on central bank balance sheets by 2030,” Deutsche Bank said in its latest note.

Gold and bitcoin have both seen record inflows over the course of 2025, reflecting their growing appeal among institutional and retail investors alike.

Moreover, Deutsche Bank pointed out that the dollar’s share of global reserves has declined from 60% in 2000 to 41% in 2025, while gold prices have surged toward $4,000 per ounce on the back of sustained central bank buying.

Meanwhile, bitcoin’s price has surpassed $125,000, bolstered by declining volatility and renewed confidence following the U.S. Executive Order to establish a Strategic Bitcoin Reserve — a move Deutsche Bank says could elevate crypto to a role similar to gold in shaping global financial standards.

Link to Seeking Alpha News Article - Oct. 07, 2025

OXY 0.00%↑ QCLN 0.00%↑ #1PointFive

Trump administration said to mull deeper funding cuts for clean energy projects

The Trump administration is weighing canceling an additional $12B in funding for clean energy projects, Semafor reported, after reviewing a list of potential targets.

These include two major direct air capture hubs approved by the Biden administration, one of which is being developed by Occidental’s (NYSE:OXY) unit 1PointFive.

Other funding on the list includes GM’s (NYSE:GM) $500M grant to prepare its Lansing Grand River plant to produce electric vehicles, as well as two grants awarded to Stellantis’ (NYSE:STLA) Fiat Chrysler - a $335M grant to convert the idled Belvidere plant for EV production and a $250M grant to convert an Indiana transmission plant to produce EV modules.

The list also included Volvo’s (OTCPK:VLVLY) $208M grant aimed at accelerating heavy-duty electric truck production, Harley-Davidson’s (NYSE:HOG) $89M grant to expand its Pennsylvania plant to produce electric motorcycles, and Blue Bird’s (NASDAQ:BLBD) $80M grant to boost electric school bus manufacturing.

Cummins’ (NYSE:CMI) $75M grant to convert existing manufacturing space to build zero-emissions components is also on the list.

Link to Seeking Alpha News Article - Oct. 08, 2025

Rocket Lab rallies to an all-time high after signing a new multi-launch contract

The contract will see Rocket Lab (NASDAQ:RKLB) be the primary launch provider to deploy Q-shu Pioneers of Space’s (iQPS) commercial Earth-imaging constellation.

The multi-launch contract includes three dedicated Electron missions that will launch no earlier than 2026 from Rocket Lab Launch Complex 1 in New Zealand.

Rocket Lab (RKLB) noted that the three additional missions bring the total number of upcoming launches for iQPS to seven.

Rocket Lab (RKLB) highlighted that it has increased its production and launch cadence to meet the demand for more than 20 launches in 2025.

Link to Seeking Alpha News Article - Oct. 08, 2025

FTSE Russell to upgrade Vietnam to emerging market status in 2026

Vietnam will be upgraded to emerging market status by FTSE Russell, a move that could unlock billions of dollars of foreign investment. The news sent its benchmark index to a record high on Wednesday.

The country’s upgrade from “frontier” to “secondary emerging market” status will be effective on September 21, 2026, subject to an interim review in March 2026.

The review “is to determine whether sufficient progress has been made in enabling access to global brokers,” FTSE Russell said. It added that the upgrade could add up to $6B in redirected foreign inflows to Vietnam.

Link to Seeking Alpha News Article - Oct. 08, 2025

QS 0.00%↑ #MRAAY #MRAAF

QuantumScape rises on development pact with Murata

QuantumScape (NYSE:QS) shares rose 6.6% premarket on Wednesday after the maker of lithium-metal batteries entered a joint development agreement with Japanese electronic component maker Murata Manufacturing (OTCPK:MRAAY) (OTCPK:MRAAF).

The agreement is aimed at high-volume production of ceramic separators for QuantumScape’s solid-state batteries.

Link to Seeking Alpha News Article - Oct. 08, 2025

Eaton completes $100 Million expansion at Texas facility to support grid modernization

Eaton Corporation (NYSE:ETN) on Wednesday said that it has completed a $100 million expansion of its manufacturing facility in Nacogdoches, Texas, doubling U.S. production capacity for voltage regulators and three-phase transformers.

It aims to meet rising demand for solutions that accelerate grid modernization.

