Alpha Coverage #149

AI, Robotics, Space, Quantum Computing, Climate Change/Energy Transition, Biotech/Genomics

Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve. WealthWise Coverage Universe (Only for paying subscribers).

A Seeking Alpha subscription would help. Here is a 7 Day Free Trial + $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist or Weekly Compilation.

Editor’s Pick:

TTE 0.00%↑ GOOG 0.00%↑ TAN 0.00%↑

[News] TotalEnergies signs long-term solar power deals to supply Google data centers in Texas

TotalEnergies (TTE) has signed two new long-term power purchase agreements to deliver 1 GW of solar capacity – equivalent to 28 TWh of renewable electricity over 15 years – to supply Google’s (GOOG) (GOOGL) data centers in Texas.

The power will be generated from TotalEnergies-owned sites currently under development in Texas: Wichita (805 MWp) and Mustang Creek (195 MWp), with construction scheduled to begin in Q2 2026.

Link to Seeking Alpha News Article - Feb. 09, 2026

#SpaceX

[News] SpaceX Pivots to focus on the moon

Tesla (TSLA) CEO Elon Musk said that his space transportation company SpaceX (SPACE) will focus on building a base on the moon before it attempts to send people to Mars.

“For those unaware, SpaceX has already shifted focus to building a self-growing city on the moon, as we can potentially achieve that in less than 10 years, whereas Mars would take 20+ years,” Musk wrote in a post on X.

“It is only possible to travel to Mars when the planets align every 26 months (six-month trip time), whereas we can launch to the Moon every 10 days (2 day trip time). This means we can iterate much faster to complete a Moon city than a Mars city,” Musk continued.

“That said, SpaceX will also strive to build a Mars city and begin doing so in about 5 to 7 years, but the overriding priority is securing the future of civilization, and the Moon is faster,” Musk added.

Link to Seeking Alpha News Article - Feb. 09, 2026

[News] Amazon takes 5.3% stake in BETA Technologies, driving shares higher

Shares of BETA Technologies (BETA) surged in after-hours trading Tuesday following an SEC filing that revealed Amazon (AMZN) has secured a 5.3% stake in the electric aviation firm.

The filing confirms that Amazon beneficially owns 11,753,896 shares of BETA’s Class A common stock. These shares are held of record by Amazon.com NV Investment Holdings LLC (NV Holdings), a wholly owned subsidiary that Amazon utilizes as its primary vehicle for managing strategic investments.

While NV Holdings is the legal entity listed on the paperwork, the filing clarifies that Amazon retains sole voting and investment power over the position.

Link to Seeking Alpha News Article - Feb. 11, 2026

[News] Trump Invokes Defense Production Act to Prop Up Coal Power

On Wednesday, President Trump officially signed the executive order during a White House “Champion of Coal” event, formalizing the support for the industry.

Invoking Cold War-era authorities, the order mandates Defense Secretary Pete Hegseth to enter into long-term purchase agreements with coal-fired plants to power military operations.

The Department of Energy also officially announced $175 million in federal funding to modernize six specific coal-fired plants across West Virginia, Ohio, North Carolina, and Kentucky.

This financial injection is designed to retrofit aging facilities and extend their operational lifespans, reversing years of planned retirements.

Link to Seeking Alpha News Article - Feb. 12, 2026

WealthWise Research

#SpaceX

[News] Elon Musk Wants to Build an A.I. Satellite Factory on the Moon

Elon Musk told employees at xAI, his artificial intelligence company, on Tuesday evening that the company needed a factory on the moon to build A.I. satellites and a massive catapult to launch them into space.

Inspired by the billionaire’s love of science fiction, the space catapult would be called a mass driver, and would be part of an imagined lunar facility that manufactured satellites to provide the computing power for the company’s A.I.

“You have to go to the moon,” Mr. Musk said during an all-hands meeting, which was heard by The New York Times. The move would help xAI harness more power than other companies to build its A.I., he said.

“It’s difficult to imagine what an intelligence of that scale would think about, but it’s going to be incredibly exciting to see it happen,” he added.

Link to The New York Times Article - Feb. 11, 2026

APP 0.00%↑ META 0.00%↑ U 0.00%↑ GOOG 0.00%↑

[News] AppLovin drops over competitor concerns, but analysts highlight positive growth drivers

“On META, the company emphasized that Meta Audience Network has been a longtime bidder within APP’s ad supply and that incremental bidding activity on IDFA traffic is not new,” said Morgan Stanley analysts, led by Matthew Cost, in an investor note.

“Our main focus remains on the ecommerce ramp through 1H:26 and into the general launch of the web self-serve tool,” Cost added.

AppLovin CEO and co-founder Adam Foroughi directly addressed the competition narrative during the earnings call.

“As you know from our business over the last couple of years that you’ve been following, there have been numerous times where we’ve added more competition in the MAX auction,” he said. “Unity (U) has grown with Vector, Liftoff rolled out Cortex, and it’s growing really quickly. Moloco has been growing, and we turned them into a bidder in the last year. You had Google switch to bidding. Every time this has happened, there’s been this confusion around, well, in an auction dynamic-based system, competition should decay AppLovin’s edge. You’ve never seen that happen.”

“The reason is that, one, we’re really big and really good at what we do,” he added. “But two, every impression is not worth the same thing. Our model is exceptionally good at valuing the impression for what it is.”

Link to Seeking Alpha News Article - Feb. 12, 2026

[News] Waymo to launch AVs with its most advanced, 6th-generation driver

Alphabet’s Waymo (GOOG) (GOOGL) is raising the bar on autonomous driving with the launch of its most advanced driver technology, built to handle even more treacherous road conditions and accelerate the large-scale deployment of its AVs.

The 6th generation Waymo Driver was developed using data from nearly 200 million fully autonomous miles across the dense urban cores of more than 10 major cities and expanding network of freeways.

Through advancements in Waymo’s vision systems (lidar and radar) and external audio receivers (EARs), the 6th generation Waymo Driver now “operates at a level superior to human eyes and ears” that can pull critical details out of deep shadows while being hit with bright lights from high beams or emergency vehicles.

The 6th generation system also marks a major shift at the company’s AV factory in Metro, Phoenix, to allow for a “meaningful” scale towards its goal of tens of thousands of units per year.

Link to Seeking Alpha News Article - Feb. 12, 2026

TLT 0.00%↑ SPY 0.00%↑ UUP 0.00%↑

[News] Wall Street ended near even after the latest CPI report landed

On the economic front, the January Consumer Price Index came in at +0.2% M/M versus the +0.3% consensus and +0.3% prior readings. At the same time, core CPI (excludes food and energy) arrived at +0.3% M/M versus the +0.3% consensus and +0.2% prior level.

“Friday’s delayed CPI for January was muted and in-line with expectations and it won’t increase the likelihood of a rate cut within the next few months largely because of Wednesday’s blowout employment numbers, which threw ice cold water on any hopes of a near-term rate cut. The Fed is always in a tug of war between balancing inflation with employment, but they just can’t cut rates right now with the economy having just created a six-figure jobs number,” Skyler Weinand, chief investment officer, of Regan Capital said.

