Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial + $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist or Weekly Compilation.

Editor’s Pick:

AVGO 0.00%↑ #OpenAI

[News] Broadcom surges after OpenAI deal for 10 gigawatts of custom AI accelerators

OpenAI will design the accelerators and systems, which will be developed and deployed in partnership with Broadcom.

OpenAI said that by designing its own chips and systems, it can embed what it’s learned from developing frontier models and products directly into the hardware, unlocking new levels of capability and intelligence.

The racks, scaled entirely with Ethernet and other connectivity solutions from Broadcom, will meet surging global demand for AI, with deployments across OpenAI’s facilities and partner data centers, according to the companies.

The two companies will co-develop systems that include accelerators and Ethernet solutions from Broadcom for scale-up and scale-out.

Broadcom plans to deploy racks of AI accelerators and network systems targeted to start in the second half of 2026 and to be completed by the end of 2029.

Link to Seeking Alpha News Article - Oct. 13, 2025

GLD 0.00%↑ SLV 0.00%↑ KGC 0.00%↑ AEM 0.00%↑

[News] Gold notches new all-time high above $4,100, silver soars to first record since 1980

Gold and silver futures surged to fresh highs Monday, with gold breaking through the $4,100/oz level for the first time and silver surpassing the previous record set in January 1980, as a flare-up in U.S.-China trade tensions and prospects of further U.S. interest rate cuts drove up demand for precious metals.

Front-month Comex gold (XAUUSD:CUR) for October delivery jumped $132.70/oz, or +3.3%, to $4,108.60/oz, the largest one-day dollar gain on record and biggest percentage gain since April 16, and front-month Comex October silver (XAGUSD:CUR) gained $3.192/oz, or +6.8%, to $50.13/oz, the largest one-day dollar gain since January 23, 1980 and biggest percentage gain since March 13, 2023.

Front-month gold and silver are up 56.3% and 74.2%, respectively, so far this year, and have gained a respective 6.9% and 8.4% in October.

Link to Seeking Alpha News Article - Oct. 13, 2025

[News] Geopolitical Arbitrage: Americans flocking to get second citizenship

U.S. citizens are increasingly hedging against global risk by applying for golden visas — investment migration programs offered by other nations.

Migration consultancy Henley & Partners says a decline in U.S. passport power is fueling an unprecedented surge in demand for alternative residence and citizenship options.

At the end of Q3, “applications from U.S. nationals were already 67% higher than the total for 2024, which itself recorded a 60% year-on-year increase,” Henley said. Among the firm’s clients, Americans now outnumber the next four nationalities — Turkish, Indian, Chinese, and British — combined.

“Faced with unprecedented volatility, investors and wealthy American families are adopting a strategy of geopolitical arbitrage to acquire additional residence and citizenship options,” said Dominic Volek, Henley’s Group Head of Private Clients. “They are hedging against jurisdictional risk and leveraging differences across countries to optimize personal, financial, and lifestyle outcomes.”

For the first time in the 20-year history of the Henley Passport Index, the United States passport is no longer ranked among the Top 10 most powerful. Once holding the top spot in 2014, the American passport has fallen to 12th place, offering visa-free access to 180 out of 227 destinations.

In contrast, China has been one of the biggest climbers on the index over the past decade, moving from 94th place in 2015 to 64th in 2025, increasing its visa-free access by 37 destinations. China has also improved its openness, now granting visa-free entry to 76 nations, which is 30 more than the U.S.

Dr. Tim Klatte of Grant Thornton China noted the geopolitical implications, suggesting that potential U.S. trade conflicts could weaken its mobility while “China’s strategic openness boosts its global influence.”

Link to Seeking Alpha News Article - Oct. 14, 2025

[News] Oracle Cloud to deploy 50,000 AMD AI chips

Beginning in the third quarter of 2026, Oracle will be the first hyperscaler to offer a publicly available AI supercluster powered by 50,000 AMD Instinct MI450 Series GPUs, the company said in a news release.

AMD’s Instinct MI450 chips are AMD’s first AI accelerators designed to scale into rack-sized systems, allowing up to 72 chips to operate as a single unit — a configuration essential for running and deploying advanced AI algorithms.

Link to Seeking Alpha News Article - Oct. 14, 2025

COIN 0.00%↑ CRCL 0.00%↑ #USDC

[News] Coinbase unveils stablecoin payments service for businesses

Coinbase Global (NASDAQ:COIN) on Thursday introduced a set of payment tools allowing businesses to send and receive dollar-pegged USDC (USDC-USD) stablecoin.

The new features, including global payouts and payment links, enable cheaper and instant cross-border payments, as well as eliminate chargebacks and simplify vendor payments, the crypto exchange said in a blog post.

USDC (USDC-USD) balances held in Coinbase Business earn a 4.1% annual percentage yield, and can be cashed out on demand to a linked business bank account via Wire or ACH.

All transactions can be synced with Intuit’s (INTU) QuickBooks or Xero (OTCPK:XROLF) through Coinbase’s (NASDAQ:COIN) accounting integrations with CoinTracker, allowing users to adopt crypto payments while staying compliant, the post said.

Coinbase (COIN) and Circle Internet Group (CRCL), the company behind USDC (USDC-USD), share the yield earned from USDC reserves on a 50-50 basis, making the new stablecoin payments service an ideal move to add more USDC volume.

Link to Seeking Alpha News Article - Oct. 16, 2025

[News] Apple iPhone Air sold out in China ‘within minutes’ of launch: report

Apple’s (NASDAQ:AAPL) iPhone Air sold out in China “within minutes” of the smartphone’s launch in the country, the South China Morning Post reported.

Pre-orders for the device, which was announced last month, started in China earlier this week after the major Chinese telecom operators received regulatory approvals for eSIM services.

