Investing 102: The Power of Retail Investors

Small Caps, Risk Taking Ability, Time Frame and more...

Institutions are trying to beat the index and it is a great strategy. For most people, that works. Not for me. Especially after what I have learned about the markets, I cannot settle for ‘just’ beating the index.

I think people who manage their own money have distinct advantages over people who don’t and I am going to share my perspective on The Power of Retail Investors in this article.

This article is Part 3 of my Edu series where I share things I’ve learned about investing in public markets.

As mentioned in my last Edu article, if you understand that you need these skills which no one talks about and are willing to take more risk, you could beat the markets and professional money managers by just using ETFs alone.

Is Retail Smart Money?

I think most of retail is smart money (at least in recent times).

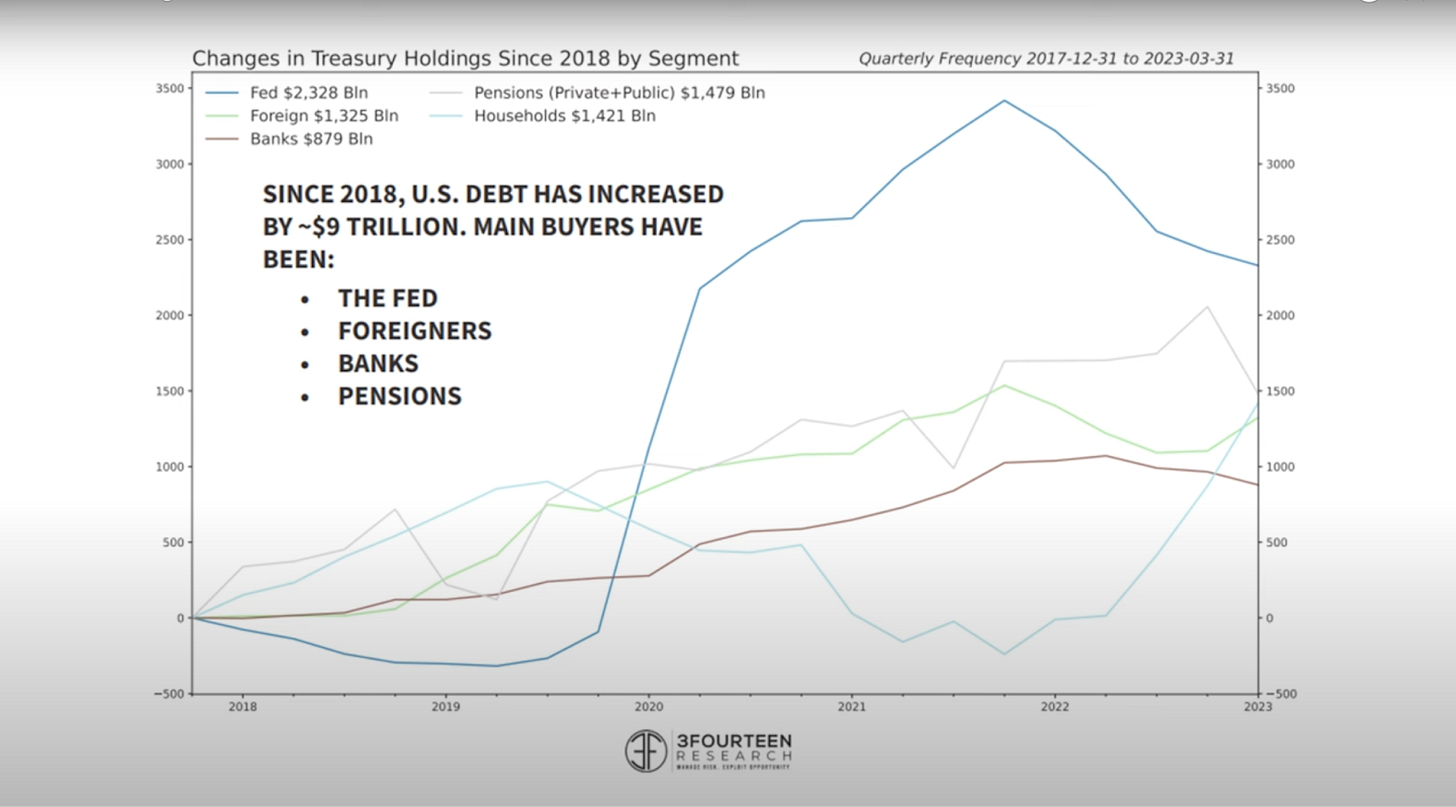

They are one of the few groups that made money in the 2023 bull market, they are also the only group that seemed to be buying bonds at the right time as rates were going up (Look at the light blue line for households climbing since late 2021 just when the Fed started raising interest rates and accelerated their buying in mid 2022 - just when the fed started hiking by 50 and 75 bps):