In the near term, however, policy is widely expected to remain on hold. According to the CME FedWatch Tool, markets assign roughly a 90% probability that the Federal Reserve will leave the target federal funds rate unchanged at the upcoming March 18 meeting.

Link to Seeking Alpha News Article - Feb. 13, 2026

TLT 0.00%↑ SPY 0.00%↑ UUP 0.00%↑ IVW 0.00%↑ IVE 0.00%↑

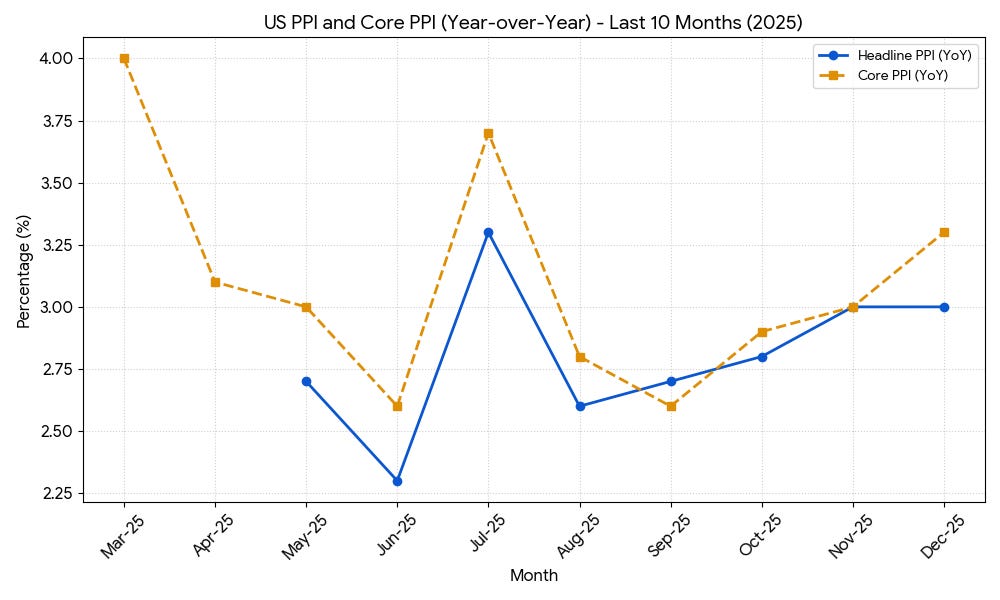

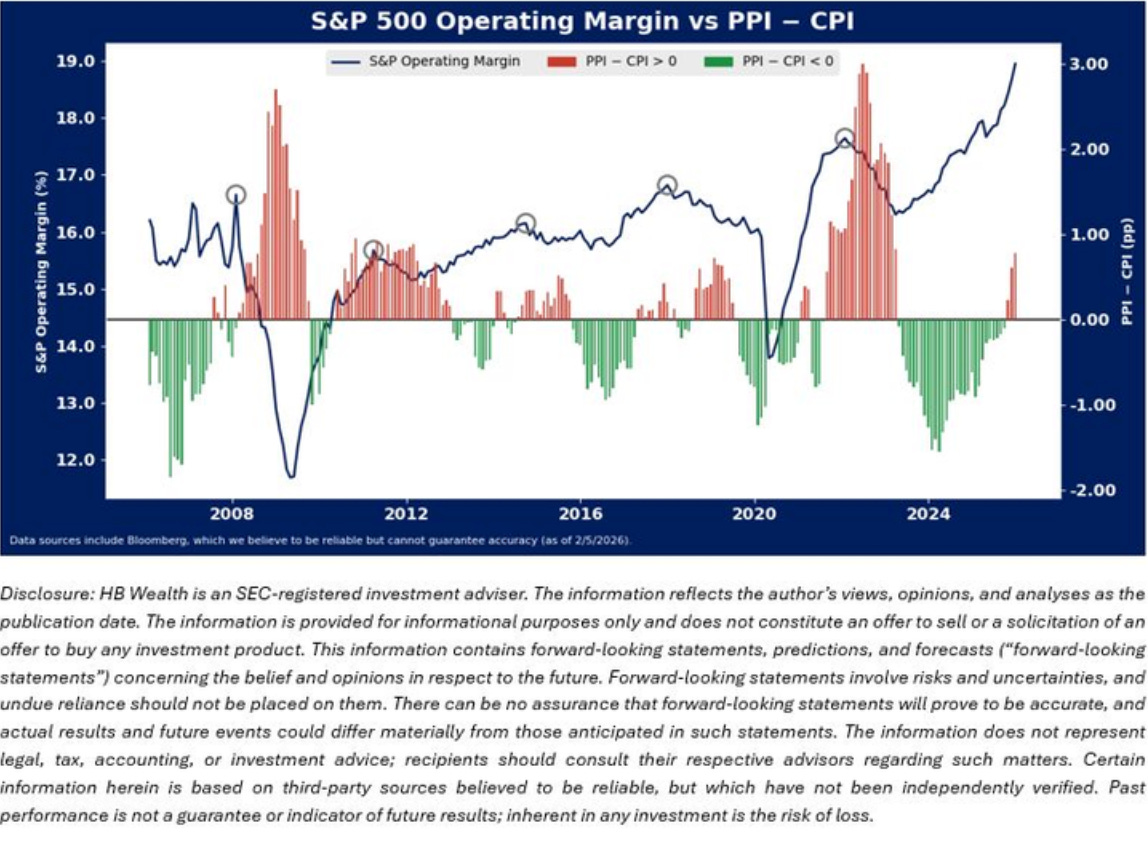

[News] The widening gap between CPI and PPI is what truly matters for the stock market – strategist

Gina Martin Adams, chief market strategist for HB Wealth argued this spread has been “going the wrong way since October,” signaling potential trouble ahead for corporate profits and stock valuations.

The timing of this shift appears significant, the strategist noted. “It’s not likely a coincidence that October was also the latest peak in growth stocks and value has been on a tear since,” Adams said.

The rotation from growth (IVW) to value stocks (IVE) has closely tracked the deteriorating relationship between consumer and producer prices, suggesting investors are already pricing in concerns about corporate pricing power.

The implications for the broader market could be substantial if current trends persist. According to Adams, if “core producer prices continue to rise at a faster pace than core consumer prices, it may indicate fading pricing power.”

This dynamic threatens to undermine the optimistic outlook many analysts have held for corporate America.

Link to Seeking Alpha News Article - Feb. 13, 2026

WealthWise Research

[News] Coinbase CEO: Stablecoins will become the default currency for AI agents

“We’re even seeing these AI agents adopt stablecoins for payment, and I believe that stablecoins will be the default payment method for AI agents,” Armstrong said in the company’s earnings conference call earlier this week.

“These AI agents that have been spinning up, we put out some really useful tools for developers to just get any AI agent a crypto wallet and begin to make stablecoin payments and begin to complete agentic commerce essentially,” he added. “And that started to get quite a good amount of traction.”