Link to Seeking Alpha News Article - Oct. 17, 2025

GLD 0.00%↑ UUP 0.00%↑ KGC 0.00%↑ AEM 0.00%↑

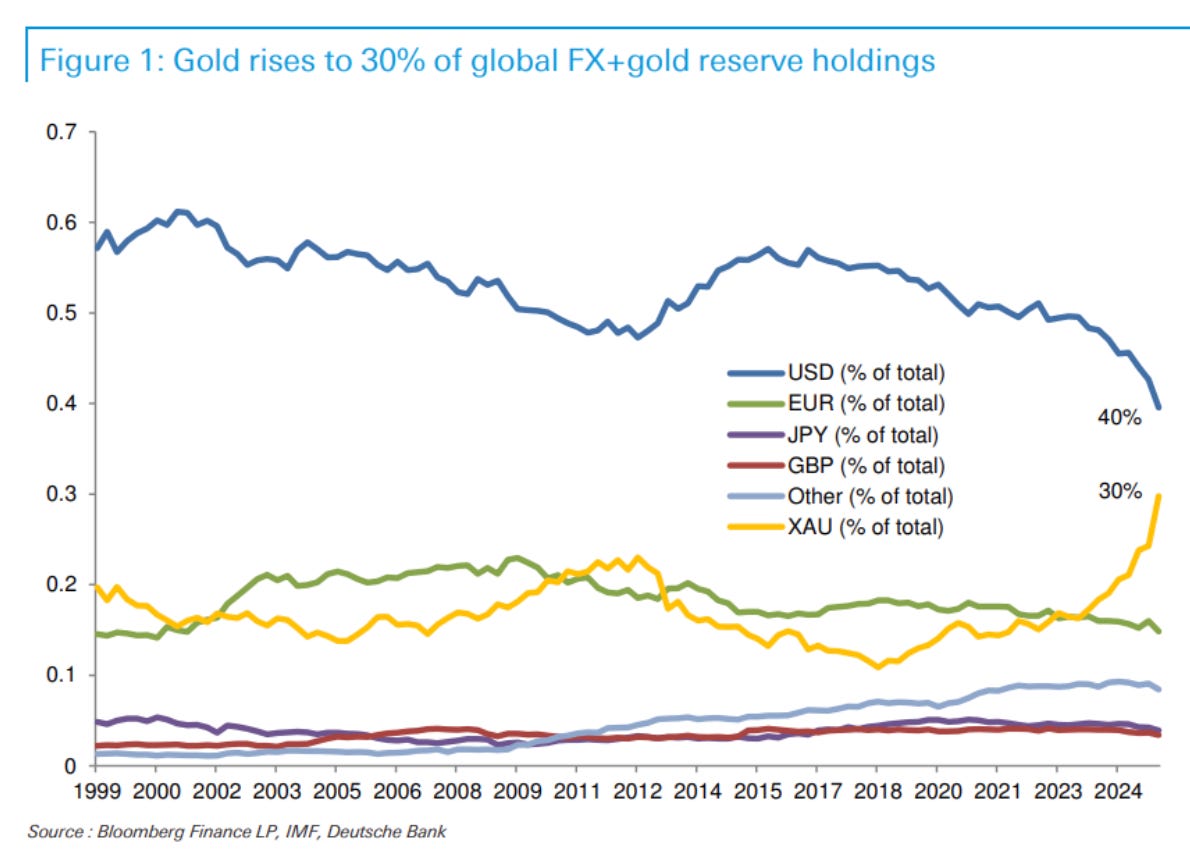

[News/Charts] Gold’s share in global reserves rises to 30%, narrowing gap with USD

Gold (XAUUSD:CUR) has risen to represent 30% of global foreign exchange and gold reserve holdings, up from 24% at the end of June, according to Deutsche Bank Research.

This significant increase occurred as the U.S. dollar’s (DXY) share dropped from 43% to 40% during the same interval, highlighting a notable shift in central bank reserve allocation strategies, said Michael Hsueh, research analyst at Deutsche Bank.

The World Gold Council’s survey found that 43% of central banks are planning to raise their gold holdings, up from 29% the year before, indicating growing confidence in the precious metal.

Also, 95% of reserve managers expect global central bank holdings to rise over the next 12 months, up from 81% the year before, the survey – conducted between February 25 and May 20 of this year – showed.

For gold (XAUUSD:CUR) to equalize its share with the U.S. dollar, the price would need to rise to $5,790 per ounce, assuming no change in the quantity of gold holdings, Hsueh said.

Such a price movement would result in both gold (XAUUSD:CUR) and the U.S. dollar (DXY) each representing 36% of global reserve holdings of foreign exchange and gold, he added.

Link to Seeking Alpha News Article - Oct. 17, 2025

[News] Nvidia and TSMC complete first made-in-the-USA Blackwell chip wafer

Nvidia (NASDAQ:NVDA) and Taiwan Semiconductor Company (NYSE:TSM) have completed their first made-in-the-USA Blackwell wafer, which will be used for the eventual production of Blackwell GPUs.

“This is a historic moment for several reasons,” Huang said. “It’s the very first time in recent American history that the single most important chip is being manufactured here in the United States by the most advanced fab, by TSMC, here in the United States.”

“To go from arriving in Arizona to delivering the first U.S.-made NVIDIA Blackwell chip in just a few short years represents the very best of TSMC,” added Ray Chuang, CEO of TSMC Arizona.

Link to Seeking Alpha News Article - Oct. 17, 2025

GLD 0.00%↑ UUP 0.00%↑ KGC 0.00%↑ AEM 0.00%↑

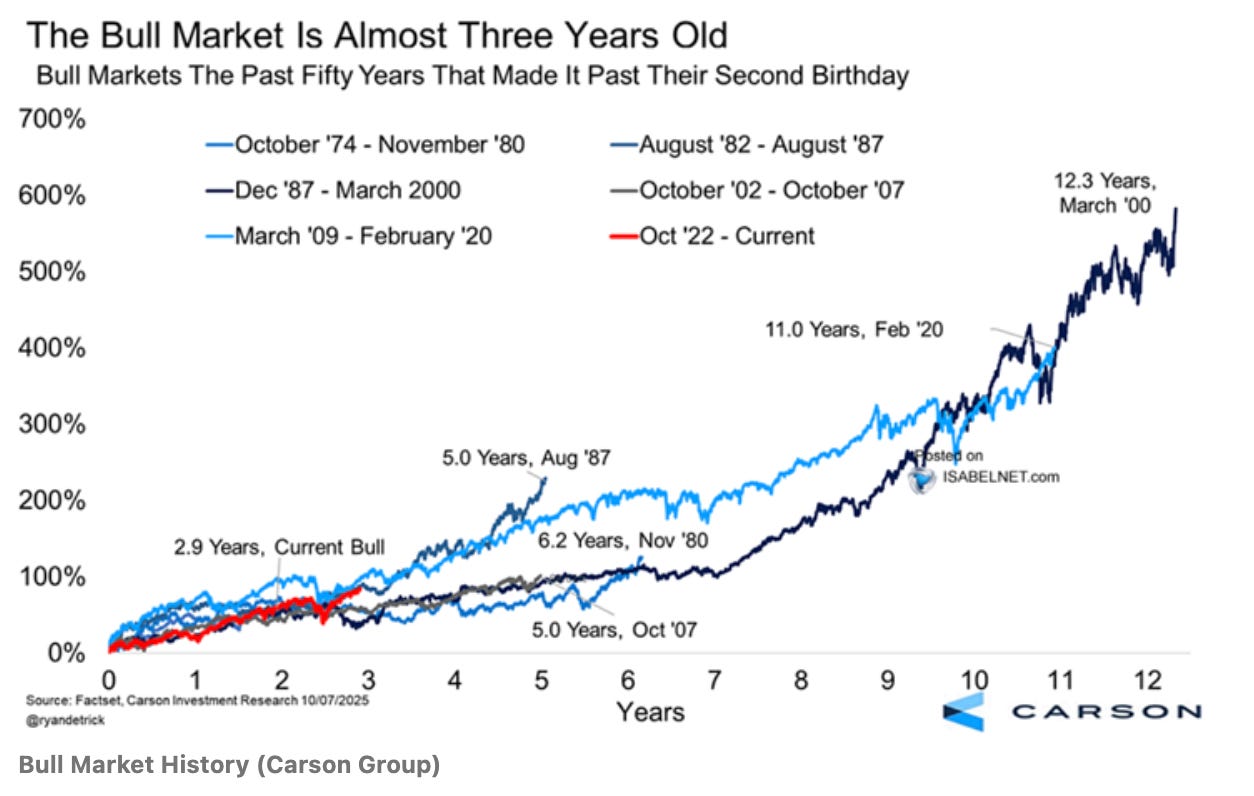

[News/Charts] If history repeats, this bull market’s only in the early innings, Carson Group says

Carson Group remains upbeat, arguing that the current bull market is still in its early stages when viewed through a historical lens.

“Eight years and 288% gains—that’s on average the bull market playbook over the past 50 years. As today’s bull market enters its third year, there’s reason to believe the party is far from over,” the firm noted.

According to Carson’s data, the current rally is 2.9 years old—still young compared to past cycles. For context, the bull run from December 1987 to March 2000 spanned 12.3 years, the October 2002 to October 2007 advance lasted five years, and the post-financial crisis rally from March 2009 to February 2020 extended for 11 years.

See the below chart provided by Carson Group:

Link to Seeking Alpha News Article - Oct. 08, 2025

News, Facts, Analyst & Market Commentary - Short Reads:

Target enters THC beverage market in Minnesota test run

Retail giant Target (NYSE:TGT) is entering the market for hemp-derived THC beverages as part of a test run launched at several Minnesota stores as Congress debates how to regulate the federally legal industry.