Institutional Investor Structure Vs Retail Investor:

I am going to make a series of comparisons highlighting the advantages of a Retail Investor over an Institutional Investor to drive home my point. I will talk about structural issues like Small/Micro/Nano Caps + Information Edge, behavioral issues like Risk Taking Ability & Conviction.

The basic case I want to make is that as a Retail Investor, you can put in the time and learn about stocks which are outside of the purview of institutional investors because of their lack of size. Because institutions managing money for other people are just trying to beat the index, they often mimic the index and make tiny changes to drive higher returns. This strategy, while great for most investors, is built with the intention to reduce risk and, therefore by definition (high risk, high returns), is not set up to deliver high returns. At the risk of repeating myself, I would go so far as to say that you are better off just using the indexes and doing it yourself.

The other issue that institutions struggle with is that their time frame is often 1 year because their performance is gauged against that. Their bonuses, their targets are all on an annual basis. This forces Wall Street into a myopic view which reinforces itself as everyone around is also in the same bubble, doing the same thing.

12 months is not long term investing and that is what Wall Street focuses on.

Small/Micro/Nano Caps + Information Edge

Let’s start with a couple of clips from The Compound & Friends about how most of the greatest investors & stocks in history started in Micro Caps - Clip.

80% of stocks that went up 10x, came from Micro Caps (2012 - 2022) - Clip

As you’ve understood by now, I am trying to make the case that if you are looking to create high returns, then small/micro caps is one way to do it.

When I first started investing and started paying attention to the Mega Cap stocks, I realized that their P/Es are so much higher than the market multiple, add to that their market caps, I quickly realized that this is not where I am going to get my 10x returns from. I, therefore, naturally gravitated towards Mid-caps and Small-caps. At that time, I had not read any literature, or listened to any podcasts on cap structures and how they perform, I had no clue that this was a legit strategy. I just naturally figured out that, to make big returns, I should diversify and go small.

It didn’t take me long to discover Micro Caps (Definition) and Nano Caps (Definition), thanks to the 2021 run up in growth stocks and the subsequent 80-90% crash. But often during such times, the baby gets thrown out with the bath water and that is very much the case right now!

One can find hidden gems and get that elusive 10x return.

However, it takes effort. And I have learned that you need to have the skill to identify which stocks are the gems, have the courage to buy them when they are down and everyone else is shitting on them, display conviction and discipline to hold it through tough times and the wherewithal to sell it when it’s time. All of these things are not easy by any stretch of the imagination. Most “experts” fail to do this. But it is often because of lack of discipline and courage, not so much information. Information edge is no more for the institutional investors (or at the very least, it is greatly reduced). You can get access to pretty much the same research that a money manager on Wall Street does. The question is: Are you willing to put in the effort?

(In an effort to make it easier to keep up, I publish Wall Street Research on the WealthWise YouTube Channel)

However, what big institutional investors definitely don’t have is the Small/Micro/Nano Caps edge, simply because of their size. It’s basic math. If they have to put $10 Billion to work, they cannot do that in companies that have a $1 Billion market cap, you would run out of companies soon and still have billions left to put to work. Besides, if they put $0.5 Billion to work in a $1 Billion market cap company, they now own 50% of the company, which is a lot of concentration risk.

But your $1000, $5000, $50,000… will not have the same effect.

As long as you are small, you have the Small/Micro/Nano Cap edge.

Also an important PSA, don’t buy cap weighted ETFs, you have to buy the stocks. Large cap ETFs or thematic ETFs are fine but not ETFs for Mid-cap, small-caps or nano-cap. The reason is simple, stocks make up the ETF. If a stock goes 10x, it definitely won’t remain in the small-cap or nano-cap ETF, therefore limiting your upside (These ETFs, by definition, sell their best performers). This was detailed particularly well in this Seeking Alpha article about QQQJ by Kurtis Hemmerling.