Armstrong is not the first crypto executive to see stablecoins as a good pairing with AI agents. Last month, Circle (CRCL) CEO Jeremy Allaire similarly predicted that the digital assets could become central to the AI agent economy.

Link to Seeking Alpha News Article - Feb. 13, 2026

IGV 0.00%↑ MSFT 0.00%↑ CRM 0.00%↑ IGPT 0.00%↑ XSW 0.00%↑

[News] Software firms need a ‘Google moment’ to prove their relevance amid AI disruptions – analyst

The long-term value of software companies (IGPT), (XSW), (IGV) hinges on a fundamental question, according to Munster: whether agents will eventually outnumber humans in the workforce.

If bots replace human workers at scale, there will simply be less demand for traditional software seats, threatening the revenue models of giants like Salesforce (CRM) and Microsoft (MSFT). Munster expressed doubt that a company like Salesforce (CRM) could sustain a premium valuation “when you have that lingering out there.”

Munster shared that Deepwater is already experiencing this shift firsthand, using AI tools to build spreadsheets that bypass the need for traditional Microsoft licenses.

“Unless the software companies have a Google moment where they basically punch back like Google did with their search number back in the March,” he warned, “I think the case will still be open that bots are going to take seats lower.”

Without radical adjustments to hiring and infrastructure, Munster finds it difficult to imagine earnings continuing to grow for disrupted software firms. Until these companies demonstrate innovation that protects their core business or deliver exceptionally strong earnings showing no signs of disruption, their stock multiples will likely remain under pressure.

WealthWise Research suggests thinking about the next most important question, which is “Which companies will enable and manage those agents?”

Link to Seeking Alpha News Article - Feb. 13, 2026

WealthWise Research

[Research] Microsoft Denies Partnership with Richtech Robotics

After Richtech ($RR) stock added more than $370 million in market cap on the announcement of a “collaboration” Tuesday, the company announced a dilutive fundraise the next morning. Microsoft tells Hunterbrook Media the engagement was a “standard” customer program with “no commercial element.” This comes after Richtech missed its 10-K deadline, hampering its ability to raise money through at-the-market offerings.

Link to Hunterbrook Media Research - Jan. 29, 2026

[YouTube | The Compound] The Baddest Hedge Fund in the World | TCAF 229

On episode 229 of The Compound and Friends, Michael Batnick and Downtown Josh Brown are joined by Nathaniel Horwitz and Sam Koppelman of Hunterbrook to discuss: how investigative journalism can be an edge in investing, the Sable Offshore story, how Sphere is changing entertainment, and much more!

This is one of their best episodes, EVER! In a world where anyone can create anything, Truth becomes invaluable. And these guys have figured out a way to not just sustain truth but enable it to challenge the status quo.

Link to Full Video (01:07 Hours) - Feb 12, 2026

News, Facts, Analyst & Market Commentary - Short Reads:

Hims & Hers Health to stop offering copycat Wegovy pill

Following pressure from Novo Nordisk (NVO) and the US FDA, Hims & Hers Health (HIMS) will no longer offer a compounded version of Novo’s Wegovy (semaglutide) pill for weight loss.

Link to Seeking Alpha News Article - Feb. 07, 2026

Japan’s Nikkei hits record as ruling party lands supermajority; Topix jumps 3%

Japan’s Nikkei 225 (NKY:IND) hit a record on Monday, rising to 5% after Prime Minister Sanae Takaichi’s party won a two-thirds parliamentary supermajority, while the Topix advanced over 3%.

Technology and machinery stocks led the advance, with some chip-equipment makers jumping more than 10%.

With Takaichi widely expected to adopt market-friendly policies, promising to reinvigorate Japan’s underperforming economy, equities across Asia climbed, with South Korea’s Kospi rallying 4% and other major indexes posting gains of more than 1%.

Link to Seeking Alpha News Article - Feb. 08, 2026

Anti-U.S. shopping apps gain traction in Denmark amid Greenland tensions - report

Mobile apps that allow shoppers to identify and boycott American products have reportedly seen a spike in downloads, particularly in Denmark, amid renewed controversy over U.S. President Donald Trump’s remarks on Greenland.

The creator of the “Made O’Meter” app, Ian Rosenfeldt, said he saw around 30,000 downloads of the free app in just three days at the height of the trans-Atlantic diplomatic crisis in late January out of more than 100,000 since it was launched in March, the Associated Press reported.

Rosenfeldt, who lives in Copenhagen and works in digital marketing, decided to create the app a year ago after joining a Facebook (META) group of like-minded Danes hoping to boycott U.S. goods, the report said.

The latest version of “Made O’Meter” is said to use artificial intelligence to identify and analyze several products at a time, then recommend similar European-made alternatives. Users can set preferences, like “No USA-owned brands” or “Only EU-based brands.” The app claims over 95% accuracy.

Another Danish app, “NonUSA,” topped 100,000 downloads at the beginning of February, according to the report.

Link to Seeking Alpha News Article - Feb. 08, 2026

Lumentum should benefit as Nvidia ‘accelerates’ co-packaged optics: GF

Lumentum (LITE) should benefit as Nvidia (NVDA) “accelerates” its use of co-packaged optics, GF Securities said.

“At GTC 2025, Nvidia (NVDA Buy) launched its [co-packaged optics] switches, Quantum-X scheduled in 2H25 and Spectrum-X in 2H26,” GF analyst Jeff Pu wrote in a note to clients. “Nvidia’s first-generation of scale-out [co-packaged optics], Quantum-X, utilizes a pluggable architecture rather than fully integrated co-packaged optics. For 2026’s GTC, we believe that Nvidia may launch the new generation [co-packaged optics] switch. We expect this generation to feature 115.2T and TSMC (2330 TT Buy) does the CPO (co-package optics). We believe the supply chain will start ramping in 2Q26, followed by an acceleration in 2H26/2027. We revised up our estimate for Nvidia’s scale out CPO switch to 2k/20k/80k in 2025/2026/2027.”

Pu said Lumentum should benefit from the “demand upside” for continuous-wave lasers, while there is more of a “neutral” impact for Coherent (COHR).

“According to recent earnings calls, Lumentum highlighted that optical scale-up is a longer-term structural opportunity starting late CY27,” Pu added. “We believe that Nvidia will consider the introduction of CPO/NPO starting with Rubin Ultra in 2H27, while the rack-to-rack interconnects are likely to transition toward [co-packaged optics] or NPO-based optical interconnect. We believe [Taiwan Semiconductor’s] (TSM) [co-packaged optics] solution for scale-up has already been sampled. However, volume production readiness remains uncertain, suggesting that NPO vs. CPO debate will continue.”

Link to Seeking Alpha News Article - Feb. 09, 2026

China urges banks to curb U.S. Treasury exposure, but data shows its grip on U.S. debt Is fading

Officials advised banks to limit new purchases of U.S. government bonds and asked institutions with large existing positions to gradually reduce their holdings, the sources said. The guidance, delivered in recent weeks to some of the country’s largest banks, does not apply to China’s state holdings of U.S. Treasuries.

However, the scale of China’s holdings today is far smaller than commonly assumed.