The facility expansion, which added 200,000 square feet, strengthens Eaton’s position as a leading supplier of grid modernization products and is part of the company’s broader $1 billion investment in North American manufacturing.

Link to Seeking Alpha News Article - Oct. 08, 2025

Critical Metals secures 10-Year offtake agreement with REalloys for 15% of Tanbreez production

Critical Metals (CRML) on Wednesday said that it has signed a 10-year offtake agreement with REalloys, a U.S.-based full-cycle rare earth processor, for 15% of the annual production from its Tanbreez project in Southern Greenland.

This agreement follows a similar arrangement made in August with Ucore Rare Metals, which secured 10% of the project’s production.

Link to Seeking Alpha News Article - Oct. 08, 2025

U.S. soybean farmers struggle without China as top buyer: WSJ

American soybean growers are bracing for financial pain as they bring in a near-record harvest without their biggest customer, China. Farmers say the loss of Chinese demand, once accounting for more than half of the $24.5 billion U.S. soybean export market, has left them with shrinking prices and mounting uncertainty, The Wall Street Journal reported Wednesday.

Illinois farmer Ron Kindred, who is halfway through his harvest, warned that prices will “collapse” without a trade deal. He has contracts for about 40% of his crop, but the rest is at risk as local prices continue to fall.

China has avoided new U.S. soybean purchases for months, turning instead to Brazil and Argentina. From January through August, Chinese imports of U.S. soybeans totaled just over 200 million bushels, down from nearly a billion in the same period last year.

Washington is weighing another farmer bailout, potentially $10 billion to $14 billion, funded partly by tariff revenue.

The financial strain is real. Farmer Robb Ewoldt said his operation requires about $1.3 million each year just to cover debt and expenses. Others are exiting altogether: Illinois farmer Dean Buchholz, facing rising costs and low prices, said 2025 will be his final season.

“I always thought I would farm till they threw dirt on top of me,” Buchholz told the Journal. “I can’t make it work to where it would be practical to keep going without me spending a boatload of money and keep putting myself into more debt.”

Link to Seeking Alpha News Article - Oct. 08, 2025

GOOG 0.00%↑ GOOGL 0.00%↑ #OpenAI

Gemini traffic surges on new Gen-AI image tool as ChatGPT also makes gains: BofA

User traffic for Google’s (NASDAQ:GOOG)(NASDAQ:GOOGL) artificial intelligence assistant Gemini surged in September due in part to its new AI image generation tools, while OpenAI’s (OPENAI) ChatGPT also continues to post significant gains, according to Bank of America.

“In mid-Sep, viral popularity of Google’s Nano Banana image generation model gave Gemini a boost in adoption, with the app briefly reaching the No. 1 spot on major app stores,” said BofA analysts, led by Justin Post, in a Wednesday investor note. “Given investor sentiment around Alphabet has become somewhat linked to Gemini’s perceived competitiveness versus ChatGPT, we think progress on Gemini adoption is constructive for the stock.”

Gemini’s global average daily web traffic, which includes desktop and mobile, increased 54% month over month, according to BofA, citing data from Similarweb. ChatGPT increased 4%, Google search increased 2%, and Microsoft (NASDAQ:MSFT) Bing declined by 4%. In the U.S. alone, Gemini jumped 37%, and ChatGPT climbed 16%. Bing dropped 8%. Year-over-year U.S. data was off the charts for Gemini and ChatGPT, with traffic up 124% and 272%, respectively.

Meanwhile, Sensor Tower data showed AI apps are experiencing dramatic upticks by mobile users. In September, Gemini added 8M global daily average users, ChatGPT added 15M, Perplexity tacked on 1M, and xAI’s (X.AI) Grok increased by 1.8M.

Link to Seeking Alpha News Article - Oct. 08, 2025

ASML 0.00%↑ AMAT 0.00%↑ LRCX 0.00%↑ KLAC 0.00%↑ #TOELY

ASML, KLA fall after US House panel calls out industry for sales to China’s military-linked companies

ASML (NASDAQ:ASML) and KLA (NASDAQ:KLAC) shares fell during Wednesday market action following allegations by the U.S. House of Representatives Select Committee on China that these companies, along with Applied Material (NASDAQ:AMAT), Lam Research (NASDAQ:LRCX) and Tokyo Electron, earned substantial revenue by selling semiconductor manufacturing equipment to Chinese state-owned and military-linked companies.

