Weekly newsletter bringing you a summary of unbiased, critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help. Here is a $30 off coupon to help you get started (Affiliate Link).

This Week’s Alpha Coverage: YouTube Playlist.

Editor’s Pick:

NVDA 0.00%↑ AVGO 0.00%↑ AMD 0.00%↑ MRVL 0.00%↑

[News] France unveils $112B AI investment package to rival US’ Stargate

French president Emmanuel Macron on Sunday unveiled a total of €109 billion ($112 billion) in private investments in the AI ecosystem ahead of the nation’s global AI summit this week.

Speaking with French broadcaster TF1, Macron described the multibillion-euro AI investment package as “the equivalent for France of what the United States announced with Stargate,” referring to U.S. President Donald Trump’s $500B, four-year initiative to build out artificial intelligence infrastructure.

The French financing has drawn pledges from foreign and local players, with alternative asset manager Brookfield Asset Management (NYSE:BAM) announcing a €20 billion infrastructure investment program to support the deployment of AI infrastructure in the country.

The UAE has also pledged a €30B-€50B investment, while France’s public investment bank Bpifrance has committed up to €10B. A few companies have yet to announce their plans.

Link to Seeking Alpha News Article - Feb. 10, 2025

NVDA 0.00%↑ AVGO 0.00%↑ AMD 0.00%↑ MRVL 0.00%↑

[News] EU launches $200B AI investment plan

On Tuesday, European Commission's President Ursula von der Leyen launched an initiative called InvestAI to mobilize €200B for investment in AI, including a new European fund of €20B for AI gigafactories.

"This unique public-private partnership, akin to a CERN for AI, will enable all our scientists and companies – not just the biggest - to develop the most advanced very large models needed to make Europe an AI continent," said von der Leyen.

InvestAI fund will finance four future AI gigafactories across the EU and they will specialize in training the complex, large AI models. The gigafactories will have about 100,000 last-generation AI chips.

The Commission's initial funding for InvestAI will come from existing EU funding programs.

In addition, the Commission noted that it has already announced the initial seven AI factories in December 2024 and will soon announce the next five.

Link to Seeking Alpha News Article - Feb. 11, 2025

[News] Apple exploring humanoid, non-humanoid robotics: Ming-Chi Kuo

"Apple is exploring both humanoid and non-humanoid robots for its future smart home ecosystem, and these products are still in the early proof-of-concept stage internally," TF International Securities' analyst Ming-Chi Kuo said on X. "While the industry debates the merits of humanoid vs. non-humanoid designs, supply chain checks indicate Apple cares more about how users build perception with robots than their physical appearance (so Apple uses anthropomorphic instead of humanoid), implying sensing hardware and software serve as the core technologies."

The launch of an Apple-branded robot, which could be its "next big thing," is unlikely to occur anytime soon, Kuo added. Citing current progress and the typical development cycles, mass production of a robot likely will not start until at least 2028, if not later.

In addition, Apple has been "unusually open" about sharing some of its robotics research in recent memory, Kuo said. This includes a research paper published last month that described a robot that looks similar to the lamp at the start of Pixar movies. (Apple co-founder Steve Jobs was the CEO of Pixar before he sold it to Disney (DIS) in 2006).

The company is also said to be working on a smart home tabletop robot that has an iPad-like display and a robotic arm.

Link to Seeking Alpha News Article - Feb. 12, 2025

Link to Apple Blog - Jan, 2025

[News] Meta is said to be investing heavily in humanoid robots with AI

Meta Platforms (NASDAQ:META) is investing heavily in humanoid AI robots and is forming a new team within the Reality Labs division to develop it, Bloomberg reported Friday, citing people familiar with the matter.

The new Reality Labs subdivision will be led by Marc Whitten, former CEO of GM's autonomous vehicle unit Cruise.

Meta plans to work on the robot hardware, which will focus on household chores for now. Eventually, it hopes to make the underlying AI, sensors, and software for robots that will be made and sold by a range of companies, sources told Bloomberg.