According to the U.S. Treasury’s International Capital (TIC) data, China now holds less than 2% of total outstanding U.S. Treasury debt. This marks a significant decline from prior decades and suggests that shifts in China’s portfolio, while noteworthy, carry far less systemic weight than they once did.

Link to Seeking Alpha News Article - Feb. 09, 2026

LightPath Technologies receives $9.6M purchase order; shares up 4%

LightPath Technologies (LPTH) announced on Monday that it has secured a $9.6 million purchase order for cooled infrared cameras from an existing defense customer for use in defense and security applications, with deliveries expected throughout calendar year 2026.

The company said that production of the cameras will be split between its facilities in Florida and New Hampshire, leveraging its expanded domestic manufacturing capabilities.

Link to Seeking Alpha News Article - Feb. 09, 2026

BMNR 0.00%↑ #ETH

Bitmine Immersion Technologies announces ETH holdings reach 4.326 million tokens

Bitmine Immersion Technologies (BMNR) announced on Monday that Bitmine crypto + total cash + “moonshots” holdings totaling $10.0 billion.

Bitmine said its ETH holdings are 3.58% of the ETH supply (of 120.7 million ETH).

Link to Seeking Alpha News Article - Feb. 09, 2026

CCCX 0.00%↑ #INFQ

Infleqtion lands deal with DOE to help achieve grid optimization through quantum computing

Infleqtion, a quantum computing company in the process of going public through a merger with Churchill X (CCCX), a special purpose acquisition company, has landed a deal with the U.S. Department of Energy to help improve electric grid optimization.

The rapid rise of artificial intelligence data centers has placed increased pressure on grid operators. This has prompted the U.S. DOE’s Advanced Research Projects Agency-Energy (ARPA-E) to launch development of its $6.2M Enhancing Neutral-atom Computers for Optimizing Delivery of Energy (ENCODE) project.

With classical computer systems already reaching their limits regarding grid optimization, the “ENCODE program addresses this gap by applying quantum-enhanced logic to provide the precision and speed necessary for a secure and stable energy future.”

Established nearly 20 years ago, Infleqtion designs and builds quantum computers, precision sensors, and quantum software for governments, enterprises, and research institutions.

Link to Seeking Alpha News Article - Feb. 09, 2026

Credo sees higher Q3 2026 revenue

Credo (CRDO) said on Monday Q3 2026 revenue is expected to come in at $404M to $408M, exceeding the upper end of its earlier guidance of $335M to $345M.

The company expects mid-single-digit sequential revenue growth into FY27, driving more than 200% YoY growth in the current fiscal year.

Consensus Q3 2026 revenue is $342.33M.

Link to Seeking Alpha News Article - Feb. 09, 2026

TSLA 0.00%↑ TM 0.00%↑ #BYDDY #BYDDF

BYD Company faces headwinds in Japan as rivals capture larger subsidies

China’s BYD (BYDDF) faces challenges in Japan as rivals capture a considerable share of government subsidies, undercutting the Chinese automaker’s efforts to scale sales.

After tariff negotiations with the U.S., the Japanese government increased the upper limit of subsidies on certain autos, with companies like Toyota Motor (TM) and Tesla (TSLA) receiving over 1M yen on certain vehicles. While BYD (BYDDF) had been receiving only 350,000 yen in subsidies with no changes under the revised framework.

Link to Seeking Alpha News Article - Feb. 10, 2026

Baidu and Uber team up to launch Apollo Go self-driving ride-hailing in Dubai

Expected to launch in the coming month, the fully autonomous vehicles will be available via the Uber app across select locations within the Jumeirah area, and the deployment will expand based on operational learnings and regulatory approvals across the city.

Link to Seeking Alpha News Article - Feb. 10, 2026

Vertical Aerospace inks a new eVTOL deal in Saudi Arabia

Vertical Aerospace (EVTL) announced on Tuesday that it struck a three-way deal with Saudi conglomerate AHQ Group and the government-backed National Industrial Development Centre to fast-track an Advanced Air Mobility ecosystem in Saudi Arabia.

Signed in Riyadh, the MoU creates a framework to evaluate localization of manufacturing, commercial deployment of electric vertical take-off and landing services, and potential financial incentives, including investment structures that could support the company’s aircraft certification plans and long-term expansion.

At the product level, the collaboration is centered on Valo, Vertical’s piloted four-passenger eVTOL, which is being engineered to fly up to 160 km at 240 km/h with zero operating emissions and to meet UK CAA and EASA airliner-level safety standards. Vertical is also working on a hybrid-electric variant to extend range and mission flexibility, and highlights that Valo has been designed for “hot and high” environments, with thermal management, high payload capability in temperatures up to 50 degrees Celsius and fuselage-mounted, thermally isolated batteries tailored to conditions in Saudi Arabia and the wider Gulf region.

Link to Seeking Alpha News Article - Feb. 10, 2026

Cadence unveils AI agent to accelerate chip design

Cadence Design Systems (CDNS) unveiled a virtual AI agent called ChipStack AI Super Agent to help companies such as Nvidia accelerate the process of designing computer chips.

Cadence said ChipStack AI Super Agent is the world’s first agentic workflow for automating chip design and verification. The AI agent autonomously creates and verifies designs from specifications and descriptions, according to the company.

ChipStack AI provides up to 10 times productivity improvements for coding designs and testbenches, creating test plans, orchestrating regression testing, debugging, and automatically fixing issues, the company added.

Link to Seeking Alpha News Article - Feb. 10, 2026

CCCX 0.00%↑ #INFQ

[Newsletter Exclusive] Infleqtion partners with NASA to launch first quantum gravity sensor into space

The one-year mission, slated for launch in 2030, is dubbed the Quantum Gravity Gradiometer Pathfinder mission. The quantum sensor will be capable of measuring Earth’s gravitational fields and gradients. It is designed to monitor mass dynamics across the planet’s surface, including changes in water, ice and land, while operating in microgravity, which enables longer interaction times and correspondingly improved measurement sensitivities.

Link to Seeking Alpha News Article - Feb. 10, 2026

[Newsletter Exclusive] India’s second-largest automaker selects Mobileye’s ADAS for six new models

Mahindra & Mahindra is developing new vehicles equipped with Mobileye’s (MBLY) SuperVision and Surround ADAS hands-free, eyes-on driving assistance systems. Production on the six new Mahindra & Mahindra models with Mobileye’s tech is expected to begin in 2027.

Link to Seeking Alpha News Article - Feb. 10, 2026

FCC approves Amazon’s 4,500-Leo satellite plan

According to a CNBC report, the FCC said Amazon must launch 50% of the approved satellites by Feb. 10, 2032 and the remaining half by Feb. 10, 2035. The FCC’s approval brings the size of Amazon’s planned constellation of low Earth orbit satellites to roughly 7,700 satellites.

Link to Seeking Alpha News Article - Feb. 11, 2026

IBIT 0.00%↑ #BTC

[Newsletter Exclusive] Bitcoin whales renew support for the cryptocurrency - report

The bitcoin whales have reportedly accumulated about 53,000 coins in the past week, making it their biggest buying spree since November, a Bloomberg report stated.