The committee released figures from 2024 showing that Tokyo Electron received 44% of its revenue from China, Lam Research received 42%, KLA received 41%, and ASML and Applied Materials received 36%.

Link to Seeking Alpha News Article - Oct. 08, 2025

Freeport-McMoRan upgraded at Citi, which sees copper hitting $12,000 by 2026

Freeport-McMoRan (NYSE:FCX) late Tuesday was upgraded to Buy from Neutral by analysts at Citi, who said supply disruptions and macroeconomic tailwinds could send prices of the industrial metal to record highs within 18 months .

The bank now projects copper will reach $12,000 per metric ton in the first half of 2026, citing “unprecedented mine outages, still strong demand and supportive macro trends” such as U.S. rate cuts and a weaker dollar. Citi also highlighted that recent market sell-offs tied to the Grasberg mine accident in Indonesia left Freeport-McMoran (NYSE:FCX) undervalued relative to peers, creating what it called a “rare opportunity” for investors .

Citi acknowledged that rebuilding production at Grasberg may take longer than guidance suggests. The bank’s own modeling assumes a nearly 50% reduction in 2026 output, but emphasized that the ore body is not structurally compromised. Citi said market fears have over-discounted the risks: “Even a two-year shutdown would only cut our NAV by around 15%,” analysts led by Alexander Hacking wrote.

The report also pointed to upside from Freeport’s (FCX) U.S. operations, where efficiency improvements and potential tariffs on refined imports could bolster earnings.

Citi’s base case assumes copper deficits will ease after 2026 as Grasberg, Kamoa-Kakula and other major projects ramp up. Still, it sees Freeport (FCX) outperforming as investors grow more comfortable with the company’s recovery plan and its position as the world’s largest publicly traded copper miner.

Link to Seeking Alpha News Article - Oct. 08, 2025

MP 0.00%↑ USAR 0.00%↑ CRML 0.00%↑

[Newsletter Exclusive] China tightens export rules for crucial rare earths and related technology

The announcement from the Ministry of Commerce clarifies and expands sweeping controls announced in April, which had caused massive shortages around the world before a series of deals with Europe and the U.S. resumed shipments.

The new announcement, however, makes it clear that licenses will likely be denied to arms makers and some semiconductor companies.

Technology used to mine and process the rare earths, or to make magnets from rare earths, can only be exported with permission from the government, the Ministry of Commerce said.

Link to Seeking Alpha News Article - Oct. 08, 2025

NHTSA probes Tesla’s FSD system following traffic law violations, crashes

The U.S. National Highway Traffic Safety Administration (NHTSA) said Thursday it has launched an investigation into 2.88 million Tesla (NASDAQ:TSLA) vehicles equipped with its Full Self-Driving (FSD) system following more than 50 reports of traffic safety violations and multiple crashes.

The agency said it received reports of Tesla vehicles using FSD driving through red lights and traveling in the wrong direction during lane changes.

The preliminary evaluation marks the first step before a potential recall if the agency determines the vehicles pose an unreasonable safety risk. In total, NHTSA said it is examining 58 reports involving FSD-related safety issues, including 14 crashes and 23 injuries.

The agency also said it will assess FSD’s behavior near railroad crossings after lawmakers, including Senators Ed Markey and Richard Blumenthal, cited rising reports of near-collisions.

Tesla (NASDAQ:TSLA) began the rollout of a software update to FSD two days ago.

Link to Seeking Alpha News Article - Oct. 09, 2025

DoorDash partners with Serve Robotics for autonomous robot deliveries on sidewalks in Los Angeles

DoorDash (NASDAQ:DASH) and Serve Robotics Inc. (NASDAQ:SERV) announced a new multi-year strategic partnership to roll out autonomous robot deliveries across the U.S.

The partnership will begin with Los Angeles residents being able to order through the DoorDash (NASDAQ:DASH) app from participating merchants to have their order delivered by a Serve (NASDAQ:SERV) robot.

Link to Seeking Alpha News Article - Oct. 09, 2025

JPMorgan CEO Jamie Dimon says U.S. stock market could be headed for serious correction — report

The U.S. stock market could be at high risk of a serious correction within the next six months to two years, according to JPMorgan (JPM) CEO Jamie Dimon.

