Alpha Coverage #147

AI, Robotics, Space, Quantum Computing, Climate Change/Energy Transition, Biotech/Genomics

Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve. WealthWise Coverage Universe (Only for paying subscribers).

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial + $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist or Weekly Compilation.

Editor’s Pick:

[News] U.S. government to invest $1.6B in USA Rare Earth for 10% stake - FT

The Trump administration is poised to inject $1.6B into USA Rare Earth (USAR) in exchange for a 10% stake in the company, the U.S. government’s biggest investment in the rare earths sector so far, the Financial Times reported Saturday.

The federal government investment and a separate $1B private financing deal led by Cantor Fitzgerald are expected to be announced Monday, according to the report.

The government reportedly will receive 16.1M shares in USA Rare Earth (USAR) and warrants for another 17.6M shares, both priced at $17.17/share.

Link to Seeking Alpha News Article - Jan. 24, 2026

[News] IonQ to acquire SkyWater Technology for $1.8B in cash-stock deal

With SkyWater acquisition, IonQ strengthens its position as the only vertically integrated full-stack quantum platform company, with embedded access to a Trusted U.S. foundry. As a result, the combined company is expected to pull forward functional testing of its 200,000 qubit QPUs in 2028 enabling over 8,000 ultra-high fidelity logical qubits.

IonQ expects to deliver full year 2025 revenue results at the high end or above its previously announced range of $106 million to $110 million ($108.56M consensus) when it reports its fourth quarter and full year 2025 earnings results next month.

“In our view, the most significant competitive advantage for IONQ will be the ability to bring manufacturing and packaging in-house to accelerate its development cycle (IONQ expects cycle times to reduce from 9 to 2 months) while also receiving instant and critical engineering feedback on each iteration of its quantum systems,” Wedbush analyst Antoine Legault wrote in a note to clients. “We note that this acquisition would make IONQ the only vertically integrated trapped-ion player.”

Link to Seeking Alpha News Article - Jan. 26, 2026

Link to Seeking Alpha News Article - Jan. 27, 2026

MSFT 0.00%↑ GOOG 0.00%↑ AMZN 0.00%↑ #SKHynix

[News] Microsoft releases new AI accelerator in challenge to Google and Amazon’s in-house offerings

Microsoft (MSFT) has released its latest artificial intelligence accelerator chip, the Maia 200, which is built for inference and to improve the efficiency of token generation.

“This makes Maia 200 the most performant, first-party silicon from any hyperscaler, with three times the FP4 performance of the third-generation Amazon Trainium and FP8 performance above Google’s seventh-generation TPU,” Microsoft’s executive vice president of cloud and AI, Scott Guthrie said. “Maia 200 is also the most efficient inference system Microsoft has ever deployed, with 30% better performance per dollar than the latest generation hardware in our fleet today.”

SK Hynix Inc. (HXSC.F) shares surged toward a record closing high after local media reported the company is the exclusive supplier of advanced memory for Microsoft’s (MSFT) new AI chip.

Link to Seeking Alpha News Article - Jan. 26, 2026

Link to Seeking Alpha News Article - Jan. 27, 2026

[News] EU-India Free Trade Agreement: ‘Mother of all deals’ represents one-third of global trade

The EU and India already trade over €180B ($213.36B) worth of goods and services per year. The Free Trade Agreement (FTA) is expected to double EU exports to India by 2032 by eliminating or reducing tariffs, saving around €4B ($4.74B) per year in duties on European products.

Under the deal, India will slash tariffs on EU cars from 110% to as low as 10%, and duties on car parts will be eliminated after 5-10 years.

India will mostly eliminate tariffs ranging up to 44% on machinery, 22% on chemicals and 11% on pharmaceuticals that it imports from

The FTA also removes or reduces India’s tariffs on EU exports of agri-food products—tariffs on wines will be cut from 150% to 75% and eventually to levels as low as 20%; tariffs on olive oil will go down from 45% to 0% over five years; processed agricultural products like bread and confectionary will see tariffs of up to 50% eliminated.

The deal will grant EU companies privileged access to the Indian services market, including sectors such as financial services and maritime transport.

The EU and India intend to launch a joint platform on climate action in the first half of 2026. The EU plans to provide €500M in support over the next two years to help India’s efforts to reduce greenhouse gas emissions and accelerate its long-term sustainable industrial transformation.

The FTA must be approved by the European Parliament and ratified by India before it becomes effective.

Link to Seeking Alpha News Article - Jan. 27, 2026

[News] Space firm Redwire stock rockets 29% after joining $151 billion contract for Trump’s ‘Golden Dome’

Redwire Corporation (RDW) shares surged over 27% on January 27, 2026, after the company announced its selection for the Missile Defense Agency’s Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) program.

This massive multi-vendor contract, which carries a ceiling of $151 billion, is a cornerstone of the Trump administration’s “Golden Dome” initiative designed to modernize U.S. homeland defense through advanced sensors and autonomous systems.

Link to Seeking Alpha News Article - Jan. 27, 2026

Link to CNBC News Article - Jan. 27, 2026

[News] Tesla’s robot-fueled vision for the future

On the company’s earnings call with analysts, Musk laid out his vision for the company as it transitions from a purely auto manufacturing entity to a leading manufacturer of advanced and humanoid robots.

The company is sunsetting the Model S and Model X vehicles next quarter given the increased focus on autonomy. Consequently, Tesla is converting the Fremont factory for Optimus production.

On robotics, the company said it continued to make progress on its Optimus program with plans to unveil the Gen 3 version of Optimus in the first quarter of this year to include major upgrades from version 2.5.

Taneja cautioned that the biggest constraint globally, however, continues to be on the battery pack.

Major investments are being made in batteries, AI chips, and solar cell manufacturing.

Link to Seeking Alpha News Article - Jan. 28, 2026

Link to Seeking Alpha News Article - Jan. 28, 2026

Link to Seeking Alpha News Article - Jan. 28, 2026

TSLA 0.00%↑ #SpaceX #xAI

[News] Elon Musk’s SpaceX, xAI in merger talks ahead of planned IPO - Reuters

Under the proposed merger, shares of xAI would be exchanged for shares in SpaceX (SPACEX), according to a Reuters report on Thursday, which cited a person briefed on the matter and two recent company filings viewed by the news agency. Two entities have been set up in Nevada to facilitate the transaction.

On Wednesday, Tesla announced it had agreed to invest approximately $2B in xAI.

Link to Seeking Alpha News Article - Jan. 29, 2026

[News] U.S. eyes Robinhood Markets for oversight of Invest America initiative - report

Robinhood Markets (HOOD) is preparing internally for a possible trustee role as the U.S. federal government considers tapping the fintech company to help oversee new Invest America accounts for children, according to a media report on Thursday.

The Treasury Department has weighed picking as many as three firms to serve as the initial trustees, the Wall Street Journal reported, citing people with knowledge of the talks. The selected firm is still subject to change, the people added. Any firm ultimately selected to serve as trustee for the accounts would stand to acquire millions of new customers.

Meanwhile, brokerage giants including Fidelity Investments and Vanguard Group have yet to be on the list of candidates for the program’s initial launch, separate people familiar told Bloomberg. A decision is expected to be announced soon.

Link to Seeking Alpha News Article - Jan. 29, 2026

GLD 0.00%↑ SLV 0.00%↑ KGC 0.00%↑ AEM 0.00%↑

[News] Gold and silver sink by most since 1980 as Trump’s Fed pick calms independence fear

Gold and silver futures crashed Friday in their biggest one-day dollar declines on record, halting a shocking rally that had pushed the precious metals to all-time highs as investors were said to have lost faith in traditional currencies like the dollar.

The declines began when reports suggested that President Trump would nominate former Federal Reserve governor Kevin Warsh as the next Federal Reserve Chair; Warsh historically has been more concerned with higher inflation than slower growth, easing Wall Street fears that the Fed would lose its independence over Trump’s relentless push for the central bank to reduce rates.

After Trump confirmed Warsh’s pick Friday morning, the dollar posted its strongest day in months, essentially ruining the trade that metals would replace the greenback as the world’s reserve currency.

The selloff gained steam in the afternoon as metals investors raced to book profits, with some analysts suggesting that traders taking profits at month’s end or banks shielding themselves from the impact of sudden declines also could have added to the selloff.

“For the precious metals, the pullback is probably not unexpected given the speed and magnitude of January’s rally,” Britannia Global Markets Head of Metals Neil Walsh said in a note. “Gold and silver had become technically overextended, with gains of nearly 20% and over 40% respectively, and positioning, leverage, and options activity were at levels typical of short-term peaks.”

However, “the broader trend remains intact, [as] the macro forces that drove gold, silver and copper are still firmly in place,” Walsh said. “This episode appears to be a positioning correction within an ongoing uptrend, not the end of one. In my opinion, the outlook for precious metals is to remain well supported through 2026, albeit with wider trading ranges.”

Link to Seeking Alpha News Article - Jan. 30, 2026

[YouTube | The Compound] What Tom Lee’s Worried About in 2026 | TCAF 227

The second half in particular is bonkers: Robots will pay taxes via blockchain and humans will chill!

