Alpha Coverage #134

AI, Robotics, Space, Quantum Computing, Climate Change/Energy Transition, Biotech/Genomics

Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial + $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist or Weekly Compilation.

Editor’s Pick:

QCOM 0.00%↑ NVDA 0.00%↑ AMD 0.00%↑

[News] Qualcomm looks to take on Nvidia, AMD as it enters AI accelerator market

The Cristiano Amon-led company unveiled its Qualcomm AI200 and AI250 chip-based accelerator cards and racks, all of which use the company’s neural processing units technology.

The AI200, set to be released in 2026, supports 768 GB of LPDDR per card for higher memory capacity and lower cost, San Diego-based Qualcomm said. The AI250 — available in 2027 — will have an “innovative memory architecture based on near-memory computing,” which Qualcomm said will enable 10 times higher effective memory bandwidth and lower power consumption.

Qualcomm also teased that it would unveil another AI accelerator in 2028. The company has committed to an annual cadence, similar to what Nvidia and AMD have already done.

Separately, on Monday, Saudi artificial intelligence company Humain said it would use Qualcomm’s AI accelerators. Humain is targeting 200 megawatts starting in 2026, the company added.

While Qualcomm still generates the vast majority of its semiconductor revenue from handsets — $6.33B out of a total $8.99B — the company has worked to diversify its revenue. In the most recent quarter, automotive revenue rose 21% year-over-year to $984M, while sales attributed to the internet of things jumped 24% to $1.68B.

Link to Seeking Alpha News Article - Oct. 27, 2025

[News] Cameco, Brookfield, Westinghouse to partner with U.S. in $80B push for nuclear reactors

The reactors would be constructed across the U.S. using Westinghouse Electric’s nuclear reactor technology; Westinghouse is 51% owned by Brookfield Renewable Partners (NYSE:BEP) and 49% by Cameco (NYSE:CCJ).

Westinghouse’s AP1000 technology has already been selected for nuclear energy programs in Poland, Ukraine, and Bulgaria.

The companies said the deal aims to accelerate nuclear power deployment and meet surging electricity demand from AI and data centers.

Under the new partnership, the U.S. government will be granted a participation interest, which, once vested, will entitle it to receive 20% of any cash distributions in excess of US$17.5 billion made by Westinghouse; for the participation interest to vest, the U.S. Government must make a final investment decision and enter into definitive agreements to complete the construction of new Westinghouse nuclear reactors in the U.S. with a total value of at least US$80 billion.

The U.S. government also could participate in a future IPO of Westinghouse, purchasing equity securities equivalent to 20% of the public value of the IPO entity at the time of exercise after deducting US$17.5 billion from the public value.

Link to Seeking Alpha News Article - Oct. 28, 2025

BWXT 0.00%↑ #RYCEF #RYCEY

[News] BWXT, Rolls-Royce sign deals advancing key nuclear component manufacturing

Key elements of the MoU are Rolls-Royce SMR’s (OTCPK:RYCEF) (OTCPK:RYCEY) readiness to procure steam generators for multiple reactor units from BWXT (NYSE:BWXT) and the development of a localization plan for future manufacturing work and other activities to support the Rolls-Royce SMR deployment in the global market.

Rolls-Royce SMR (OTCPK:RYCEF) (OTCPK:RYCEY) is the only company with multiple commitments to develop small modular reactors in Europe, having been selected as preferred bidder in the Great British Energy-Nuclear SMR competition, and by European utility CEZ to build up to 3 GW of new nuclear power in the Czech Republic.

Link to Seeking Alpha News Article - Oct. 28, 2025

SPY 0.00%↑ FXI 0.00%↑ NVDA 0.00%↑ MP 0.00%↑

[News] Trump cuts fentanyl tariffs on China, reaches rare earths deal with Beijing

U.S. President Donald Trump announced a one-year agreement with China covering rare earths and critical minerals, while also halving fentanyl-related tariffs on Beijing (from 20% to 10%), effective immediately, following his meeting with Chinese President Xi Jinping in South Korea on Thursday.

He added that the rare earths deal will be reviewed and renegotiated annually, and that tariffs on Chinese exports will drop to 47% from 57%.

Trump also said he discussed sales of Nvidia (NVDA) chips to China with Jinping, and that it’s up to Beijing to continue conversations with the $5 trillion company about access to the world’s largest semiconductor market.

But discussions Thursday did not focus on sales to China of Nvidia’s latest Blackwell accelerators

Trump also confirmed plans to visit China in April, with Xi expected to make a return visit to the U.S. at a later date.

In a possible sign of easing tensions, China purchased its first cargoes of U.S. soybeans in months, according to a Reuters report on Wednesday.

Link to Seeking Alpha News Article - Oct. 30, 2025

[News] Marvell Technology rises as Amazon calls out strong demand for Trainium chips

“Trainium2 continues to see strong adoption, is fully subscribed is now a multibillion-dollar business that grew 150% quarter-over-quarter,” Amazon CEO Andy Jassy said on the company’s earnings call.

Marvell manufactures Amazon’s Trainium processors.

Trainium3 is expected to be previewed for customers at the end of 2025, with greater volume coming in 2026.

Link to Seeking Alpha News Article - Feb. 28, 2024

BOTZ 0.00%↑ ICLN 0.00%↑ XBI 0.00%↑

[YouTube | Big Think | Freethink] Why 2025 is the single most pivotal year in our lifetime | Peter Leyden

“We’re living in an extraordinary moment in history. We are at a moment here in 2025 where we have world historic game-changing technologies now starting to scale.”

This could be one the most important videos you will ever see in your life.

I agree with everything in this video 100%, except maybe Global governance.

I am actually writing an article which addresses the same subject in much more detail and with tickers of course. Watch out for that!

Link to Full Video (15:08 Minute) - Oct. 20, 2025

News, Facts, Analyst & Market Commentary - Short Reads:

[Newsletter Exclusive] Apple Maps ads coming in 2026

Apple (AAPL) is preparing to introduce advertising within its Maps app as early as next year, allowing businesses such as restaurants to pay for prioritized placement in search results. The feature will mirror App Store Search Ads but with a redesigned interface and AI-driven personalization, according to people briefed on the project.

The move expands Apple’s growing advertising ambitions, which already include placements across Apple News and the App Store.

Link to Seeking Alpha News Article - Oct. 26, 2025

U.S. and China signal progress in trade talks as soybean purchases resume

Senior U.S. and Chinese officials reported “constructive” progress in weekend trade talks, signaling a thaw in relations ahead of a planned meeting between President Donald Trump and Chinese leader Xi Jinping later this week, according to multiple news reports.

U.S. Treasury Secretary Scott Bessent said negotiators had “a successful framework” for the leaders’ discussion, following two days of meetings in the Malaysian capital. Chinese Vice Commerce Minister Li Chenggang described the talks as yielding a “preliminary consensus” on key disputes that have strained the world’s two largest economies.

The agenda covered export controls, reciprocal tariffs, rare earths and illicit fentanyl trade, along with discussions over TikTok and agricultural purchases. Bessent confirmed in an interview with CBS’s Face the Nation that China intends to make “substantial” purchases of U.S. soybeans, a move seen as a goodwill gesture that could bring relief to American farmers hurt by the recent halt in Chinese buying.

While both sides were cautious about details, officials suggested the temporary tariff truce, set to expire Nov. 10, may be extended. Bessent said President Trump will make the final decision, adding that the administration is unlikely to proceed with the threatened 100% tariff on all Chinese goods scheduled for Nov. 1.

Vice Premier He Lifeng, who led the Chinese delegation, said both governments will now begin internal reviews to formalize their tentative agreements.

Despite the renewed optimism, analysts note that Beijing remains intent on diversifying soybean sources and reducing reliance on U.S. imports in the long term, keeping one of its most powerful trade levers firmly in hand.

Link to Seeking Alpha News Article - Oct. 26, 2025

GOOGL 0.00%↑ #OpenAI #Anthropic

Anthropic is said to gain ground on OpenAI with focus on corporate AI market

OpenAI targets consumers through ChatGPT, while Anthropic has built its business primarily around corporate clients. Roughly 80% of Anthropic’s revenue comes from enterprises, compared with about 30% for OpenAI.

That approach is paying off. Anthropic, which has around 300,000 corporate customers, is generating an estimated $7 billion annual revenue run rate, with projections near $9 billion by year-end, roughly comparable to OpenAI’s $13 billion run rate but with far higher revenue per user.

Its Claude models have earned praise for reliability in coding, legal drafting and financial analysis, core enterprise functions where measurable cost savings matter. A Menlo Ventures survey found Anthropic held 42% of the coding market share among AI developers, compared with OpenAI’s 21%. Even Microsoft (NASDAQ:MSFT), OpenAI’s biggest partner, said in September it would integrate Anthropic’s Claude model into its Copilot software suite.

While OpenAI dominates public attention with ChatGPT’s 800 million weekly users, its consumer business remains difficult to monetize beyond subscription tiers costing $20 to $200 a month. Advertising could eventually become a revenue stream, but integrating ads into chatbot conversations poses obvious challenges and would put OpenAI in direct competition with Google (NASDAQ:GOOG) (NASDAQ:GOOGL), the global leader in online advertising.