Disclosure: Only a portion of my entire net worth is invested in small/micro/nano caps stocks. I believe with small caps you buy them small and you let them grow into big positions.

Investing in Micro Caps and Small Caps is extremely risky, probably the riskiest equities you can buy in the stock market. Nothing in this article should be constituted as investment advice.

Risk Taking Ability & Conviction:

People ask me all the time: “Why don’t you just manage my money for me?”

I tell them the same thing every time: “I would not be comfortable taking the same risks for a client’s investments as I would for my own” (which in turn affords me the high returns).

If I start managing money for other people, I will face some of the same limitations that an institutional investor faces.

Institutional Managers are trying to preserve wealth, and I totally understand that. I believe that once you reach a certain amount saved (It differs based on your spending lifestyle), you should in fact seek out risk free investments and again, I personally, would just put it in an ETF (and definitely long term bonds, given where interest rates are right now).

However, my assignment is to build wealth, preserving will come later.

Until recently, my largest position was $RKLB (it is still my 3rd largest position now and I am continuing to dollar cost average into it as long as it is below my average buy price). If I was a professional money manager, I would never expose so much of a client’s portfolio to a non-profitable company.

However, I have conviction in RocketLab. Their leadership has delivered strong execution and trails only SpaceX in their launch cadence. Besides, unlike SpaceX, RocketLab is an end to end space company for hire (SpaceX does it for SpaceX only). So I continue to hold and buy more but I would not want to justify being down 20% on a position I purchased 2 years ago to a client.

I am exposed to many stocks like RocketLab, I think of myself as doing venture style investing in the public markets. I expect 90% of the risky companies that I am invested in to go to zero. Which means that I will only hit break even when the rest 10% go up at least 10x+.

It is not possible to take this level of risk when you are managing someone else's money. One has to have conviction and make these bets based on their own due diligence. Some hedge funds might but they won't respond to your or my phone calls.

Time Frame:

The other big issue with institutional money managers and Wall Street is the obsession with the next 12 months. It is understandable to some extent, the recency bias is justified if you are concerned about what your 12 month return is going to be. And that is also how folks who are managing your money on Wall Street get paid: Their annual appraisal, salary, promotion, growth all depends on the returns they can drive in the next 12 months.

There is also the consideration that we have the most visibility over the next 12 months, however, that visibility is often not very trustworthy and our emotions play games with us. I can tell you with higher certainty what a stock will do in 3 years, than what it will do over the next 1 year. Markets are forward looking and often don’t respond to economic events the way you might anticipate them to, either because it is already in the price or because of the fact that markets can be very mis-priced in the short term (We’ve seen many examples in the past from $GME, $MRNA). So managing money with a 12 month time frame is a fool's errand which some, very few of the money managers are good at. And I have mad respect for folks who can pull that off, year after year.

So often chasing 12 months performance is not rewarding but then these institutional investors are judged based on that, hence creating one more structural issue that prevents institutions from delivering high returns.

Consensus:

Wall Street follows consensus because going outside consensus is risky from a reputation and career point of view. While some on Wall Street do walk their own path, like Fundstart’s Tom Lee and Hightower’s Stephanie Link, most follow consensus. It’s not about one trade, it’s about someone’s career.

And the problem is that consensus is often wrong because if it is consensus, it’s in the price silly.

Especially if you look at the last year, almost everyone was wrong about the next 12 months in Q4 2022, except retail which based on my readings was buying in Q4 last year and Q1 this year.

So, trying to fit in and saying what is perceived to be the right thing limits their ability to take bold actions.

Conclusion:

Being a retail investor is an edge if you are willing to put in a little bit of work (for ETF based strategy) and a lot of work (for individual stocks based strategy or even if individual stocks are in the mix).

You don’t need to pay anyone to manage your money and being WealthWise helps you make wise decisions in life too. Just the awareness of Global Economy and Geopolitics and knowing some basic things about the markets and taxation will alone take you a long way.

However, If you are not willing to put in the effort, then please consider consulting a registered investment advisor to help you manage your money.

Borrowed Conviction Rarely Works

Past performance is no guarantee of future results.

The ideas discussed in this article should not be constituted as investment advice.

I reserve the right to change my mind if the facts change.

Disclosure: We own positions in some/all of the tickers mentioned in this article.