On episode 227 of The Compound and Friends, Michael Batnick and Downtown Josh Brown are joined by Fundstrat’s Tom Lee to discuss: market headwinds in 2026, why Tom is still bullish, the precious metals rally, the crypto bear market, Tesla’s big bet on robots, and much more!

Link to Full Video (01:17 Hours) - Jan 30, 2026

News, Facts, Analyst & Market Commentary - Short Reads:

GLD 0.00%↑ SPY 0.00%↑ UUP 0.00%↑ TLT 0.00%↑

German economists push for gold repatriation from U.S. vaults

Germany is facing mounting pressure to withdraw its substantial gold reserves from American vaults, as concerns grow over the unpredictability of the Trump administration and shifting transatlantic relations, The Guardian reported Saturday.

Germany holds the world’s second-largest national gold reserves after the United States, with approximately $194B worth — 1,236 metric tons—currently stored at the Federal Reserve in New York. The country’s total gold reserves are valued at around $530B, with just over half held at the Bundesbank in Frankfurt, 37% in New York, and 12% at the Bank of England in London.

However, not all experts agree. Clemens Fuest, president of the Institute for Economic Research, warned that repatriation could “only pour oil on the fire of the current situation.”

The Merz coalition government has stated that withdrawal is not currently under consideration.

Link to Seeking Alpha News Article - Jan. 24, 2026

Tesla reportedly mulls training Optimus robots at its Austin facility

The company issued a February timeline to start training Optimus on how to operate in the Texas Gigafactory. The vehicle manufacturer has been conducting data collection and training sessions for Optimus prototypes at its Fremont, California, site for over a year.

Link to Seeking Alpha News Article - Jan. 24, 2026

[Newsletter Exclusive] How Americans are using AI - Gallup

The Associated Press reports that a survey of more than 22,000 U.S. workers found that 12% of employed adults now use AI daily in their jobs, with roughly one-quarter using it at least a few times a week. Nearly half report using AI at least a few times a year—a dramatic increase from 2023, when just 21% were using AI at least occasionally.

Technology workers remain at the forefront of AI adoption, with about 6 in 10 using AI frequently and 3 in 10 doing so daily. While adoption in the tech sector has grown significantly since 2023, there are indications it may be starting to plateau after an explosive increase between 2024 and 2025.

Despite increasing AI integration, most workers remain unconcerned about losing their jobs to the technology. A separate Gallup Workforce survey from 2025 found that half of employees said it was “not at all likely” that AI would eliminate their job within five years—though that confidence has declined from about 6 in 10 in 2023.

Link to Seeking Alpha News Article - Jan. 25, 2026

Eaton named as top 2026 pick at BNP Paribas on data center demand

Andrew Buscaglia, a senior analyst at BNP Paribas, set a price target of $430 for the electrical equipment maker, implying nearly 30% upside from recent trading levels. His updated bull case suggests shares could climb toward $500 if growth expectations are met.

Buscaglia in a Jan. 23 note to clients said investor sentiment toward Eaton’s (ETN) data center business has cooled despite improving sales trends. Data center revenue rose 45% in 2024 and increased another 50% through the first nine months of 2025, yet the stock has de-rated over that period. He views that shift as an opportunity.

Eaton’s (ETN) Electrical Americas unit faced margin pressure last year as the company expanded production capacity to meet rising demand. The firm has been building six final facilities as part of a broader expansion plan, with most scheduled for completion by early 2026.

As utilization improves and volumes increase, BNP Paribas expects margins to recover. Buscaglia said sales tied to AI-driven data centers could begin contributing more meaningfully to earnings in the second half of the year, potentially pushing margins above current market forecasts.

The report also revisits Eaton’s (ETN) acquisition of Boyd, a supplier of liquid cooling solutions. Buscaglia now estimates Eaton’s (ETN) data center revenue could grow at an annual rate of more than 40% over the next several years, up from a prior forecast in the mid-30% range.

Buscaglia also pointed to reports that Eaton (ETN) is exploring options for its vehicle business, including a potential sale.

A separation could be welcomed by investors, he said, especially if proceeds are used to reduce debt or return capital to shareholders.

Link to Seeking Alpha News Article - Jan. 25, 2026

[Newsletter Exclusive] What investors need to know about the Artemis launch

The space sector will be in the spotlight next month as the launch window for Artemis II opens up. The launch, which will be the first crewed mission of NASA’s Artemis program, will be a roughly 10‑day journey around the Moon and back to Earth. The mission is designed as a critical test of the Space Launch System rocket and Orion spacecraft with astronauts on board before NASA attempts a crewed lunar landing later in the decade.

Earlier in the month, the fully stacked SLS and Orion vehicle were rolled from the Vehicle Assembly Building to Launch Pad 39B at Kennedy Space Center, initiating final integration, testing, and countdown rehearsals. NASA has outlined a primary launch window opening February 6, with additional opportunities on February 7-11, and further dates in March and early April to accommodate technical and orbital constraints.

Looking ahead, NASA plans a full “wet dress rehearsal” before setting a launch date, including loading propellants and running through the entire countdown to validate systems and procedures.

Following Artemis II, Artemis III is planned as the first crewed lunar landing of the program, using a commercially provided human landing system to put astronauts on the Moon’s south polar region. The return of a human to the surface of the Moon will be one of the biggest stories of the decade.

Later missions will assemble and use the Gateway lunar space station in orbit around the Moon, test advanced life support, power, and surface mobility systems, and support extended stays on the surface. The infrastructure is intended to mature technologies such as long‑duration habitation, in‑situ resource utilization, and deep‑space navigation that are essential for the multi‑month journey to Mars. There are also expected to be defense industry considerations with a U.S. presence on the Moon.

Link to Seeking Alpha News Article - Jan. 25, 2026

GLD 0.00%↑ SLV 0.00%↑ KGC 0.00%↑ AEM 0.00%↑

Gold tops $5,000 per ounce

Gold surged past $5,000 an ounce for the first time on Sunday, extending a remarkable rally driven by President Donald Trump’s reshaping of international relations and a broad investor retreat from sovereign bonds and currencies.

Spot gold (XAUUSD:CUR) rose 0.8% to $5,028, building on an 8.5% gain last week. A weaker dollar (DXY) reinforced demand, with the Bloomberg Dollar Spot Index falling 1.6% for its biggest weekly decline since May, making precious metals more affordable for most buyers. Silver (XAGUSD:CUR) (SLV) also hit a record high, advancing 1.7% to $104.91.

Link to Seeking Alpha News Article - Jan. 25, 2026

Eaton to spin off Vehicle, eMobility businesses

Eaton (ETN) +1.4% pre-market Monday after saying it plans to spin off its vehicle and electric mobility segments into an independent, publicly traded company, which the company will allow it to focus on its higher growth, higher margin electrical and aerospace operations as part of its 2030 growth strategy.

The tax-free spinoff is expected to close in the first quarter of 2027 and is designed to create two distinct companies with clearer strategic priorities.

Link to Seeking Alpha News Article - Jan. 26, 2026

Link to Seeking Alpha News Article - Jan. 26, 2026

Nvidia invests $2B in CoreWeave; to help build over 5 GW AI factories

The companies intend to build AI factories developed and operated by CoreWeave using Nvidia’s accelerated computing platform technology to meet customer demand.

The companies also plan to deploy multiple generations of Nvidia infrastructure across CoreWeave’s platform via early adoption of Nvidia’s computing architectures, including the Rubin platform, Vera CPUs and Bluefield storage systems.

Link to Seeking Alpha News Article - Jan. 26, 2026

Century Aluminum, EGA to build first U.S. aluminum smelter since 1980

Century Aluminum (CENX) and Emirates Global Aluminum announced plans Monday to build the first new primary aluminum production plant in the U.S. since 1980, in a joint venture to be owned 60% by EGA and 40% by Century.

The new plant, to be built in Inola, Oklahoma, is expected to produce 750K metric tons/year of aluminum, larger than previously planned and more than doubling current U.S. production.

The companies said the project will use EGA’s latest state-of-the-art EX technology, the most advanced ever installed in the U.S.

Construction of the project is expected to start by year-end 2026, with production planned to begin by the end of the decade; detailed engineering work is already underway, and negotiations for a long-term power supply are progressing.

Link to Seeking Alpha News Article - Jan. 26, 2026

CCCX 0.00%↑ #INFQ

[Newsletter Exclusive] Infleqtion and SPAC Churchill’s filing gets SEC clearance

Quantum computing firm Infleqtion’s joint registration statement on Form S-4 with Churchill Capital Corp X (CCCX) was declared effective by the Securities and Exchange Commission on Jan. 23.

Infleqtion said Churchill has set a meeting date of Feb. 12 for its extraordinary general meeting to approve the proposed business combination and related matters.

Infleqtion designs, builds, and sells quantum computers, precision sensors, and software to governments, enterprises, and research institutions, according to the company. The company noted that its systems are used in collaboration with Nvidia (NVDA) and by customers including the U.S. Department of War, NASA, and the U.K. government.