OpenAI’s broad appeal also risks alienating corporate buyers that prefer AI systems focused on accuracy and compliance rather than entertainment. Recent moves, such as allowing adult conversations within ChatGPT, have reinforced its reputation as a mass-market platform rather than a business tool.

Meanwhile, Anthropic’s disciplined strategy appears to be resonating with enterprise users. Independent evaluations, such as those by Vals AI, rank Claude ahead of OpenAI’s latest models on business-oriented benchmarks spanning finance, legal and programming tasks.

OpenAI’s charismatic CEO Sam Altman may still command the spotlight, but Anthropic’s steadier focus and its backing from two of Big Tech’s most powerful cloud providers suggest that it may be building a more sustainable AI business, the Journal reported.

Link to Seeking Alpha News Article - Oct. 26, 2025

Palantir to ink letter of intent with Polish defense ministry

Palantir Technologies (NASDAQ:PLTR) is set to sign a letter of intent with Poland’s Defense Ministry on Monday, Bloomberg reported, citing a statement from the ministry.

The signing ceremony, scheduled for Oct. 27 in Warsaw, will be attended by Defense Minister and Deputy Prime Minister Wladyslaw Kosiniak-Kamysz.

Poland, now NATO’s largest defense spender as a share of GDP since Russia’s invasion of Ukraine more than three years ago, continues to deepen its defense and technology partnerships with Western allies.

Link to Seeking Alpha News Article - Oct. 27, 2025

BMNR 0.00%↑ ORBS 0.00%↑ #ETH #BTC

BitMine’s Ethereum holdings top 3.3M tokens

BitMine Immersion’s (NYSE:BMNR) Ether (ETH-USD) holdings now exceed 3.31 million tokens, bringing its total crypto and cash holdings to $14.2 billion.

As of October 26, the company’s crypto holdings consisted of 3,313,069 ETH, 192 Bitcoin (BTC-USD), $88 million stake in Eightco Holdings (ORBS) and unencumbered cash of $305 million.

Link to Seeking Alpha News Article - Oct. 27, 2025

Trump reverses Biden-era pollution rules on U.S. copper smelters

President Trump signed a proclamation granting an exemption for U.S. copper smelters, including Freeport-McMoRan (NYSE:FCX), from certain Biden-era air pollution rules that had imposed stricter limits on emissions, the White House announced late Friday.

The Environmental Protection Agency’s “Copper Rule,” finalized in May 2024, had required smelters to curb pollutants including lead, arsenic, mercury, benzene and dioxins under updated federal air standards.

Trump’s proclamation granting a two-year exemption from compliance “ensures that the stationary source, a copper smelting facility, can continue to operate uninterrupted to support national security without incurring substantial costs to comply with unattainable compliance requirements.”

The proclamation noted only two primary copper smelters remain in operation in the U.S.; the order will apply to Freeport-McMoRan (NYSE:FCX) smelter in Arizona, while Rio Tinto’s (RIO) smelter in Utah by the 2024 rule due to the company’s investment in equipment that captures emissions.

Link to Seeking Alpha News Article - Oct. 27, 2025

BABA 0.00%↑ QCOM 0.00%↑ META 0.00%↑ AAPL 0.00%↑

Alibaba enters the smart eyewear race, taking dead aim at Meta’s AI glasses

Alibaba (NYSE:BABA) has started preorders for its smart AI glasses, officially called Quark AI Glasses. The product introduction marks the company’s launch into consumer-focused wearable AI hardware. The first customer orders for the Quark AI glasses are slated to begin in December.

The smart AI glasses are priced at about $660 for the public, with discounts offered for Alibaba (NYSE:BABA) members. Initially, the main market focus is China.

The device connects directly to services like Alipay for hands-free payments, Amap for augmented reality navigation, Taobao for real-time product recognition and price comparison, and Fliggy for travel information. The glasses run on powerful Qualcomm (QCOM) AR1 and BES2800 dual flagship chips. They operate primarily through voice commands powered by Alibaba’s (BABA) proprietary Qwen large language model and the new Quark AI assistant.

Alibaba (BABA) is selling a standard AI variant and a premium AI+AR model. Both models include a 12-megapixel Sony camera with an advanced night mode for high-quality photos, even in low light. Sound and communication are enhanced by dual off-ear speakers and multiple microphones, supporting effective noise isolation and clear audio experiences.

Link to Seeking Alpha News Article - Oct. 27, 2025

AMD 0.00%↑ ORCL 0.00%↑ HPE 0.00%↑

AMD rises as CEO, Energy Secretary disclosed $1B partnership for supercomputers

AMD (NASDAQ:AMD) shares rose 1.3% on Monday as AMD CEO Dr. Lisa Su and Energy Secretary Chris Wright told Reuters the two entities were coming together in a $1B partnership aimed at developing supercomputers.

The Dept. of Energy is creating two supercomputers that will go after large scientific issues, including cancer treatments and nuclear power, with Wright telling the news outlet that the systems would “supercharge” advances in these areas.

The first computer, known as Lux, will be built and come online in roughly six months and will use AMD’s MI355X AI accelerators. It is being co-developed by AMD, HP Enterprise (HPE), Oracle (ORCL) Cloud Infrastructure and Oak Ridge National Laboratory.

The second computer, known as Discovery, will use AMD’s MI430 series of AI accelerators and will also be co-developed by AMD, HP Enterprise, and Oak Ridge National Laboratory. It is slated to be delivered by 2028 and come online by 2029.

Link to Seeking Alpha News Article - Oct. 27, 2025

Google partners with NextEra Energy to restart shuttered Iowa nuclear plant

NextEra Energy (NYSE:NEE) +2.7% post-market Monday after unveiling a partnership with Google (NASDAQ:GOOG) (NASDAQ:GOOGL) to restart the Duane Arnold Energy Center, Iowa’s only nuclear facility, with plans to be fully operational by Q1 2029.

Once operational, Google (NASDAQ:GOOG) (NASDAQ:GOOGL) has agreed to purchase power from the 615 MW plant as a 24/7 carbon-free energy source to help power its growing cloud and AI infrastructure in Iowa.

NextEra (NYSE:NEE) said one of the plant’s minority owners, Central Iowa Power Cooperative, will purchase the remaining portion of the plant’s output on the same terms as Google (NASDAQ:GOOG) (NASDAQ:GOOGL).

NextEra (NYSE:NEE) also said it agreed to acquire CIPCO and Corn Belt Power Cooperative’s combined 30% interest in Duane Arnold, raising its ownership to 100%.

The companies also entered into a separate agreement to explore the deployment of nuclear generation nationwide, NextEra (NEE) said.

NextEra (NEE) said it now has nearly 3 GW of energy projects executed with Google (GOOG) (GOOGL) across the U.S.

Link to Seeking Alpha News Article - Oct. 27, 2025

AMD 0.00%↑ CSCO 0.00%↑ #G42

Cisco, G42 strengthen US-UAE AI infrastructure partnership

Cisco (NASDAQ:CSCO) will power, connect, and secure a large-scale AI cluster deployed by G42, featuring AMD’s (AMD) advanced MI350X GPUs.

Link to Seeking Alpha News Article - Oct. 28, 2025

UBER 0.00%↑ PONY 0.00%↑ WRD 0.00%↑

Robotaxi relations: Uber plans to invest in the Hong Kong listings of Pony AI and WeRide

The investment by Uber (NYSE:UBER) in Pony AI’s (NASDAQ:PONY) share sale in Hong Kong may top $100 million, which would be a sizable portion of the offering that could raise as much as $972 million. The expected investment amount in WeRide (NASDAQ:WRD) by Uber (NYSE:UBER) is not clear. Uber (UBER) invested in the U.S. IPOs of both Pony AI (NASDAQ:PONY) and WeRide (NASDAQ:WRD).

Link to Seeking Alpha News Article - Oct. 28, 2025

Qualcomm’s AI data center push adds a ‘meaningful diversification,’ BofA says

“This announcement is a needed diversification away from the low growth smartphone market, which accounts for roughly 75% of QCT revenues, and is addressing a market that we expect to grow to ~$114B by 2030, with key customers looking for vendor diversity outside of the likes of Nvidia,” Bank of America analyst Tal Liani wrote in a note to clients. “On the other hand, the 2026 opportunity is limited with a single deal and technical execution needs to be demonstrated by the company.”

Liani, who has a Buy rating and $200 price target on Qualcomm, said the move continues diversification of the Cristiano Amon-led firm, citing the recent Alphawave deal.

“High exposure to Apple’s expected declines and risks of losing parts of Samsung’s business, combined with a market that is secularly stagnant, explain Qualcomm’s stock underperformance and low valuation, which we believe make the stock interesting for investors, given the potential for [total addressable market] expansion and share gains,” Liani added.

Link to Seeking Alpha News Article - Oct. 28, 2025

Rambus recedes despite 41% product revenue growth; analysts say buy the dip

Analysts contend the dip presents a buying opportunity. Rambus specializes in designing high-speed memory interface chips and supplies silicon intellectual property.

