The Definitive Guide to Trading Covered Call ETFs

Why you need to know about TSLY, NVDY, CONY...

Investors often get carried away by high incomes from covered call ETFs and don’t realize that their total gains from such ETFs often lag the underlying stock. In this article, I am going to uncover how good these covered call ETFs really are and the opportunity cost involved in owning them.

I am fascinated by covered call strategy ETFs and have written about it in the past, primarily focused on $JEPI, $JEPQ and $QYLD. You can find that article here. It is obvious, you do not want to hold the covered call strategy during a bull market. However, in a sideways to down market, these strategies can help you get some Alpha, which is why I made the case that these covered call ETFs are a hedge with a built in exit strategy.

As mentioned earlier, It is kind of obvious that a covered call strategy will underperform the underlying in a bull market. This is because the structure of a covered call strategy is such that it has defense built into the strategy, you sell calls against your position, so if the stock goes down or sideways, you get some extra income but if the stock goes up, you lose the money that you sold calls for, limiting your upside.

So I realized that a better question to ask is if these covered call strategies can perform better than the average stock in the portfolio, can it outperform the market, can it outperform the S&P 500. This is important because for most investments, the primary way of gauging performance is against a benchmark and even though these covered call ETFs don’t beat their underlying, if they can beat the benchmark, there is a case to be made for them to have a place in a portfolio that wants to reduce risk and have built in hedges.

To my surprise, I noticed that $JEPQ was actually outperforming $SPY and that was interesting, so I wrote another article exploring if $JEPQ is a better investment than $SPY. $JEPQ was a very new ETF when I first wrote and I didn’t have enough data to conclusively declare anything. However, now we have a little more data, so I wanted to revisit that and see if JEPQ is still outperforming SPY even after the most recent bull.

On top of that, in this article, I also want to take this research a step further by comparing single stock covered call strategies and see how they have performed for stocks that have gone up, stocks that have gone sideways and stocks that have gone down.

Whether these single stock ETFs beat the S&P 500 really depends a lot on how the specific stock has performed. For example, Nvidia and Coinbase have performed well since their respective covered call ETFs were launched so they significantly outperform S&P 500 and since Tesla and Google have not, they are underperforming the S&P 500. However, I have still included the S&P 500 data in the chart below in case you want to review for yourself.

It is still too early to say anything with any authority given the data we have is very small. However, based on the data we have so far, this is the most comprehensive and definitive guide to investing in & trading Covered Call ETFs.

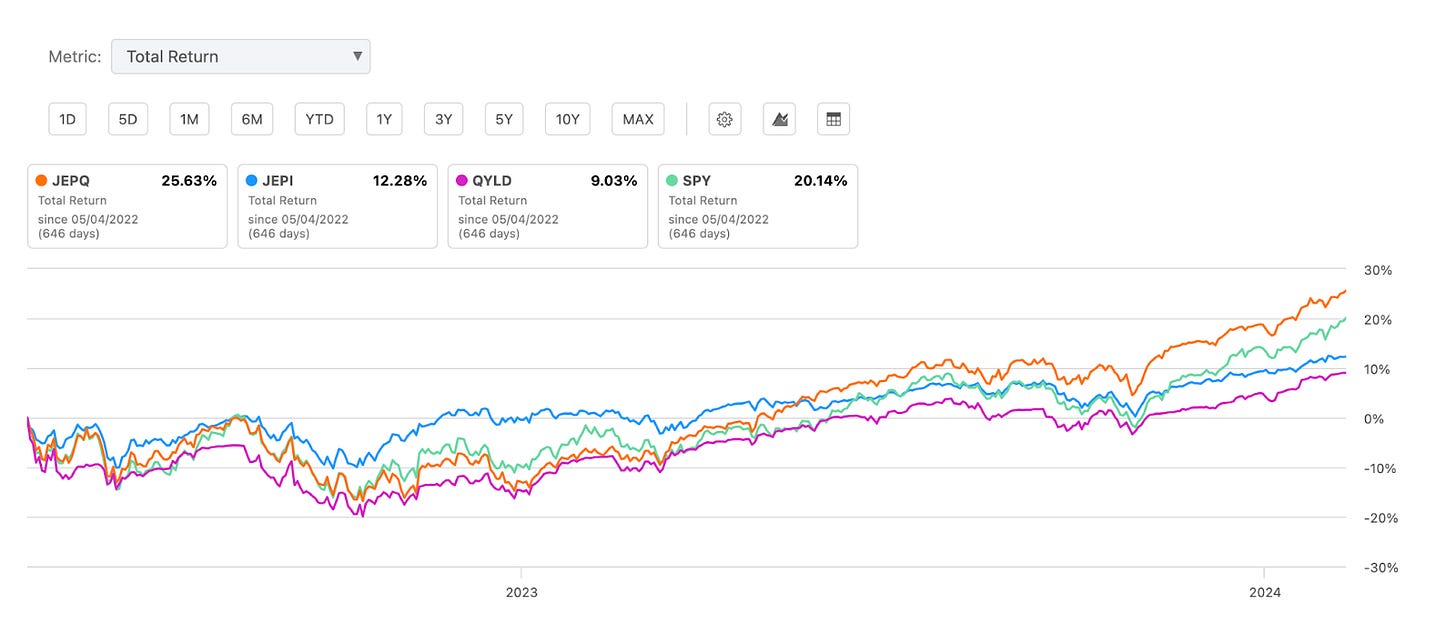

$SPY vs $JEPQ vs $JEPI vs $QYLD (May 4th, 2022 to Feb 11th, 2024*)

*$JEPQ was launched on May 4th, 2022, so this is the longest time frame in which we can measure all four ETFs)

Data pulled on Feb 11th, 2024

As you can see, on a Total Return basis $JEPQ is delivering ~25% higher returns than $SPY and continues to outperform S&P 500 since it was launched. This makes sense as $JEPQ is based on Nasdaq 100 which has handsomely outperformed $SPY. What makes $JEPQ compelling is the downside protection that’s built into the ETF.