Link to Seeking Alpha News Article - Jan. 26, 2026

AAPL 0.00%↑ GOOG 0.00%↑ #Anthropic

[Newsletter Exclusive] Anthropic asked Apple for ‘several billion dollars’ per year for Siri deal: report

The Apple-Google deal is a multi-year partnership, and Apple is believed to be paying Google billions of dollars over the life of the deal.

Link to Seeking Alpha News Article - Jan. 26, 2026

Salesforce unit secures $5.6B contract for U.S. Army

Salesforce (CRM) unit Computable Insights secured a $5.6B contract to support military operations modernization using cloud-based software, AI, and data analytics.

The 10-year IDIQ contract includes a 5-year base ordering period and one 5-year optional ordering period with a $5.6B ceiling.

Computable Insights is a unit of Salesforce (CRM) and acts as a contracting vehicle for government contracts, especially with the U.S. Army.

Link to Seeking Alpha News Article - Jan. 27, 2026

META 0.00%↑ GOOG 0.00%↑ #TikTok

France’s National Assembly OKs social media ban for under-15s

French lawmakers have approved a law prohibiting children under 15 from using social media, joining other governments in tightening protections for minors against harmful content, following Australia’s landmark legislation last year.

It will now go to the Senate, France’s upper house, before it could become law. Lawmakers are hoping the ban will come into force before the new school year begins in the autumn.

Link to Seeking Alpha News Article - Jan. 27, 2026

AVGO 0.00%↑ TSM 0.00%↑ MRVL 0.00%↑ GOOG 0.00%↑ AMZN 0.00%↑ MSFT 0.00%↑

Broadcom set to retain leadership position as AI server compute ASIC partner through 2027: Counterpoint

Broadcom is projected to retain its leadership as an artificial intelligence server compute ASIC design partner with 60% of market share in 2027, according to an analysis by Counterpoint Research.

The rampant growth stems from demand for Google’s TPU infrastructure to support Gemini, sustained scaling of Amazon’s Trainium clusters, as well as ramp-ups for Meta’s MTIA and Microsoft’s Maia chips as they expand their in-house offerings.

Counterpoint expects AI server compute ASIC shipments will reach more than 15M in 2028 and surpass data center GPU shipments.

Taiwan Semiconductor Manufacturing (TSM) holds nearly 99% of the wafer fabrication share for the top 10 companies in AI server compute ASIC shipments.

Although Google and Amazon dominated the AI server compute ASIC shipment share in 2024, that is diversifying rapidly with Meta, Microsoft and others entering the domain. Google’s market share is expected to drop from 64% to 52% by 2027, while Amazon’s is projected to decline from 36% to 29%.

Broadcom and Taiwan’s AIchip are expected to retain the bulk of partner share with these hyperscalers for ASIC design services at 60% and 18%, respectively, by 2027. However, Marvell’s share is projected to decline to 8% from 12% over this time frame.

“Having said that, Marvell’s end-to-end custom chip portfolio looks more solid than ever, with its custom silicon innovations, such as its customized HBM/SRAM memory and PIVR solutions, and the Celestial AI acquisition broadening Marvell’s addressable market in scale-up connectivity,” said Counterpoint analyst Gareth Owen. “Celestial AI could not only add multi-billion-dollar increments to Marvell’s revenues every year but also potentially drive a leadership position in optical scale-up connectivity in the coming years.”

Link to Seeking Alpha News Article - Jan. 27, 2026

D-Wave Quantum pops as Florida Atlantic University signs $20M purchase order

The Boca Raton, Fla.-based university signed an agreement to purchase and install D-Wave’s Advantage2 annealing quantum computer at its Boca Raton campus, the company said in a statement. The system will be deployed later in the year, D-Wave added.

Separately, on Tuesday, D-Wave announced that it will collaborate with Davidson Technologies and Anduril Industries to develop quantum-classical hybrid applications for complex U.S. military needs.

Additionally, D-Wave said it had signed a $10M, two-year enterprise quantum-computing-as a-service agreement with an unnamed Fortune 100 company.

Link to Seeking Alpha News Article - Jan. 27, 2026

‘Google AI Plus’ now available in the U.S. for $7.99

The plan will give users limited access to its AI models and tools like Gemini 3 Pro and Nano Banana Pro in the Gemini app, AI filmmaking tools in Flow, research and writing assistance in NotebookLM, among other things, when compared to its “AI Pro” plan, which is priced at $19.99 per month.

The “AI Plus” plan starts at $7.99 monthly in the U.S., but first-time customers can avail the plan for $3.99 per month for the initial two months.

Existing Google One Premium 2 TB subscribers will automatically get full access to the benefits of the “AI Plus” plan in the coming days, the tech giant said.

Link to Seeking Alpha News Article - Jan. 27, 2026

NextEra Energy weighing nuclear power expansion to deliver to data centers, CEO says

NextEra Energy (NEE) +2.1% in Tuesday’s trading, poised for its highest closing price in two years, after saying it is considering expanding its nuclear fleet to deliver electricity to data centers and that it is in advanced discussions to power an additional 9 GW of the server warehouses.

On its earnings conference call Tuesday, the company said it currently has the ability to add 6 GW of new nuclear technologies to serve data centers at its existing nuclear sites, and it is also considering greenfield sites to build advanced nuclear power.

Link to Seeking Alpha News Article - Jan. 27, 2026

Judge revives Iberdrola’s Vineyard Wind project stopped by Trump

A U.S. District judge said Tuesday he would grant a preliminary injunction allowing the Vineyard Wind project off the coast of Massachusetts to resume construction, weeks after the Trump administration required all wind projects to stop work.

Vineyard Wind is the fourth U.S. offshore project that has won court approval for a restart following the Trump administration’s halt last month, which cited unspecified national security concerns for the suspension of five east coast wind projects for 90 days.

The project is 95% complete and is intended to deliver power to more than 400K homes and businesses.

Link to Seeking Alpha News Article - Jan. 27, 2026

TSLA 0.00%↑ #BYDDY

BYD reportedly weighs India expansion as hundreds of car orders pile up

BYD Co. (BYDDY) (BYDDF) is said to be weighing options to expand in India, including local assembly to meet surging demand for the Chinese automaker’s electric vehicles.

The company is evaluating some form of local assembly in India and working on obtaining local safety and regulatory certifications for more models because of import quotas, Bloomberg News reported, citing people familiar with the matter.

Though India previously rejected BYD’s (BYDDY) plans to build a full assembly plant in the country, the Chinese company is considering putting together semi-assembled parts—which would be cheaper and easier to clear in terms of regulatory approvals, the report said.

Any manufacturing move would follow a visit by senior BYD executives.

Strong demand is leading the automaker to reconsider how it can bring more vehicles into the country, sources said, noting that dealers are holding hundreds of customer bookings. This stands in stark contrast to Tesla (TSLA), which has been rolling out discounts on select models to spur sales in India.

Link to Seeking Alpha News Article - Jan. 27, 2026

Nextpower raises FY2026 outlook to $3.5B revenue and $4.36 EPS with $500M buyback as JV, product innovation drive growth

CEO Daniel Shugar noted, “Q3 revenue grew 34% year-on-year to $909 million, and adjusted EBITDA increased 15% to $214 million.” He announced the completion of the Nextpower Arabia joint venture with Abunayyan Holding, which will supply 2.25 gigawatts of tracking systems to a major solar project and support local manufacturing for up to 12 gigawatts of solar capacity annually.

Shugar also emphasized the company’s new investment-grade rating.

“U.S. bookings were up and revenue increased 63% year-over-year.” President Howard Wenger noted international expansion with “record quarterly bookings and expansion into 2 new countries” in Europe.

Wenger also noted increasing non-tracker impact on U.S. revenue mix, but did not provide specific figures.

Praneeth Satish, Wells Fargo: Asked about permit freeze effects and project pipeline. CEO Shugar and Wenger emphasized that “several projects that are on federal lands...are now moving forward” and that developers are navigating constraints with favorable project velocity.

CFO Charles Boynton confirmed the buyback will start “slow and cautious” but be “more of a formalized program.”

Nextpower (NXT) raised guidance for FY 2026 adjusted EPS to $4.26-$4.36 from its prior outlook of $4.04-$4.25 and ahead of $4.25 FactSet consensus, revenues to $3.43B-$3.5B from $3.28B-$3.48B previously and in line with $3.45B FactSet consensus, and adjusted EBITDA to $810M-$830M from $775M-$815M.