Rosenblatt Securities reiterated its Buy rating and $130 price target. The firm noted share value has surged 75% since the last earnings report, and the 15% quarter-over-quarter product revenue growth was not enough to satisfy all investors.

Jefferies also maintained its Buy rating and $120 price target, adding that the stock decline presents a buying opportunity due to high demand in the memory market.

Evercore ISI echoed this sentiment, reiterating its Buy rating and increasing its price target to $126 from $114.

Link to Seeking Alpha News Article - Oct. 28, 2025

MSFT 0.00%↑ #OpenAI

Microsoft rises after reaching deal with OpenAI with a $135B stake

Shares of Microsoft (NASDAQ:MSFT) jumped about 4% premarket on Tuesday after the company signed an agreement with OpenAI (OPENAI) that would value its stake at about $135B in the AI giant.

Microsoft said it supports the OpenAI board moving forward with formation of a public benefit corporation, or PBC, and recapitalization.

Following the recapitalization, Microsoft holds an investment in OpenAI Group PBC valued at about $135B, representing around 27% on an as-converted diluted basis, inclusive of all owners — employees, investors, and the OpenAI Foundation, the software giant said in a blog post on Tuesday.

In addition, Microsoft said that OpenAI has contracted to buy an incremental $250B of Azure services, and Microsoft will no longer have a right of first refusal to be OpenAI’s compute provider.

Under the agreement, once AGI is declared by OpenAI, that declaration will now be verified by an independent expert panel.

Microsoft’s IP rights for both models and products are extended through 2032 and now include models post-AGI, with appropriate safety guardrails.

Microsoft’s IP rights to research, defined as the confidential methods used in the development of models and systems, will remain until either the expert panel verifies AGI or through 2030, whichever is first, the company noted.

Microsoft’s IP rights now exclude OpenAI’s consumer hardware.

Jony Ive and his design firm, LoveFrom, remain independent and assume deep design and creative responsibilities across OpenAI.

Microsoft said OpenAI can now jointly develop some products with third parties. API products developed with third parties will be exclusive to Azure. Non-API products may be served on any cloud provider.

In addition, Microsoft said that it can now independently pursue AGI alone or in partnership with third parties.

The revenue share agreement remains until the expert panel verifies AGI, though payments will be made over a longer period of time.

OpenAI can now provide API access to U.S. government national security customers, regardless of the cloud provider.

Link to Seeking Alpha News Article - Oct. 28, 2025

[Newsletter Exclusive] Drivers that could run the ‘everything rally’ by year-end – Wells Fargo

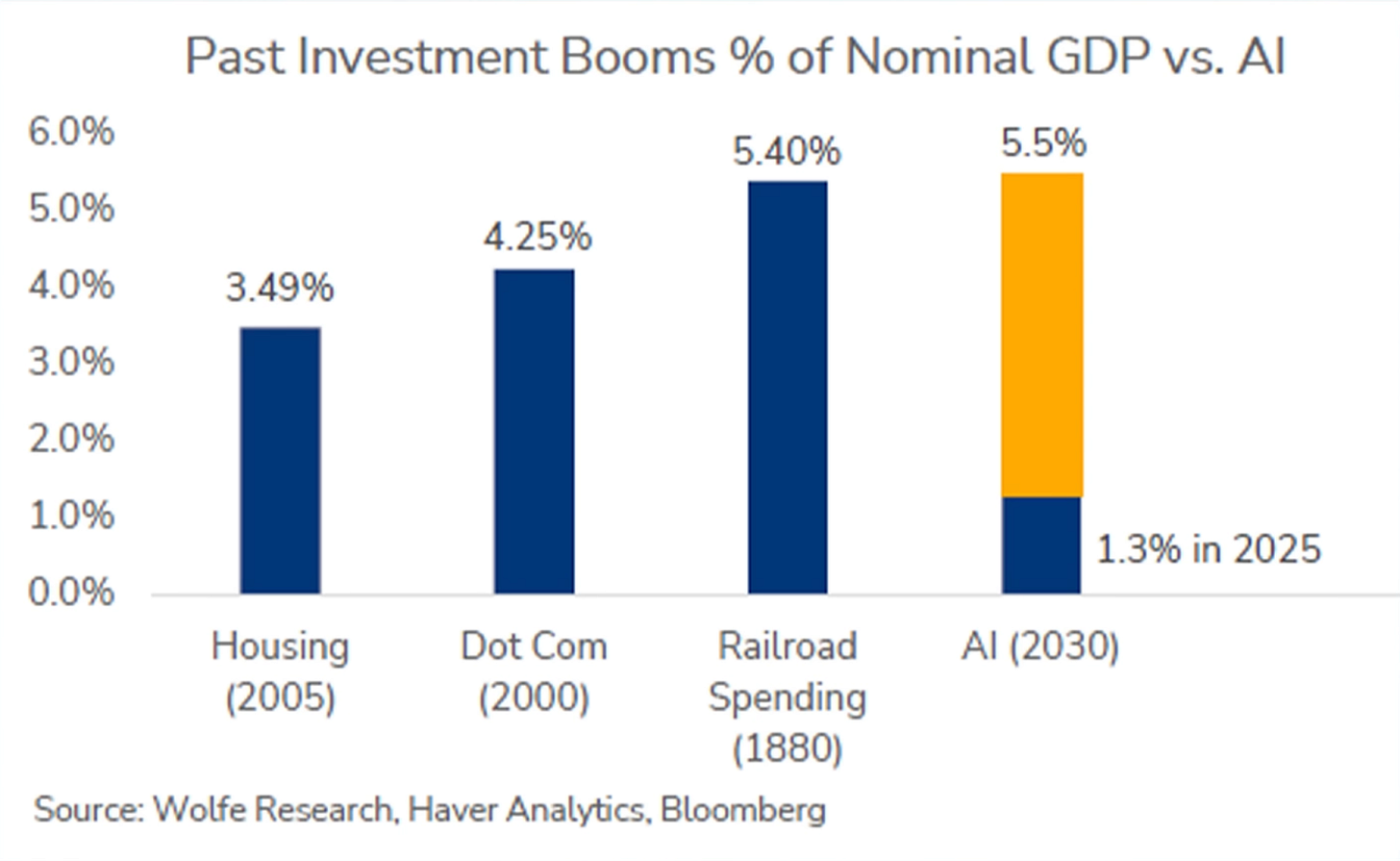

“We’re in the fourth inning of the AI capex cycle,” Kwon said, explaining that while early stages were funded with cash, companies are now transitioning to debt financing.

According to the analysis, hyperscalers have only funded 8% of their capex with debt so far.

Link to Seeking Alpha News Article - Oct. 28, 2025

NVDA 0.00%↑ RGTI 0.00%↑ WQTM 0.00%↑

Nvidia Unveils System to Link Quantum Computers to Its AI Chips

Nvidia Corp. unveiled a new system to connect quantum computers with the company’s artificial intelligence chips, seizing on an emerging technology that holds the promise of significantly faster processing to drive advances in medicine and materials science.

For quantum computing to become a practical reality, it will need to be able to connect with traditional equipment. Nvidia has created software and hardware that will pair the interface of future quantum techniques with its technology.

Nvidia’s new offering, known as NVQLink, will help pave the way for a new generation of super computers and reduce the error rate in the units of information used in quantum computing known as qubits, Chief Executive Officer Jensen Huang said on Tuesday.

“It doesn’t just do error correction for today’s number of qubits, it does error correction for tomorrow,” Huang said in his keynote address at Nvidia’s GTC event in Washington. “We’re going to essentially scale up these quantum computers from the hundreds of qubits we have today to tens of thousands of qubits, hundreds of thousands of qubits in the future.”

Link to Bloomberg News Article - Oct. 28, 2025

Link to Seeking Alpha News Article - Oct. 28, 2025

NVDA 0.00%↑ UBER 0.00%↑ JNJ 0.00%↑

Nvidia creates brave new world as its chips power breakthroughs across industry lines: GTC DC

“We have visibility into half a trillion in sales for Grace Blackwell and Vera Rubin through 2026,” Nvidia (NASDAQ:NVDA) CEO Jensen Huang said.

The Vera Rubin, Nvidia’s next line of GPUs, is expected to enter production by the third quarter of 2026.

Nvidia announced a new partnership with Uber (NYSE:UBER) to power its vehicles with the Hyperion system. Uber plans to begin scaling its global autonomous fleet by 2027 with 100,000 vehicles.

Nvidia is working with Johnson & Johnson (NYSE:JNJ) to build medical robots capable of performing precision non-invasive surgeries and other procedures.

“AI is not a tool,” Huang said. “AI is work. AI is, in fact, workers that can actually use tools.”

Link to Seeking Alpha News Article - Oct. 28, 2025

[Newsletter Exclusive] Enphase Energy Non-GAAP EPS of $0.90 beats by $0.24, revenue of $410.43M beats by $40.83M

Revenue to be within a range of $310.0 million to $350.0 million vs $382.97M consensus, which includes shipments of 140 to 160 MWh of IQ Batteries. This outlook does not include any safe harbor shipments.

GAAP gross margin to be within a range of 40.0% to 43.0%, including approximately five percentage points of reciprocal tariff impact.