The soft launch was initially confirmed by multiple THC beverage producers participating in the rollout, which got underway at 10 stores run by the big box retailer in Minnesota, according to cannabis publication Marijuana Moment.

As part of the rollout, at least a dozen hemp drink brands with a limit of 5 milligrams of THC content will be available for shoppers aged 21 years and above at the stores’ liquor outlets, which have separate entrances.

Link to Seeking Alpha News Article - Oct. 11, 2025

China ‘not afraid’ of trade war with U.S.

China pushed back Sunday against President Donald Trump’s threat to impose 100% tariffs on Chinese goods, warning that it “will not back down” in the face of escalating trade pressure.

The Commerce Ministry urged Washington to resolve disputes through dialogue rather than threats, calling the U.S. approach “not the correct way to get along with China.”

“We do not want a tariff war but we are not afraid of one.”

Link to Seeking Alpha News Article - Oct. 12, 2025

Trump downplays rift with China, says U.S. ‘wants to help’

President Donald Trump sought to dial down tensions with Beijing on Sunday, saying “it will all be fine” with China even as his administration moves toward a possible 100% tariff on Chinese imports.

In a post, Trump described Chinese President Xi Jinping as “highly respected” and suggested that both nations want to avoid economic pain, writing that the U.S. “wants to help China, not hurt it.”

Crypto, already higher on comments from Vice President J.D. Vance that Trump would be reasonable in China negotiations, rallied further.

Link to Seeking Alpha News Article - Oct. 12, 2025

BitMine’s Ethereum holdings top 3 million

BitMine Immersion Technologies’ (NYSE:BMNR) Ethereum holdings has exceeded 3.03 million tokens, bringing its total crypto and cash holdings to $12.9 billion.

As of October 12th, the company’s crypto holdings are comprised of 3,032,188 ETH at $4,154 per ETH (Bloomberg), 192 Bitcoin (BTC), $135 million stake in Eightco Holdings (ORBS) and unencumbered cash of $104 million.

“The crypto liquidation over the past few days created a price decline in ETH, which BitMine took advantage of. We acquired 202,037 ETH tokens over the past few days pushing our ETH holdings to over 3 million, or 2.5% of the supply of ETH,” said Thomas “Tom” Lee of Fundstrat, chairman of BitMine. “We are now more than halfway towards our initial pursuit of the ‘alchemy of 5%’ of ETH.”

Link to Seeking Alpha News Article - Oct. 13, 2025

U.S. pushing back against China export controls, Bessent says

The U.S. has reached out to its allies and will meet with them this week in its efforts to push back against China’s move to impose strict export controls on rare earth materials, U.S. Treasury Scott Bessent said on Monday in a broadcast interview.

“I expect we will get global support” from democracies, including India, Bessent said on Monday. “We will not let these export restrictions and monitoring go on,” he said during an interview on Fox Business.

Still, Bessent is hoping that the dispute with China can be de-escalated. “Everything is on the table... I am optimistic this can be de-escalated,” he said.

Bessent said that there had been “substantial communication” between U.S. and Chinese officials over the weekend, with multiple staff-level meetings scheduled in the coming days.

He also hinted that the U.S. was prepared to “move more aggressively” if China refused to engage in talks on this.

Reports suggested that Trump has threatened to impose export controls on Boeing (NYSE:BA) aircraft parts destined for China in direct response to recently announced restrictions on rare earth mineral exports.

Rare earth stocks have been rallying as tensions between the U.S. and China over exports of critical minerals prompted bets on alternative suppliers.

“Note that the suspension of higher U.S. tariffs on Chinese goods expires on November 10. There’s still plenty of time for negotiations, and I suspect the market will begin to price in a reasonable probability of a deal once the initial shock fades,” Deutsche Bank’s Jim Reid said.

Link to Seeking Alpha News Article - Oct. 13, 2025

Link to Seeking Alpha News Article - Oct. 13, 2025

Link to Seeking Alpha News Article - Oct. 13, 2025

Eightco invests in Mythical Games Series D financing

Eightco (NASDAQ:ORBS) has made a strategic investment into Mythical Games Series D financing, alongside Cathie Wood’s ARK Invest and World Foundation.

The transaction is expected to close the week of October 20.

Led by former Call of Duty studio head John Linden, Mythical Games is a pioneer in Web3 gaming and digital ownership, with a growing portfolio of leading franchises including NFL Rivals, Pudgy Penguins’ Pudgy Party, and FIFA Rivals.

Its Mythical Marketplace hosts over 9.6 million funded wallets and processes more than $400 million in annual NFT sales volume.

Mythical Games plans to expand its marketplace to integrate with Worldchain — an ERC-20-compatible blockchain designed for Proof of Human (PoH) verification and single sign-on — representing a key step toward more secure and verifiable gaming infrastructure.

This investment aligns with Eightco’s current corporate roadmap to allocate up to 1% of its treasury assets toward venture-style investments that advance next-generation authentication technologies.

Link to Seeking Alpha News Article - Oct. 13, 2025

American Battery Tech completes required NEPA baseline studies for Tonopah Flats lithium project

American Battery Technology (NASDAQ:ABAT) +19.5% pre-market Monday after saying it completed all required baseline studies and submitted all subsequent baseline reports to the U.S. Bureau of Land Management for the review process in the development of its Tonopah Flats lithium project in Nevada.

After more than two years of efforts, American Battery Technology (NASDAQ:ABAT) said all 21 studies that would be required for the project to complete the NEPA review process have been completed and reports submitted for review.

In addition to the submitted baseline studies, American Battery Technology (ABAT) said it has submitted a comprehensive mine plan of operations for Tonopha Flats which is now under review by the BLM, and is preparing for the next phases of the development process which include the release of the pre-feasibility study for the project.

Link to Seeking Alpha News Article - Oct. 13, 2025

Rocket Lab could challenge SpaceX sooner than expected - Morgan Stanley

Analyst Kristine Liwag noted that after a strong 2025 rally, investors have been increasingly asking how to contextualize valuation. “Elevated interest in space and a scarcity of high-performing pure plays in public markets have together, in our view, helped support RKLB’s valuation. RKLB today is the market’s clear small-launch leader with a new medium-class launcher nearing entry into service at a time when supply of launch capacity is constrained,” wrote Liwag. She highlighted that the company also has a fast-growing space systems business and is pulling the pieces together for its own constellation.

The Morgan Stanley view is that as Rocket Lab (NASDAQ:RKLB) continues to deliver on its end-to-end space strategy, the stock could be seen as a potential alternative to SpaceX (SPACE) in the making since the company is mirroring SpaceX’s (SPACE) footsteps in a number of respects, including scaling up rocket lift capacity, embracing booster reusability, and ultimately moving out on a constellation of its own (ala Starlink (STRLK)).

“Meanwhile, successive Electron launches and a growing manifest reinforce the company’s already-impressive track record. The market, in our view, is now taking valuation cues for RKLB from SpaceX’s implied valuation, which has grown from a reported ~$100bn at the end of 2021 to ~$400bn today,” added Liwag.

Morgan Stanley assigned a price target of $68 to Rocket Lab (RKLB), which implies the stock will cool off in the near term following its 168% year-to-date rally.

Link to Seeking Alpha News Article - Oct. 13, 2025

#BTC

[Newsletter Exclusive] Elon Musk links bitcoin’s energy base to AI boom

“Bitcoin (BTC-USD) is based on energy,” Elon Musk said on Tuesday, adding that while governments can issue unlimited fiat currency, “it’s impossible to fake energy.”