The purchases helped keep the price relatively steady after a huge fall, the report added.

Data from research firm Glassnode showed that wallets with more than 1K bitcoin added over ~$4 billion worth of the crypto over the period, the Bloomberg report said.

BofA Securities strategist Michael Hartnett has called out $58K as a key support level for Bitcoin.

Link to Seeking Alpha News Article - Feb. 11, 2026

Link to Seeking Alpha News Article - Feb. 11, 2026

Astera Labs in focus as analysts debate results, Amazon deal

J.P. Morgan analyst Harlan Sur said the results in the most recent quarter were “strong,” citing the continued ramp of Astera’s Scorpio “P” series, its PCIe Gen 6 retimers, and the networking connectivity Taurus product line. And while its guidance was stronger-than-expected, there were some concerns, including a potential decline in future gross margins, due in part to Amazon getting a warrant in the company, an “unfavor- able” SKU mix, and a higher mix of hardware sales.

“Higher shipments to Amazon will negatively impact the margin profile due to contra-revenue recognition (warrants); however, we expect this impact to diminish over time as the team continues to diversify its customer mix,” Sur wrote in a note to clients. “Operating expenses are set to increase materially in the March quarter due to recent acquisitions and accelerated R&D spending. While revenues are trending higher, earnings growth is dampened by margin compression and higher operating expenses. We believe it is prudent for the team to prioritize revenue growth, given the strong demand profile they are seeing. Overall, we believe Astera’s robust and expanding new product pipeline will continue to set a high bar for competitors, reinforcing our confidence that it will maintain over 80% PCIe retimer market share and drive strong share in the PCIe/fabric XPU switching, networking connectivity, and memory controller markets over the long term.”

Sur kept his Overweight rating on Astera, but lowered his price target to $205 from $215.

Morgan Stanley analyst Joseph Moore had a similar take, noting that the company’s “strong” topline growth is being offset by its aggressive expansion plans.

“We have viewed 1H26 as a transitional phase, with the importance of the Scorpio X ramp with Amazon’s Trainium 3 in 2H, so the continued upside is welcome here,” Moore wrote in a note to clients. He added that there is “visibility into multiple product cycles that have yet to even start ramping,” but added that the stock is “quite expensive,” and with operating expenses ramping, that limits earnings per share upside. He kept his Overweight rating and $210 price target on the stock.

Needham analyst N. Quinn Bolton also pointed out the strong growth, coupled with the high operating expenses. He also noted the Amazon warrant deal could result in an additional $6.5B in future revenue.

“Astera is a unique investment, in our opinion, as the company’s entire product line targets connectivity challenges in cloud and AI infrastructure,” Bolton wrote. “Astera’s product suite features interoperability and observability, which we believe will drive customer stickiness and share retention. We acknowledge Astera’s valuation is rich, but the company is among the fastest growers in the semiconductor industry with industry-leading margins, and we believe estimates will rise, specifically from higher AI server shipments and/or higher retimer attach rates.”

Bolton has a Buy rating and $220 price target on Astera.

Link to Seeking Alpha News Article - Feb. 11, 2026

[Newsletter Exclusive] Generac shares jump as data center demand lifts outlook

Generac Holdings Inc. (GNRC) reported fourth quarter results that missed Wall Street estimates for revenue and adjusted earnings, but strong momentum in data center demand and a bullish 2026 outlook sent its shares up nearly 18% in Wednesday’s trading.

Within its Commercial and Industrial segment, sales increased about 10% to $400 million, driven primarily by higher revenue from products sold to data center customers.

Generac (GNRC) is guiding for full-year 2026 net sales growth in the mid-teens percentage range, including a 1% favorable effect from foreign currency and completed acquisitions and divestitures.

Commercial and industrial product sales are expected to increase in the 30% range, driven largely by data center customers and the recent acquisition of Allmand. Residential product sales are projected to rise in the 10% range, assuming a return to more typical power outage activity.

CEO Aaron P. Jagdfeld highlighted progress in the data center market, stating “momentum accelerated during the fourth quarter and into early 2026.” He added, “partnerships...with multiple hyperscalers” have reached pilot phases, with expectations for “potential significant volumes in 2027 and 2028.”

Link to Seeking Alpha News Article - Feb. 11, 2026

Link to Seeking Alpha News Article - Feb. 11, 2026

Vertiv soars on strong 2026 outlook for earnings and revenue

The supplier of power and thermal management equipment for data centers posted fourth-quarter net sales of $2.88 billion, up 23% from a year earlier but slightly below the consensus estimate of $2.89 billion.

Adjusted earnings were $1.36 a share, up from $0.99 a share a year earlier and above the Wall Street consensus estimate of $1.30 a share.

Orders accelerated sharply, with organic orders up about 252% from the prior year quarter. The book-to-bill ratio was approximately 2.9 times and backlog reached $15.0 billion, more than doubling from a year ago.

Fourth quarter operating cash flow reached $1.005 billion, while adjusted free cash flow rose 151% to $910 million. Net leverage stood at about 0.5 times at quarter end.

Vertiv (VRT) issued first quarter 2026 guidance calling for net sales between $2.50 billion and $2.70 billion and adjusted diluted EPS between $0.95 and $1.01.

For full year 2026, Vertiv (VRT) expects net sales of $13.25 billion to $13.75 billion, above the consensus estimate of $12.39 billion. Adjusted diluted EPS is projected at $5.97 to $6.07, ahead of the $5.33 estimate.

The company also forecast full year adjusted operating margin of 22.0% to 23.0% and adjusted free cash flow of $2.10 billion to $2.30 billion.

Link to Seeking Alpha News Article - Feb. 11, 2026

Beta Technologies upgraded at Jefferies on near-term growth catalysts

Jefferies highlighted three near-term drivers: expected awards in March under the Department of Transportation and FAA’s eVTOL Integration Pilot Program, planned certification of Beta’s H500 pusher motor in the first half of 2026 and the start of the EVEX flight test program tied to a 10-year, up to $1 billion motor supply agreement.

Jefferies said the FAA’s eVTOL Integration Pilot Program, known as eIPP, could accelerate the introduction of electric aircraft into the national airspace system. The analysts see the program as a pathway for Beta (BETA) to begin cargo and medical operations as early as this year in a phased framework with regulators.

The report argues that Beta’s CX300 conventional takeoff and landing aircraft provides an edge versus pure vertical takeoff competitors because it has already logged more than 100,000 nautical miles, including demonstration flights in Norway and New Zealand.

Jefferies said certification of the CX300 is targeted for 2027, with the ALIA 250 vertical aircraft expected about a year later.

The analysts estimate 2025 revenue of about $33 million, up 117% from 2024, with growth supported by ground support equipment sales and initial deliveries under technology partnerships.

Beta (BETA) holds a backlog of 891 aircraft, including firm orders and options, valued at roughly $3.5 billion based on deposited orders. In addition, the company has more than $1 billion in contracted technology partnerships, including the EVEX pusher motor agreement signed in December 2025.