Enphase said on its post-earnings call that it expects limited exposure to new China-related tariffs, as it continues shifting its supply chain out of China.

Link to Seeking Alpha News Article - Oct. 28, 2025

Link to Seeking Alpha News Article - Oct. 28, 2025

Joby Aviation shares soar after teaming up with NVIDIA to advance autonomous flight tech

Joby Aviation (NYSE:JOBY) is collaborating with NVIDIA (NASDAQ:NVDA) to advance the development of Joby’s autonomous flight technology “Superpilot” with the integration of NVIDIA’s (NASDAQ:NVDA) IGX Thor compute platform.

Powered by NVIDIA’s Blackwell architecture, IGX Thor is designed to power the next generation of physical AI applications.

Link to Seeking Alpha News Article - Oct. 28, 2025

Aurora outlines hundreds of driverless trucks by end of 2026 while accelerating lane expansion and hardware cost reduction

Chris Urmson, CEO, highlighted that “the Aurora Driver surpassed 100,000 driverless miles on public roads” and maintained “100% on-time performance, while upholding our perfect driverless safety record.” He announced the launch of driverless commercial operations on the 600-mile Fort Worth to El Paso lane and said this expansion, accomplished six months after the initial driverless launch, is “faster than any other self-driving company has scaled to a second U.S. market.”

Urmson stated that to meet expected customer demand in Q2 2026, Aurora plans to launch its second-generation commercial hardware kit on a new fleet that will “enable driverless operation without a partner requested observer,” supporting scaling objectives for 2026.

He detailed the upcoming expansion with the Phoenix extension, which will “add another 400 miles to establish a continuous 1,000-plus mile multistate route between Fort Worth and Phoenix,” with software release planned for January 2026. Future planned expansions include lanes between Dallas and Laredo and between Dallas and Atlanta, aiming for a “2,000-mile” driverless corridor.

Third quarter revenue totaled $1 million, a 12% increase from the second quarter.

Operating losses were reported at $222 million, with R&D at $138 million, SG&A at $28 million, and cost of revenue at $6 million (all figures excluding $51 million in stock-based compensation).

Link to Seeking Alpha News Article - Oct. 29, 2025

Teradyne outlines Q4 sales target up to $1B as AI test demand accelerates

CEO Gregory Smith highlighted sequential revenue growth of 18% and a 49% increase in non-GAAP EPS for Q3, attributing this to “AI demand in semiconductor tests”.

Smith noted that “our view of the second half of 2025 revenue is more than 50% higher than our expectations just 3 months ago,” driven by compute and memory demand linked to AI applications.

Smith also reported that Q3 memory test sales “more than doubled from Q2 to $128 million, with the majority of those shipments supporting AI applications.”

Semi Test revenue was $606 million and product test revenue at $88 million, both reporting sequential and year-over-year growth. Robotics revenue was $75 million.

Link to Seeking Alpha News Article - Oct. 29, 2025

Adobe falls despite Wall Street analysts’ positive commentary after MAX event

The analysts noted that the robust product innovation pipeline and open ecosystem, coupled with enforcement of generative credit limits (which recently started), could position Adobe as a better business a year from now.

More specifically than “genAI”, a key focus area of the event was third party models and partnerships. By hosting the majority of state-of-the-art genAI models natively, and simultaneously developing its own Firefly models, Adobe continues to solidify itself as the Creative OS for the coming years, the analysts added.

Link to Seeking Alpha News Article - Oct. 29, 2025

Wall Street ended mixed after Powell says Dec cut ‘far from’ a foregone conclusion

The Federal Reserve reduced its benchmark interest rate by 25 basis points to 3.75%-4.00%, its second straight cut, as it seeks to ease off the brakes in an effort to protect the labor market.

In Powell’s address he stated: “In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December rate is not a foregone conclusion. Far from it.”

“My own assessment is that the Federal Reserve is in an untenable situation. It has a dual mandate that it has to balance. Usually, that is fairly easy to do. This is because, when jobs data starts looking weaker, inflation tends to be weak as well. This gives them the opportunity to cut rates in order to improve both metrics. And when jobs data is strong, inflation tends to be strong as well, providing them an opportunity to hike rates,” Seeking Alpha analyst Daniel Jones said.

“But because of tariffs, there is a disconnect, which I have argued since August is pushing the US toward a stagflationary recession where inflation can remain elevated even while job losses mount. I do expect that, as the economic climate worsens, the central bank will prioritize jobs, allowing the rate to fall faster than many anticipate. But that could come at the cost, at least in the short run, of even higher prices,” Jones added.

Link to Seeking Alpha News Article - Oct. 29, 2025

Chipotle Mexican Grill Non-GAAP EPS of $0.29 in-line, revenue of $3B misses by $20M

Comparable restaurant sales increased 0.3%.

Opened 84 company-owned restaurants, with 64 locations including a Chipotlane, and two international partner-operated restaurants.

Restaurant level operating margin was 24.5%, a decrease from 25.5%.

For 2025, management is anticipating the following:

Full year comparable restaurant sales declines in the low-single digit range

315 to 345 new company-owned restaurant openings with over 80% having a Chipotlane

For 2026, management is anticipating the following:

350 to 370 new restaurant openings, including 10 to 15 international partner-operated restaurants. Over 80% of company-owned restaurants will have a Chipotlane

Link to Seeking Alpha News Article - Oct. 29, 2025

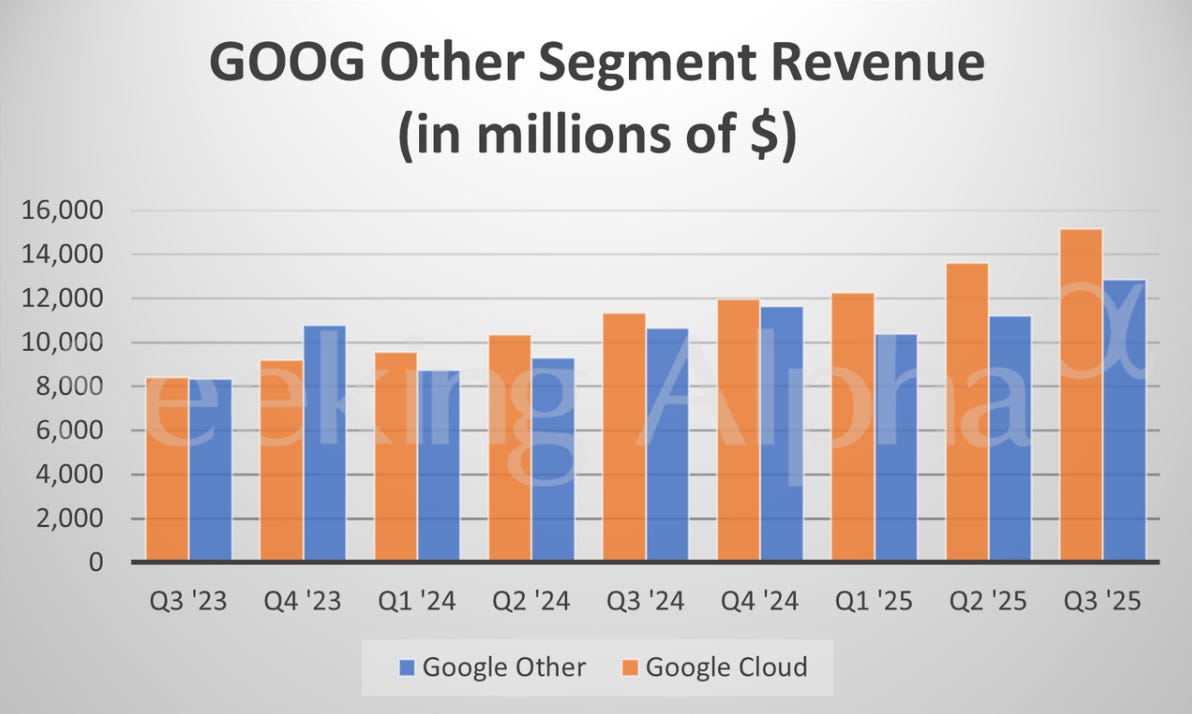

Alphabet GAAP EPS of $2.87 beats by $0.61, revenue of $102.35B beats by $2.21B

“The Gemini App now has over 650 million monthly active users,” CEO Sundar Pichai said in initial reaction.

“Google Cloud accelerated, ending the quarter with $155 billion in backlog. And we have over 300 million paid subscriptions led by Google One and YouTube Premium,” he added.

The company showed double-digit sales gains almost across the board. Revenues by segment: Google Search and other, $56.57B (up 14.5%); YouTube ads, $10.26B (up 15%); Google Network, $7.35B (down 2.6%); Google subscriptions, platforms, and devices, $12.87B (up 20.8%); Google Cloud, $15.16B (up 33.5%); Other Bets, $344M (down 11.3%).

Operating income by segment: Google Services, $33.53B (up 8.7%); Google Cloud, $3.59B (up 84.6%); Other Bets, -$1.43B (vs. -$1.12B a year ago).

“With the growth across our business and demand from Cloud customers, we now expect 2025 capital expenditures to be in a range of $91 billion to $93 billion,” the company said.