Musk agreed with financial outlet ZeroHedge that artificial intelligence “is the new global arms race, and capex will eventually be funded by governments (US and China). If you want to know why gold/silver/bitcoin is soaring, it’s the ‘debasement’ to fund the AI arms race,” the ZH post on X said. “But you can’t print energy.”

Musk responded, “true. That is why Bitcoin is based on energy: you can issue fake fiat currency, and every government in history has done so, but it is impossible to fake energy.” Creating new BTC and securing the blockchain network require powerful computers that use a large amount of electricity to solve complex math problems to validate transactions.

Link to Seeking Alpha News Article - Oct. 14, 2025

ARM 0.00%↑ AVGO 0.00%↑ #OpenAI

[Newsletter Exclusive] OpenAI reportedly partners with Arm in Broadcom-led AI chip effort

OpenAI (OPENAI) is reportedly working with Softbank’s (OTCPK:SFTBY) (OTCPK:SFTBF) subsidiary Arm (NASDAQ:ARM) to develop a central processing unit chip, as part of its larger deal with Broadcom (NASDAQ:AVGO).

According to the report, the central processing unit chip is designed to work with OpenAI’s AI server chip, which it is co-designing with Broadcom. Arm also hopes that OpenAI will adopt the CPU chip alongside other AI chips it plans to deploy from Nvidia and AMD.

Link to Seeking Alpha News Article - Oct. 14, 2025

Astera Labs tumbles after AMD’s new partnership with Oracle

Astera Labs (NASDAQ:ALAB) plunged 19% by the time the market closed on Tuesday following news of AMD’s (NASDAQ:AMD) new partnership with Oracle (NYSE:ORCL) to deploy 50,000 GPUs beginning in the second half of 2026.

Astera Labs designs and manufactures semiconductor-based connectivity solutions for cloud and artificial intelligence infrastructure.

In September, Astera Labs tumbled after Morgan Stanley said that Intel’s (INTC) deal with Nvidia (NVDA) to co-develop PC and data center chips could have major implications for Astera.

“There is some concern that this extension of NVLink into the x86 domain could replace the traditional PCIe connection between the x86 CPU and NVIDIA GPU, which would impact ALAB given its meaningful PCIe content,” Morgan Stanley noted at the time.

The new deal between AMD and Oracle has appeared to possibly reignite some of those same concerns.

However, on Monday, Astera Labs revealed its connectivity solutions for AI infrastructure built with PCIe, UALink, Ethernet, CXL, and OpenBMC standards.

Link to Seeking Alpha News Article - Oct. 14, 2025

Chinese solar stocks rise as government cracks down on overcapacity

Chinese solar manufacturers rose Tuesday after state media reported that government authorities are planning stricter controls on the bloated manufacturing capacity that has created price wars and large losses for companies.

At midday, U.S.-traded shares of Canadian Solar (NASDAQ:CSIQ), Daqo New Energy (NYSE:DQ) and JinkoSolar (JKS) were +10%, +4.7% and +1.8%, respectively, while Trina Solar, JA Solar and LONGi Green Energy Technology all rose sharply in Shanghai.

China’s solar industry, the world’s largest, is facing significant losses as production capacity has increased to nearly double global demand, driving down prices to unsustainable levels.

The combined losses of six of China’s biggest solar panel and cell manufacturers doubled in H1 2025 to $2.8 billion (~20.2 billion yuan) from the same period a year ago, the Financial Times reported last month.

Link to Seeking Alpha News Article - Oct. 14, 2025

#BTC #ETH #DOGE #SOL

Crypto whales heavily shorting Bitcoin, major altcoins - report

Crypto whales are ramping up short positions on bitcoins and major altcoins, with the entity known as the “Trump Insider Whale” intensifying its bearish stance on Bitcoin (BTC-USD), according to Arkham Intelligence data, cited by CoinGape.

Arkham’s data shows that the entity recently added $150 million in new short positions, bringing the total to $485 million, with around $22 million in unrealized profit from the ongoing market downturn.

Earlier, CoinGape reported that “Trump Insider Whale” had opened a $340 million short position on Bitcoin (BTC-USD), after previously shorting $700 million in Bitcoin and $350 million in Ethereum (ETH-USD) before the crypto market crash last week, netting $200 million in profits.

Other crypto whales are also opening short positions on major altcoins such as Ripple (XRP-USD), Dogecoin (DOGE-USD), and Pepe Coin (PEPE-USD), anticipating another crypto market downturn today. Wallet 0x9eec9, with $31.8 million in profit, held $98 million in short positions across DOGE, ETH, PEPE, XRP, and Aster (ASTR-USD), according to a CoinGape report. Another whale, 0x9263, with $13.2 million in profit, opened $84 million in shorts on Solana (SOL-USD) and Bitcoin (BTC-USD).

Link to Seeking Alpha News Article - Oct. 14, 2025

BlackRock to play a ‘larger role’ in asset tokenization, CEO Larry Fink says

BlackRock (NYSE:BLK) CEO Larry Fink said Tuesday the world’s largest asset manager plans to play a “larger role” in the tokenization and digitization of assets, envisioning commercial opportunities leveraging this financial innovation to further bridge traditional capital markets with blockchain technology.

“I do believe we have some exciting announcements in the coming years, on how we could play a larger role on this whole idea of the tokenization and digitization of all assets,” Fink said during BlackRock’s (NYSE:BLK) third-quarter earnings call.

Link to Seeking Alpha News Article - Oct. 14, 2025

[Newsletter Exclusive] Astera Labs to work with Arm Total Design on chiplet solutions for AI infrastructure

Astera Labs (NASDAQ:ALAB) has joined Arm Total Design to combine the former’s Intelligent Connectivity Platform ecosystem with the latter’s Arm Neoverse CSS for chiplet solutions for custom AI infrastructure.

The companies explained that chiplet designs are a significant improvement over traditional monolithic chip designs because they “enable AI platform developers to combine diverse processing units—including Arm compute subsystems alongside memory, networking, and acceleration components—into unified systems optimized for different functions.”

Astera Labs will supply chiplet infrastructure though its Intelligent Connectivity Platform that provides comprehensive PCIe, Ethernet, CXL, and UALink connectivity solutions.

Link to Seeking Alpha News Article - Oct. 14, 2025

Morgan Stanley sees $3 trillion in AI investment through 2028

Morgan Stanley’s Mapping AI’s Circularity note highlights the early stages of a massive investment cycle in artificial intelligence (AI), with global spending expected to approach $3 trillion by 2028.

The bank’s global tech team notes that this surge marks just the beginning of what could be a multi-year expansion in AI-related capital expenditures.

The report points out that hyperscale cloud providers are driving a significant portion of this growth. Purchase commitments have climbed to $330 billion, while leasing agreements now total roughly $340 billion, underscoring the scale and intensity of investment in the sector.

Morgan Stanley analysts emphasize that the AI ecosystem is becoming increasingly interconnected. As major players commit more capital, collaboration and integration among hardware providers, software developers, and cloud platforms are intensifying, creating a tightly woven network of dependencies.

Sustainability remains a focal point, with the bank’s strategists noting that the long-term viability of this investment cycle depends on AI delivering consistent cash flows. Their bottom-up analysis projects AI software revenue could reach $1.1 trillion by 2028, supported by standard software margins, indicating strong potential for returns on invested capital.

Link to Seeking Alpha News Article - Oct. 14, 2025

Uber’s AV ambitions, delivery business underestimated by investors -- Guggenheim

Guggenheim initiated coverage of Uber (NYSE:UBER) with a Buy rating, reflecting the rideshare company’s “industry-leading” network, technology, and brand equity.

Uber’s (NYSE:UBER) multi-platform network is more than 3 times larger than that of its nearest competitor with a reach that further positions the company for increased autonomous vehicle adoption.