The company is discussing plans with robotics companies, including Unitree Robotics and Figure AI Inc.

“The core technologies we’ve already invested in and built across Reality Labs and AI are complementary to developing the advancements needed for robotics,” CTO Andrew Bosworth reportedly said in a memo.

Meta believes humanoids are still a couple of years away from being widely available.

Link to Seeking Alpha News Article - Feb. 14, 2025

[Fox Business]: Watch Rocket Lab CEO Peter Beck on Fox Business

In this interview, Peter Beck focuses on Rocket Lab’s journey and shares his perspective of how he sees Rocket Lab as a competitor to SpaceX.

Link to Link to Fox Business Clip (04:23 Mins) - Feb. 14, 2025

[WealthWise/YouTube]: What I Am Doing With My Rocket Lab Position

I haven’t taken any profits in my core Rocket Lab position. In this video I reveal:

What % of my net worth Rocket Lab is

What I think of the current valuation

What are my plans to take profit on the equity position

Link to Link to YouTube Video (03:05 Mins) - Feb. 15, 2025

News, Facts, Analyst & Market Commentary - Short Reads:

Momentus secures expanded Defense Department contract for large space structure assembly; shares up

Momentus (NASDAQ:MNTS) has been awarded a contract expansion by the U.S. Department of Defense organization, the Defense Advanced Research Projects Agency to conduct an in-orbit demonstration of the assembly of large scale structures.

The mission will launch on an upcoming SpaceX Transporter rideshare as soon as early 2026.

For this upcoming mission, Momentus is under contract to provide full-service support to the DARPA Novel Orbital and Moon Manufacturing, Materials, and Mass-efficient Design program, including arranging launch services, payload integration, and in-orbit hosting of the payload for a complex in-space assembly mission.

The in-space assembly will be conducted on the Momentus Vigoride Orbital Service Vehicle.

The latest contract award from DARPA’s Defense Sciences Office is for Phase 3 of the program valued at about $3.5M.

Link to Seeking Alpha News Article - Feb. 10, 2025

CLF 0.00%↑ NUE 0.00%↑ VALE 0.00%↑

Trump signs order imposing 25% tariffs on steel and aluminum

President Trump signed the executive orders after-hours Monday imposing 25% tariffs on all steel and aluminum imports into the U.S., canceling all exemptions and duty-free quotas for major suppliers Canada, Mexico, Brazil and other countries.

The proclamations signed at the White House were extensions of Trump's 2018 Section 232 national security tariffs to protect steel and aluminum makers.

The president also will impose a new North American standard requiring steel imports to be "melted and poured" and aluminum to be "smelted and cast" in the region to curb imports of minimally processed Chinese steel into the U.S.

Link to Seeking Alpha News Article - Feb. 10, 2025

#BYDDF #BYDDY TSLA 0.00%↑

BYD Company hits record high as God's Eye driver assistance features shakes up the sector

BYD Company Limited (OTCPK:BYDDF) (OTCPK:BYDDY) shook up the electric vehicle sector on Tuesday by announcing new advanced driver-assistance features across most of its lineup for no extra cost.

The electric vehicle giant announced at an event on Monday evening in Shenzhen that it will make its God’s Eye driver-assistance system standard in vehicles priced from 100,000 yuan ($13,700) and include it in several lower-cost models such as the popular Seagull hatchback.

The God's Eye system comes in three variants. The God's Eye A (DiPilot 600) is considered the most advanced version, featuring three LiDAR sensors. It will be used in BYD's luxury Yangwang brand vehicles. God's Eye B (DiPilot 300) is a mid-tier system with one LiDAR unit, intended for the semi-premium Denza brand and flagship BYD vehicles. God's Eye C (DiPilot 100) is the entry-level version, utilizing 12 cameras and 12 ultrasonic radar sensors. The system will be fitted to more affordable models, including the Seagull.

In a broad view, BYD founder Wang Chuanfu said the industry is entering an era where autonomous driving is for everyone.

