Weekly newsletter bringing you a summary of critical, thesis changing stock market news with long term impact. We cover news articles, opinion pieces and all forms of media to help you stay ahead of the curve.

A Seeking Alpha subscription would help.

This Week’s Alpha Coverage: YouTube Playlist.

Also introducing sector specific playlists. A lot of emphasis has been put on reducing content and only adding the most critical news-worthy clips. Brevity is hard.

If you want something specific, please share in the comments section below

Editor’s Pick:

#Bitcoin #BTC

Michael Saylor of MicroStrategy on Bitcoin

Michael Saylor explains how $MSTR is a leveraged play on Bitcoin. He explains why it is different from the Spot Bitcoin ETF. He talks about how MicroStrategy uses intelligent leveraging and the fact that they don’t have any fee which an ETF is going to have. Very interesting POV.

Link to Link to YouTube Video - Nov. 3, 2023

#Bitcoin #BTC

Crypto funds book largest weekly inflow since July 2022 - report

The heightened optimism that a U.S. spot bitcoin exchange-traded fund will soon get approved served as a boon last week for crypto-focused funds, having garnered the largest single week of inflows in over a year, data from CoinShares showed on Monday.

Indeed, digital asset investment products logged inflows of $326M for the week ended October 27, the most since July 2022. Bitcoin (BTC-USD) funds accounted for 90% of the inflows, the report said, though recent price increases prompted inflows of $15M into short-BTC products.

Bitcoin (BTC-USD) closed out last week just 0.5% higher, but still outpaced the stock market's 2.4% slump.

"While positive for Bitcoin, this weekly inflow ranks as only the 21st largest on record, suggesting continued restraint amongst investors, although we do believe a spot-based ETF is now highly likely in the coming months, and will represent a step-change for the industry from a regulatory perspective," CoinShares said.

Link to Seeking Alpha News Article - Oct. 30, 2023

CRISPR, Vertex sickle cell disease gene editing therapy gets warm response from FDA panel

The meeting of the FDA's Cellular, Tissue, and Gene Therapies Advisory Committee was unusual in that it didn't actually ask members to vote on whether the therapy's benefits outweigh the risks. Instead, they were asked to discuss if enough research had been done to see exa-cel could be impacted by off-target editing -- essentially editing errors causing unintended genomic changes and, therefore, potential side effects. FDA reviewers flagged the editing and potential side effects in briefing documents.

Although several members indicated more studies might be helpful, as a whole, they seemed to back exa-cel and didn't see off-target concerns as holding the treatment back.

The briefing documents also indicated that efficacy of exa-cel doesn't appear to be a concern. "Given the strongly positive results, FDA does not believe that the study design limitations call the efficacy of exa-cel into question."

While the FDA is not bound to the recommendations of its advisory committees, it generally follows them before taking a final decision, which, in the case of exa-cel, is expected by Dec. 8.

If approved, exa-cel cost cost as much as $2M per patient.

Link to Seeking Alpha News Article - Oct. 31, 2023

Semiconductor stocks in focus as Biden is set to meet with Xi Jinping

Semiconductor stocks will be in focus as U.S. President Joe Biden is slated to meet with China's President Xi Jinping in the coming weeks. The two leaders are scheduled to meet at an economic summit in San Francisco, the White House has said.

While no formal agenda has been put on the table, global security, climate, cybersecurity, and the ongoing demand and competition around semiconductors are among the likely topics of conversation. Of late, the relationship between Washington and Beijing has been shaky.

Semiconductors are especially in the spotlight amid growing tensions over Taiwan.

Other names investors should keep an eye on as the two superpowers meet are Nvidia (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD), Intel (NASDAQ:INTC) and Qualcomm (QCOM).

Link to Seeking Alpha News Article - Nov. 01, 2023

SPY 0.00%↑ DIA 0.00%↑ QQQ 0.00%↑

FOMC looks to be in a 'hawkish hold mode' – Wells Fargo

"We forecast that the FOMC will remain on hold through most of Q2-2024, which is more or less consistent with market pricing," the firm stated. "But the stance of monetary policy, as measured by the real fed funds rate, likely will become more restrictive in coming months as inflation slowly recedes back toward target but as the FOMC keeps the nominal fed funds rate on hold."

Wells Fargo added that it sees the bar for further rate increases higher now than it was a few months ago.

Furthermore, after the Fed announced its rate decision, U.S. Treasury yields (US10Y) (US2Y) pushed lower. On Thursday the 10Y sits at 4.66% and the 2Y hovers at 4.99%.

Link to Seeking Alpha News Article - Nov. 02, 2023

News, Facts, Analyst & Market Commentary - Short Reads

Redwire announces first spaceflight mission for new pharmaceutical drug development lab

Redwire Corp. (NYSE:RDW) Monday announced the first spaceflight mission for its in-space pharmaceutical manufacturing platform, PIL-BOX.

The platform is designed to offer researchers novel and flexible services to grow small-batch crystals of protein-based pharmaceuticals and other key pharmaceutically relevant molecules for research.

The new platform would launch onboard SpaceX’s 29th cargo resupply services mission for NASA to the International Space Station.