“We expect AVs to account for 20% of overall U.S. rideshare by 2035 with Uber’s industry-leading demand benefitting from increased AV supply,” said Guggenheim’s Michael Morris.

Additionally, the delivery business is relatively overlooked by investors, currently positioned for double-digit growth with tailwinds across grocery and retail, subscriptions, and advertising.

“We see current valuation as an attractive entry point,” Morris adds, setting his target price at $140, a 48% upside to Tuesday’s closing price.

Link to Seeking Alpha News Article - Oct. 14, 2025

Netflix to carry video podcasts under new tie-up with Spotify

Netflix (NASDAQ:NFLX) has struck a partnership with Spotify (NYSE:SPOT) to bring select video podcasts onto its platform, the companies said on Tuesday.

As part of the pact, shows like The Bill Simmons Podcast, The Zach Lowe Show, The McShay Show, The Rewatchables, and Conspiracy Theories, among many others, will be available to watch on the video streaming giant’s platform.

The video podcasts will be available on Netflix in the U.S. in early 2026, with other markets to follow.

Link to Seeking Alpha News Article - Oct. 14, 2025

AAPL 0.00%↑ TSLA 0.00%↑ #BYDDY

Apple to join hands with China’s BYD for tabletop robot, home hub production in Vietnam - report

Apple (NASDAQ:AAPL) is planning to expand its manufacturing operations in Vietnam to build the next generation of smart home devices, including a tabletop robot and a home hub display, marking a major shift away from reliance on China’s supply chain, Bloomberg reported, citing people familiar with the matter.

The iPhone maker is teaming up with China’s BYD (OTCPK:BYDDF) for the final assembly, testing, and packaging of these new smart home products, including the home hub and robot, in Vietnam.

The company already makes iPads, AirPods, Apple Watches, Macs, and HomePods in the country, and products manufactured in Vietnam will face a 20% tariff in certain markets. It is also planning to expand its manufacturing of iPads with BYD in Vietnam, according to the report.

The company plans to produce several new home devices, including indoor security cameras and a smart display designed to control appliances and act as a central home hub. A more advanced tabletop robot, capable of moving with motors and sensors, is expected to follow in 2027.

Reports indicate the device will feature a 9-inch display mounted on a motorized arm capable of moving and rotating autonomously.

The device is designed to follow users or adjust angles during interaction, with the expectation that it will be ideal for use on a desk or kitchen counter to help with household or work tasks.

Notably, the introduction by the Cupertino-based tech giant of a product that moves physically would be the first of its kind since Apple’s (AAPL) founding in 1976 and could lead to other products that would challenge humanoid robots and other physical AI products for investor attention.

Morgan Stanley highlighted that Apple’s (AAPL) decision marks another ‘moment’ in the journey of AI getting physical.

“In our view, the physical AI addressable market has the potential to exceed the size of global GDP ($115 trillion) by multiples,” he added.

A $3.6 trillion company with Apple’s (AAPL) resources and pedigree is seen as having the potential to have a deterministic impact on the world of robotics, which is an area that Elon Musk has said Tesla (TSLA) would be a clear leader in.

While Elon Musk is credited with being early in identifying the opportunity of physical AI and robotics with robotaxis under development for over a decade and Optimus for the better part of five years, Jonas said the secret is now out.

The home hub display, initially planned for March 2025, has been delayed to spring 2026 due to postponements in AI software development. Indoor security cameras are slated for late 2025 release.

Link to Seeking Alpha News Article - Oct. 15, 2025

Link to Seeking Alpha News Article - Oct. 15, 2025

MSFT 0.00%↑ NVDA 0.00%↑ DELL 0.00%↑ #Nscale

Nscale plans massive Texas AI data center for Microsoft in expanded deal for 200,000 Nvidia chips

Nscale has signed an expanded deal with Microsoft (NASDAQ:MSFT) for approximately 200,000 Nvidia GB300 GPUs of hyperscale Nvidia AI (NASDAQ:NVDA) infrastructure across Europe and the U.S. in one of the largest AI infrastructure contracts ever signed, it said on Wednesday.

Nscale will deliver approximately 104,000 Nvidia GB300 GPUs in a ~240 MW hyperscale AI campus in Texas, supporting the phased delivery of Nvidia (NASDAQ:NVDA) AI infrastructure services to Microsoft (NASDAQ:MSFT) from Q3 2026.

The site is leased from Ionic Digital, and Nscale plans to scale its footprint to 1.2 GW over time, with Microsoft holding an option on a second phase of 700 MW starting in late 2027.

This work is in collaboration with Dell Technologies (DELL).

Link to Seeking Alpha News Article - Oct. 15, 2025

ASML rises as orders beat estimates amid AI rush, China demand to see slowdown in 2026

Shares of ASML (NASDAQ:ASML) rose about 4% premarket on Wednesday after the company’s orders surpassed estimates in the third quarter and it noted that sales next year would not be less than that in 2025.

However, the Dutch chip equipment maker did warn that it expects a decline in demand from China next year.

The company reported bookings of €5.4B in the third quarter, beating an average estimate of €4.9B by analysts, Bloomberg News reported. Net bookings for EUV machines were €3.6B.

China accounted for 42% of the total net system sales of about €5.552B, more than any region with Taiwan being second having 30% share in the third quarter of 2025. In the second quarter of 2025, China had accounted for 27% of the total net system sales of about €5.602B, behind Taiwan with 35% share.

The U.S. had 6% share in the third quarter of 2025, while in the second quarter of 2025. it had 10% share of the total net system sales of about €5.602B.

Link to Seeking Alpha News Article - Oct. 15, 2025

GOOG 0.00%↑ GOOGL 0.00%↑ UBER 0.00%↑

Waymo to launch robotaxis in London next year

Waymo, Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) autonomous driving unit, plans to launch its driverless ride-hailing service in London next year, marking its first European and second international market after Tokyo.

The company will begin testing a small fleet with safety drivers across a 100-square-mile area in the coming months, in partnership with Uber-backed (UBER) Moove for fleet operations, according to a spokesperson.

Commercial service is expected after 2026, when the U.K. permits self-driving pilots. Unlike in U.S. cities, where it partners with Uber (UBER) and Lyft (LYFT), Waymo intends to operate through its own app in London, setting up direct competition with major ride-hailing platforms.

Uber (UBER), alongside its partner Wayve Technologies, is targeting the same 2026 regulatory window to begin autonomous vehicle trials in London.

Link to Seeking Alpha News Article - Oct. 15, 2025

U.S. Army launches Janus Program for nuclear microreactors

The biggest portable generators for the U.S. military these days have an output of about 800 kilowatts. While that might be enough to power major systems, the weapons and radar of the future are changing, and the need for more power is of the essence.

The solution? Going big in the nuclear game by building on Project Pele. The newly announced Janus Program aims to supply microreactors to bases by 2028, which would be small enough to move by truck or aircraft. These tiny reactors will generate anywhere up to 20 megawatts of electricity, but more importantly, they will not need to be refueled constantly, yielding power savings and assisting logistics in hard-to-reach areas. It’s all aimed at helping keep American forces ready on the home front and across remote locations, as well as maintaining critical base operations on a 24/7 basis.

While the U.S. Army and Energy Department will supply uranium fuel for the program, the microreactors will be owned and operated commercially. That’ll open up the industry to BWX Technologies (NYSE:BWXT) and other nuclear players, which have seen major share rallies over the past year. Should all go to plan, small nuclear reactors may eventually be licensed to other sectors, like power-hungry data centers powering the artificial intelligence revolution.

Link to Seeking Alpha News Article - Oct. 15, 2025

GOOG 0.00%↑ GOOGL 0.00%↑ META 0.00%↑ #OpenAI

Consumers using generative AI more frequently, Wedbush survey shows

Google’s Gemini platform continues to gain traction. About 35% of respondents said they had used Gemini in the past three months, up from 30% in the prior survey, ahead of OpenAI’s ChatGPT at 32% and Meta AI at 19%.