Link to Seeking Alpha News Article - Feb. 11, 2025

MSFT 0.00%↑ #Anduril

[Newsletter Exclusive] Microsoft teams up with Anduril for next phase of US Army battle goggles

Officially dubbed the Integrated Visual Augmentation System (IVAS) program, the headwear will provide soldiers with a comprehensive, body-worn system that integrates advanced augmented reality and virtual reality. Enhancements include beyond line-of-sight perception capabilities, increasing combat effectiveness, survivability against drones, and accelerating mission command of unmanned systems.

The U.S. Army initially awarded the contract to Microsoft back in 2021. Microsoft signed a deal which it said at the time could be worth $21.88B, to provide HoloLens technology for 120,000 headsets.

Through this new agreement, Anduril will now establish Azure as its preferred hyperscale cloud to support its artificial intelligence development.

Link to Seeking Alpha News Article - Feb. 11, 2025

First Solar raised to Buy at Mizuho on improved sales outlook post-2026

First Solar (NASDAQ:FSLR) -0.7% in Tuesday's trading despite receiving an upgrade at Mizuho to Outperform from Neutral with a $259 price target, hiked from $218, citing a materially improved sales outlook after 2026 and a stronger competitive position in the U.S. market.

Mizuho analyst Maheep Mandloi touts First Solar's (NASDAQ:FSLR) TOPCon technology patents that give the company an edge over competitors who are relegated to using older and less efficient PERC cells.

First Solar (FSLR) shares likely have underperformed YTD given negative sentiment around 45X manufacturing tax credits surviving the Trump administration but, even in a base case assuming 45X expires after 2026, Mandloi thinks any negative impact on the company could be mitigated by tariffs, leading to better negotiating power in 2027.

Also, while competitors could develop solar supply chains in regions currently not subject to tariffs, this would "take time and could come under Trump tariffs in the future," Mandloi writes.

Link to Seeking Alpha News Article - Feb. 11, 2025

[Newsletter Exclusive] Citadel’s Ken Griffin says Trump's 'bombastic' trade rhetoric has already caused damage

"From my vantage point, the bombastic rhetoric, the damage has already been done," Griffin said on Tuesday at the UBS Financial Services Conference in Florida.

"It's a huge mistake to resort to this form of rhetoric when you're trying to drive a bargain because ... it tears into the minds of CEOs, policymakers that we can't depend upon America, as our trading partner," the billionaire businessman said.

"It makes it difficult for multinationals, in particular, to think about how to plan for the next five, 10, 15, 20 years, particularly when it comes to long lead time capital investments that could be adversely impacted by a degradation of the current terms of engagement as amongst the leading Western countries when it comes to terms and trade," the hedge fund manager added.

Griffin has spoken about tariffs before. Last year, in an interview at the Economic Club of New York, he said tariffs will put the U.S. on a "slippery slope towards crony capitalism."

Link to Seeking Alpha News Article - Feb. 11, 2025

MU 0.00%↑ EPI 0.00%↑ INQQ 0.00%↑

[Newsletter Exclusive] Micron said to look for partner for phase 2 of chip plant in India: report

Micron Technology (NASDAQ:MU) is looking for construction partners of the second phase of its fabrication plant in Sanand, Gujarat, the Economic Times reported.

Shares rose 0.5% in premarket trading.

Micron has asked for bids, with construction firms Larsen & Toubro and KEC International among those under consideration, the news outlet added, citing sources. The first phase of the plant was set to open last year, but due to construction delays, it is expected to be operational in the early part of this year.

Boise, Idaho-based Micron is contributing $825M to the plant, while the Indian government is contributing 50% of the total $2.75B it is expected to cost, the news outlet added. The Gujarat is also offering an additional 20% in incentives.

