ChatGPT & BARD were used to generate some sections of this article.

Energy is ‘fundamental’ to human existence, just as fundamental as air, oxygen and water. Food is energy, warmth is energy, movement is energy, your phone is energy, all light is energy. Energy moves the world and for the longest time, it was scarce, only in certain geographies and usually owned by a few who understand they have all the leverage in this exchange and they often take advantage of it, like there is literally a cartel and there is nothing anyone could do about it…until now!

Brief Recent History of Energy:

Since the 18th century, the industrial revolution has catapulted energy usage around the world. First with biofuels like wood, then coal. Oil did not become widely consumed until the onset of World War II (the Model-T Ford debuted in 1908) & Natural Gas in the 70s.

Interesting side note: The world's per capita growth seemed to level off in the 1980s and then the final climb you see on the chart, up post 2000, is all China!

Source: The Atlantic

Energy’s Relationship With War:

Sadly, the history of Oil is also the history of War - at least in the last century. Why? Because it is ‘fundamental’ and in a race to supremacy, you have to secure the ‘fundamentals’.

The two World Wars were largely fought over control of natural resources, including oil. During World War II, Japan attacked the United States partly to gain control of oil-rich territories in Southeast Asia.

In more recent times, the Gulf War of 1990-1991 was sparked in part by Iraq's invasion of Kuwait, which was seen as a move to gain control of the country's oil reserves.

The ongoing conflict in Syria has also been influenced by competition over oil and gas resources.

Energy Independence:

Today, energy security remains a significant concern for many nations, and the threat of conflict over energy resources continues to loom.

In this environment, if a country can secure energy independence, wouldn’t that be great? And for the first time in history, every nation (and humanity in general) has a real shot at becoming energy independent using renewables. I don’t know exactly which renewables will take us through the finish line but I'll discuss in more detail below.

We are rewiring the world, better, cleaner, safer, faster, pay attention!

Wind and solar generated over a tenth (10.3%) of global electricity for the first time in 2021, rising from 9.3% in 2020, and twice the share compared to 2015 when the Paris Climate Agreement was signed (4.6%). Combined, clean electricity sources generated 38% of the world’s electricity in 2021, more than coal (36%).

Source: Ember

A visual of the progress countries have made with Wind & Solar in this century.

Environmental Factor:

Every great investment has a catalyst and there has never been one bigger than, ah, only the future of humanity! As the late great George Carlin once said, “The planet is fine, the people are f*****”!