Alphabet (GOOG) (GOOGL) had previously signaled $22.4B in capex for the third quarter -- it came in at just under $24B -- and analysts had expected full-year capex would come in at just over $84B.

AI infrastructure investments were spotlighted, with Pichai stating, “We are scaling the most advanced chips in our data centers, including GPUs from our partner, NVIDIA, as well as our own purposeful TPUs. As we announced yesterday at NVIDIA GTC, we are now shipping the new A4X Max instances powered by NVIDIA GB300 to our cloud customers.”

Eric Sheridan, Goldman Sachs: Asked about custom silicon and YouTube monetization. Pichai explained, “We are seeing substantial demand for our AI infrastructure products, including TPU-based and GPU-based solutions... we continue to see very strong demand, and we are investing to meet that.”

Link to Seeking Alpha News Article - Oct. 29, 2025

Link to Seeking Alpha News Article - Oct. 29, 2025

Link to Seeking Alpha News Article - Oct. 29, 2025

Link to Seeking Alpha News Article - Oct. 29, 2025

GOOGL 0.00%↑ GOOG 0.00%↑ INQQ 0.00%↑ #OpenAI

Google to offer free Gemini AI service to India’s Reliance Jio users

The U.S. tech giant is collaborating with Reliance Intelligence to offer Google’s AI Pro plan, and with it the latest version of Google Gemini, to Jio Unlimited 5G plan users at no extra cost for 18 months.

Google noted that eligible Jio customers will get access to Gemini 2.5 Pro model in the Gemini app, higher limits to generate images and videos with its Nano Banana and Veo 3.1 models, expanded access to NotebookLM, 2 TB of cloud storage across Google Photos, Gmail, Drive and for backing up WhatsApp chats (on Android). These services, otherwise, have a combined value of about INR 35,100.

U.S. tech giants are vying to provide their AI services to India’s massive mobile user market. Earlier this week, Microsoft (MSFT)-backed OpenAI (OPENAI) noted that it will be giving Indian users a free one-year subscription to its ChatGPT Go service, starting from Nov. 4.

Link to Seeking Alpha News Article - Oct. 30, 2025

Uber Eats and Kroger expand delivery partnership adding pressure to Instacart shares

Kroger (KR) and Uber Eats (UBER) have expanded their relationship by adding more locations to the existing partnership, offering an extended free trial of Uber One to Kroger (KR) Boost Members, and including restaurants to the Kroger app.

“Kroger is the first retailer in the world to bring Uber Eats directly into its digital shopping experience—and to connect our two membership ecosystems,” said Susan Anderson, Global Head of Delivery at Uber.

Customers can now have their groceries delivered through Uber Eats (UBER) from a variety of Kroger (KR) banners, including Ralph’s, Fred Meyer, King Soopers, Smith’s, Fry’s, and others, directly through the Uber Eats (UBER) app.

The partnership also enables Kroger Boost members to enjoy an extended free trial of Uber One for 6% cash back, 0% delivery fees, and up to 10% off all Uber Eats orders. Additionally, Uber One members can try an extended free trial of Kroger’s Boost membership.

Finally, Uber Eats’ (UBER) restaurant selection will be integrated on the Kroger (KR) app, enabling users to order groceries and restaurant orders from the same app.

Link to Seeking Alpha News Article - Oct. 30, 2025

RCAT 0.00%↑ AVAV 0.00%↑ DRNZ 0.00%↑

Pentagon’s DOGE unit is said to take charge of massive drone overhaul

The Pentagon’s Department of Government Efficiency (DOGE) has taken the lead in a sweeping effort to revamp the U.S. military’s drone program. The initiative that aims to simplify procurement, boost domestic manufacturing and rapidly deploy tens of thousands of inexpensive drones, Reuters reported Thursday, citing U.S. defense officials and people familiar with the plan.

Defense Secretary Pete Hegseth announced plans to approve hundreds of domestically produced drone models and train combat units for what he called the era of “drone wars,” a direct response to lessons from Ukraine.

President Donald Trump, through a June executive order, elevated the military’s drone modernization program to a top defense priority. The Pentagon declined to comment to Reuters on the DOGE initiative.

One person familiar with the plan said the goal is to purchase at least 30,000 drones in the next few months, with larger orders to follow. That would be a windfall for U.S. drone makers such as Red Cat (RCAT), Skydio, PDW and Neros, which are already supplying low-cost quadcopters to military branches.

Link to Seeking Alpha News Article - Oct. 30, 2025

First Solar GAAP EPS of $4.24 misses by $0.05, revenue of $1.59B beats by $20M

Contracted sales backlog of 53.7 GW, valued at $16.4 billion, as of September 30, 2025.

Mark Widmar, CEO announced the decision to establish a new U.S. production facility to onshore finishing for Series 6 modules, expected to have a planned capacity of 3.7 GW and begin production at the end of 2026, ramping through H1 2027.

Link to Seeking Alpha News Article - Oct. 30, 2025

Link to Seeking Alpha News Article - Oct. 30, 2025

Solid Power to partner with Samsung SDI, BMW to advance all-solid-state battery technology

Under the arrangement, Solid Power (SLDP) will provide sulfide-based solid electrolyte to Samsung SDI, which Samsung SDI will integrate into separator and/or catholyte and use to build cells, which will be evaluated based on performance parameters and requirements to be agreed between Samsung SDI and BMW.

Ultimately, Solid Power (SLDP), Samsung SDI, and BMW aim to develop and supply all-solid-state battery cells for integration into a demonstration vehicle.