Link to Seeking Alpha News Article - Feb. 12, 2025

LRCX 0.00%↑ EPI 0.00%↑ INQQ 0.00%↑

[Newsletter Exclusive] Lam Research plans to invest over $1B in India to boost semiconductors

U.S.-based chipmaker Lam Research (NASDAQ:LRCX) plans to invest over $1 billion in India over the next few years. The investment was revealed during an 'Invest Karnataka' event.

The company has signed a memorandum of understanding with the Karnataka Industrial Area Development Board for the investment.

India's government is actively promoting the growth of its chip-making industry through initiatives, including a $10 billion incentive package.

Other companies are also making significant investments in the Indian semiconductor market, including NXP Semiconductors (NXPI), which is investing $1 billion to double its R&D efforts and workforce in India.

Link to Seeking Alpha News Article - Feb. 12, 2025

Adobe expands gen-AI offerings with the launch of new video tool

Adobe (NASDAQ:ADBE) on Wednesday released the new Firefly application, a destination to generate images, vectors and now videos with the Firefly Video Model in public beta.

The new Firefly Video Model powers Generate Video (beta) in the Firefly application, as well as Generative Extend (beta) in Adobe Premiere Pro, and generates IP-friendly video content that can be used in production.

Firefly Standard plans enable access to 2,000 video/audio credits per month, up to 20 five-second 1080p video generations, starting at $9.99 USD. Firefly Pro plans enable access to 7,000 video/audio credits per month, up to 70 five-second 1080p video generations, starting at $29.99 USD.

Additionally, a new Firefly Premium plan designed for professionals looking to generate video content regularly will be coming soon.

Link to Seeking Alpha News Article - Feb. 12, 2025

[Newsletter Exclusive] Micron offers Q3 update at Wolfe conference

The Boise, Idaho-based company is seeing stronger volumes than it had anticipated in a number of consumer markets and now projects low to mid-single digit growth in areas like PCs and smartphones, company executives said at the event.

It also expects bit shipments to be higher in the coming period, while inventory levels have continued to improve.

Link to Seeking Alpha News Article - Feb. 12, 2025

QuantumScape sets out goals for 2025, confirms talks with automotive OEMs

The company noted that its primary objective is to prepare for the launch with their prospective customer.

A specific goal is to integrate Cobra, the core scalable manufacturing platform, into baseline production. This involves qualifying downstream processing equipment and metrology to match the increased separator production rates. Once the full separator production flow achieves sufficient yield and quality, Cobra will replace Raptor in the baseline production process.

QuantumScape (NYSE:QS) also aims to install higher-volume cell production equipment in partnership with PowerCo. The joint effort will focus on automating and developing equipment to match Cobra's higher throughput for QSE-5 B1 sample production.

Another goal is to ship Cobra-based B1 samples of the QSE-5 cell for customer testing. The B1 samples are designed to reflect mature cell performance and manufacturing specifications, with initial shipments supporting the demonstration phase of the launch program targeted for 2026.

Lastly, QuantumScape (QS) plans to expand its commercial engagements. Using their partnership with Volkswagen's PowerCo as a blueprint, the company aims to increase its portfolio of potential licensing partnerships.

Notably, QuantumScape (QS) said it is currently in active discussions with two automotive OEMs and is building relationships with technology partners and global players across the battery value chain.

Link to Seeking Alpha News Article - Feb. 12, 2025

BlackSky wins multiple, multi-year contracts with a combined value of eight figures

BlackSky Technology Inc. (BKSY) (NYSE: BKSY) won multi-year contracts that include Assured access to subscription-based low-latency, high-cadence imagery and AI-enabled analytics services. The deals also include the delivery of one high-resolution Earth observation satellite and launch support operations and on-orbit maintenance services. These contracts have a combined eight-figure value.

Link to Seeking Alpha News Article - Feb. 13, 2025

AAPL 0.00%↑ BABA 0.00%↑ BIDU 0.00%↑

Alibaba to partner with Apple on AI features, continues to work with Baidu

Alibaba (9988.HK), will partner with Apple (AAPL.O), to support iPhones' AI services offering in China, its chairman said on Thursday.