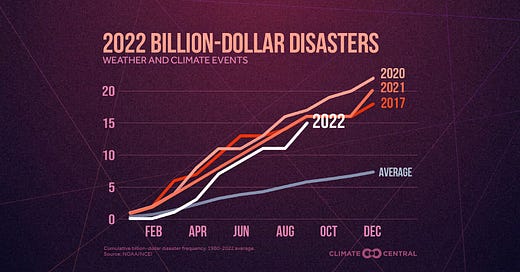

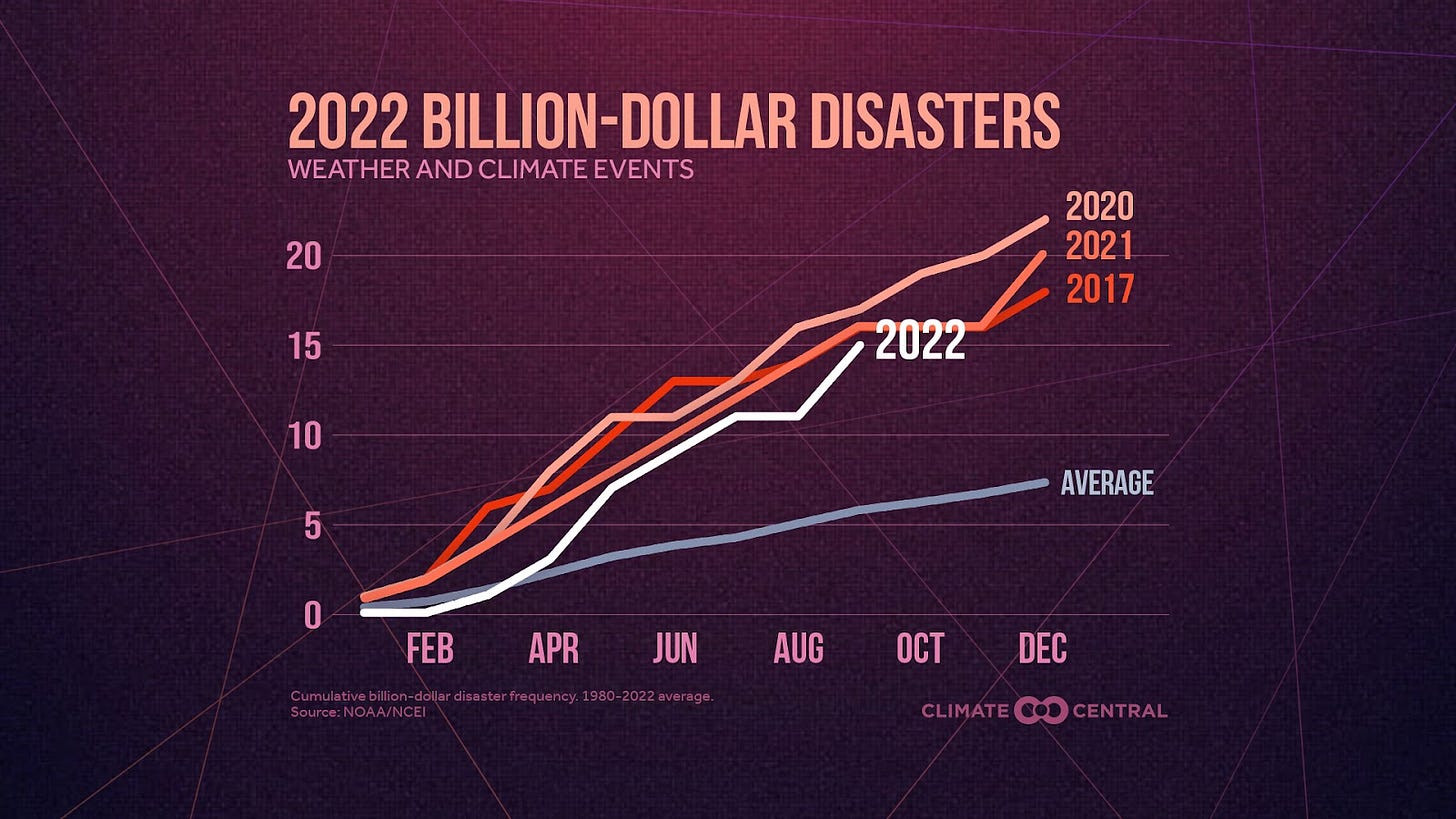

I’m a data person, I’d find patterns in a chart even if there wasn’t one. It is very easy to see that the instances of extreme weather events are increasing at a rapid clip. But if you don't, here are some statistics:

According to the Intergovernmental Panel on Climate Change (IPCC) and other scientific studies, the frequency and intensity of climate disasters and extreme weather events have been increasing in recent decades. Here are some statistics that illustrate the trend:

Heatwaves: In Europe, for example, the number of heatwave days has tripled since 1950.

Hurricanes and typhoons: The average intensity of tropical cyclones worldwide has increased by about 8% over the past 40 years.

Floods: In the United States, the number of heavy precipitation events has increased by about 30% since the early 20th century - ask California in March 2023

Wildfires: In the western United States, the average wildfire season has become 105 days longer and burns six times more area than in the 1970s.

Droughts: In California, for example, a prolonged drought from 2012 to 2016 was the worst in at least 1,200 years.

Side note to self: Maybe reconsider the idea of moving back to California

Billion Dollar Disaster:

It’s not cheap either. According to NOAA, the U.S. had experienced 15 weather and climate disasters with losses exceeding $1 billion each as of September 30, 2022. The total cost of these disasters through the end of September was $29.3 billion. Adding up the final costs will take months after the end of the year to complete. So there is an inherent reason for Wall Street to care about this.

Our Options:

We do enough to turn the tide and these violent weather events subside, we live happily every after to explore the galaxies.

We don’t turn things in time - I find it hilarious when scientists try to predict the ‘Point of No Return’ date for Climate Change. ‘Point of No Return’ will probably be over a century (or a decade), not a specific date or a month. Scientists can’t predict weather 7 days out and we know that 2030 is the point of no return for something that is going on for 100s of years (climate change really sped up in the 20th century).

If we don’t turn things in time, we will all one day experience the wrath of mother nature and it might also be the final show and a tragic end to “what could have been”.

Or somehow, we are wrong about this whole Climate Change thing and it will go away, just like covid did.

My Favorite Investments in Renewables:

I am not an investment advisor, I don’t have a background in finance, I am sharing what I have learned and what I am doing. These are not recommendations. I will tell you why I bought what I bought & I will share with you data points/other research that led me to build my conviction. Make sure to subscribe. A lot of these thesis changing developments will be reported in my weekly Newsletter Alpha Coverage - Inaugural Edition.