Link to Seeking Alpha News Article - Oct. 30, 2025

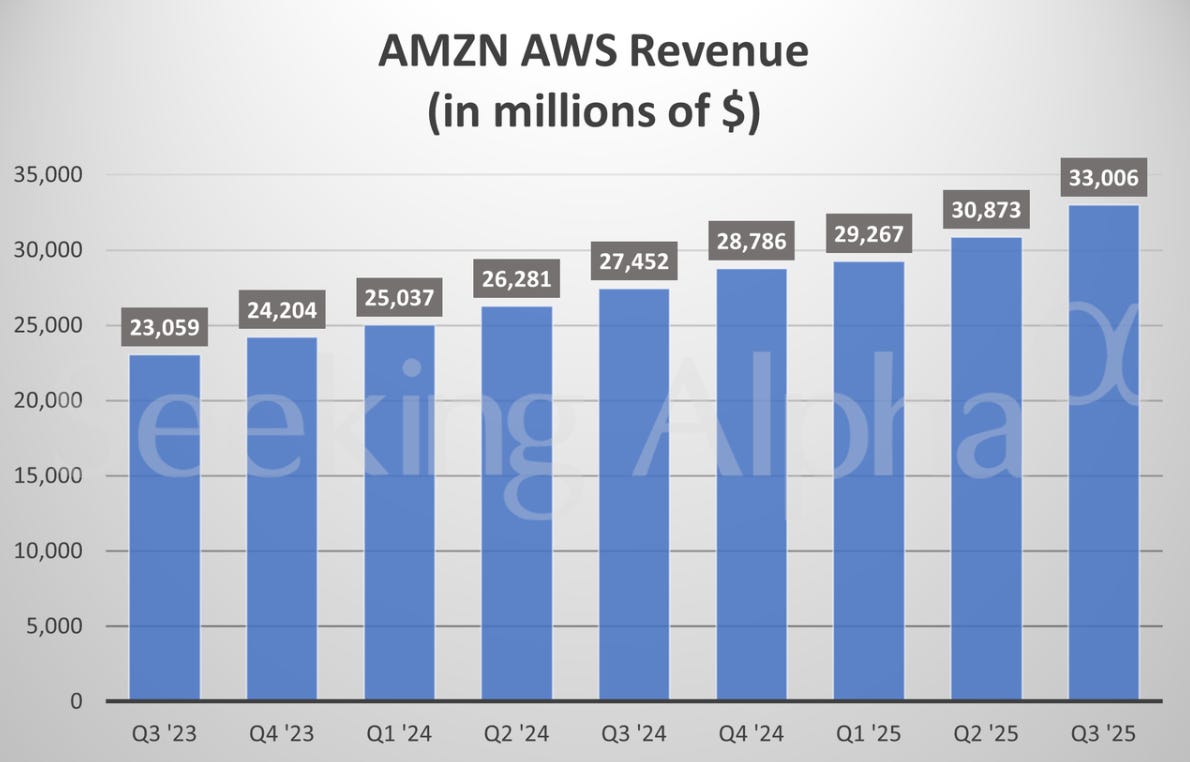

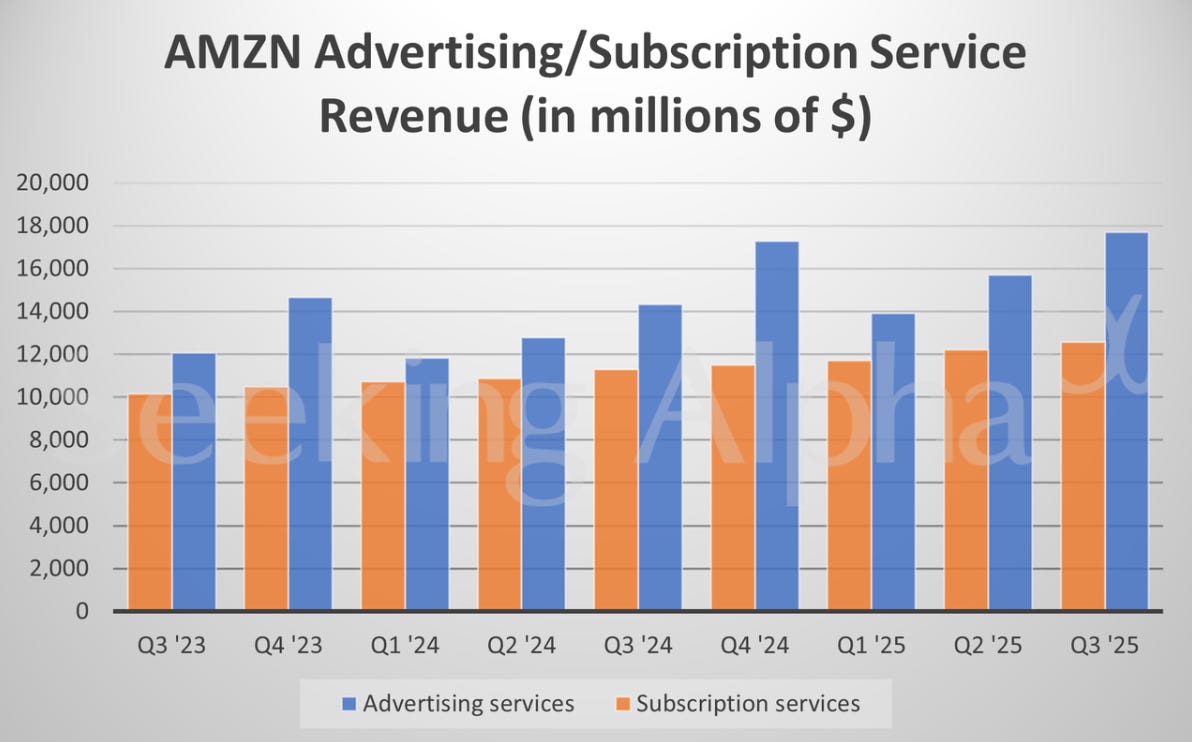

Amazon surges after Q3 beat driven by AWS, ad growth, offsetting margin pressures

The e-commerce giant earned a profit of $1.95 per share, up 16% year-over-year and $0.37 better than expected.

Total sales were up 13% to $180.2B, nearly $3B above estimates.

CEO Andrew Jassy highlighted AWS’s reacceleration to 20.2% year-over-year growth with sales reaching $33.01B (up 7% from the previous quarter) and a backlog rise to $200 billion.

The ad services business, Amazon’s (AMZN) fastest growing segment, posted revenue of $17.7B versus estimates of $17.34B.

Jassy also noted new Amazon Ads partnerships with Netflix, Spotify, and SiriusXM.

Within its retail sector, online store revenue increased nearly 10% to $67.41B, beating $66.93B.

Project Rainier, Amazon’s AI compute cluster, now includes nearly 500,000 Trainium2 chips and is expected to surpass 1 million by year-end. Jassy explained, “Trainium is being used by a small number of very large customers but we expect to accommodate more customers starting with Trainium3.”

Link to Seeking Alpha News Article - Oct. 30, 2025

Link to Seeking Alpha News Article - Oct. 30, 2025

Link to Seeking Alpha News Article - Oct. 30, 2025

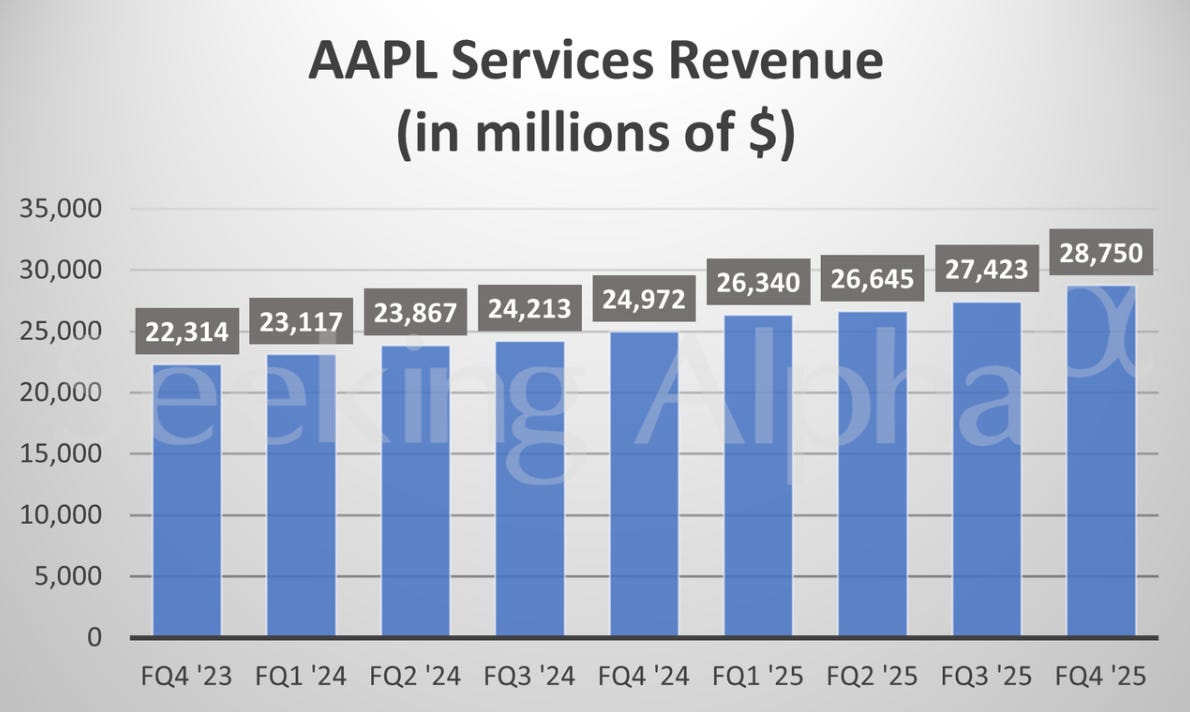

Apple GAAP EPS of $1.85 beats by $0.08, revenue of $102.47B beats by $220M

Speaking with CNBC, CEO Tim Cook said revenue for the upcoming fiscal first-quarter is expected to rise between 10% and 12%, translating to $136.7B to $139.2B, above the $131.82B estimate. Cook also noted that iPhone revenue during the quarter should reach double-digit growth, and China should return to growth.

Cook added that the artificial intelligence-infused version of Siri is still expected next year, and there will be integration with more AI models over the course of time.

$49.025B from the iPhone, below the $50.3B estimate. Overall revenue from products came in at $73.72B, slightly above expectations of $73.49B. Seeing strength during the period was Apple’s Mac business, as sales rose 13% year-over-year to $8.73B, above the $8.55B estimate.

Also topping analyst’s forecasts was Apple’s Services business, which rose 15% from the year-ago period and accounted for $28.75B in revenue during the period, above the $28.18B forecasted.

Conversely, Apple’s Wearables business generated $9.01B in revenue, down 0.3% year-over-year, but above analyst estimates of $8.64B. The iPad accounted for $6.95B in revenue during the quarter, slightly below the $6.97B estimate.

Revenue from Greater China fell 3.6% year-over-year during the period to come in at $14.49B, below the $16.43B that analysts had expected.

Link to Seeking Alpha News Article - Oct. 30, 2025

Link to Seeking Alpha News Article - Oct. 30, 2025

Link to Seeking Alpha News Article - Oct. 30, 2025

China to buy 12M metric tons of U.S. soybeans this season, 87M tons through 2028

China has agreed to buy 12 million metric tons of U.S. soybeans during the current season through January and 25 million tons/year for the next three years, as part of a larger trade agreement between the two countries, U.S. Treasury Secretary Bessent said Thursday.

The deal would represent a return to normalcy in trade with the top U.S. soy importer, which averaged purchases of 28.8 million tons over the previous five September-to-August crop seasons.

Bessent also said other countries in Southeast Asia have agreed to buy another 19 million tons of U.S. soybeans, but did not specify a timeframe or the countries involved; Asian importers other than China have imported 8 million-10 million tons/year in recent years.

Link to Seeking Alpha News Article - Oct. 30, 2025

Nvidia to send over 260,000 GPUs to South Korea

South Korea’s government has announced a wide-ranging collaboration with Nvidia to acquire over 260,000 of its most advanced AI GPUs, marking deployment in the public and private sector.

Of these, ~50,000 GPUs will be rapidly supplied to the public sector, including the National AI Computing Center and the development of proprietary AI foundation models. Private companies like Samsung Electronics (OTCPK:SSNLF), SK (OTCPK:HXSCF), Hyundai Motor Group, and Naver will utilize over 200,000 GPUs to drive AI in manufacturing.

Nvidia said it is working with SK Group to build an AI factory to advance semiconductor research, development and production, and cloud infrastructure to support digital twin and AI agent development.