Link to Seeking Alpha News Article - Jan. 28, 2026

Link to Seeking Alpha News Article - Jan. 28, 2026

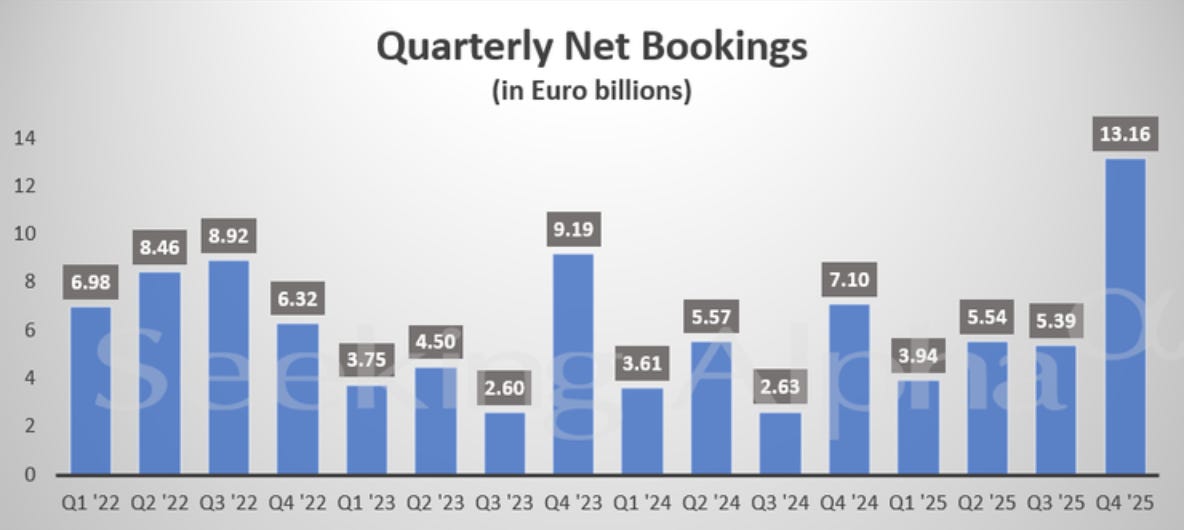

[Newsletter Exclusive] ASML in charts: Q4 total sales +5% Y/Y, net bookings surge 144.2% Q/Q to €13.16B

ASML reported net bookings of about €13.2B in the fourth quarter, beating an average estimate of €6.85B by analysts, Bloomberg News reported. Net bookings for EUV machines were €7.4B.

“It was a record quarter in terms of revenue. It was a record quarter in terms of order intake. It was a record quarter in terms of free cash flow generation,” said ASML’s CFO Roger Dassen.

Fouquet noted that the market outlook has notably improved in the last few months.

“This is especially true when it comes to the build-up of the capacity for AI applications, being data centers or other infrastructure. Now, we start to see that this build-up is also translating into need for capacity at our advanced customers. This is true for Logic. This is true for DRAM. This starts to translate also into orders for our most advanced technology, especially EUV,” Fouquet added.

Fouquet added that “AI accelerators are migrating from the 4-nanometer node to the more litho-intensive 3-nanometer node” and customers are ramping the 2-nanometer node for next-generation HPC and mobile applications.

China accounted for 36% of the total net system sales of about €7.58B in the fourth quarter of 2025 (down from 42% in the third quarter of 2025), followed by South Korea at 22% and the U.S. at 17%. Taiwan accounted for 13% of shipments of total net system sales (down from 30% in the third quarter of 2025).

Link to Seeking Alpha News Article - Jan. 28, 2026

Link to Seeking Alpha News Article - Jan. 28, 2026

Link to Seeking Alpha News Article - Jan. 28, 2026

China said to greenlight first batch of Nvidia H200 chip imports

ByteDance (BDNCE), Alibaba (BABA) and Tencent (TCEHY) have been cleared to buy over 400,000 H200 chips in total.

Other Chinese companies are reportedly joining a queue for subsequent approvals, but it’s unclear how many will be permitted to buy H200 chips.

Chinese tech firms placed orders for over 2M H200 chips, far exceeding Nvidia’s (NVDA) available inventory, Reuters reported last month.

“I’m hoping the Chinese government will allow Nvidia to sell the H200,” Nvidia CEO Jensen Huang told reporters in Taipei on Thursday. “It’s up to the Chinese government now. They are still deciding, and we are waiting patiently.”

Reuters reported on Friday that China has approved its key AI startup, DeepSeek (DEEPSEEK), to buy Nvidia’s (NVDA) H200 artificial intelligence chips, although the final regulatory conditions are still being finalized, citing two sources.

Link to Seeking Alpha News Article - Jan. 28, 2026

Link to Seeking Alpha News Article - Jan. 29, 2026

Link to Seeking Alpha News Article - Jan. 30, 2026

[Newsletter Exclusive] GE Vernova beats top-line and bottom-line estimates; updates FY26 outlook

CEO Scott Strazik highlighted “very strong new gas contracts with an incremental 6 gigawatts signed in the last 3 weeks of December, for a total of 24 gigawatts of new contracts in 4Q ‘25 alone.” He also noted the Electrification segment “had its largest order quarter in its history and Wind had its largest order quarter of ‘25.”

Strazik reported increase in “total backlog by over 25% or $31 billion to $150 billion with robust profitable order growth in Power and Electrification,” and detailed that gas power equipment backlog “increased from 62 to 83 gigawatts sequentially,” with expectations to “reach approximately 100 gigawatts under contract in ‘26.”

Electrification segment backlog rose “to $35 billion, up $4 billion sequentially and $11 billion year-over-year,” while Wind “received approximately $3 billion of orders in 4Q, the largest of the year for the segment.”

Strazik said on the call that GE Vernova (GEV) had signed more than $2B of electrification orders directly tied to data centers in 2025.

While the wind segment “continues to generate losses, and equipment bookings suggest ongoing losses, we believe it is notable that bookings have started to grow on non-U.S. business, which should give the company opportunities to improve margins,” Oppenheimer analyst Colin Rusch said in a note.

Q4 GAAP EPS of $13.39 beats by $10.26. Revenue of $10.96B (+3.8% Y/Y) beats by $740M, +2% organically* with services growth in each segment.

Orders of $22.2B, +65% organically with growth in all segments.

GE Vernova is increasing its 2026 financial guidance and outlook by 2028, which now includes the Prolec GE acquisition.

For 2026, GE Vernova now expects revenue of $44-$45 billion vs. $41.85B consensus, up from $41-$42 billion, adjusted EBITDA margin* of 11%-13%, and free cash flow* of $5.0-$5.5 billion, up from $4.5-$5.0 billion.

Link to Seeking Alpha News Article - Jan. 28, 2026

Link to Seeking Alpha News Article - Jan. 28, 2026

Link to Seeking Alpha News Article - Jan. 28, 2026

[Newsletter Exclusive] Celestica rises as BofA starts with Buy rating ahead of earnings

“We think this leading provider of white-box switches will be a beneficiary of an AI-driven upgrade boom for high-speed data center switches, and strong growth in custom ASIC accelerated servers,” Bank of America analysts wrote in a note to clients. “CLS has consistently maintained first-mover advantage in 400G, 800G and 1.6T switching, and we expect continued market share gains. F27 should be a strong year with many new programs ramping. We are above Street on F27 earnings and see upside to consensus estimates.”

In addition to the Buy rating, Bank of America put a $400 price target on Celestica. The analysts said they believe the stock is “still undervalued,” despite the sharp run in the last year, as earnings could grow at a 47% annual rate through 2027.

The company may also benefit from OpenAI’s (OPENAI) deal with Broadcom (AVGO) to deploy 10 gigawatts of OpenAI-designed AI accelerators, the analysts said. “This project allows Celestica to showcase its full-suite of ODM capabilities in design, manufacturing, orchestration and deployment. We expect it will drive multi-billion dollars of revenue for CLS in 2027 and beyond.”

Link to Seeking Alpha News Article - Jan. 28, 2026

[Newsletter Exclusive] SoundHound AI announces partnership expansion with Five Guys

The developer of independent voice artificial intelligence (AI) solutions said its voice AI technology is trained on Five Guys’ extensive menu and is designed to understand natural human speech, allowing customers to place orders by speaking normally, just as they would to another person.

SoundHound AI said the renewal highlights the strength of the collaboration, as its AI-powered ordering agents have already supported Five Guys in processing well over a million customer AI interactions to date.

Link to Seeking Alpha News Article - Jan. 28, 2026

LLY 0.00%↑ #SeamlessTherapeutics

Eli Lilly inks a gene-editing deal worth up to $1.12B with Seamless

Privately owned biotech firm Seamless Therapeutics on Wednesday announced a global research and licensing deal worth up to $1.12B with Eli Lilly (LLY) to develop treatments for hearing loss conditions based on its gene editing platform.

As part of the deal, Seamless will focus on developing recombinases, a group of enzymes designed to enable therapeutic editing in certain genes related to hearing loss.

Indiana-based Lilly (LLY) will obtain an exclusive license to the recombinases programmed by the company, which it will then advance through drug development and commercialization.

Per the terms, the Dresden, Germany-based biotech will receive over $1.12B from LLY, including potential development and commercial milestone payments in addition to tiered royalties on commercialized products.