Some of these stocks are pre-revenue and are not a good fit for most investors.

Very rarely is a really good stock cheap and that is true for the renewables sector, especially if you look at just the P/E. Price to earnings ratio is a snapshot in time and does not take into account future growth. However, the value of an investment is not made based on what’s in the rear view mirror. You don’t ask “How much is it worth today?”, you ask “How much is it going to be worth 5/10/30 years from now?”. And in order to understand long term growth of a company, you need to pay attention to what the ‘story’ is, beyond the numbers. And equally important, who the management team behind the story is and their track record on execution.

Tesla is an energy, robotics and AI company that makes products that help humanity transition to renewables. Their website reads: “We’re building a world powered by solar energy, running on batteries and transported by electric vehicles.”

Tesla’s GAAP P/E is 51 and the sector is closer to 15, so like 3 times more expensive.

But it is not apples to apples.. Tesla’s Margin Profile is 3x better than the sector, but it is deteriorating and therefore, it alone cannot make up for the higher P/E.

Tesla is also growing 5x faster than the sector. While that growth rate is decelerating, it is still growing and that along with the profit profile makes up that 3x gap. So Tesla undervalued right now? It would seem so.

I invest in management teams and given the innovation that Tesla has driven, I don’t see that slowing down anytime soon. I don’t know what new directions Tesla will take and what new businesses it will get into, I just want to own a piece of this business that is literally changing the world when a lot of the incumbents failed us.

I think Tesla will continue to push the cost of production down by continuing to automate, introduce lower cost models and get into other business verticals to fulfill their mission statement.

I have a full position in Tesla, I am not adding here but if I didn’t have a full position, I would start dollar cost averaging here & add more if it falls more. I would make bulk buys at $175,

Here is a deeper analysis by one of my favorite authors on Seeking Alpha, Deep Tech Insights - He makes a case for Tesla’s intrinsic value to be $253.

Enphase Energy was the first stock that I identified as something that I thought could go 10x, it far exceeded my hopes. I first bought this stock on April 3rd, 2019 for $9.63! However, I had no clue what I was doing and I didn’t buy enough. 4 years later and it is the premier company that develops and manufactures solar micro-inverters, battery energy storage, and EV charging stations for residential customers.

Here is an excerpt from Enphase Energy’s website explaining why their technology has changed the solar industry (rearranged/paraphrased):

Traditional solar panels - send high-voltage direct current (DC) solar power to a solar inverter that converts it to low-voltage alternating current (AC) that our home’s devices can use. This electricity is fed into the home’s circuit breaker panel to create a solar powered home.

In traditional solar systems, the central inverter acts as an Achilles heel: If one panel stops producing energy due to dirt, shade, or other issues, the inverter prevents the rest of the system from producing as much energy as it otherwise could. This can lead to lower lifetime performance and reliability.

In contrast, AC solar modules eliminate this single source of failure with microinverter technology. The microinverter enables each module to operate independently, which means it can continue producing energy even if its neighbor isn’t. With this enhanced reliability, your system maximises energy production and long-term value.

So if you are installing solar, why would you not have microinverters? The question then becomes, who do you buy it from. $SEDG is another big competitor in this field. $ENPH has a better growth and profitability profile than $SEDG, while $SEDG is slightly cheaper.

Also The Alpha Sieve writes on Seeking Alpha (IQ8 is Enphase Energy’s latest microinverter):

“Contrary to popular belief, during power outages, solar systems don’t function even if the sun is shining. However, the IQ8 software-defined microinverter has the capability to form a microgrid and provide sunlight backup during an outage, even without the aid of a battery."

Read the full article here.

I think Enphase has better tech than SolarEdge & I lean towards the company that is driving higher growth and is more profitable. One of the other reasons why I am so bullish on Enphase Energy is because they are about to almost double their capacity (+82% to be exact). From their last earnings report: “The CEO also said Enphase (ENPH) plans to add a quarterly production capacity of 4.5M microinverters in 2023 and reach a total of 10M by year-end.”

$ENPH is not cheap at 60.7 FWD GAAP P/E but again, a snapshot of what it will be valued in the year ahead, does not take into account the decade of growth ahead of it. For any Peter Lynch fans, the PEG GAAP (TTM) for ENPH is 0.44. ENPH is growing 5x faster than the sector median.

The involvement of TJ Rodgers, who I will talk about more below is also one of the reasons I am bullish on Enphase Energy.

I have a full position in ENPH but if I didn’t, I’d start Dollar Cost Averaging now, increase denomination below $200 and add in bulk close to $150.

