Past performance is no guarantee of future results.

In this article we will identify 3 REITs which have delivered above average returns over the last 10 years. These are split across specialized REIT, Mortgage REIT and Multi-Family Residential REIT.

I really want to get exposure to real estate but I don’t want to buy hard assets (yet) and even if I did, I can’t make up my mind on location. Investing in Real Real Estate is a big commitment and I am not ready for it yet. So what should I do? Wait on the sidelines or is there something I can do about it?

I strongly believe in diversification and real estate is one category that I feel is a must have in every portfolio, but without the baggage. I would like to continue to build exposure using equities (REITs) until I figure out if and where I want to buy Real Estate. While I wait, I’ll earn income which I’ll re-invest. If and when I’m finally ready to make a Real Estate investment, I would have hopefully saved up enough for down payment.

Buy low, sell high, right?

Owing to the Federal Reserve’s historic Interest Rate Hiking campaign to tame Inflation, Real Estate has taken a hit. However, actual home prices have not come down that much yet but Equities are a discounting mechanism and the prices have already come down significantly. So this might be a great time to add Real Estate exposure.

Real Real Estate 10 Year Appreciation

Here are historical returns for Real Real Estate Investments in areas I have considered buying real estate in:

Source: Norada Real Estate Investments

Please take note that the table above reflects money in - money out, it does not take into consideration that you are either living in that house (saves you rent money) or you are renting it (gives you an income). Since we are using the ‘Total Return’ metric to run this analysis, we need to take into consideration that these real estate returns are appreciation only and do not include income. Hence the Total Return for real estate investments will be higher than the 10 Year Appreciation figure you see in the table above. Add to that the tax benefits that Real Estate affords you and buying an actual Real Estate property starts to make a lot more sense.

But then, these are unforeseen costs with owning a home which you don’t have to deal with if you are renting. One of my friends in California had to spend $40K in roofing after the recent storms in California. Buying real estate also usually locks you in for a few years (at the bare minimum) which some argue can be a good thing because you don’t touch that investment and let it compound while some might argue it’s a bad thing because of lack of liquidity.

So we’ve established that there are pros and cons to renting and owning - basically no progress made on the age old debate.

So let’s say a total return of close to 200% in 10 years is a good benchmark as that is close to 2x the median (Median is 118). For context $SPY 10 year total return is 204%.

Real Estate Investment Trust (REITs) 10 Year Appreciation, Valuation & Dividend Profile

I did a deep dive of 20 REITs to begin with. I then eliminated 8 primarily based on consecutive years of dividend payments (removed anything less than 2 years).

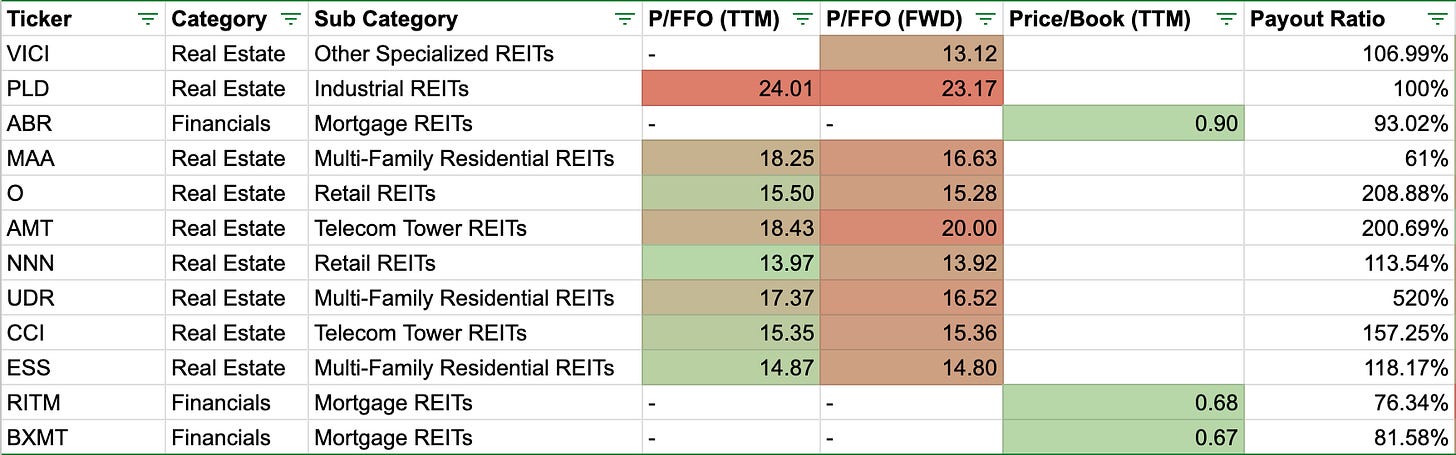

Here is what I found for the 12 REITs that we ran an analysis for:

$VICI $PLD $ABR $MAA $O $AMT $NNN $UDR $CCI $ESS $RITM $BXMT

(REITs that were not included in the analysis: $BXP $NLY $DX $PSA $NYMT $CPT $AVB $EQR)

Seeking Alpha Link to follow along (Make sure to change the Metric to “Total Return”, does not default to it.