As per the survey, Google Gemini, Meta AI, and ChatGPT are significantly more popular among consumers relative to Microsoft Copilot, Snap MyAI, Perplexity AI, and Anthropic Claude.

The survey also pointed out that Google’s (GOOG) (GOOGL) new AI-powered search interface, AI Mode, has been well received by consumers. About 48% said that Google’s AI Mode has improved their searching experience, but 41% believed it has had no impact on their experience so far.

Link to Seeking Alpha News Article - Oct. 15, 2025

[Newsletter Exclusive] Factory boom is set to reshape the U.S. economic landscape, Apollo says

Apollo’s chief economist Torsten Slok said the world is in the midst of an ongoing industrial revival, with the United States emerging as a key driver of this global manufacturing upswing.

According to Slok, America’s manufacturing resurgence is gaining notable momentum, supported by a wave of large-scale factory investments and the rapid expansion of high-value production facilities across the country. Since mid-2023, nearly 200 factories have been completed, underscoring the strength of the sector’s recovery and signaling that industrial growth is poised to remain a lasting economic force.

A robust $590B project pipeline—anchored by multiple megaprojects valued at over $5B each—is helping solidify the U.S. as a hub for advanced manufacturing. These investments, which span industries such as semiconductors, energy, and electric vehicles, are expected to create long-term ripple effects across the broader economy.

Slok noted that this manufacturing momentum is likely to boost demand for industrial real estate, expand opportunities in private credit markets, and fuel employment growth nationwide, reinforcing manufacturing’s role as a central pillar of America’s next phase of economic expansion.

Link to Seeking Alpha News Article - Oct. 15, 2025

Hims & Hers offers menopause, perimenopause treatments

Hims & Hers Health (NYSE:HIMS) said that it has introduced affordable treatment options for those going through perimenopause and menopause.

The menopause care expands on its services into hormone-replacement therapies.

Hims & Hers added that they anticipate this new specialty will help their Hers division exceed $1B in annual revenue next year.

Link to Seeking Alpha News Article - Oct. 15, 2025

[Newsletter Exclusive] Sana Biotech surges as Eric Jackson calls it a 100-bagger

Shares of Sana Biotechnology (NASDAQ:SANA) climbed ~24% in the morning hours on Wednesday, triggering several trading halts after Canadian hedge fund manager Eric Jackson said that he is long the stock and the cell therapy developer could be a potential “100-bagger.”

Jackson, whose social media posts led to a trading explosion of online real estate service Opendoor (OPEN) in July, argued that Sana (NASDAQ:SANA), currently with a valuation of about $1B, is on track to $100B in market capitalization.

The EMJ Capital president and founder wrote on X that “the science is working, the market is turning, and the upside math checks out,” and added, “this is what it looks like when a platform transitions from promise to proof.”

Jackson, who is also known for causing a rally in shares of mortgage lender Better Home & Finance in September (BETR), reasoned that Sana (NASDAQ:SANA), with a potential $10B–12B in sales and at 30% of margins, could reach $90B–$100B in enterprise value assuming a 30× multiple. “That’s the math of a 100-bagger,” he added.

Link to Seeking Alpha News Article - Oct. 15, 2025

American Battery Tech tumbles after DoE nixes grant for lithium hydroxide project

American Battery Technology (NASDAQ:ABAT) -24.6% post-market Wednesday after disclosing the U.S. Department of Energy terminated its grant for the construction of a commercial scale facility for the manufacturing of battery cathode grade lithium hydroxide.

Under the grant, the DoE would have contributed $57.7 million towards the facility, while the company would have put in an equal amount; the company said ~$52 million of reimbursable DoE funds remained as of October 9.

American Battery (NASDAQ:ABAT) said it has appealed the termination, but also said it has raised more than $52 million from public markets this year and intends to continue the project without changes to its timeline or scope.

In April, American Battery (ABAT) received a letter of interest from U.S. Export-Import bank for $900 million in financing to support construction of its Nevada-based lithium mine and refinery.

Link to Seeking Alpha News Article - Oct. 15, 2025

Nvidia joins $2.9 billion data center initiative in Australia

Nvidia (NASDAQ:NVDA) is teaming up with Australian startup Firmus Technologies to build a massive fleet of renewable energy-powered artificial intelligence data centers across the country.

Construction is already underway on two data centers in Melbourne and Tasmania for Project Southgate, an A$4.5 billion ($2.9 billion) undertaking that will utilize 150 megawatts of power, Firmus said in a statement.

Facilities will use Nvidia’s GB300 chips and are expected to come online by April.

The alliance’s $4.5 billion first-stage investment is to be delivered at Southgate Melbourne.

Link to Seeking Alpha News Article - Oct. 16, 2025

Wedbush’s Asia checks show bullish sentiment for “AI Revolution,” accelerating chip demand for Nvidia

“In a nutshell, we are seeing clearly accelerating chip demand in the field for Nvidia as we estimate the demand to supply ratio from enterprises for Nvidia’s next generation GPUs are approaching 10:1 which is a staggering number which speaks to how early this AI Revolution is in its life cycle,” said analysts led by Daniel Ives.

The analysts added that supply chain checks are seeing no signs of cracks and to some extent it’s the opposite as the demand trajectory is way quicker than many across Taiwan and the broader region expected at this point.

Link to Seeking Alpha News Article - Oct. 16, 2025

Snowflake, Palantir tie up to boost AI data cloud endeavor

Snowflake (NYSE:SNOW) and Palantir (NASDAQ:PLTR) announced a partnership on Thursday to integrate Snowflake’s AI data cloud with Palantir’s artificial intelligence platform.

As part of the deal, customers in both the commercial and public sectors will have more efficient and trusted data pipelines, as well as faster access to data analytics and AI applications.

Link to Seeking Alpha News Article - Oct. 16, 2025

COIN 0.00%↑ #BTC

Coinbase launches US bitcoin yield fund for accredited investors

Coinbase (NASDAQ:COIN) Asset Management is introducing a US Bitcoin Yield strategy, designed to seek excess returns over bitcoin (BTC-USD), to U.S. accredited investors, following its launch of a similar offshore fund in May, the company said on Thursday.

The creation of the two funds is in response to growing demand for bitcoin yield-generating products, as many investors increasingly see bitcoin (BTC-USD) as a store of value and reserve asset.

The Coinbase US Bitcoin Yield Fund’s (USCBYF) yield is generated from a combination of BTC private credit lending and basis trading, the company said.

The US Bitcoin Yield Fund will be available to U.S. accredited investors in coming weeks and will be available in certain retirement accounts in 2026.

Link to Seeking Alpha News Article - Oct. 16, 2025

atai Life Sciences, Beckley Psytech get FDA breakthrough therapy status for BPL-003

atai Life Sciences (NASDAQ:ATAI) and Beckley Psytech have received Breakthrough Therapy designation from the FDA for their nasal spray BPL-003 (mebufotenin benzoate) aimed at adults suffering from treatment-resistant depression.

The breakthrough therapy status is intended to speed up the development of medications that address serious or life-threatening conditions.

This designation comes after promising results from a phase 2b study conducted by Beckley Psytech.

Link to Seeking Alpha News Article - Oct. 16, 2025

GLD 0.00%↑ KGC 0.00%↑ AEM 0.00%↑

Gold hits another record with bank worries in focus alongside trade, rate cuts

Gold and silver soared again to new all-time highs Thursday, sparked by concerns about credit quality in the economy, in addition to U.S.-China trade frictions and growing expectations for further interest rate cuts by the Federal Reserve.