Interestingly this Seeking Alpha Author makes the case that microinverters are commoditized.

Let me know what you think in the comments below.

FAN 0.00%↑ (Expense Ratio 0.60%)

Wind actually has a higher global penetration than Solar, Wind is 6.59% of Global Electricity Generation by Source, while Solar is only 3.72%.

However, Solar is growing faster. Solar generation grew 23% in 2021, while wind generation grew 14%.

I have spent considerably more time focusing on Solar than on wind, Solar is expected to continue to grow twice as fast as wind:

According to the International Renewable Energy Agency (IRENA), global solar photovoltaic (PV) capacity is set to almost triple over the 2022-2027 period, surpassing coal and becoming the largest source of power capacity in the world. The report also forecasts an acceleration of installations of solar panels on residential and commercial rooftops, which help consumers reduce energy bills. Global wind capacity almost doubles in the forecast period, with offshore projects accounting for one-fifth of the growth. Together, wind and solar will account for over 90% of the renewable power capacity that is added over the next five years.

Here is the projected growth rate for wind and solar in the next 5 years:

Energy SourceProjected Growth Rate (2022-2027):

Solar PV: 200%

Wind: 95%

It is important to note that these are just projections. The actual growth rate for each energy source may vary depending on a variety of factors, including government policy, technological advancements, and market conditions.

I am, therefore, less bullish on wind energy and have admittedly not researched enough to recommend individual stocks.

I have a position in $FAN which gives me broad exposure.

Enovix is a loss making, cash burning company that is still trying to scale manufacturing.

What’s one thing everyone hates most? I bet it's the battery running out on “everything”, but especially your phone and your wearables. Enovix is here to solve that problem.

I’ve had my eye on battery tech for a long time now, ever since I started investing actually and battery tech has not changed in decades. While Enovix is not quite a solid state battery yet, it is a lot closer to commercialization and the first place you might see it is in some of your wearables.

Enovix is the leader in advanced silicon-anode lithium-ion battery development and production. The company’s proprietary 3D cell architecture increases energy density and maintains high cycle life. Enovix is building an advanced silicon-anode lithium-ion battery production facility in the U.S. for volume production. Enovix is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable widespread utilization of renewable energy. (Paraphrased)

Source: Enovix Website

If management executes as per their plan, they will double manufacturing output every quarter from here for the rest of 2023.

They continue to work with 50 Internet of Things companies (as per their Q4, 2023 shareholder letter) and have non-binding agreements with some mega-cap companies (which they have not disclosed the names of), testing their 3D battery technology.

Enovix is also testing their batteries with the US Army as they can nearly double the energy of the current CWB, which could result in substantial operational advantages including a much longer lasting battery. Another key advantage for the Army is BrakeFlow™ technology, a breakthrough in battery safety, made possible due to the company’s unique battery architecture.

Also to note that TJ Rodgers (mentioned earlier), who is a tech pioneer, scientist, entrepreneur & founder of Cypress Semiconductor. He holds patents ranging from semiconductors to energy to winemaking. In recent years he’s been investing a lot of his time in renewable energy.

He has been a director at Enphase Energy since 2017 & at Enovix from 2012 to present. He was appointed the Executive Chairman at Enovix in November 2022.

His legacy and expertise add to my bullish thesis as someone who has delivered the kind of execution that is required with Enovix multiple times in their career. Read this article on Seeking Alpha by author TJ Roberts explaining the technology, & relationship with TJ Rodgers in further detail.

Here is a 12 min CNBC Video that talks about Silicon Batteries.

Solid Power is also a loss making, cash burning company that is still trying to scale manufacturing.

Solid Power is developing the next-generation all-solid-state battery technology. It promises considerably higher energy and greatly improved safety.

Solid Power’s has a two-pronged approach to develop their business model:

Providing all-solid-state battery cell technology to Solid Power’s partners

Selling sulfide solid electrolytes to those also pursuing a solid-state future.

Solid Power has partnerships with both BMW and Ford to jointly develop all-solid-state batteries. In October 2021, Solid Power announced a partnership with SK Innovation to produce Solid Power’s automotive-scale all-solid-state battery cells utilizing Solid Power’s sulfide-based solid electrolyte, proprietary cell designs and production processes.

Here is the company’s 2023 Outlook:

Solid Power is focused on delivering on the following key objectives for 2023:

With respect to electrolyte:

Initiate and scale production from Solid Power’s electrolyte production facility.

Deliver electrolyte to potential customers for sampling and feedback.