Feel free to use this Google Sheets Link to follow along as it might be easier to read, you can also play around with the filters there - in lieu of screenshots below:

Let’s also take a look at Valuation & Payout Ratios for a more fundamental analysis:

And finally Dividend Profile:

Top REITs after considering 10 Year Price Return, Valuation & Dividend Profile:

$VICI - Real Estate - Other Specialized REITs

$PLD - Real Estate - Industrial REITs

$ABR - Financials - Mortgage REITs

$MAA - Real Estate - Multi-Family Residential REITs

Let’s dive deeper into 3 out of these 4 REITs that I am adding to:

VICI Properties Inc. is an S&P 500 experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip. VICI Properties’ geographically diverse portfolio consists of 49 gaming facilities across the United States and Canada comprising approximately 124 million square feet and features approximately 60,100 hotel rooms and more than 450 restaurants, bars, nightclubs and sportsbooks.

Source: VICI Website

Since I am looking for a proxy for residential real estate, I’m not particularly keen on a specialized REIT that owns Gaming Facilities, Restaurants, Bras, Clubs, Sportsbook & Golf Courses. However looking at that Total Return and given that I am very bullish on travel long term, I’ll consider it.

It doesn’t hurt that $VICI seems to be the highest quality name based on past performance and dividend profile. Analysts seem to agree. Seeking Alpha Authors Rates this a “Buy” while Wall Street and Seeking Alpha Quants rate this a “Strong Buy”

Key Takeaways:

It has the best performance in the last 1, 3 & 5 years. 5th best in 10 years.

Cheapest in the cohort: P/FFO (FWD) at 13.12

3 year dividend growth rate is average

4 years of consecutive dividend growth

For a more detailed analysis on $VICI refer to this Seeking Alpha article by Yannick Frey.

I am going to start dollar cost averaging into $VICI starting today.

As mentioned, I primarily set out looking for residential REITs and while $PLD looks good based on performance, the P/FFO is too high around 23-24 times.

Since it is not in the category & expensive compared to the cohort, I am not going to consider $PLD at the moment.

Like every retail investor, I am guilty of chasing dividend yield. I found Mortgage REITs as a result of this. Mortgage REITs are, let’s call it, Real Estate adjacent. You’ll notice that all the mortgage REITs are categorized as financials, that’s because these companies work like financials, they usually make money from interest income made for loans on real estate.

Mortgage REITs (mREITS) provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities (MBS) and earning income from the interest on these investments. It can be for both Residential as well as Commercial.

Arbor Realty Trust, Inc. (NYSE:ABR) is a nationwide real estate investment trust and direct lender, providing loan origination and servicing for multifamily, single-family rental (SFR) portfolios and other diverse commercial real estate assets.

ABR’s portfolio of loans primarily consist of bridge loans but they also invest in mezzanine loans and preferred equity. Bridge loans makes up 98% of their portfolio while mezzanine and preferred equity make up 1% each.

By property type, the vast majority of their portfolio is made up of multifamily at 91%, followed by single-family rental at 7%, land at 1% and office at 1%.

Given the current environment in the office sector, ABR’s property mix should put their portfolio in a strong position compared to many of their mortgage REIT peers as they have much less office exposure than many other commercial mREITs.

Source: Seeking Alpha’s Author Brad Thomas does a deep dive on $ABR in his Article & addresses the recent short report by NINGI.

Key Takeaways:

$ABR delivered the best performance on 10 Years, 2nd best in 3 years and 5 years

With a payout ratio of 0.90, it is undervalued

2nd highest dividend growth 5 year (CAGR) & 3rd highest 3 year (CAGR)

9 consecutive years of dividend growth

ABR also has a 13.89% Short Interest

Apart from $ABR, I also hold positions in other mREITs: $RITM $BXMT & $NYMT. I have held these for a couple of years now for fundamental reasons and will continue to hold them in the short term but will pause adding to it. Right now is probably the worst possible time to analyse the performance of mREITs because some of them have been cut in half since the Federal Reserve started raising interest rates last year. The banking turmoil is not helping either. However, owing to the drop in prices, some of these REITs are paying close to a 15% dividend. I think the Federal Reserve is done hiking and if that indeed is true, we could literally be sitting at the bottom. Buy low, sell high, right? So right now would be the worst possible time to get out of these names. Instead, I’ll add more to my $ABR position.

Having said that, the financial system has taken a few blows in the last couple of months and the risks remain elevated, so be careful out there.

I came across $MAA in my quest to look for a REIT which has exposure to the Sunbelt. Mid-America Apartment Communities, Inc is an S&P 500 company and real estate investment trust (REIT) that develops, redevelops, and manages apartment communities primarily throughout the Southeast, Southwest, and Mid-Atlantic regions of the United States.