The landmark deal also resolves months of speculation over Apple's AI strategy in the region as the iPhone maker had been in talks with Chinese tech leaders including Baidu (9888.HK), opens new tab, ByteDance and Tencent (0700.HK), opens new tab, Reuters and the Information have reported.

Apple continues to work with Baidu on AI features for iPhones in China, The Information reported on Thursday, citing two people with direct knowledge of the matter.

Link to Reuters News Article - Feb. 13, 2025

AppLovin rockets towards record high; no more games as focus shifts to AI, e-commerce

AppLovin (NASDAQ:APP) revealed plans to sell its gaming app segment and focus on other opportunities after the company's fourth quarter 2024 results and guidance easily topped market expectations.

"Seven years ago, we began acquiring gaming studios to help train our earliest machine learning models, an invaluable step in shaping the AI that underpins our AXON platform," said AppLovin CEO and co-founder Adam Foroughi. "However, we've never been a game developer at heart."

"Today, we're announcing we've signed an exclusive term sheet to sell all of our Apps business," he added.

"Total estimated consideration is $900M, including $500M in cash, with the remainder representing a minority equity stake in the combined private company," said AppLovin CFO Matt Stumpf.

"This cements the company's focus on the ad network business, while removing a lower margin/lower multiple asset that the company has been seeking to sell for multiple years," said Morgan Stanley analysts, led by Matthew Cost, in a Thursday investor note.

Needham analysts highlighted AppLovin's expansion into a wider variety of advertisers, utilizing artificial intelligence.

Link to Seeking Alpha News Article - Feb. 13, 2025

[Newsletter Exclusive] HP ships first Nvidia Blackwell-based AI computing system

Hewlett Packard Enterprise (NYSE:HPE) has shipped its first Nvidia (NASDAQ:NVDA) Blackwell-based system, the NVIDIA GB200 NVL72.

This rack-scale system is designed to help service providers and large enterprises deploy large AI clusters.

The GB200 NVL72 features shared-memory, low-latency architecture and GPU technology designed for large AI models of over a trillion parameters.

It has 72 Nvidia Blackwell GPUs and 36 Nvidia Grace CPUs interconnected via Nvidia NVLink, up to 13.5 TB of HBM3e memory with 576 TB/sec bandwidth, and HPE’s direct liquid cooling technology.

Link to Seeking Alpha News Article - Feb. 13, 2025

Quantum computing stocks in focus as D-Wave Quantum announces systems sale

Quantum computing stocks were in the spotlight on Thursday as D-Wave Quantum (NYSE:QBTS) announced a system sale to Germany's Jülich Supercomputing Centre, making it the first high-performance computing center in the world to own a D-Wave Advantage annealing quantum computing system.

Link to Seeking Alpha News Article - Feb. 13, 2025

[Newsletter Exclusive] U.S. household debt tops $18T in Q4, New York Fed says

U.S. household debt rose by $93B in Q4 2024, reaching $18.04T, the New York Fed's Quarterly Report on Household Debt and Credit said on Thursday.

Aggregate delinquency rates ticked up 0.1 percentage point to 3.6% from the previous quarter.

Mortgage balances rose by $11B to $12.61T at the end of December. Auto loan balances also rose by $11B to $1.66T, while credit card balances climbed by $45B to $1.21T, the report said. Student loan balances reached $1.62T, up $9B from the prior quarter.

While transitions into serious delinquency, defined as 90 days or more past due, were stable for mortgages, they edged up for auto loans, credit cards, and home equity lines of credit, the New York Fed said.

Link to Seeking Alpha News Article - Feb. 13, 2025

[Newsletter Exclusive] Bloom Energy, Chart Industries to launch carbon capture partnership

Bloom Energy (NYSE:BE) +1.9% in Thursday's trading after saying it launched a carbon capture partnership with equipment manufacturer Chart Industries (GTLS) to generate near zero-carbon power using natural gas and fuel cells.