With respect to cell development:

Continue to improve key cell performance metrics, including energy density, pressure, cycle life, low temperature operations and safety.

Deliver EV cells to our joint development partners and officially enter the automotive qualification process.

As Solid Power executes on its milestones, the Company estimates that in 2023, cash used in operations will be between $70 million and $80 million and capital expenditures will range from $50 million to $60 million. Total cash investment is expected to range between $120 million and $140 million.

2023 revenue is expected to be in the range of $15 million to $20 million.

Source: Solid Power

The company has 323.08M in cash.

The revenue is not expected to pick up until 2027 when the company scales manufacturing. As you can see, it is a long way to go from here.

One could also consider $QS, it has a similar trajectory but 6x more expensive.

It is not a slam dunk just quite yet but if they manage to scale manufacturing, they would very quickly take over the world.

Now let’s talk about commodities a little bit. I like to keep my commodities investments small and ETFs are a great way to gain broad exposure in commodities. I do hold some commodity stocks but that is for another day.

LIT 0.00%↑ (Expense Ratio 0.75%)

Call it White Gold/White Crude/White Oil, it all fits. You have lithium on you, right now, everyone does. If you have anything electronic that may require any kind of energy storage (a battery), it is lithium. I’m 99.9% sure you are reading this on a device that is in an intimate relationship with lithium! And it is only going one way (at least for the foreseeable future). $LIT is my way to get Lithium exposure.

COPX 0.00%↑ (Expense Ratio 0.65%)

The most important metal in electrifying the world is Copper. Copper sits at the centre of the Renewables Energy economy.

Copper usage averages up to five times more in renewable energy systems than in traditional power generation, such as fossil fuel and nuclear power plants. Since copper is an excellent thermal and electrical conductor among engineering metals (second only to silver), electrical systems that utilize copper generate and transmit energy with high efficiency and with minimum environmental impacts. I have $COPX.

URNM 0.00%↑ (Expense Ratio 0.85%)

Nuclear is the most interesting topic within renewables in my opinion. Nuclear Fission is by far the cleanest source of energy humans have been able to figure out (so far), it works & it is scalable, but like all good things, Nuclear has a problem too. It’s reputation.

Nobody captured it better than HBO’s Emmy Award Winning TV Series Chernobyl. Several major disasters have occurred at old traditional nuclear plants. And decades of nuclear power has generated the problem of what to do with all of those spent radioactive nuclear fuel rods.

That’s it, that’s all there is to it. People are scared and don’t want a Chernobly in their backyard.

But nuclear power technology has advanced since these incidents. A new breed of small modular reactors (SMRs) is being developed. They are safer and less exposed to dangers like earthquakes and meltdowns than traditional large-scale reactors.

As with all nuclear power plants, they don’t emit greenhouse gases, meaning they support global efforts to reach net-zero emissions.

Importantly, SMRs can also be safely turned off and restarted, unlike conventional plants.

Nuclear is making a comeback of sorts as more and more countries are embracing it.

I hold a position in $URNM as a hedge against all my other renewable energy positions.

Hydrogen

I think Hydrogen has the potential (like Nuclear) to someday disrupt Solar & Wind, but I don’t have strong conviction in any of the Hydrogen companies yet. I’ll share if I find something, Subscribe to keep up!

Role of tech

So the tech bull market is over? You haven’t been paying attention!

All the Stock tickers I mentioned above are cutting edge tech. Tech has, and will always be part of everything we do. Tech is what accelerates productivity, tech is what helps us create value, tech is what helps us grow. It’s always renewables tech, financial tech, defense (has always been tech) and so on. What you are referring to is probably digital tech?!?!

Digital tech (I’ll call it that going forward), and specially large cap digital tech is cyclical now, it is part of everything now and whatever it is not part of, it will become part of. I bet in the first half of the 1700s, steam engines were hot-tech but over time-hot tech became everyday-tech making it cyclical. So, the mature digital tech companies: Apple, Microsoft, Alphabet & Amazon, Likely won’t give you the returns they gave you in the last 10 years.

Having said that, I think we are still very early for digital as a tech in general. Newer software companies, Crypto, AI, Robotics and a lot of other parts of tech will still continue to grow and participate in the bull run but it won’t be across the board for digital tech as a broad category and it is unlikely to be one of the mega cap tech stocks but if I did have to put my money on one, I’d put it on $MSFT. Would have picked $AAPL if not for the China exposure/risk.

Past performance is no guarantee of future results.

The ideas discussed in this article should not be constituted as investment advice.

Disclosure: We own positions in some/all of the tickers mentioned in this article.