The firm also noted that Beta (BETA) ended 2025 with an estimated $1.74 billion in cash, or about $8 per share, providing liquidity to support development and certification efforts.

Link to Seeking Alpha News Article - Feb. 11, 2026

#SSNLF

[Newsletter Exclusive] Samsung indicates staggering AI-related memory demand will extend through 2027: report

Samsung Electronics (SSNLF) Chief Technology Officer Song Jai-hyuk said that the insatiable demand for memory related to artificial intelligence infrastructure will continue through at least the end of 2027, according to The Korea Herald.

Samsung Electronics (SSNLF) Thursday said that it has begun mass production of its latest high-bandwidth memory chips, HBM4, and has shipped commercial products to customers.

Additionally, following the successful introduction of HBM4 to market, sampling for HBM4E is expected to begin in the second half of 2026, while custom HBM samples will start reaching customers in 2027, according to their respective specifications.

Link to Seeking Alpha News Article - Feb. 11, 2026

Link to Seeking Alpha News Article - Feb. 12, 2026

[Newsletter Exclusive] Uber Eats challenges rival Instacart with AI-powered Cart Assistant

Uber Eats (UBER) launched Cart Assistant, an artificial intelligence tool to help shoppers build grocery baskets based on ingredients in a recipe, past orders, a picture, or a handwritten shopping list.

Through the app, users can start shopping at their favorite grocery store on the Uber Eats (UBER) app and add items by taking a picture of a shopping list, recipe, or by selecting from search results.

Cart Assistant will automatically take availability into account and show store-level details like item prices and applicable promotions.

Link to Seeking Alpha News Article - Feb. 11, 2026

Energy Fuels initiated with Buy rating at Goldman Sachs on competitive advantages

Energy Fuels (UUUU) +2.2% in Wednesday’s trading as Goldman Sachs initiated coverage of the uranium explorer with a Buy rating and a $30 price target, pointing to the company’s ownership of the highest-grade uranium deposit in the U.S. and the White Mesa Mill, which provides a competitive advantage as the only U.S. processing facility capable of handling both uranium and rare earth elements.

Goldman’s Brian Lee noted Energy Fuels’ (UUUU) three heavy mineral sands assets that are expected to come online over the next five years, which will supply monazite, a key feedstock for rare earth production, and expansion into production of light and heavy rare earths that positions the company uniquely compared to peers, particularly given high demand and pricing trends for heavy rare earths.

The analyst also pointed to strong policy support for securing domestic supply and production capabilities for critical minerals as a favorable factor for Energy Fuels (UUUU) shares.

Link to Seeking Alpha News Article - Feb. 11, 2026

[Newsletter Exclusive] Centrus projects $425M–$475M 2026 revenue as $900M HALEU award advances U.S. enrichment build-out

Amir Vexler, President and CEO, described 2025 as a milestone year, highlighting the December announcement to begin commercial centrifuge manufacturing and the January selection by the Department of Energy for a $900 million HALEU enrichment award. He stated, “Our build-out officially ushers in America’s return to domestic commercial uranium enrichment, with a derisked, deployment-ready technology that can service both commercial and national security needs.” The first new cascade of centrifuges is expected online in 2029.

Vexler emphasized the company’s substantial commercial LEU enrichment backlog of $2.3 billion and a base case plan to include 12 metric tons of HALEU, with capacity additions dependent on demand and capital resources. He noted, “Near-term domestic LEU demand alone is set to increase by approximately 6.5 million SWUs, stemming from Russia’s exiting the market and the additional demand from restarts, uprates and new pledged reactors.”

Link to Seeking Alpha News Article - Feb. 11, 2026

MP 0.00%↑ USAR 0.00%↑ CRML 0.00%↑

[Newsletter Exclusive] CME weighs launching first-ever rare earth futures contract - Reuters

CME (CME) is working on a new futures contract combining the two most important rare earths, neodymium, and praseodymium - NdPr - according to the report; the two elements, typically traded as a combined product, are rare earths needed to make permanent magnets, which are used in electric vehicle motors, wind turbines, fighter jets, and drones.

Link to Seeking Alpha News Article - Feb. 11, 2026

AppLovin outlines 5%–7% Q1 sequential revenue growth as AI drives platform expansion

Adam Foroughi, CEO, highlighted internal AI model advancements as the key growth driver, stating, “What’s fueling that growth is our own AI models.”

Matt Stumpf, CFO, highlighted, “Revenue in the fourth quarter was $1.66 billion, up 66% year-over-year.”

Adjusted EBITDA reached $1.4 billion, marking an 82% annual margin and a 700 basis point expansion over the prior year.

Free cash flow for Q4 hit $1.31 billion, growing the cash balance to $2.5 billion.

Benjamin Black, Deutsche Bank: Asked about e-commerce self-service launch learnings and contribution to revenue. Foroughi explained, “In Q4, we opened up the self-service platform, referral only... we’re not at the point yet where we’re sort of a GA type launch. We’ll get there. We said first half of this year, that’s still on track.”

Black followed up on creative automation. Foroughi stated generative AI tools are in pilot with over 100 customers and will soon expand, aiming to enable bulk video ad creation “in cost of dollars versus cost of thousands of dollars.”

Bernard McTernan, Needham: Asked about changes in customer size post self-service launch and non-e-commerce pixel use. Foroughi noted, “you’re getting companies that have a few hundred thousand dollars of GMV, a couple of million dollars of GMV a year buying on our platform,” and outlined expansion into new transactional verticals.

Link to Seeking Alpha News Article - Feb. 11, 2026

QuantumScape outlines $250M–$275M adjusted EBITDA loss target for 2026 while expanding licensing model and Eagle Line production

Shares of QuantumScape (QS) were pinned down in Wednesday’s late trading, pressured by the company’s most recent quarterly results, which showed a modest beat on profit expectations but again showed no revenue generated from its core business.

Moreover, the company expects to increase investment in scaling production of its solid-state battery using the Eagle Line but did not outline any revenue guidance for FY26 or new OEM partnerships, instead setting a vague set of “ambitious goals to bring our revolutionary technology to market.”

Siva Sivaram, President, CEO & Director, stated that “2025 was an extraordinary year on all fronts for QS,” highlighting successes in integrating the Cobra process into cell production, shipping Cobra-based QSE-5 cells, installing equipment for the Eagle Line, and expanding commercial engagements. Sivaram also noted the expansion of collaborations with PowerCo and the addition of two major global automotive OEMs as customers, as well as the first customer billings issued during 2025.

Sivaram identified the inauguration of the Eagle Line as a key milestone, explaining its role as “a suite of equipment materials and highly automated processes forming the blueprint for production of QSE-5 technology.”

For 2026, Sivaram outlined four key goals: demonstrate scalable production on the Eagle Line, advance automotive commercialization, expand into new high-value markets, and push technology beyond the QSE-5 platform.