As part of the partnership, Chart Industries (GTLS) will use its carbon capture technology to process high-purity carbon dioxide exhaust stream that is a byproduct of Bloom Energy's (NYSE:BE) processes.

Efficient carbon capture depends on the purity of CO2 in the exhaust stream, which varies widely across power generation technologies; Bloom (BE) said its high-temperature fuel cell technology converts natural gas without combustion, yielding a CO2-rich stream that has 15x lower mass flow and 10x the CO2 concentration, making the capture process more efficient and less costly.

CO2 utilization offers a short-term mitigation to climate change, especially in areas where carbon storage infrastructure is not available.

"Our partnership with Chart aims to demonstrate that cost-effective, onsite baseload power from natural gas with carbon capture is feasible at scale," Bloom Energy (BE) Chairman and CEO KR Sridhar said.

Link to Seeking Alpha News Article - Feb. 13, 2025

Trump signs plan that could lead to reciprocal tariffs against U.S. trading partners

U.S. President Donald Trump on Thursday signed a memorandum that could result in sweeping reciprocal tariffs against all American trading partners.

Trump introduced his "Fair and Reciprocal Plan" that will allow several federal agencies to investigate current trade relations and propose tit-for-tat tariffs on a country-specific basis.

Link to Seeking Alpha News Article - Feb. 13, 2025

[Newsletter Exclusive] Arm said to sign up Meta as client for its own chip: report

Arm is likely to announce its own chip, believed to be a central processing unit, as soon as the summer, the news outlet added, citing people familiar with the matter.

Arm had been discussing building its own chip and previous reports indicated that it could acquire privately-held Ampere Computing to further boost its efforts to do so. The Times added that Arm is getting closer to acquiring Ampere, which is backed by Oracle (ORCL).

Upon launch, it would place Arm, which is still majority owned by SoftBank (OTCPK:SFTBY), further in competition with some of its largest customers, including Nvidia.

Link to Seeking Alpha News Article - Feb. 13, 2025

[Newsletter Exclusive] GE Vernova started at Outperform at Baird, set to benefit from rising global electricity demand

GE Vernova (NYSE:GEV) -0.6% in Thursday's trading even as Baird initiates coverage with an Outperform rating and $448 price target, saying the company's diverse technology portfolio, scale, pricing power, and clean financials "create a compelling investment thesis for investors looking to play the forecasted rise in energy demand on global power grids."

GE Vernova (NYSE:GEV) operates at a global scale with an industry-leading technology portfolio on a scale greater than any of its competitors, and Baird's Ben Kallo says the rising demand for energy generation solutions gives the company pricing power for out years which he believes will translate to margin expansion and may provide upside to the long-term financial targets through 2028.

Beyond the core businesses, Kallo notes several other attractive technologies and initiatives aside from GE Vernova's (GEV) bread-and-butter gas turbines: Emerging technologies such as small modular reactors and carbon capture, utilization, and sequestration provide options for GEV’s business in the longer term as markets for the technologies develop, and the Wind business is currently out of favor, but any rebound in demand likely would provide upside for the shares.

Link to Seeking Alpha News Article - Feb. 13, 2025

CEG 0.00%↑ VST 0.00%↑ GEV 0.00%↑ PWR 0.00%↑ NEE 0.00%↑

U.S. electricity demand growth through 2027 will be like adding another California

How much electricity are we going to need? A lot. Or more precisely, an "unprecedented" 3,500 terawatt hours for the globe over the next three years. That corresponds to adding more than the equivalent of a Japan to the world’s electricity consumption each year, according to the International Energy Agency, which is out with a new report called, "Electricity 2025: Analysis and Forecast to 2027."

"Strong growth in electricity demand is raising the curtain on a new Age of Electricity," per the report. "Electrification of buildings, transportation and industry combined with a growing demand for air conditioners and data centers is ushering a shift toward a global economy with electricity at its foundations." Most of the additional demand for electricity through 2027 will come from emerging and developing economies, led by China, which are expected to make up 85% of the growth.