$JEPI and $QYLD are not even close to $SPY.

$SPY vs $JEPQ vs $JEPI vs $QYLD (Last 1 year)

Data pulled on Feb 11th, 2024

In the last 1 year the difference is even more stark with $JEPQ outperforming $SPY by ~42%. $JEPI and $QYLD again not relevant.

For all other durations, $SPY continues to beat $JEPI and $QYLD and we don’t have numbers for $JEPQ, so I won't be adding the charts for the same. You can play around with the numbers if you like using this Seeking Alpha link.

So the conclusion is that it looks like $JEPQ continues to outperform $SPY and I am starting to think that this relationship is going to stick.

So far the data suggests that $JEPQ is a better investment than $SPY.

Single stock Covered Call ETFs:

Now Let’s look into single stock ETFs and see how they have performed against their underlying and against SPY. I am also going to look at how these single stock covered call ETFs have performed when the underlying is going higher, sideways and when it is going lower.

Here is all the data I gathered for:

Covered call ETF

The underlying ticker it is tracking and selling covered calls on

Total return (including dividends) for both the ETF and the underlying from the date the covered call ETF was launched.

S&P 500 return since the respective covered call ETF was launched

Data pulled on Feb 20th, 2024 (Pre-Market) from Seeking Alpha

As is clear, we did not see outperformance from any of the covered call ETFs (with the tiny exception of $PYPY) when comparing against the underlying.

It is also clear that there is no relationship between SPY and these covered call ETF. As expected, the ETFs tend to outperform SPY if the underlying outperformed SPY by a large margin.

It is interesting that most of the stocks that we reviewed are actually up in the time frame I looked at. Paypal is the only one that is going sideways and we saw a slight outperformance by $PYPY over $PYPL. We also saw $XOM is down 5.59% since the inception of $XOMO but $XOMO still underperformed $XOM. So no alpha here.

Since I did not have enough examples for stocks that are going sideways or down, I looked at TSLA vs TSLY over the last 3 months in order to see how these ETFs behave when the underlying is going down.

Since Nov 21st, 2023, $TSLA is down 17.1%. In the same duration $TSLY is only down 8.55%. Showing that the covered call ETF could deliver some alpha when the underlying is going down.

So if you buy into $TSLY while $TSLA is falling, you will lose less money as compared to $TSLA. However, when the stock recovers, sell $TSLY once you break even on a price return basis, making all the dividends you received while you were holding $TSLY a net profit. You could choose to invest the proceeds into $TSLA or choose to take that cash and put that somewhere else. In effect, while Tesla was going down, you hedged the position by buying $TSLY and you can make a tidy profit by selling $TSLY when you break even on the price.

Conclusion:

I conclude that in most cases you are better off holding the underlying instead of trying to get income out of your holdings. Not all covered call strategies are made equal. IV/Volatility matters a lot and who is managing the strategy matters a lot and how good they are matters a lot. For high volatility tickers like TSLA, NVDA & JEPQ, the high volatility drives higher premiums making covered call strategy for such tickers work better. However, tickers like XOM, JEPI and QYLD have relatively less volatility, and are therefore not able to deliver similar higher returns partially owing to lower volatility.

One other thing to take into consideration are taxes. The calculations I shared above do not take into consideration that you’d have to pay taxes on the income you generate through dividends, which could have just been capital gains, if you just held the underlying and generated alpha owing to equity appreciation. When using a covered call strategy, you take a hit on your tax bill, further solidifying the idea that holding the underlying is a better strategy.

However, as we saw in the case of $TSLA & $TSLY’s last 3 month performance, that for the right kind of ticker that is trending lower, these covered call ETFs can generate some alpha. However, you need to be nimble and switch to the underlying when the trend changes and the stock starts moving higher.

So, I still like the idea of using $JEPQ because it continues to outperform $SPY. For single stock ETFs, I would only do it only if the stock is in a downtrend which I expect to reverse in the near future, at which point, I will sell the covered call ETFs and buy the underlying instead.

SPY 0.00%↑ JEPQ 0.00%↑ JEPI 0.00%↑ QYLD 0.00%↑ TSLY 0.00%↑ APLY 0.00%↑ NVDY 0.00%↑ AMZY 0.00%↑ FBY 0.00%↑ GOOY 0.00%↑ NFLY 0.00%↑ CONY 0.00%↑ DISO 0.00%↑ MSFO 0.00%↑ XOMO 0.00%↑ JPMO 0.00%↑ AMDY 0.00%↑ PYPL 0.00%↑ SQY 0.00%↑ MRNY 0.00%↑ OARK 0.00%↑

Borrowed Conviction Rarely Works

Past performance is no guarantee of future results.

The ideas discussed in this article should not be constituted as investment advice.

I reserve the right to change my mind if the facts change.

Disclosure: We own positions in some/all of the tickers mentioned in this article.