SK Group is building an AI factory featuring over 50,000 Nvidia GPUs, with the first phase planned for completion by late 2027.

Nvidia announced plans with Samsung to build a new AI factory, representing a new era where intelligent computing and chip manufacturing converge.

Samsung’s semiconductor AI factory will be powered by more than 50,000 Nvidia graphics processing units, or GPUs.

Nvidia is collaborating with Hyundai Motor Group to boost innovation in autonomous vehicles, or AVs, smart factories and robotics with a new Nvidia Blackwell-powered AI factory.

The companies will deploy 50,000 Nvidia Blackwell GPUs. They plan to co-develop AI capabilities for mobility solutions, a next-generation smart factory and on-device semiconductor advancements. The companies aim to enable integrated AI model training, validation and deployment using the GPUs.

On the same day, Nvidia (NVDA), and the Ministry of Science and ICT also signed an MoU to position Korea as a leader in physical AI.

Link to Seeking Alpha News Article - Oct. 31, 2025

Link to Seeking Alpha News Article - Oct. 31, 2025

MP 0.00%↑ USAR 0.00%↑ CRML 0.00%↑

China pauses rare earth curbs—brokerage says relief not yet here

Breaking Beijing’s stranglehold on rare earths will remain a long-term challenge, with China expected to retain its strategic leverage over these critical minerals, Fitch’s BMI said in a note on Friday.

China’s dominance becomes even more acute along the value chain, with the country responsible for about 91% of global magnet rare earth output at the refining stage in 2024, according to the International Energy Agency.

While the US-China deal grants the West access to Mainland China’s rare earths supply chain for now, this will depend on political temperature going forward, the brokerage added.

Link to Seeking Alpha News Article - Oct. 31, 2025

Pony.ai wins Shenzhen’s first citywide permit for fully driverless robotaxis

Pony.ai (PONY) has been granted Shenzhen’s first citywide permit for fully driverless commercial robotaxi operations, paving the way for scalable driverless commercial operations, the company said on Friday.

The permit was jointly granted to Pony.ai and Shenzhen Xihu Corporation Limited, the city’s largest taxi operator.

Operations will begin in the Nanshan, Qianhai, and Baoan areas before gradually expanding to other districts across the city.

Link to Seeking Alpha News Article - Oct. 31, 2025

WeRide granted license to operate driverless robotaxis in UAE

The federal level license allows WeRide’s (WRD) robotaxis to operate in the UAE commercially without an onboard safety driver.

There are currently more than 100 WeRide (WRD) robotaxis in the Middle East.

Link to Seeking Alpha News Article - Oct. 31, 2025

Monolithic Power falls despite ‘strong’ Q3 and guidance, while analysts remain bullish

KeyBanc Capital kept its Overweight rating on Monolithic — which provides semiconductor-based power electronics solutions — and raised the price target on the stock to $1,300 from $1,250.

The analysts continue to expect strength in the second half of 2025 driven by share gains at Nvidia (NVDA) on B300 HGX and expect more meaningful growth in the second half of 2026 as Monolithic becomes the primary supplier on Nvidia’s Vera Rubin.

Link to Seeking Alpha News Article - Oct. 31, 2025

Gene editing therapy companies rise on word of streamlined FDA approval process

Companies focused on gene editing therapies, including CRISPR Therapeutics (CRSP), Editas Medicines (EDIT), and Intellia Therapeutics (NTLA) are trading higher Friday following a report that the US FDA will make it easier for these medicines to gain approval.

In an interview with Bloomberg, Vinay Prasad, director of the agency’s Center for Biologics and Research, said, “Regulation has to evolve as fast as science evolves,” adding the FDA is “going to be extremely flexible and work very fast with the scientists who want to bring these therapies to kids who need it.”

Prasad intends to outline in early November how a streamlined pathway for gene editing therapy approvals would work, adding that the paper will serve to boost investment in the gene editing space.

Link to Seeking Alpha News Article - Oct. 31, 2025

Eos Energy wins 228 MWh Frontier Power order under 5 GWh framework agreement

Eos Energy Enterprises (EOSE) +8.3% in Friday’s trading after announcing a 228 MWh order from Frontier Power to deploy Eos Z3 energy storage systems across the U.K. energy developer’s expanding portfolio of storage and grid-reliability projects.

Eos Energy (EOSE) said the new order marks the first conversion under the existing 5 GWh framework agreement with Frontier signed in April.

Frontier recently advanced 11 GWh of long-duration storage projects to the second round of Ofgem’s Cap-and-Floor program, all incorporating Eos Energy’s (EOSE) technology and more than double the original commitment.

Link to Seeking Alpha News Article - Oct. 31, 2025

YouTube:

[The Real Eisman Playbook | Inside the Data Center Boom] Understanding the Massive Infrastructure That Supports AI

On this bonus episode of The Real Eisman Playbook, Steve Eisman is joined by Nick Del Deo, the digital infrastructure analyst at MoffettNathanson.

The two of them discuss all things data centers, from CoreWeave’s explosive rise to the massive energy and infrastructure challenges ahead.

Link to Full Video (56:19 Minute) - Oct 22, 2025

META 0.00%↑ GOOGL 0.00%↑ AMZN 0.00%↑ AAPL 0.00%↑ ENPH 0.00%↑ CMG 0.00%↑

[The Real Eisman Playbook | The AI Boom Rolls On] AI Partnerships Pay Off as Stocks Soar & Meta, Google & Microsoft Go All-In

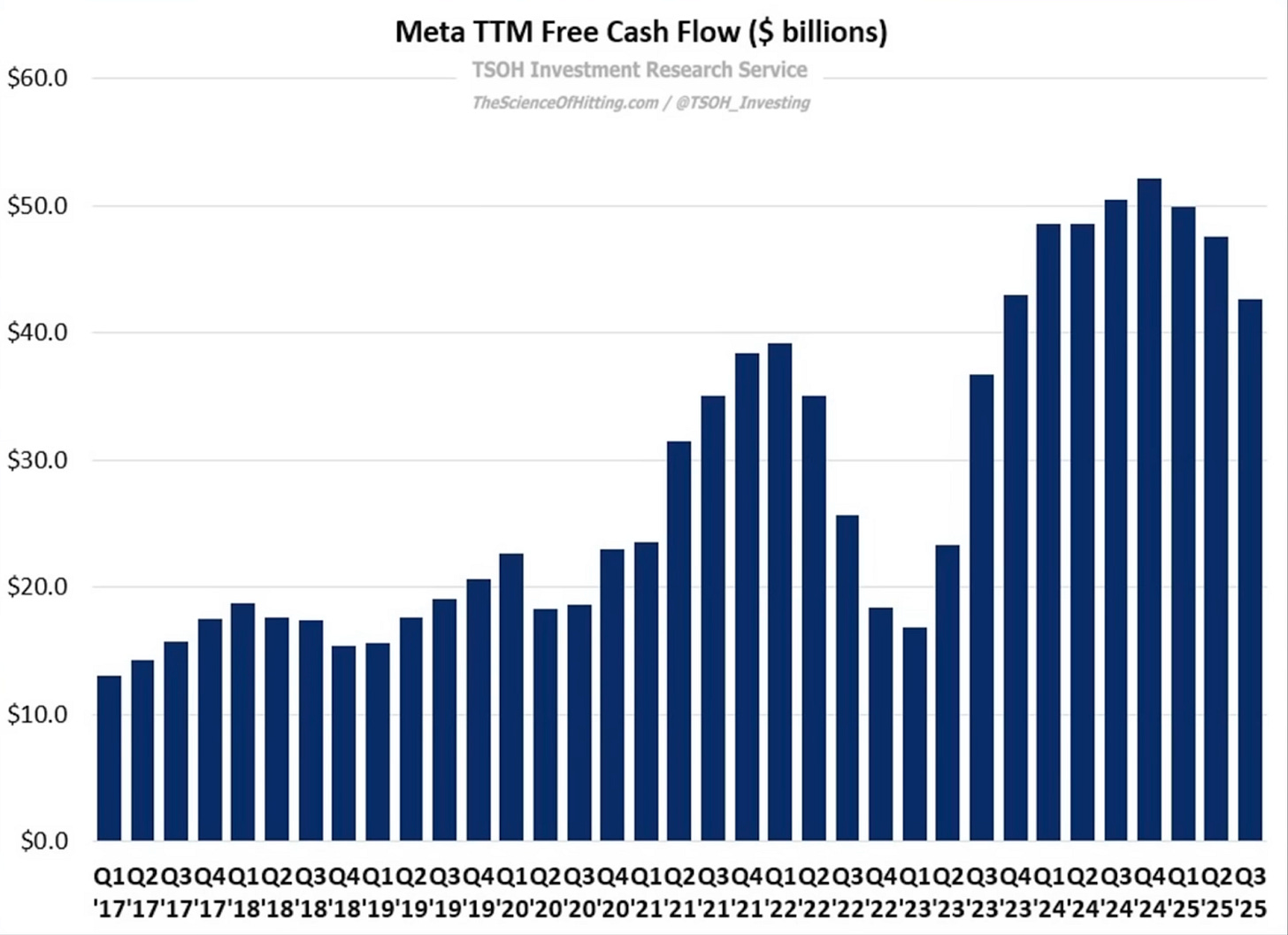

Must watch for Meta holders. Meta has no businesses spending so much money on AI CAPEX. Unlike Amazon, Microsoft and Google, it does not have a cloud business to sell AI into.