Link to Seeking Alpha News Article - Jan. 28, 2026

NVDA 0.00%↑ #SKHynix

[Newsletter Exclusive] SK hynix secures 70% of Nvidia’s HBM orders for Vera Rubin: report

The South Korean memory maker SK hynix (HXSC.F) has secured about 70% of Nvidia’s (NVDA) high-bandwidth memory orders for the Vera Rubin, its latest computing platform for artificial intelligence and high-performance computing applications, according to Yonhap News Agency.

The 70% allocation to SK hynix for HBM4 is more than the earlier market estimate of 50%, the report said, citing sources familiar with the situation. SK hynix is expected to account for 54% of the global HBM4 market in 2026, followed by Samsung (SSNLF) at 28% and Micron (MU) at 18%. Nvidia and AMD (AMD) have also completed quality testing with Samsung’s HBM4 products.

Link to Seeking Alpha News Article - Jan. 28, 2026

GLD 0.00%↑ SLV 0.00%↑ UUP 0.00%↑

[Newsletter Exclusive] Dollar weakness is a big tailwind for commodities – analyst

In an interview with CNBC, Amy Gower, Metals and Mining strategist at Morgan Stanley explained that because commodities are priced in dollars but most demand originates outside the U.S., a weaker greenback benefits buyers globally.

Gower cited multiple macro tailwinds converging at once: an ongoing rate-cutting cycle that benefits non-yielding assets, strong investor appetite for real assets driven by concerns about fiat currency debasement, and demand related to AI infrastructure buildout.

Central bank demand continues to provide structural support for gold prices (XAUUSD:CUR). Gower noted a significant pivot in how some central banks are approaching their gold reserves, pointing to Poland—the largest buyer last year—which has shifted from targeting gold as a percentage of total reserves to targeting a specific tonnage of 700 tons, up from about 550 currently.

“If they’re now thinking in tonnage terms, that’s telling you maybe price is becoming a bit less important, and we might see this structural bid sort of regardless,” she explained, adding that new buyers like Brazil have recently entered the market in significant size.

She emphasized gold’s role as a safe haven asset, particularly when compared to Bitcoin’s (BTC-USD) performance during periods of uncertainty.

“It’s one way you do have a bit more of that structural demand,” Gower said, noting that its protective performance during periods of geopolitical risk tends to become self-reinforcing.

Supply-side constraints could keep prices elevated, according to Gower. While mine economics are favorable at current prices and capital expenditure is increasing, the long development timeline for new mines means production responses will lag significantly.

For silver, the supply picture is even more challenging, as roughly 70% of silver production comes as a byproduct from mining other metals like zinc, lead, and copper.

Additionally, silver’s cost share in solar panel production has surged from 3% to 30%, creating a potential demand destruction risk.

Link to Seeking Alpha News Article - Jan. 28, 2026

UBER 0.00%↑ #Waabi

[Newsletter Exclusive] Waabi raises $1B in capital as it expands to robotaxis

Autonomous trucking startup Waabi has raised $1B in a new round of venture funding to expand into the robotaxi market. The Series C round was led by Khosla Ventures and G2 Venture Partners.

Waabi has an exclusive deal with Uber Technologies (UBER) to deploy robotaxis powered by Waabi Driver on the Uber ride-hailing platform. “Partnering with Uber to deploy 25,000 or more Waabi Driver-powered robotaxis on the Uber platform, substantially accelerating the adoption of robotaxis at scale,” updated Ron.

Looking ahead, Waabi plans to work to line up deals for manufacturers to produce new trucks equipped with the company’s self-driving technology.

Notable investors in Waabi include Uber (UBER), Khosla Ventures, Nvidia (NVDA), Volvo Group Venture Capital, and Porsche Automobil Holding SE (POAHY).

Link to Seeking Alpha News Article - Jan. 28, 2026

Ondas says Optimus drone had been granted Blue List Status by DCMA

Ondas (ONDS) on Wednesday said its Optimus drone, provided by subsidiary, American Robotics, has been granted Blue List status by the Defense Contract Management Agency (DCMA).

The Blue List identifies unmanned aerial systems that meet the Department of War’s standards for cybersecurity, supply-chain integrity, and operational reliability. Inclusion on the Blue List confirms that the Optimus drone satisfies these requirements for defense and government procurement.

Link to Seeking Alpha News Article - Jan. 28, 2026

GOOGL 0.00%↑ #RedwoodMaterials

[Newsletter Exclusive] Google joins energy storage firm Redwood Materials’ $425M funding round as new investor

Google (GOOG) (GOOGL) has participated in a funding round for Redwood Materials, a privately held company that produces metals for energy storage batteries, manufactures key components for them, and deploys solutions critical for keeping data centers and electric grids operational.

The U.S. tech giant joined the Series E funding round for Redwood as a new investor, alongside existing investors, Capricorn and Goldman Sachs Alternatives. Redwood closed the capital raise round at $425M.

Link to Seeking Alpha News Article - Jan. 28, 2026

Needham thinks Vertical Aerospace could soar off eVTOL developments

“We continued to see EVTL as undervalued by an order of magnitude within the eVTOL space, with piloted transition flight, an imminent catalyst based on company commentary and press releases as a hard catalyst to begin to help close the gap,” wrote Needham analyst Chris Pierce. “We understand investor patience has been fraying modestly as time has passed, but, with EVTL potentially set to join JOBY as the only eVTOL company having proven their aircraft can fly a full mission profile, we see a bullish risk/reward skew given the market cap disparities,” he added.

Last week, Vertical Aerospace (EVTL) brought its full-scale Valo electric air taxi to New York City as part of its U.S. debut, using the city as a proving ground for future urban eVTOL operations. The aircraft was displayed at the Classic Car Club Manhattan on Pier 76, where investors, partners, and the public could walk around the full-scale mockup, experience the cabin, and learn about its planned performance and safety standards. The event focused on showcasing Valo’s design—a four-seat (expandable to six) zero-operating-emissions aircraft targeting about 100 miles of range and 150 mph cruise speed. The company also outlined prospective use cases such as airport transfers, cross-city hops, trips to leisure destinations like the Hamptons, sightseeing, and potential emergency medical services.

Link to Seeking Alpha News Article - Jan. 28, 2026

Energy Fuels leads nuclear names higher as DoE launches steps to boost nuke fuel supply chain

Energy Fuels (UUUU) leads a rally in nuclear technology stocks Wednesday, +14.2% to its highest in nearly 15 years, as the Department of Energy unveiled an initiative to build out the U.S. nuclear fuel supply chain.

The DoE said it is seeking input from U.S. states on any interest they have in hosting sites for developing the nuclear fuel lifecycle, which includes storing nuclear waste and spent fuel reprocessing.

The sites, called Nuclear Lifecycle Innovation Campuses, could offer federal support for deployment of advanced nuclear reactors and co-located data centers, which also could enrich uranium, the agency said.

Among other nuclear tech and uranium names: Oklo (OKLO) +10.6%, Denison Mines (DNN) +9.3%, NexGen Energy (NXE) +9.1%, Centrus Energy (LEU) +7.9%, Nuscale Power (SMR) +6.4%, Cameco (CCJ) +6.1%, Uranium Energy (UEC) +5.2%, Lightbridge (LTBR) +3.9%, Ur-Energy (URG) +3.3%.

Roth noted the spot uranium price has finally broken through $80/lb with some velocity, and the firm continues to anticipate the spot price reaching $100/lb by mid-2026 with the potential for significant upside beyond $100, although this may hinge on the discipline of holders of uranium stockpiles.

Link to Seeking Alpha News Article - Jan. 28, 2026

Rare earth stocks slide as Trump administration backs off critical mineral price floors - Reuters

The Trump administration is stepping back from plans to guarantee a minimum price for U.S. critical minerals projects, Reuters reported late Wednesday, sending shares of rare earth companies sharply lower after-hours.

The shift, which comes as a U.S. Senate committee is reviewing a price floor extended last year to MP Materials (MP), would mark a reversal from commitments made to industry by U.S. officials; the shift would guide future deals and would not affect MP’s price floor, according to the report.

Link to Seeking Alpha News Article - Jan. 28, 2026

[Newsletter Exclusive] Caterpillar sees Double-digit growth across segments and regions in Q4; Asia Pacific flat

CEO Joseph Creed highlighted that “our Centennial year marked a significant milestone, and we achieved full year sales and revenues of $67.6 billion, the highest in Caterpillar’s history.” Creed emphasized robust MP&E free cash flow of $9.5 billion, deployment of $7.9 billion to shareholders, and a record backlog of $51 billion, up 71% year-over-year. Approximately 62% of the backlog is expected to be delivered in the next 12 months.

He stated that “sales and revenues were $19.1 billion, an all-time record for a single quarter,” with an 18% increase versus the previous year, driven by higher volumes across all segments. Volume growth was especially notable in Power and Energy, where sales to users rose 37% and power generation grew 44%.

Creed noted that the company ended 2025 with 827 autonomous haul trucks, up from 690 in 2024, and that power generation sales exceeded $10 billion, growing over 30% year-over-year.

Asked about the battery energy storage mix in the AIP order. Creed said, “most of that order is going to be in generators and natural gas generators,” with batteries a small portion.