Perhaps surprisingly, in advanced economies like the U.S., total and per capita demand has stayed relatively flat or even declined since 2009. That's due to increased efficiency across all end-use sectors (like lighting, appliances, and the restructuring/relocation of heavy industries), but things are starting to change amid higher consumption from data centers, EVs, crypto, 5G networks, and heat pumps. In fact, U.S. electricity demand is now estimated to grow at an average annual rate of 2% over the 2025-2027 period, which is equivalent to adding the total electricity demand of California over the next three years.

Link to Seeking Alpha News Article - Feb. 14, 2025

SOUN 0.00%↑ SERV 0.00%↑ ARM 0.00%↑ NVDA 0.00%↑

SoundHound AI, Serve, Nano-X in focus as Nvidia exits stakes; cuts Arm investment

SoundHound AI (NASDAQ:SOUN), Serve Robotics (NASDAQ:SERV) and Nano-X (NASDAQ:NNOX) fell sharply in premarket trading on Friday as Nvidia (NASDAQ:NVDA) exited its stakes in the companies, according to its latest 13-F filing.

The Jensen Huang-led chipmaker also cut its stake in British chip design firm Arm Holdings (ARM).

The new 13-F filing indicated Nvidia still owned stakes in Applied Digital (APLD), Nebius (NBIS) (it invested as part of a $700M funding round late last year) and Recursion Pharmaceuticals (RXRX) as of the filing date.

It also indicated Nvidia purchased a new stake in Chinese self-driving startup WeRide (WRD), buying 1.7M shares.

Link to Seeking Alpha News Article - Feb. 14, 2025

$GTBIF HITI 0.00%↑ MSOS 0.00%↑

Here is what new HHS Secretary RFK Jr. thinks about marijuana use

In an interview with Fox News late yesterday, RFK Jr said that given state-level legalizations, the harmful effects of marijuana can be studied.

“I hear stories all the time of the impacts of marijuana on people—and the really catastrophic impacts on them,” RFK Jr said, adding, “Because of the legalization of recreational marijuana in 25 states, we have a capacity to really study it and to compare it to states.”

“We need to do studies. We need to figure it out, and then we need to implement policies to address any health concerns,” Marijuana Moment reported, quoting RFK Jr. as telling Fox News’ Laura Ingraham.

Link to Seeking Alpha News Article - Feb. 14, 2025

DELL 0.00%↑ #xAI

Dell rises after company nears $5B AI server deal with Musk's xAI: Bloomberg

Dell Technologies (NYSE:DELL) is in advanced talks to secure a contract worth over $5B to provide Elon Musk’s xAI with servers optimized for AI, Bloomberg News reported.

The company will sell servers consisting of Nvidia (NVDA) GB200 semiconductors to Musk’s AI company for delivery this year. Some details are being finalized but could still change, the report added, citing people with knowledge of the matter.

xAI is also looking to raise $10B in new funding that would value the Elon Musk-led company at $75B, Bloomberg reported.

Link to Seeking Alpha News Article - Feb. 14, 2025

Link to Seeking Alpha News Article - Feb. 14, 2025

Opinion Pieces - Facts & Opinions - Long Reads:

Spire Global: Debt Issues Back In Focus After Failed Maritime Business Sale -- Sell

Spire Global, Inc.'s shares sold off after the satellite data provider failed to close on the $241 million sale of its maritime business.

As a result, debt issues are back in focus, with secured lender Blue Torch Capital having the right to accelerate the company's debt at any time.

Adding insult to injury, Spire Global is experiencing liquidity issues, thus resulting in the requirement to raise additional capital in the near term.

Under a worst-case scenario, the company might end up in bankruptcy.