Link to Seeking Alpha News Article - Feb. 11, 2026

Link to Seeking Alpha News Article - Feb. 11, 2026

[Newsletter Exclusive] Aurora outlines 400% revenue growth target and 200+ driverless trucks for 2026 as expansion accelerates

CEO Christopher Urmson described 2025 as a pivotal year, highlighting “our launch of the first driverless commercial trucking operations on U.S. public roads.” Urmson reported that the Aurora Driver passed 250,000 driverless miles in January, nearly tripling cumulative miles since early October and maintaining “100% on-time performance and a perfect driverless safety record with zero Aurora Driver-attributed collisions.”

The CEO announced the expansion of driverless capabilities, expecting to “nearly triple our current addressable market to over 3.6 billion vehicle miles traveled with the opening of 7 additional driverless lanes.” He outlined progress in enabling driverless operations in “inclement weather, including rain, fog and heavy wind” and the launch of supervised autonomous freight delivery supporting multiple customer sites.

Urmson detailed the upcoming launch of a second-generation hardware kit, stating that “the Aurora Driver is now sufficiently generalized for us to begin expanding across the Sunbelt in 2026,” with the goal to exit 2026 with “more than 200 driverless trucks in operation.”

The company expects its second-generation commercial kit to “drive a 50% plus reduction in our hardware costs.”

Aurora Innovation (AUR) announced that its latest software release will triple its commercial driverless trucking network to 10 routes and enable expansion across the U.S. Sun Belt beginning in 2026. Notably, the upgraded Aurora Driver can now support longer-haul lanes, including a roughly 1,000-mile driverless route between Fort Worth and Phoenix that extends beyond current federal hours-of-service limits for human drivers, allowing significantly shorter transit times and higher asset utilization for carriers. With the addition of Phoenix, Aurora (AUR) said its driverless network now covers lanes including Dallas–Houston, Fort Worth–El Paso, El Paso–Phoenix, Fort Worth–Phoenix, and Dallas–Laredo.

Aurora is also rolling out “direct-to-customer” lanes by using its Verifiable AI mapping system to automate map creation after a single manual drive, sharply reducing the time and human effort needed to open new routes and customer endpoints. The company has begun supervised autonomous deliveries to multiple customer facilities, including Hirschbach Motor Lines hauling for Driscoll’s between Dallas and Laredo, Detmar Logistics serving Capital Sand’s mining site in Monahans, Texas, and a leading U.S. carrier from its Phoenix facility. The new software enables driverless operation on highways and surface streets in adverse conditions such as rain, fog, and high winds, which previously constrained operations in Texas about 40% of the time, and is expected to materially increase uptime across the Sun Belt.

The CEO referenced key partnerships, including a new agreement with Detmar Logistics and industrialization progress with Volvo, noting that “the first group of Volvo VNL Autonomous trucks equipped with the Aurora Driver have come off the pilot line at their new River Valley, Virginia manufacturing facility.”

FY net losses of $816 million vs. previous year’s $748 million net loss.

Revenue of $3M beats by $1.53M.

CFO David Maday reported a fourth quarter operating loss of $238 million, cash usage of $146 million, and year-end liquidity of nearly $1.5 billion. He further projected, “In 2026, we expect revenue of $14 million to $16 million, up 400% year-over-year at the midpoint.”

Nancy, Morgan Stanley: Asked about the ramp-up of trucks and revenue utilization for 2026. CFO Maday responded that the fleet launches in Q2 and revenue is “back-end loaded really to the third and predominantly the fourth quarters,” reiterating “more than 200 trucks at the end of the year” and an approximate $80 million run rate for 2027.

Nancy, Morgan Stanley: Inquired about the timeline for serial commercial production in 2027. Maday explained, “Serial production... is really mostly from how you would describe serial production, I think once we bring in our third-generation hardware kit with the AUMOVIO, we then have the ability to start building tens of thousands of trucks.”

Link to Seeking Alpha News Article - Feb. 11, 2026

Link to Seeking Alpha News Article - Feb. 12, 2026

Link to Seeking Alpha News Article - Feb. 12, 2026

WeRide, Uber begin first commercial robotaxi service in downtown Abu Dhabi

The service now operates in Khalifa City, Masdar City, Rabdan, and along routes between Corniche Road and the Sheikh Zayed Grand Mosque, in partnership with the Integrated Transport Centre.

With this expansion, the WeRide-Uber robotaxi service now covers about 70% of Abu Dhabi’s main areas, and the fleet has quadrupled in size since operations began in December 2024.

Link to Seeking Alpha News Article - Feb. 12, 2026

#Anthropic

[Newsletter Exclusive] Anthropic to cover electricity price increases from its data centers

The AI startup noted that it will pay for 100% of the grid upgrades needed to interconnect its data centers, paid through increases to its monthly electricity charges.

The company added that it will procure new power and protect consumers from price increases. Anthropic will work to bring net-new power generation online to match its data centers’ electricity needs.

Where new generation is not online, the company will work with utilities and external experts to estimate and cover demand-driven price effects from its data centers.

The company added that it will address environmental impacts, including deploying water-efficient cooling technologies.

Training a single frontier AI model will soon require gigawatts of power, and the U.S. AI sector will need at least 50 gigawatts of capacity over the next several years, according to the company.

Link to Seeking Alpha News Article - Feb. 12, 2026

How should investors position their portfolio for a spreading SaaSpocalypse?

“Software is not on the verge of obsolescence. Rather, AI is widening the gap between winners and losers, making outcomes more asymmetric,” Neuberger Berman writes in Software Leads AI-Driven Tech Rout - What Next? “Some incumbents will falter, but others will adapt—integrating AI, innovating and strengthening competitive positions—creating selective opportunities for investors who can differentiate. Indiscriminate selling can create opportunity, but only for businesses that are fundamentally sound and demonstrably capable of adapting. The near-term objective should be to position for transition rather than extinction; this can be done by emphasizing resilience in business models and flexibility in balance sheets, as periods of structural change tend to punish fragility.”

Link to Seeking Alpha News Article - Feb. 12, 2026

Arista Networks raises 2026 revenue outlook to $11.25B with 25% growth target amid surging AI demand

For the quarter ended December 31, the cloud networking solutions company reported adjusted earnings per share of $0.82 versus the consensus estimate of $0.76. GAAP EPS was $0.75 compared to the $0.69 estimate.

Revenue for the quarter totaled $2.48B, which was more than the $2.39B estimate.

For the entirety of 2025, Arista Networks’ revenue increased 28.6% year over year to total $9B. Its GAAP gross margin remained static year over year at 64.1%.

For the quarter in progress, Arista expects revenue of $2.6B, which is more than the $2.46B estimate. It expects a non-GAAP gross margin ranging from 62% to 63%. Its non-GAAP gross margin averaged 64.6% during 2025.

CEO Jayshree Ullal highlighted “28.6% growth, driving a record revenue of $9 billion, coupled with non-GAAP gross margin of 64.6% for the year and a non-GAAP operating margin of 48.2%.” Ullal emphasized surpassing “150 million cumulative ports of shipments in Q4 ‘25” and noted international growth “in both Asia and Europe, growing north of 40% annually.” Cloud and AI titans accounted for 48% of annual revenue, with Customer A and B contributing 16% and 26% respectively. Ullal announced a doubling of AI networking revenue targets from $1.5 billion to $3.25 billion for 2026, stating, “we are now doubling from 2025 to 2026 to $3.25 billion in AI networking revenue.”