Charles Albert Dillard, Bernstein: Asked if Power & Energy revenue momentum could continue at 2025’s 30% growth rate. Creed emphasized, “it’s not a demand issue for us. It’s really going to be, can we bring on supply faster.”

Creed said, “solar had a record year in 2025. We expect something comparable in 2026.”

Caterpillar Inc. (CAT) said power and energy sales climbed 23% to $9.4 billion. Within that segment, power generation revenue jumped 44% to $3.24 billion, driven by higher sales of large reciprocating engines that the company said were primarily tied to data-center applications. The segment also benefited from higher turbine and turbine-related services sales, along with gains in oil and gas.

Link to Seeking Alpha News Article - Jan. 29, 2026

Link to Seeking Alpha News Article - Jan. 29, 2026

Link to Seeking Alpha News Article - Jan. 29, 2026

Microsoft delivers strong Q2, but surging capex, in-line Azure growth prompts pullback: analysts

“While Azure growth at these levels remains impressive and continues to suggest market share gains, capex rose 66% year over year, and investors are increasingly looking for clearer evidence that this elevated investment is translating into incremental Azure acceleration,” said Evercore analysts, led by Kirk Materne, in a Thursday investor note.

“Additionally, despite Microsoft reporting approximately $345bn in backlog (+28% y/y) from customers excluding OpenAI (OPENAI), ongoing concerns around OpenAI’s funding outlook and Microsoft’s exposure continue to represent a modest overhang,” Materne noted. “We believe this concern should diminish over time, but it remains a headwind today.”

“MSFT’s AI footprint and cloud growth remain underappreciated, in our view, and we would be buyers on the pullback” said RBC analysts, led by Rishi Jaluria, in a note.

“The company’s ability to exceed targets in this supply-constrained environment will largely be dictated by the pace of capacity build-outs, which may have less variability than investors imagined,” said Morgan Stanley analysts, led by Keith Weiss, in a note.

Link to Seeking Alpha News Article - Jan. 29, 2026

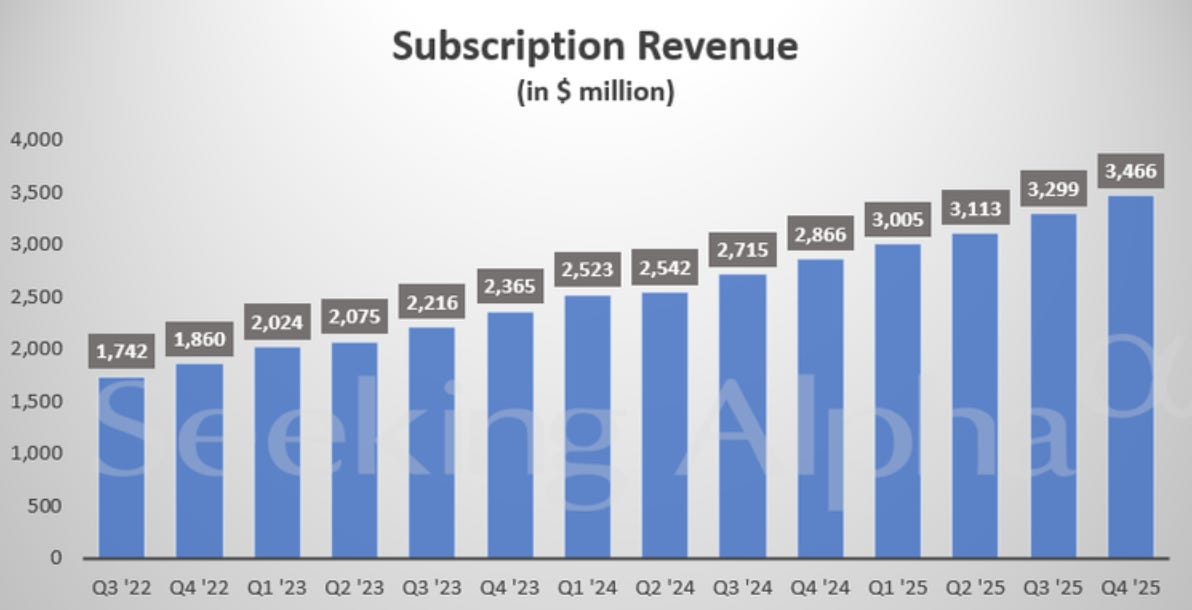

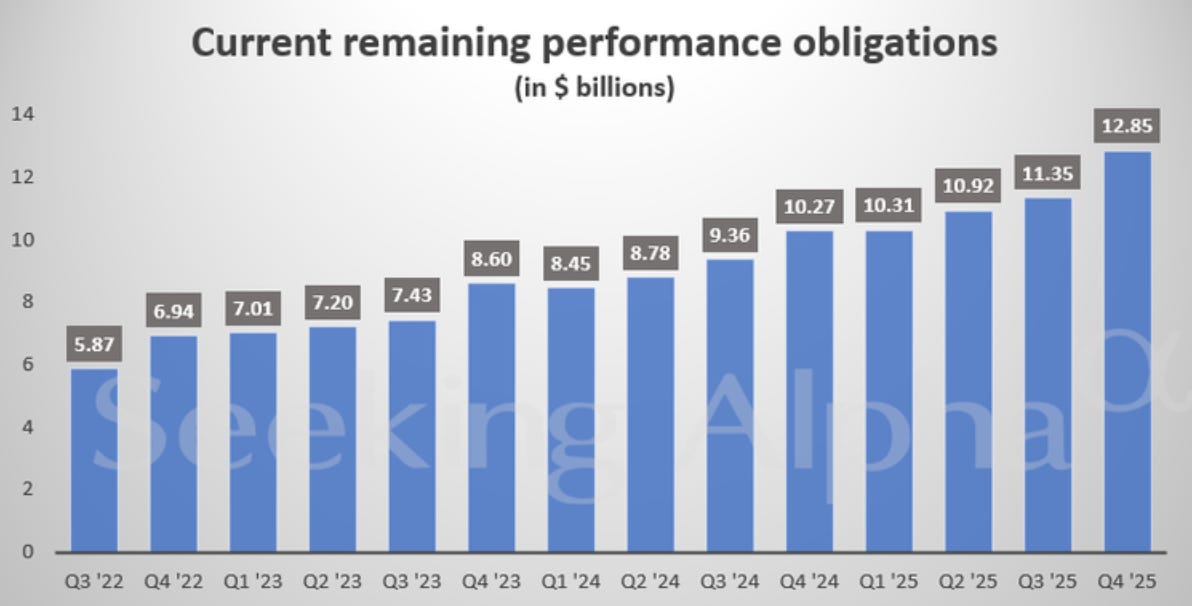

ServiceNow shows enterprise software thrives with AI, but acceleration concerns prompt drop

“AI products reached $600MM ACV, which bested their $500MM guide and our model as it continued to demonstrate the fastest rate of adoption for a new feature,” said analysts Peter Weed and Luwei Yang with Bernstein Société Générale Group in a Thursday investor note said. “This isn’t just new customers, as they saw 70%+ upsell expansion at renewal for current adopters.”

“We continue to believe they will handily beat their $1B ACV guide for FY26, reaching closer to $1.2B if our modeled rollout continues,” he added.

Similarly, Wells Fargo noted that ServiceNow’s fourth quarter federal-related revenue remained in line despite the extended U.S. government shutdown from October 1 through November 12, which was the longest in history.

“ServiceNow has an attractive financial profile with 2026 revenue growth plus free cash flow margin expected to hit 57%, up from 55% in 2025,” said Citizens’ analysts, led by Patrick Walravens, in a Thursday note.

“The speculation that AI will eat software companies is out there,” CEO Bill McDermott said. “Let’s clear it up with the facts. Enterprise AI will be the largest driver of return on the multitrillion-dollar supercycle of investment in AI infrastructure. The real payoff comes when trillions of tokens move beyond pilots to be embedded directly into the workflows where business decisions are made.”

“AI doesn’t replace enterprise orchestration,” he added. “It depends on it”.

Link to Seeking Alpha News Article - Jan. 29, 2026

Link to Seeking Alpha News Article - Jan. 28, 2026

AIQ 0.00%↑ NOW 0.00%↑ CRM 0.00%↑

[Newsletter Exclusive] AI could replace white-collar jobs, and other implications of the AI impact – Constellation Research

Constellation Research founder and chairman Ray Wang noted that while OpenAI (OPENAI) serves as the “big broad player,” Anthropic’s Claude is “winning on the coding round,” and Google’s Gemini has made significant gains across the stack.

He added that Anthropic is currently “more enterprise than most of the other LM players” because being enterprise-ready requires having “an enterprise sales team,” a trustworthy roadmap, and solid customer service in place.

Wang endorsed Anthropic CEO Dario Amodei’s recent assessment that AI poses significant risks to white-collar employment.

“Some of these jobs in the white-collar areas are going to go away because they’re summarization jobs,” Wang said, explaining that AI can quickly handle the work of distilling information and generating insights.