Dimon, in an interview with BBC, added that the U.S. has become a “less reliable” partner on the global platform and that he was still a little worried about the inflation in the country.

However, Dimon emphasized that the Federal Reserve should remain independent. This comes amid President Donald Trump’s strong criticism towards Fed Chair Jerome Powell and concerns about the autonomy of the central bank.

The bank’s chief believes that there are a lot of things that are leading to an environment of uncertainty, including geopolitical risks, fiscal spending and the remilitarization of the world.

Link to Seeking Alpha News Article - Oct. 09, 2025

Nvidia receives price target high of $300 due to multi-trillion AI buildout: Cantor

Nvidia (NASDAQ:NVDA) shows no signs of slowing its efforts to dominate the processing power behind the multi-trillion-dollar buildout of artificial intelligence infrastructure, prompting Cantor to reiterate its “Top Pick” Overweight rating and increase its price target to a Wall Street high of $300 from $240.

The next highest target was set by Melius Research, which increased its target to $275 from $240 earlier this week. Goldman Sachs recently increased its price target to $210 from $200. Last month, Bank of America increased its target to $235 from $220, and Barclays boosted its target to $240 from $200. In August, Wells Fargo hiked its target to $220 from $185.

Cantor now sees Nvidia hitting an $8 earnings per share in calendar year 2026 versus the consensus of $6.26 and $11 in 2027 compared to the $7.37 consensus.

The analysts also pointed out that token demand has skyrocketed in the last few months, which is increasing profit per token.

“OpenAI and other platforms are now generating 50-70% gross margins, leading to every stood up GPU now sold out,” Muse said. “Customers are searching desperately for compute wherever they can find it. More specifically, in the last 12-16 weeks we have seen an inflection - likely tied to time-based reasoning explosion coupled with multimodal inputs, led by video where context length is super long.”

Cantor is also convinced the rapid, wide-scale adoption of generative AI proves this is not a bubble.

“In the last 12 months, recommenders have adopted Generative AI,” Muse noted. “Search has moved to Generative AI. Social Media to Generative AI. User-Generated content, Ad recommendation, everything has moved from classical machine learning to Generative AI. NVDA sees $2 Trillion in spending here from traditional compute to Generative AI alone. We are simply not in a bubble, rather the market is beginning to see how ‘quality’ AI can deliver meaningfully positive ROI’s.”

Link to Seeking Alpha News Article - Oct. 09, 2025

TLRY 0.00%↑ MSOS 0.00%↑ HITI 0.00%↑

Cannabis stocks rise on Tilray results, bullish view from Canaccord Genuity

Canaccord Genuity initiated coverage of a range of U.S. MSOs, including Curaleaf Holdings (OTCPK:CURLF), Green Thumb Industries (OTCQX:GTBIF), and TerrAscend (OTCQX:TSNDF), with mostly bullish views, citing a potential rescheduling of cannabis in the U.S.

Its rating initiations came on Thursday, as a proposal to categorize marijuana as a less dangerous drug in Schedule III under the Controlled Substances Act (CSA) is currently undergoing review at the U.S. Drug Enforcement Administration (DEA).

However, analyst Kenric Tyghe pointed to uncertainty over the U.S. Internal Revenue Code 280E, which prohibits cannabis companies from deducting expenses when calculating gross income for tax purposes, as marijuana remains in Schedule I under the CSA.

If cannabis is moved to Schedule III, 280E won’t apply to marijuana firms, the analyst noted, arguing that risks related to Uncertain Tax Positions are exaggerated given “relatively recent precedents and legal opinions.”

“While we are mindful that the chatter and headlines around these UTPs makes for unsettling listening, we believe that stepping back and revisiting this issue is prudent, given the possible near-term rescheduling,” Tyghe wrote.

Link to Seeking Alpha News Article - Oct. 09, 2025

TLRY 0.00%↑ MSOS 0.00%↑ HITI 0.00%↑

Oklo rated Buy in new research coverage by Canaccord Genuity

Technology advantage

Oklo’s (OKLO) small modular reactor (SMR) design, producing up to 75 MW, is factory-built rather than bespoke, reducing costs and construction risks. Its sodium-cooled fast reactor avoids the high-pressure systems of conventional nuclear plants, lowering complexity and enhancing safety. According to management, the design can passively cool itself and shut down without external power, a key differentiator.