Out of the top 4 REITs we found in our analysis, MAA is the only one that is an actual residential REIT. It does what you think a Residential REIT does.

Portfolio: Unique Diversification & Balance across the Sunbelt Region:

MAA owns 102K units in 16 states + DC:

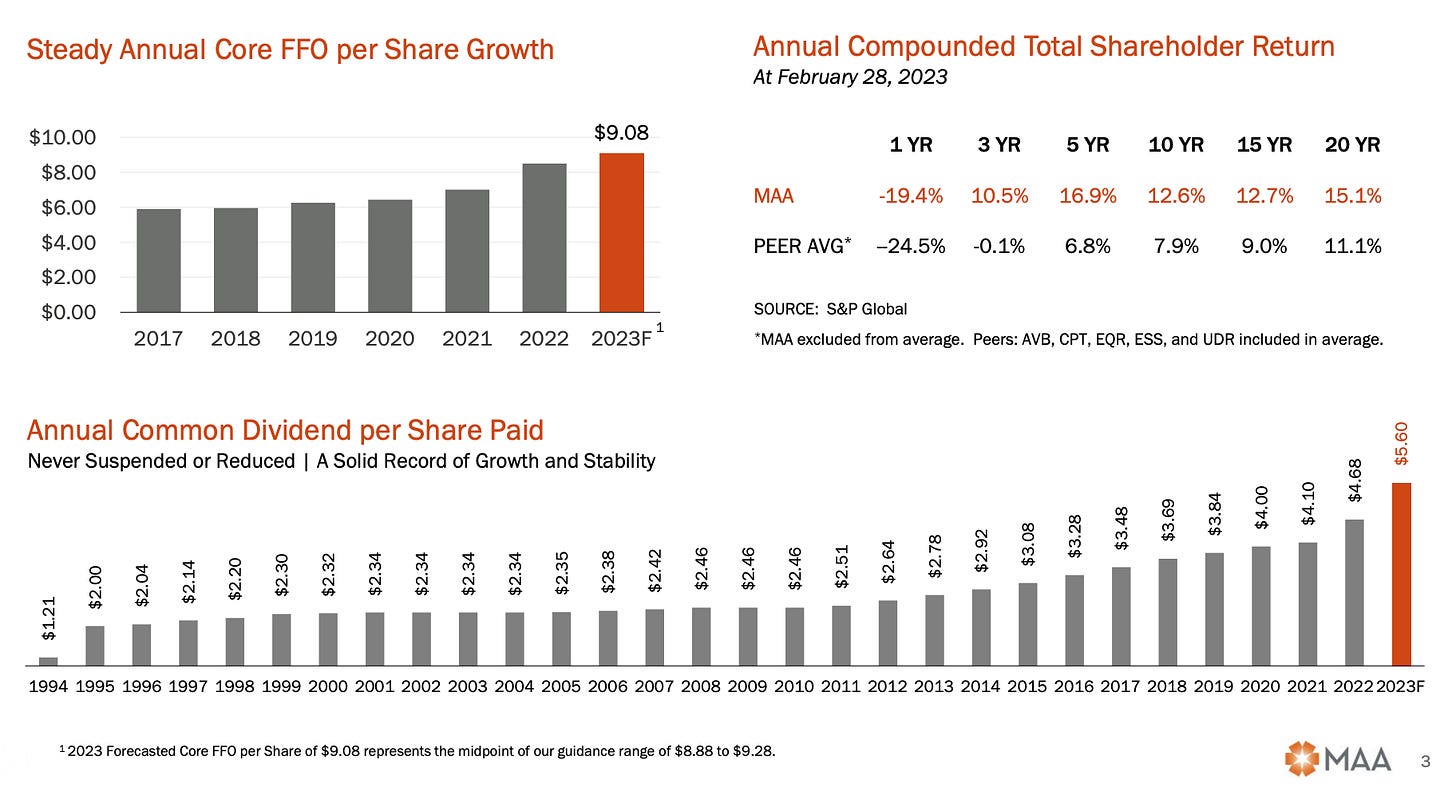

Growth & Dividend Profile:

I would encourage you to spend some time with this deck which has some very interesting research about the Sun Belt & a lot more details about MAA.

Key Takeaways:

“Normal” Residential REIT

Exposure to the Sunbelt which is the hottest real estate market right now

3rd best Total Return in 10 Years, 4th in 5 years

Steady Annual Core FFO per share growth

12 Consecutive Years of Dividend Growth

I am going to continue to add to my $MAA position and build it into one of my largest REIT positions.

Conclusion:

For the specific goal of investing in Residential REITs, $MAA seems to be the best REIT. However for someone willing to be creative, $VICI & $ABR are also good ways to diversify income from REITs.

Looking for a way to “safe hedge” in this treacherous market, see why I think Why JEPI & JEPQ are Hedges.

Looking for more stock recommendations? Check out my article The Ideal US Equity ETF Portfolio.

The ideas discussed in this article should not be constituted as investment advice.

Disclosure: We own positions in some/all of the tickers mentioned in this article.