Meanwhile, he predicted a shift toward blue-collar trades like plumbing and master electricians, driven by massive investments in data centers, energy infrastructure, and reshoring factories.

For investors, Wang sees opportunity in traditional software companies making the transition to AI. He argued that companies like ServiceNow (NOW) and Salesforce (CRM) are “undervalued” because they’re “being treated like SaaS companies” when in fact “these companies are basically AI companies now.”

Wang suggested ServiceNow (NOW) in particular, trading around $118, should be valued much higher given its fundamentals.

Link to Seeking Alpha News Article - Jan. 29, 2026

#SIEGY #SMAWF

[Newsletter Exclusive] Siemens overtakes SAP as Germany’s most valuable company after software selloff

Investors have been increasingly optimistic about Siemens’ (SIEGY) (SMAWF) exposure to AI-driven infrastructure spending, particularly through its energy business, which is expected to benefit from rising demand for power and equipment at data centers.

Siemens’ (SIEGY) (SMAWF) automation division is also viewed as well positioned to gain from wider adoption of artificial intelligence. The stock received an additional boost after Swiss rival ABB (ABBNY) (ABBV) projected stronger profitability, reinforcing positive sentiment toward the industrial automation sector.

Link to Seeking Alpha News Article - Jan. 29, 2026

AAPL 0.00%↑ #QAI

Apple buys Israeli startup Q.AI for about $2B - FT

Patents filed by Q.AI indicate its technology being used in headphones or glasses, using “facial skin micro movements,” to communicate without talking, according to a Financial Times report on Thursday, which cited people familiar with the matter.

Johny Srouji, Apple’s senior vice-president of hardware technologies, said Q.AI is “a remarkable company that is pioneering new and creative ways to use imaging and machine learning,” according to the report.

The acquisition is designed to help Apple (AAPL) narrow its gap with Meta (META), Google (GOOGL) and OpenAI (OPENAI) in the race to create new kinds of wearable devices that speak to AI.

Link to Seeking Alpha News Article - Jan. 29, 2026

[Newsletter Exclusive] Trump Wants Interest Rates to be Near 0.5%-0.75%

“We’re paying far too much interest in the Fed — the fed rate’s too high, unacceptably high… We should have the lowest interest rate of anywhere in the world,” Trump said.

He believes that it should be two points, “and even three points” lower than where it is today, he said. Reducing the federal funds rate target range by three percentage points would bring it down to 0.5%-0.75%.

“Each point is the equivalent of, I would say, $500B,” he said, likely referring to the lower interest the U.S. would pay on its debt. “So if you have two points, then you have a trillion dollars in savings.”

“It’s so easy to do, but we have a guy who doesn’t want to do it, because I think he’s politically biased,” Trump said.

The Fed’s mandate from Congress is to conduct monetary policy to maintain price stability and full employment. Fed Chair Jerome Powell has consistently maintained that political considerations aren’t part of the decision-making process.

With the help of the Fed, “we could hit numbers that we’ve never hit before — we could hit eight, nine, ten (percent),” he said, referring to GDP growth. “There’s no reason why not.”

“Growth is a great thing. It doesn’t mean inflation,” Trump said. “If inflation comes, we’ll take care of it when it comes.”

Link to Seeking Alpha News Article - Jan. 29, 2026

First Solar sinks as BMO downgrades, saying Tesla’s potential plans may hit sentiment

BMO analyst Ameet Thakkar said he initially dismissed as “aspirational” last week’s remarks by Tesla CEO Elon Musk in Davos around potentially building a significant vertically integrated solar PV module manufacturing base to self-generate, but his comments during Tesla’s earnings call this week indicate that “this is likely to become a bona fide effort in the next few quarters and may be an overhang on FSLR shares for some time.”

The timing, cadence and ultimately how much excess solar module capacity Tesla will have to sell to entities serving load outside of the company’s facilities remain uncertain, but “Tesla’s proven track record to quickly scale up large amounts of clean energy manufacturing (i.e., ESS, inverters) capacity in the U.S. increases the risk to FSLR’s competitive positioning,” Thakkar wrote.

Even if a portion of Tesla’s planned 100 GW manufacturing capacity is available for third parties, it could negatively affect long-term module pricing or at least will be viewed as a potential overhang on First Solar (FSLR) shares, according to Thakkar.

Link to Seeking Alpha News Article - Jan. 29, 2026

Nubank gets OCC approval for U.S. bank charter

Brazilian digital bank Nubank (NU) has won approval from the Office of the Comptroller of the Currency to establish a de novo U.S. bank, it said on Thursday.

The company applied in September for the national bank charter, seeking to operate under a comprehensive federal framework and facilitate the launch of deposit accounts, credit cards, lending and digital asset custody.

With the approval, Nu (NU) is now in the bank organization phase, in which Nu will focus on fully capitalizing the institution within 12 months and opening the bank within 18 months.

Link to Seeking Alpha News Article - Jan. 29, 2026

NVDA 0.00%↑ UBER 0.00%↑ #MBGAF

Mercedes, Nvidia, and Uber to partner on large-scale commercial robotaxi deployment

The global collaboration will use Mercedes’ (MGAF) new S-Class, Nvidia’s (NVDA) autonomous driving hardware and software stack, and Uber’s (UBER) ride-hailing network to offer driverless rides in major markets.

The robotaxi service will run on Mercedes-Benz’s (MBGAF) MB.OS operating system, allowing Nvidia (NVDA) and other partners to layer high-level automated driving applications on top while the German automaker keeps control of core vehicle software and integration.

Nvidia (NVDA) will supply its DRIVE Hyperion architecture, Alpamayo AI driving models, and simulation and safety tools to deliver level 4-capable autonomy.

Uber (UBER) will provide the marketplace for the robotaxis via its existing platform.

Link to Seeking Alpha News Article - Jan. 29, 2026

MP 0.00%↑ USAR 0.00%↑ CRML 0.00%↑

[Newsletter Exclusive] U.S. to discuss rare earth price mechanism with allies next week - report

In an interview on Thursday, US Under Secretary of State for Economic Affairs Jacob Helberg said he expects a lot of “momentum and excitement” toward “agreeing on a pricing mechanism that we can all coordinate together on in order to ensure price stability for people in the mineral refining and extraction business.”

The move follows a late-Wednesday selloff in rare earth stocks after Reuters reported that the Trump administration had stepped back from plans to guarantee minimum prices for U.S. critical minerals projects.

U.S. mining and processing companies have pushed for price floors and other government backstops to help them compete with China, whose state-backed producers can cut prices to punish rivals, undercut projects, and deter private investment.

Link to Seeking Alpha News Article - Jan. 29, 2026

[Newsletter Exclusive] Trump names Kevin Warsh as pick for Federal Reserve chair

Warsh, if confirmed, would become the 17th Fed chair. He served as the Fed governor from February 2006 to March 2011.

TS Lombard economist Dario Perkins is pushing back on the idea that Kevin Warsh, President Trump’s reported pick to lead the Federal Reserve, would bring a distinctly hawkish turn to U.S. monetary policy.

Warsh’s reputation as a hardliner was forged during his tenure as a Fed governor in the early 2010s, when he emerged as one of the most vocal critics of quantitative easing. He argued that large-scale asset purchases warped financial markets, exacerbated inequality, and risked long-term currency debasement and inflation. His opposition was so strong that he ultimately stepped away from the Federal Open Market Committee, cementing his image as a “hard money” traditionalist.

But Perkins argues that the label no longer fits. In his view, Warsh’s past stance reflected the political and economic climate of that era more than a fixed ideological commitment. While Warsh remains deeply skeptical of QE, Perkins notes that his broader outlook has shifted markedly.

Over the past year, Warsh has consistently downplayed short-term inflation concerns and expressed little faith in traditional data-driven policymaking. Instead, he has emphasized the prospect of a powerful productivity-driven disinflationary boom, suggesting inflation pressures will fade regardless of near-term readings.

That mindset, Perkins contends, makes Warsh far less of a conventional hawk—and more of a policy opportunist shaped by long-run optimism rather than tight-money discipline.

Link to Seeking Alpha News Article - Jan. 30, 2026

Link to Seeking Alpha News Article - Jan. 30, 2026

AMD dips on report that MI450 faces delays, but Wells Fargo refutes

AMD (AMD) shares had dipped 4% by late morning market action on Friday, possibly due to a report from SemiAnalysis that said the chipmaker might suffer from production delays in its next-generation MI450-series artificial intelligence accelerators.

However, Wells Fargo issued a note with high confidence that AMD’s MI450 was, in fact, not facing any delays, and they expect it to begin ramping up during the second half of 2026.

“Our checks suggest AMD’s progression on TSMC’s N2 (2nm) process is on track (already taped-out; Venice EPYC samples have shipped — same process node used in MI450-series),” said Wells Fargo analysts, led by Aaron Rakers. “We expect AMD to reaffirm its confidence in MI450-series ramp commencing in 2H26 [reiterate volume weighted toward 4Q26 w/ OpenAI (OPENAI), Oracle (ORCL), & others].”

