As I start sharing more of my investment thesis and before I start talking about individual stocks, I want to share with you the concept of Borrowed Conviction.

You could consider this whole article a disclaimer. You buy stocks at your own risk. You are 100% responsible for the gains, you are 100% responsible for the losses.

People have a lot of ideas on why investing is hard. I have come to the conclusion that the hardest thing in investing is “discipline”. People who don’t invest might not get it - A friend who does not invest in the markets once told me, why don’t you just sell it when it is high and buy when it is low.

People who invest, however, and especially ones who’ve been through a bear market will probably agree. Do you agree that discipline is the hardest thing in investing? Let me know in the comments below.

A small potion of that discipline is Conviction. I will write more about my thesis on discipline in the future but for this article, let’s focus on Conviction.

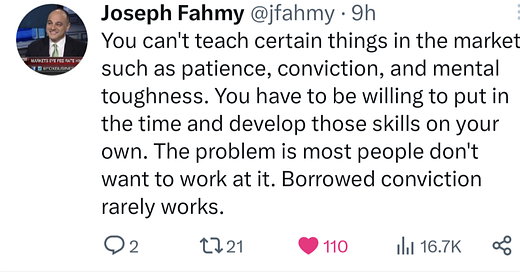

Here is a tweet from Joe (who I recommend you follow), from where I borrowed the term “Borrowed Conviction”. However, like most of my investing principles, this is also something that I stumbled upon in the wild and later found other, more experienced investors also talking about it.

It is really simple and doesn’t take that long to experience. But, for some reason people still sometimes just buy stocks because ‘someone told them to’ which is the same as Borrowed Conviction.

When the market starts tanking, it is very hard to hold on to the stocks you hand picked and “have conviction in”. The stocks that you bought on Borrowed Conviction, doesn't stand a chance! Those are the first stocks you will sell because you don’t know why you bought them! And maybe you should not be getting out of some of them, some of them, are likely great stocks and will go on to be a tenbagger.

You shouldn’t be investing on anybody’s recommendation except your financial advisor who has a fiduciary responsibility to put your interests ahead of their own. No CNBC, No Motley Fool, any of my content or any other article you read, none of it!

What you should be doing however is, take in whatever anyone is telling you about an investment as a data point, one data point in many. You need to be careful to separate hard facts from opinion and put them in separate boxes. You wanna pay more attention to hard facts and your goal is to build your own opinion. But just be aware of the difference between opinions and hard facts.

Every article you read, every opinion you listen to, every data point you have will all collectively form your opinion.

Once you have a starting point, you need to do your own due diligence. You have to look into the numbers yourself, listen to the earnings calls & a tiny bit of technical analysis will take you a long way.

Add to the box of hard facts and over time you will Build your Own Conviction! Why do YOU own this stock? What’s YOUR thesis?

In all honesty, until you have your own thesis for holding a stock, why are you even making that investment?

If you are not willing to put in this much effort, keep investing to a hobby and let a professional manage most of your wealth. Investing is a great hobby, it keeps you aware about the world, understand how money works, how risk works & how the economy works. I think CNBC has relatively less political bias (maybe because they are over indexing on $$ so much), but I’ll take it. I think investing is one of the best hobbies to have in retirement. Not only is there a higher likelihood of you having saved up for your retirement but you’d also be smart with your money in your retirement and you will still have optionality.

Even if you just do investing as a hobby and make just a few good financial decisions, you could have a lot more money to work with in your retirement.

Read my article on The Ideal US Equity ETF Portfolio to see what ETFs I have in my retirement portfolio.

Past performance is no guarantee of future results.

The ideas discussed in this article should not be constituted as investment advice.

Disclosure: We own positions in some/all of the tickers mentioned in this article.