Canaccord said Oklo (OKLO) leverages decades of validation from the EBR-II test reactor and has pioneered a “custom combined license application” to streamline U.S. regulatory approvals, potentially enabling repeatable deployments across multiple sites.

Fuel and recycling

A major constraint for advanced reactors is access to HALEU (High-Assay Low-Enriched Uranium), where Russia dominates supply. Oklo (OKLO) has diversified its strategy, securing U.S. Department of Energy downblended fuel, signing an MOU with Centrus Energy, and exploring partnerships with enrichment startups.

Beyond sourcing, Oklo (OKLO) aims to recycle spent nuclear fuel, an approach that could cut fuel costs by up to 80% while reducing waste. The company has announced a $1.68 billion recycling facility in Tennessee, using proven pyroprocessing technology to extract remaining energy from used fuel.

Financial framework

Canaccord’s price target is based on a discounted cash flow model extending to 2050, assuming buildouts are largely debt-financed and supported by U.S. investment tax credits.

The bank assumes a weighted average cost of capital just above 7% and long-term growth of approximately 6%.

Despite optimism, analysts flagged challenges: regulatory hurdles, the still-nascent HALEU supply chain, and the capital intensity of Oklo’s “build-own-operate” model. Public skepticism about nuclear safety and past industry cost overruns also remain obstacles.

Link to Seeking Alpha News Article - Oct. 09, 2025

China said to tighten customs checks on Nvidia AI chips

China is stepping up enforcement of its import controls on semiconductors, including Nvidia’s (NASDAQ:NVDA) AI chips, with customs officers conducting stringent checks at all major ports, three people with knowledge of the matter told the Financial Times.

The inspections initially aimed to ensure that local companies don’t order Nvidia’s (NASDAQ:NVDA) chips tailored for the Chinese market - H20 and RTX Pro 6000D. China’s internet regulator last month directed local firms to stop buying these chips and cancel existing orders.

But customs inspections were recently extended to all advanced semiconductor products, a source told FT, to better target smuggling of high-end U.S. chips.

Some customs officials are looking into whether companies made false declarations about advanced semiconductor imports in the past. At least $1B worth of Nvidia’s (NASDAQ:NVDA) top AI chips were smuggled and sold in China in the three months from May, FT reported in July.

Link to Seeking Alpha News Article - Oct. 10, 2025

BMNR 0.00%↑ #ETH

Tom Lee’s Bitmine Immersion adds $103M more in ethereum

Tom Lee-backed Bitmine Immersion (NYSE:BMNR) purchased over $103 million in ETH, expanding its Ethereum (ETH-USD) treasury holdings to $12.6 billion.

Link to Seeking Alpha News Article - Oct. 10, 2025

Eightco launches new pilot program to advance AI authentication for enterprise, stock jumps

Eightco (NASDAQ:ORBS) announced the launch of a new pilot program focused on advancing AI authentication for the enterprise.

The initiative aims to develop innovative approaches to address emerging identity and verification challenges.

Link to Seeking Alpha News Article - Oct. 10, 2025

Rocket Lab rallies to another record high on contract with Japan Aerospace Exploration Agency

Rocket Lab (NASDAQ:RKLB) has signed a direct contract for two dedicated Electron launches with the Japan Aerospace Exploration Agency (JAXA).

Launching from Rocket Lab Launch Complex 1 in New Zealand, the two Electron missions will deploy satellites for JAXA’s Innovative Satellite Technology Demonstration Program.

The first launch, scheduled from December 2025.