Link to Seeking Alpha News Article - Jan. 30, 2026

GOOG 0.00%↑ U 0.00%↑ APP 0.00%↑

Video game stocks nosedive as Google’s ‘Project Genie’ allows virtual world creation

Video game stocks are plummeting in Friday’s afternoon trading session after tech giant Google (GOOG) (GOOGL) announced “Project Genie,” an experimental research prototype that allows users to create virtual worlds and interact with them.

Names like Unity Software (U) -21.6%, AppLovin (APP) -13.2%, Roblox (RBLX) -12.3%, and Take-Two (TTWO) -9% are getting hit the hardest.

“Even in this early form, trusted testers were able to create an impressive range of fascinating worlds and experiences and uncovered entirely new ways to use it,” Google said in a blog post.

Google said that it has rolled out the “Project Genie” prototype for its AI Ultra subscribers in the U.S.

Analysts at Wells Fargo pointed out that Unity’s engine was used as a training platform for the Genie model and that Unity’s relationship with Google’s DeepMind lab dates back to at least 2020.

Unity CEO Matthew Bromberg earlier in the day took to social media platform X to clarify that he views the announcement not as a risk but as a “powerful accelerator” to create video games.

“Advances in large-scale ‘world models’—whether developed by partners like Google or others—materially expand the frontier of interactive content creation…their outputs remain probabilistic and non-deterministic, making them unsuitable on their own for games that require consistent, repeatable player experiences,” Bromberg said on X.

“Unity’s role is to operationalize these advances. Outputs from world models are ingested into Unity’s real-time engine, where they are converted into structured, deterministic, and fully controllable simulations. Within Unity, creators define physics, gameplay logic, networking, monetization, and live-operations systems to ensure consistent behavior across devices and sessions.”

Link to Seeking Alpha News Article - Jan. 30, 2026

GE Vernova raised to Buy at Guggenheim as market underestimates cash generation

GE Vernova (GEV) +0.8% in Friday’s trading as Guggenheim upgraded shares to Buy from Neutral with a $910 price target, believing the market still may be underestimating the company’s potential for cash generation and capital returns.

Guggenheim analyst Joseph Osha said he likes the potential for further upside relative to expectations at the free cash flow level and at the EBITDA margin level for the company’s electrification segment.

Wall Street has tended to underestimate GE Vernova’s (GEV) free cash flow, Osha said, noting the updated 2025-28 FCF target released by the company was $24B-plus, up from $22B previously, adding that GEV has substantially more ability to return capital than investors may appreciate, and the company could literally double buybacks between now and 2028 without drawing down cash.

Osha also believes GE Vernova’s (GEV) electrification segment revenues can reach ~$20B in 2028 without any capital additions beyond what is currently planned and has the potential to exit 2028 at an electrification EBITDA margin of ~25%.

Link to Seeking Alpha News Article - Jan. 30, 2026

YouTube:

[ Steve Eisman | The Weekly Wrap ] Silver Goes Crazy, United Healthcare is Falling, & AI’s CapEx is Exploding

In this episode of The Weekly Wrap, Steve Eisman breaks down the recent chaos surrounding silver and how it’s been impacted by China’s new export ban. He also discusses the collapse of UnitedHealthcare, the explosive AI CapEx forecasts from Meta and Microsoft, and much more.

Link to Full Video (23:54 Minute) - Jan 31, 2026

Charts & Technicals:

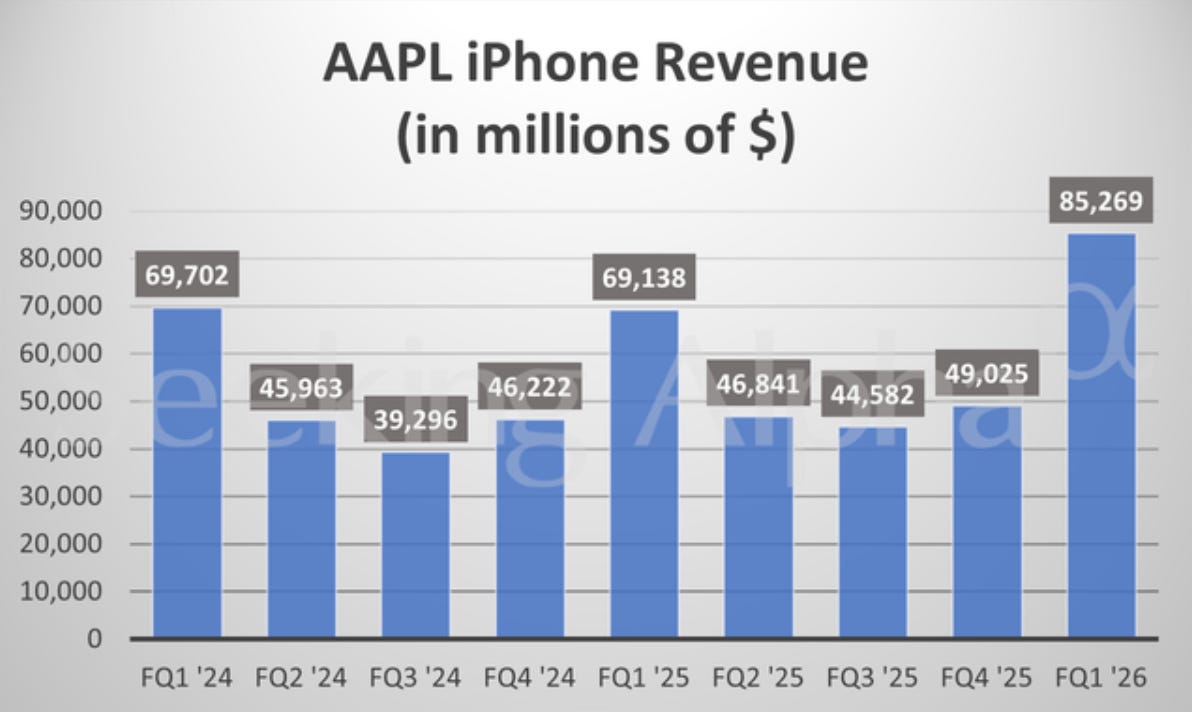

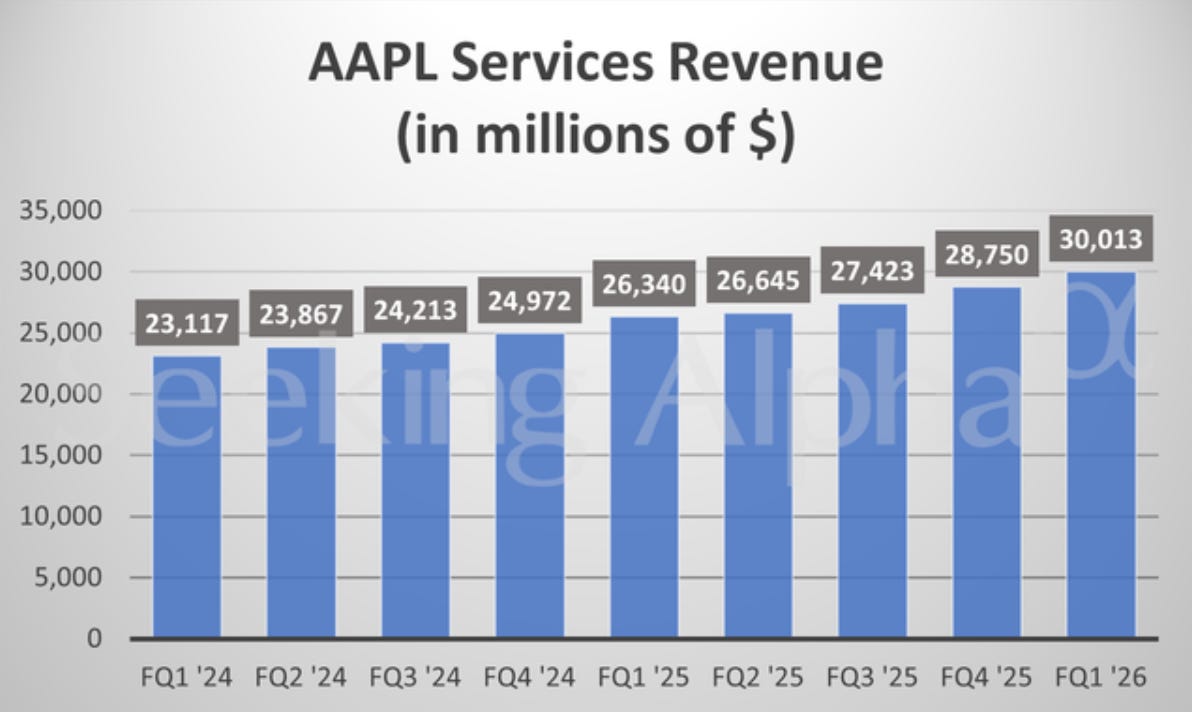

Apple in charts: Record quarterly revenue for iPhone, services

Link to Seeking Alpha News Article - Jan. 29, 2026

Disclosure: We own positions in some/all of the tickers mentioned in this article.