Broader markets were hit as two major regional banks disclosed problems with loans involving allegations of fraud, adding to concerns about wider credit-related losses in the system, following the bankruptcies of two auto industry-related companies, which have helped boost demand for safe-havens such as gold and silver.

“When you see one cockroach, there are probably more,” JPMorgan Chase CEO Jamie Dimon said on the bank’s earnings conference call earlier this week, referring to the collapse of First Brands and Tricolor Holdings.

Fed Chair Powell signaled this week that the Fed is on track to deliver another 25 basis point rate cut this month, and traders are betting on another reduction in December; non-yielding gold typically performs well in a low-rate environment.

Gold also has been supported by concerns over a resurgence in trade tensions, particularly between the U.S. and China.

The dollar continues to face headwinds of a stretched valuation and unsustainable U.S. fiscal policies, and investors seeking alternatives to the dollar are preferring gold over other developed market currencies, Insight Investment’s Francesca Fornasari said in a note.

Link to Seeking Alpha News Article - Oct. 16, 2025

[Newsletter Exclusive] Micron stock dips after report of China server chip business exit

Micron Technology (NASDAQ:MU) plans to stop supplying server chips to data centers in China after the business failed to recover from a 2023 government ban on its products in critical Chinese infrastructure, Reuters reported.

Micron was the first U.S. chipmaker to be targeted by Beijing - a move that was seen as retaliatory for a series of curbs by Washington aimed at impeding tech progress by China’s semiconductor industry.

Micron will, however, continue to sell to two Chinese customers who have significant data center operations outside China, one of which is laptop maker Lenovo (OTCPK:LNVGY), the report said.

The U.S. company, which made $3.4 billion, or 12% of its total revenue, from mainland China in its last business year, will also continue to sell chips to auto and mobile phone sector customers in the world’s second-largest economy, one person said.

Link to Seeking Alpha News Article - Oct. 17, 2025

XLK 0.00%↑ QQQ 0.00%↑ IGV 0.00%↑

U.S. Chamber of Commerce sues Trump admin over $100,000 H-1B visa fees

The U.S. Chamber of Commerce—the nation’s largest business lobby, representing companies like Amazon (AMZN), Meta (META), and Alphabet (GOOG)—filed the lawsuit in federal court in Washington, arguing that the fee is unlawful and “overrides provisions of the Immigration and Nationality Act that govern the H-1B program, including the requirement that fees be based on the costs incurred by the government in processing visas.”

“The new $100,000 visa fee will make it cost-prohibitive for U.S. employers, especially start-ups and small and midsize businesses, to utilize the H-1B program, which was created by Congress expressly to ensure that American businesses of all sizes can access the global talent they need to grow their operations here in the U.S.” said Neil Bradley, Executive Vice President and Chief Policy Officer at the U.S. Chamber, in a statement.

Trump introduced the six-figure H-1B visa fee last month through an executive order, drastically raising the cost from the previous range of $2,000–$5,000 to $100,000 per application.

H-1B visas normally have a three-year validity period, with the possibility of a six-year extension and the annual ceiling for the program is 65,000 visas, with an extra 20,000 reserved for those with advanced degrees.

Link to Seeking Alpha News Article - Oct. 17, 2025

Stellantis and Pony.ai partner to advance robotaxi development in Europe

The U.S. Chamber of Commerce—the nation’s largest business lobby, representing companies like Amazon (AMZN), Meta (META), and Alphabet (GOOG)—filed the lawsuit in federal court in Washington, arguing that the fee is unlawful and “overrides provisions of the Immigration and Nationality Act that govern the H-1B program, including the requirement that fees be based on the costs incurred by the government in processing visas.”

“The new $100,000 visa fee will make it cost-prohibitive for U.S. employers, especially start-ups and small and midsize businesses, to utilize the H-1B program, which was created by Congress expressly to ensure that American businesses of all sizes can access the global talent they need to grow their operations here in the U.S.” said Neil Bradley, Executive Vice President and Chief Policy Officer at the U.S. Chamber, in a statement.

Trump introduced the six-figure H-1B visa fee last month through an executive order, drastically raising the cost from the previous range of $2,000–$5,000 to $100,000 per application.

H-1B visas normally have a three-year validity period, with the possibility of a six-year extension and the annual ceiling for the program is 65,000 visas, with an extra 20,000 reserved for those with advanced degrees.

Link to Seeking Alpha News Article - Oct. 17, 2025

Newcleo to spend up to $2B to advance U.S. nuclear fuel ecosystem, form partnership with Oklo

Oklo (NYSE:OKLO) +1.8% pre-market Friday after announcing a joint agreement with newcleo, with the European advanced nuclear reactor developer planning to invest as much as $2 billion to develop advanced fuel fabrication and manufacturing infrastructure in the U.S.

Sweden’s advanced nuclear technology developer Blykalla also is considering co-investing in the same projects and procuring fuel-related services from them, Oklo (NYSE:OKLO) said.

Link to Seeking Alpha News Article - Oct. 17, 2025

AAPL 0.00%↑ DIS 0.00%↑ #FWONA

Apple gets streaming rights to Formula 1 races in multi-million dollar deal

Apple (NASDAQ:AAPL) and Formula 1 entered a five-year partnership to bring all F1 races exclusively to Apple TV in the U.S. from next year.

The financial terms of the deal were not disclosed, but Variety reported that the streaming deal is worth about $750M.

The U.S. tech giant noted that Apple TV will deliver coverage of Formula 1, with all practice, qualifying, Sprint sessions, and Grands Prix available to Apple TV subscribers. Select races and all practice sessions will also be available for free in the Apple TV app throughout the season.

In addition to broadcasting Formula 1 on Apple TV, Apple will amplify the sport across Apple News, Apple Maps, Apple Music, and Apple Fitness+.

Apple Sports, the free app for iPhone, will feature live updates for every qualifying, Sprint, and race for each Grand Prix in the season, with real-time leaderboards, season driver and constructor standings, Live Activities to follow on the Lock Screen, and a designated widget for the iPhone Home Screen, according to the company.

F1’s own premier content offering, F1 TV Premium, will continue to be available in the U.S. via an Apple TV subscription only and will be free for those who subscribe.

Walt Disney-owned (NYSE:DIS) ESPN currently has rights to broadcast F1 races for this year.

Link to Seeking Alpha News Article - Oct. 17, 2025

GOOG 0.00%↑ GOOGL 0.00%↑ #OpenAI

OpenAI’s ChatGPT mobile app seeing slowing download growth, daily use: report

OpenAI’s (OPENAI) ChatGPT mobile app growth may have hit its peak, TechCrunch reported, citing a new analysis of download trends and daily active users provided by Apptopia.

Its estimates suggest that new user growth, measured by percentage changes in new global downloads, slowed after April. Global daily active user growth also stopped and plateaued in more recent weeks, the report added.

The firm analyzed global daily active user, or DAU, growth and found that the numbers have started to even out over the past month or so, according to the report.

October is only half over, but the firm noted that it is on track to decline 8.1% in terms of a month-over-month percentage change in global downloads, the report added.

The report noted that the analysis was about download growth not total downloads. In terms of number of new installs, ChatGPT’s mobile app is still doing well, with millions of downloads per day, the report added.

Other metrics suggest that average time spent per DAU in the U.S., has declined 22.5% since July, and average sessions per DAU in the U.S. have also fallen by 20.7%.

This suggests that U.S. users are spending less time in ChatGPT’s app and are opening it fewer times per day. User churn in the U.S. has also declined and stabilized during this time, suggesting that the app is now retaining its core users and seeing fewer who just drop in briefly to experiment, then leave the app, the report noted.