The second launch, scheduled for 2026,

Link to Seeking Alpha News Article - Oct. 10, 2025

Link to Seeking Alpha News Article - Oct. 10, 2025

YouTube:

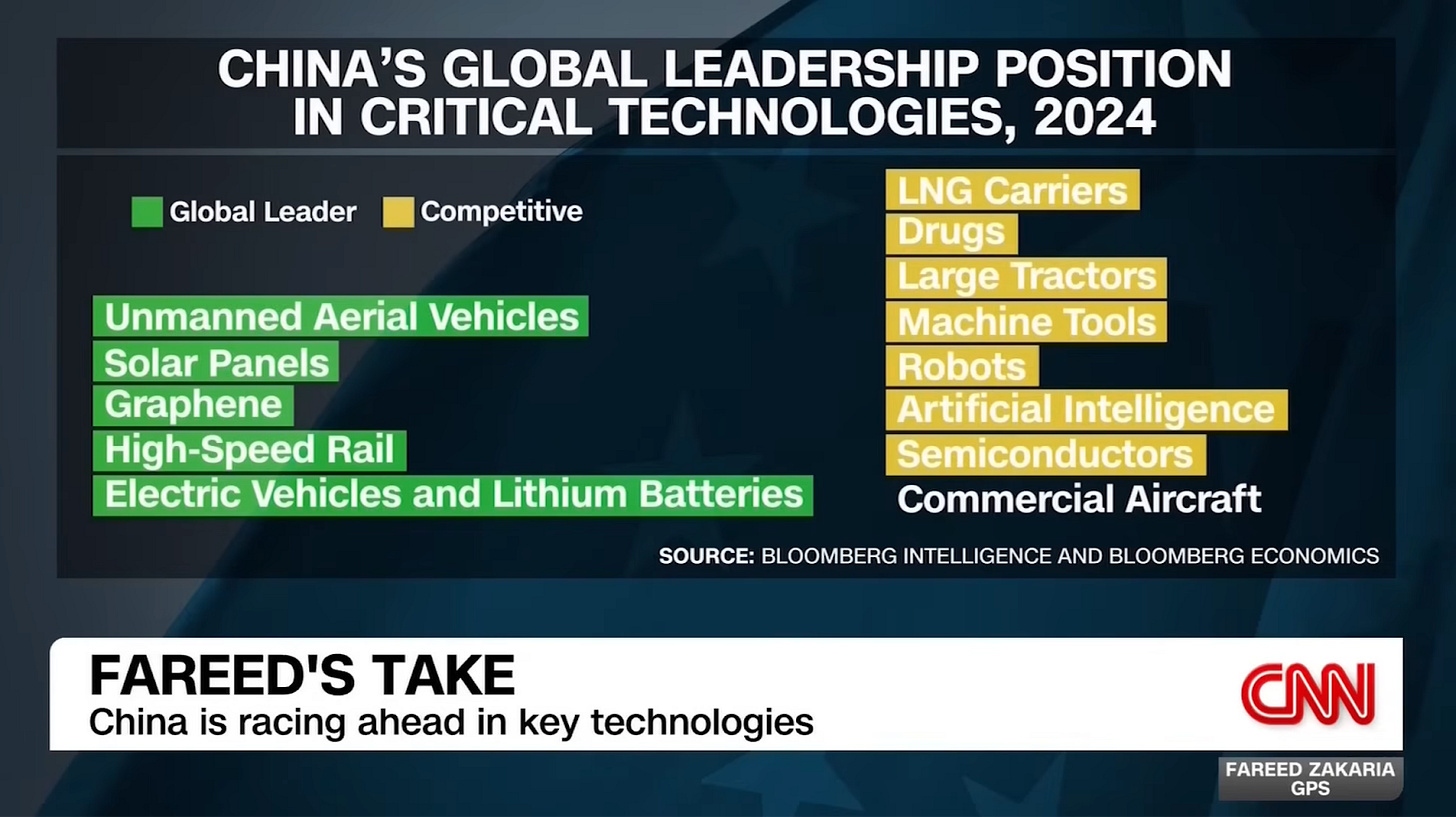

[CNN | Fareed’s Take]: While China races ahead, the US is shut down

Link to YouTube Video (06:21 Mins) - Oct 6, 2025

[The Real Eisman Playbook | Inside the AI Chip War]: From Nvidia’s Dominance to Intel’s Turmoil | Ep 28

While I didn’t learn anything I didn’t already know, this is a great refresher on semiconductors. On this episode of The Real Eisman Playbook, Steve Eisman is joined by Stacy Rasgon. The two of them break down the battle of AI. They discuss Nvidia’s dominance, AMD’s challenge, Intel’s decline, Broadcom’s custom chips, and the impact of China and tariffs.

Link to Full Video (58:29 Mins) - Oct 6, 2025

Disclosure: We own positions in some/all of the tickers mentioned in this article.