Link to Seeking Alpha Opinion Piece - Feb. 12, 2025

Charts & Technicals:

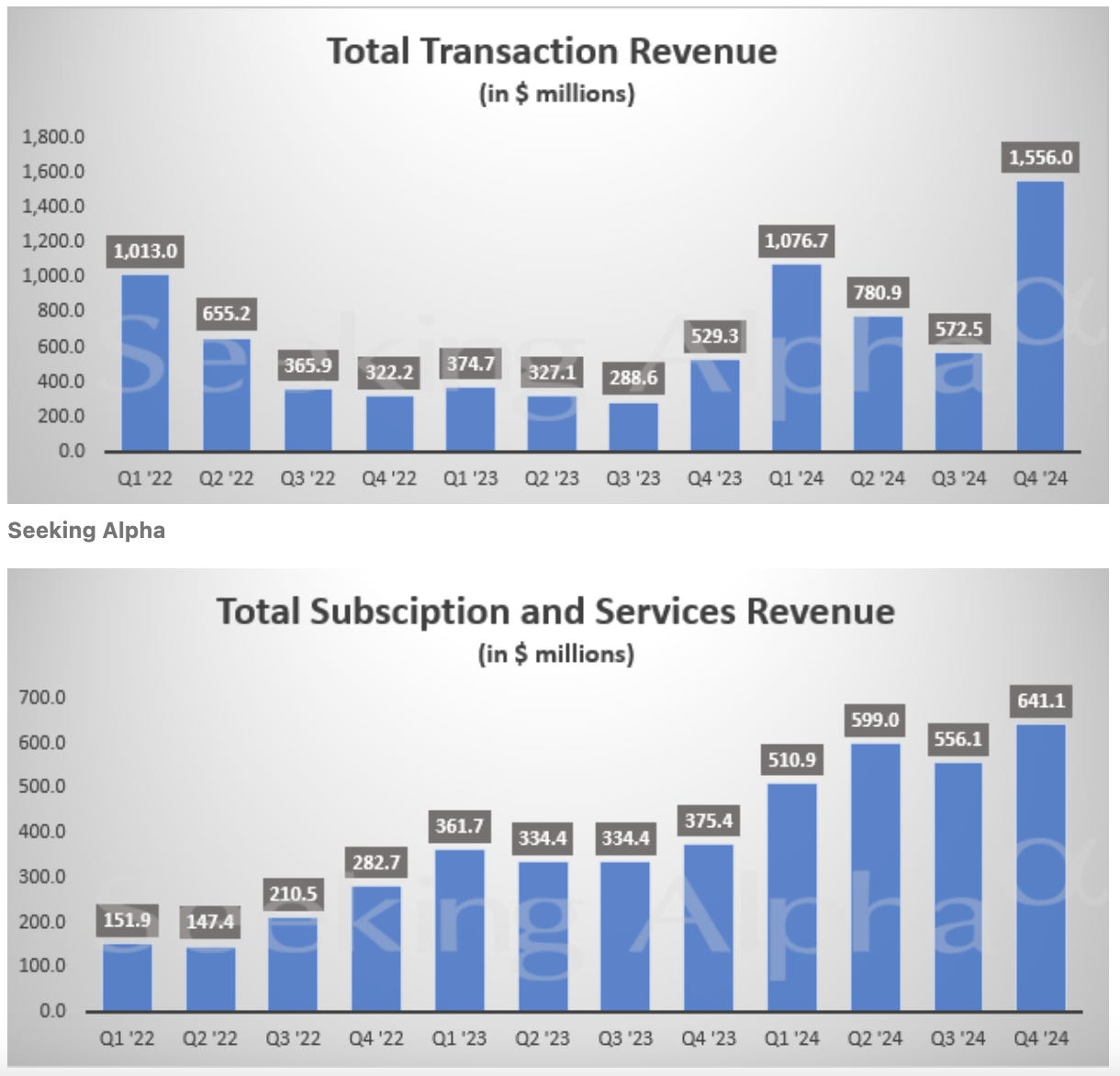

Coinbase in charts: Total transaction revenue jumps to $1.56B in Q4

Link to Seeking Alpha News Article - Feb. 13, 2025

Disclosure: We own positions in some/all of the tickers mentioned in this article.