Besides simply reaching its peak, there could be other factors that may have caused this. This includes competition from Alphabet (GOOG) (GOOGL) unit Google’s Gemini, and user engagement changes following an April update that was aimed at making the chatbot’s AI model less sycophantic. This continued with the August release of GPT-5, which was said to be less personable, the report added.

Apptopia noted that ChatGPT’s average time spent per DAU and average sessions per DAU metrics were trending lower before the sharp rise of its rival Gemini, which raced to the top of the charts in September thanks to the release of Google’s new AI image model, Nano Banana, the report noted.

Gemini’s growth could have influenced some of the more recent decline in ChatGPT’s core metrics, but it does not explain the overall trend, according to the report.

In addition, Apptopia noted that if only average time spent per DAU was declining, but not average sessions per DAU, it could have suggested that people were getting more efficient with their ChatGPT queries. But since both are on the decline, that is not the case.

Apptopia said that it is possible that the experimentation phase with the ChatGPT app is over, and now it is becoming a part of users’ daily routines. People are likely using the app when they need it or remember to use it, versus the increased use it saw when it was still new, the report added.

Link to Seeking Alpha News Article - Oct. 17, 2025

[Newsletter Exclusive] Google likely to release Gemini 3 model in December: report

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is likely to release the next version of its artificial intelligence large language model, known as Gemini 3, in December, technology journalist Alex Heath reported.

The search giant has historically released new base versions of its Gemini models in December, the most recent being Gemini 2.0.

Link to Seeking Alpha News Article - Oct. 17, 2025

GLD 0.00%↑ SLV 0.00%↑ AEM 0.00%↑ KGC 0.00%↑

Gold, silver slide on heavy profit-taking after Trump reassures on China

Trump confirmed he would meet with President Xi in two weeks in South Korea, and said his proposed 100% tariff on goods from China was “not sustainable,” while still blaming China for the latest trade dispute that began when Chinese authorities tightened control over rare earth exports.

Later, ahead of a lunch at the White House with Ukraine’s President Zelenskiy to discuss efforts to end its war with Russia, Trump said, “China wants to talk, and we like talking to China.”

The softer tone helped turn around Wall Street’s early losses Friday, which in turn sent gold and silver lower, after the metals surged in recent sessions from Trump’s abrupt reimposition of steep levies on Chinese imports and concern over the state of the U.S. credit market as two regional banks disclosed loan issues tied to alleged fraud.

Link to Seeking Alpha News Article - Oct. 17, 2025

YouTube:

[The Real Eisman Playbook | The Weekly Wrap] The Bank Stock Rout: Facts vs Fiction

Worried about the private credit blow ups on Wall Street? Hear from the Mr. Big Short himself.

On this episode of The Weekly Wrap, Steve Eisman breaks down the bank stock rout and explores whether it signals deeper issues in the financial sector. He also discusses Trump’s tariffs battle with China and provides an update on last week’s mailbag question regarding AI in the workforce.

Link to Full Video (19:51 Mins) - Oct 17, 2025

Charts & Technicals:

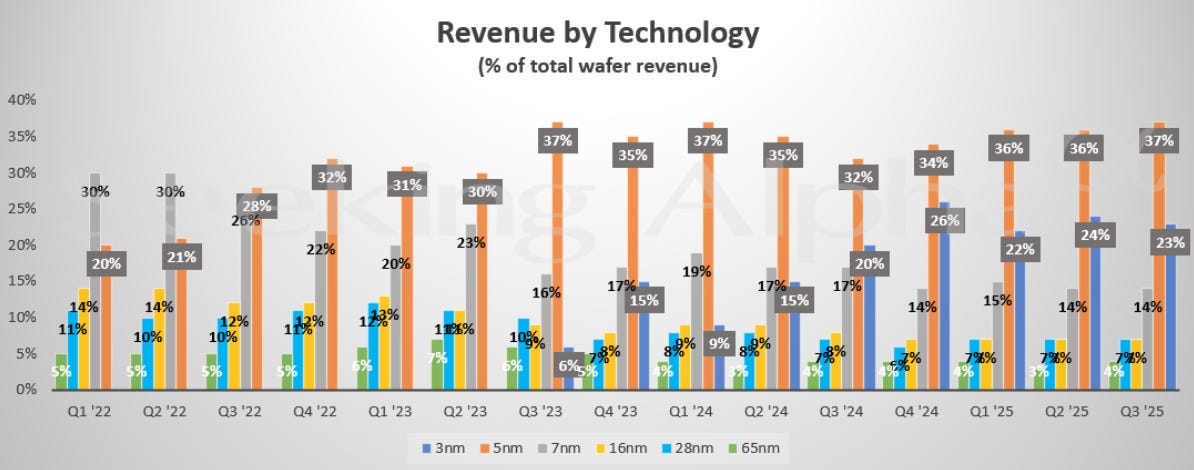

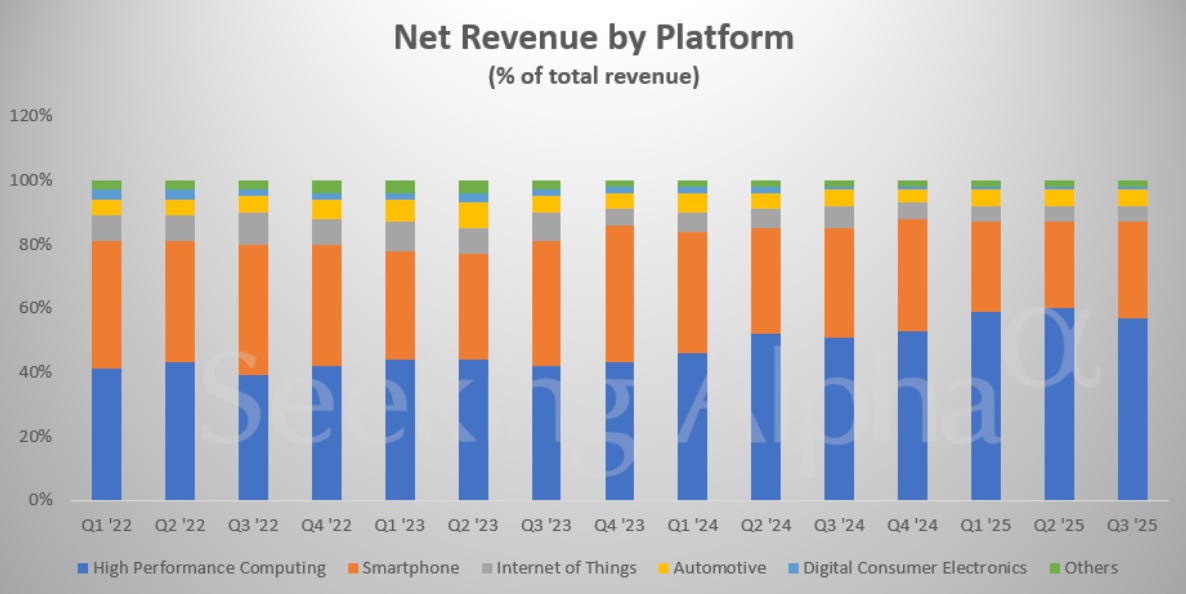

Taiwan Semiconductor in charts: Advanced nodes (3nm–28nm) continue to drive Q3 revenue growth

“Conviction in the AI megatrend is strengthening,” said TSM CEO C.C. Wei told analysts after outlining earnings, Bloomberg News reported. “The AI demand actually continues to be very strong, stronger than we thought three months ago.”

Link to Seeking Alpha News Article - Oct. 16, 2025

Link to Seeking Alpha News Article - Oct. 16, 2025

Disclosure: We own positions in some/all of the tickers mentioned in this article.

Wow, the Broadcom-OpenAI deal really stood out. Makes you reflect on the infra demands you've covered. 10 gigawatts for AI accellerators is immense.