On this episode of The Weekly Wrap, Steve Eisman breaks down everything happening in the market this week. He discusses earnings for both AI and non-AI related companies. He also gives updates on the US/China trade deal, the Fed cutting rates again, Amazon laying off 14,000 workers, and more.

Link to Full Video (20:58 Minute) - Oct 31, 2025

[The Compound | TCAF] What Did the Fed Actually Say? | TCAF 215

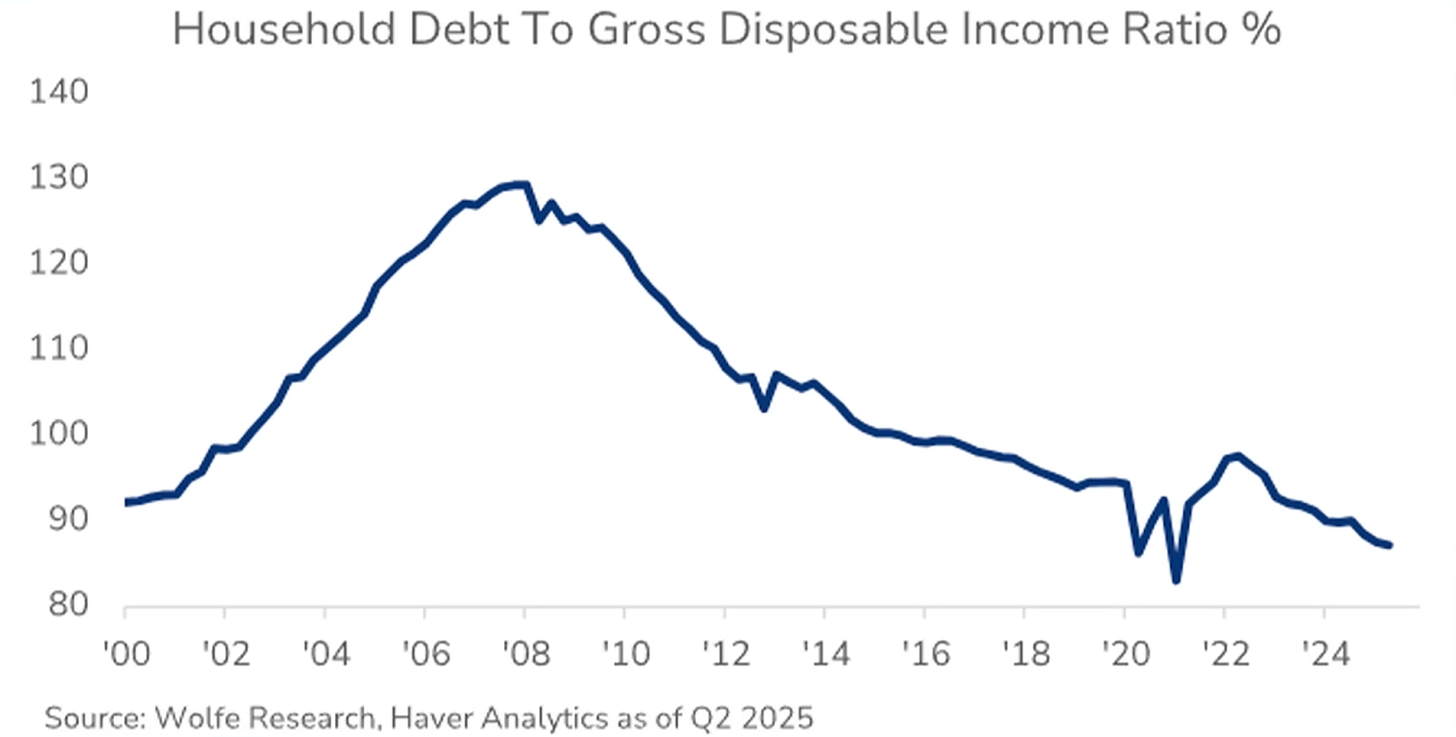

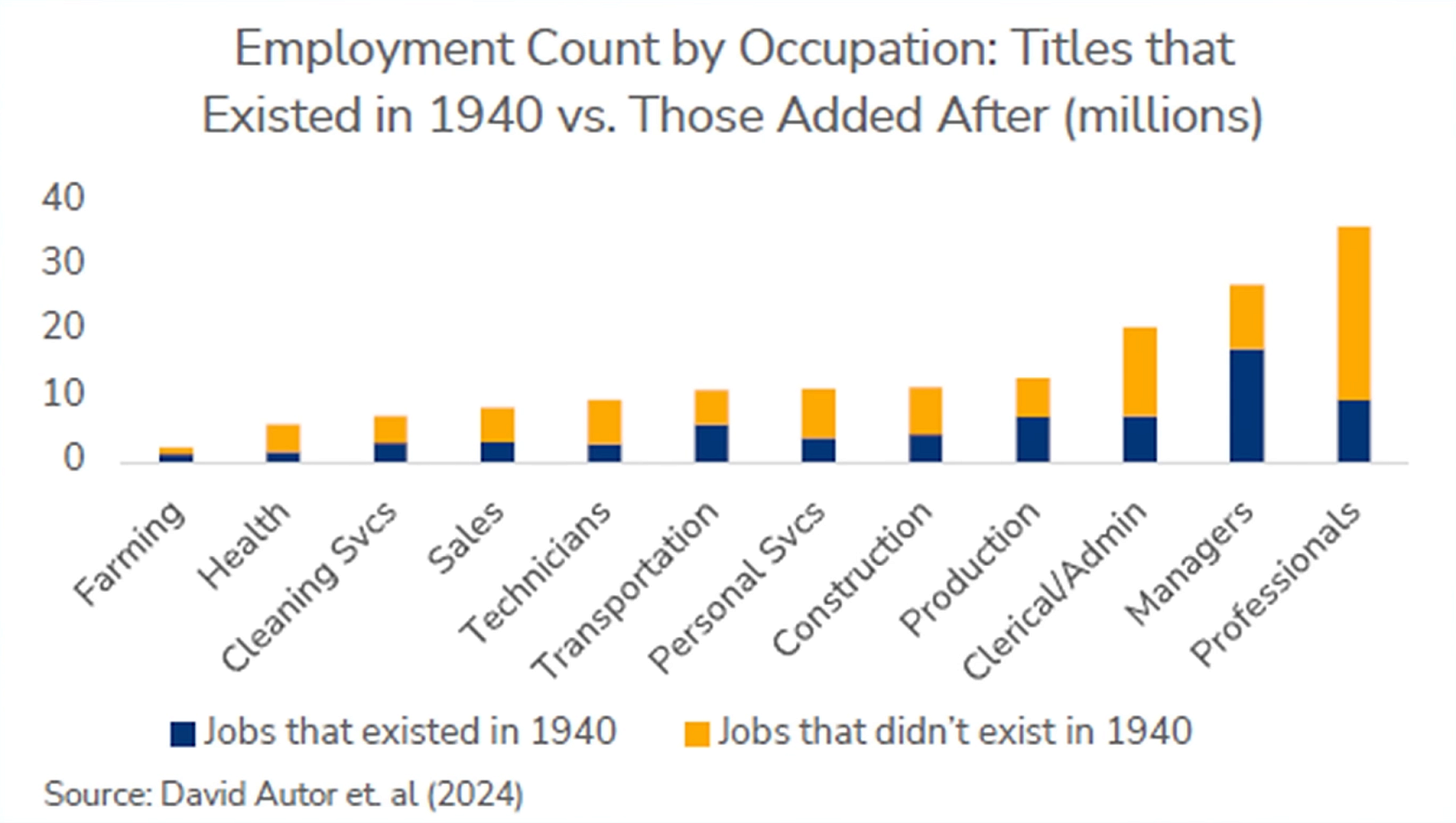

On episode 215 of The Compound and Friends, Michael Batnick and Downtown Josh Brown are joined by Stephanie Roth, Chief Economist at Wolfe Research, to discuss: the economy, tech earnings, the Fed, the wealth effect, AI and the labor market, and much more!

Link to YouTube Video (Timestamped)

Link to YouTube Video (Timestamped)

Link to YouTube Video (Timestamped)

Link to YouTube Video (Timestamped)

Link to YouTube Video (Timestamped)

Link to Full Video (01:04 Hours) - Oct 31, 2025

Charts & Technicals:

ServiceNow in charts: Subscription revenue rises 22% Y/Y in Q3

Link to Seeking Alpha News Article - Oct. 29, 2025

Disclosure: We own positions in some/all of the tickers mentioned in this article.

The Samsung partnership could be a real catalyst for SLDP, especially since they're targeting actual vehicle integration with BMW rather than just lab testing. Sulfide electrolytes have been stuck in development hell for years, but having Samsung's manufacturing expertise might finally push this into comercial viability. The demonstration vehicle timeline will be key to watch.

Couldn't agree more. My AI reading list just grew lenger.