Ullal reported, “we increased our 2026 guidance to 25% annual growth, accelerating now to $11.25 billion.”

The analysts noted that 2026 growth estimates remain conservative. Removing the expected AI and Campus contributions from the total growth guidance, it suggests no growth for the remaining 60% of the business, below the historical 7%, the analysts added.

Accounting for that growth points to total 2026 growth of at least 30%, with additional Capex increases creating incremental upside, according to the analysts.

Microsoft and Meta combined grew 56% and accounted for 42% of Arista’s revenues.

Link to Seeking Alpha News Article - Feb. 12, 2026

Link to Seeking Alpha News Article - Feb. 12, 2026

Link to Seeking Alpha News Article - Feb. 12, 2026

Link to Seeking Alpha News Article - Feb. 13, 2026

[Newsletter Exclusive] Applied Materials’ results were ‘solid,’ but Wall Street is impressed with its guidance

Wells Fargo analyst Joe Quatrochi was impressed with the company’s guidance, especially given the rising expectations from its peers. “While not providing a C2026 [wafer fab equipment estimate], AMAT expects its semi systems rev to grow >20% y/y—well ahead of prior Street est at +11% y/y,” Quatrochi wrote in a note to clients. “Similar to peers, AMAT expects rev to be 2H-weighted given fab readiness & likely sets up for a strong 2027. AI [remains] a key driver of demand w/ WFE growth led by leading-edge F/L, DRAM / HBM [and advanced] packaging, while we’d positively view updated [expectations] for flat ICAPS & China; we think [this is] supportive of AMAT [wafer fab equipment] outperformance in 2026.”

Link to Seeking Alpha News Article - Feb. 13, 2026

[Newsletter Exclusive] Taiwan Semiconductor in focus as DA Davidson starts with Buy rating

Taiwan Semiconductor (TSM) was in focus on Friday as DA Davidson started coverage on the semiconductor foundry giant with a Buy rating and $450 price target.

“We are initiating coverage of TSM with a BUY rating and a $450 price target based on what we believe is a compounding execution moat in leading edge manufacturing that’s translating into a durable, self-reinforcing advantage as AI compute demand scales through the gigawatt-gigacycle,” analysts at the firm wrote in a note to clients.

Link to Seeking Alpha News Article - Feb. 13, 2026

Coinbase stock buoyed by stock buybacks, revenue diversification, legislation outlook

Since November, Coinbase (COIN) repurchased 8.2M of its shares. In January, it expanded its share buyback program by an additional $2.0B. “We are mindful of reducing our overall dilution opportunistically,” management said in its Q4 letter to shareholders.

The stalling of the CLARITY crypto market structure legislation in the Senate has been weighing on the crypto markets in recent weeks, but Coinbase (COIN) Chairman and CEO Brian Armstrong sees a glimmer of light. “I’m actually quite optimistic that we’ll get something through here in the next few months,” he said during the company’s earnings call on Thursday. Just last month, he opposed the bill due to its ban on stablecoin rewards and safeguards regarding decentralized finance.

U.S. Treasury Secretary Scott Bessent urged lawmakers to pass the CLARITY bill and get it to President Donald Trump’s desk this spring during an interview aired on Friday.

Management emphasized that Coinbase (COIN) now has 12 products generating more than $100M in annualized net revenue, compared with four in 2023.

Link to Seeking Alpha News Article - Feb. 13, 2026

Link to Seeking Alpha News Article - Feb. 13, 2026

IGV 0.00%↑ XLF 0.00%↑ IAK 0.00%↑ KIE 0.00%↑ IYT 0.00%↑

[Newsletter Exclusive] Tracing the market’s cross-sector AI anxiety

Software (IGV) stocks became the first domino this year as Anthropic’s (ANTHRO) push into workflow automation revived fears that fast-improving AI tools can eat into parts of enterprise applications.

The fear trade jumped into financials (XLF) this week. Wealth management (IAI) and tax planning companies sank after private financial software provider Altruist Corp. launched an AI solution that creates tax strategies for clients.

From there, insurance brokers (IAK) (KIE) also suffered after the rollout of a new AI tool by private online insurance marketplace Insurify.

Real estate services stocks were dragged into the mix as well, and the latest spillover into trucking and logistics (IYT) highlighted the week’s full-blown cross-sector scare trade.

Link to Seeking Alpha News Article - Feb. 13, 2026

NFLX 0.00%↑ GOOG 0.00%↑ AMZN 0.00%↑ WBD 0.00%↑ DIS 0.00%↑ FOX 0.00%↑

[Newsletter Exclusive] Media companies could up their AI capex game to keep up with competition – analyst

Just as streaming services like Netflix (NFLX) and Amazon Prime (AMZN) forced media companies to dramatically increase spending on original content, AI could trigger a similar wave of investment.

“Could it be that it becomes a more capital-intensive industry to keep up with some of that competition?” Cahall said.

Despite acknowledging AI’s rapid advancement in visualization capabilities, Cahall emphasized the enduring value of human creativity in storytelling.

“What really makes content hard is stories. Story arcs, writers, directors, real life people acting those out that makes them compelling,” he said, adding that “visualization is not a replacement for good stories or originality.”

He pointed to Lionsgate’s recent sale of Mad Men to HBO (WBD) as evidence that quality historical content continues to command significant engagement.

Cahall identified Disney (DIS) and Fox (FOX) as companies well positioned to weather the AI transition due to their focus on experiences and live content. He noted that 70% of Disney’s (DIS) operating profit comes from its experiences division and ESPN, arguing that “the more we get flooded with content, some of which is good, a lot of which is not going to be good at all, I think that only increases the premium of experiences.”

Sports content, he added, derives its value from being “live, unpredictable, and not created by anyone.”

As AI tools become more sophisticated, Cahall’s analysis suggests media companies face a critical strategic choice: invest heavily to compete in an increasingly crowded content landscape or double down on assets that AI cannot easily replicate, such as live events, theme parks, and authentic human storytelling.

Link to Seeking Alpha News Article - Feb. 13, 2026

SPY 0.00%↑ IBIT 0.00%↑ ETHA 0.00%↑ #BTC #ETH

[Newsletter Exclusive] SA Analyst says value still leads but a growth comeback could arrive sooner than expected

“There is also change afoot below the waterline – unnoticed by many, crypto may be bottoming; IBIT and ETHA put in flat and slightly up weeks respectively. We think that points the way to a rotation back from value to growth rather sooner than folks expect,” he added.

Link to Seeking Alpha News Article - Feb. 13, 2026

YouTube:

[The Compound | WAYT?] The Stocks That Are Working This Year

I liked Josh’s Idea of HALO but don’t agree with some of the stocks he listed as HALO

Loved the discussion on Software

Robinhood Earnings coverage is also very good

Link to Full Video (01:13 Hours) - Feb 10, 2026

Disclosure: We own positions in some/all of the tickers mentioned in this article.