On the inaugural PIL-BOX-01 mission, Eli Lilly and Company (LLY) has partnered with Redwire to conduct three critical experiments focused on developing advanced treatments for diabetes, cardiovascular disease, and pain.

Link to Seeking Alpha News Article - Oct. 30, 2023

Microsoft's 'iPhone' moment is here, Piper Sandler says

The release of Microsoft’s (NASDAQ:MSFT) M365 Copilot AI assistant is an “iPhone moment” for the tech giant, according to Piper Sandler.

The formal release of the product is part of a broader strategy to capitalize on a first-mover advantage in generative AI, analysts Brent Bracelin and Hannah Rudoff wrote in a note.

“Similar to the Microsoft Cloud opportunity that began in 2008 that has now grown into a $125B+ revenue franchise, we see Microsoft AI having similar $100B+ scale potential longer-term,” the analysts said.

Microsoft (MSFT) AI revenue was small at an estimated $0.5B last quarter and growth could come quickly.

“The unprecedented pace of innovation, aggressive AI investments and broad enterprise reach could result in Microsoft AI scaling to $10B+ in revenue within three years (ARR would be even higher),” Piper Sandler said. Comparatively, Azure and AWS took roughly a decade for revenue to eclipse $10B.

The firm has an Overweight rating on the stock on positive news flow regarding new AI products and user events across Microsoft, OpenAI and GitHub.

Piper Sandler has a $425 price target on Microsoft (MSFT).

Link to Seeking Alpha News Article - Oct. 30, 2023

GM 0.00%↑ F 0.00%↑ STLA 0.00%↑

GM reaches tentative agreement with UAW

General Motors (NYSE:GM) has become the last of the Big 3 Detroit automakers to reach a tentative agreement with the United Auto Workers.

The deal is modeled on ones already reached with Ford Motor (F) and Stellantis (STLA). Union members will get 25% pay raises over the four-year contract and cost-of-living adjustments (COLA).

The deal will cumulatively raise the top wage by 33% compounded with estimated COLA to over $42 an hour, UAW said. The starting wage will increase to over $30 an hour accounting for COLA.

In addition, it eliminates several wage tiers.

The agreement still needs to be approved by a UAW council before it is sent to rank-and-file members for final approval.

Link to Seeking Alpha News Article - Oct. 30, 2023

Meta to offer ad-free subscriptions for Facebook, Instagram in Europe

Meta Platforms' (NASDAQ:META) stock rose ~4% on Monday after the company said it will offer people access to Facebook and Instagram without any ads for a subscription fee in Europe, in an effort to meet regulatory requirements in the EU related to data privacy.

The company said the people — in the EU, European Economic Area, or EEA, and Switzerland — can alternatively continue to use these services for free while seeing ads that are relevant to them.

Starting in November, users will be able to subscribe to the social media sites for €9.99 per month on the web or €12.99 per month on Apple's (AAPL) iOS and Alphabet's (GOOG) (GOOGL) Android operating systems.

The company added that the subscription will apply to all linked Facebook and Instagram accounts in a user's Accounts Center.

Until March 1, 2024, the initial subscription covers all linked accounts. However, starting March 1, 2024, an additional fee of €6/month on the web and €8/month on iOS and Android will apply for each additional account listed in the user's Account Center.

The tech giant noted that while people are subscribed, their information will not be used for ads.

Link to Seeking Alpha News Article - Oct. 30, 2023

On Semiconductor drops as fourth quarter forecasts miss estimates

ON Semiconductor (NASDAQ:ON) dropped 18% on Monday morning after forecasts missed estimates.

For the fourth quarter, the company forecast sales of $1.95B to $2.05B compared to the average analyst estimate of $2.18B. Earnings per share were estimated at $1.13 to $1.27 compared to the consensus of $1.37.

ON Semiconductor (ON) reported third-quarter revenue of $2.18B that beat the average analyst estimate by $30M. EPS of $1.39 beat by $0.05.

Bank of America maintained a Buy rating on the stock and said it would review its model following the earnings call.

The lower guidance could signal management’s efforts to rationalize expectations as auto and industrial weakness proliferates across the industry, analyst Vivek Arya wrote in a note.

Link to Seeking Alpha News Article - Oct. 30, 2023

Tesla drags as it hits lowest intraday since May; down 4%

Tesla (NASDAQ:TSLA) is down ~4% in Monday trading, as the electric vehicle maker hit its lowest intraday since May.

The drop comes as China EV maker BYD reported a record profit of more than $1.4B in Q3 on Monday.

Another negative for Tesla (TSLA) Monday is that Panasonic Holdings Corp.'s (OTCPK:PCRFY)(OTCPK:PCRFF) automotive batteries segment reported its first loss in three quarters due to sagging demand for Tesla's (TSLA) Model S and Model X vehicles.

Tesla shares may also be under pressure from a Bernstein note Monday that argues its fiscal 2024 estimates are too high. The firm rates the EV maker underperform with a price target of $150 (~28% downside based on Friday's close).

Analyst A..M. (Toni) Sacconaghi, Jr. said that in FY 2024, he expects Tesla (TSLA) to see lower margins and volume disappointments.

"We note that to drive growth of 500K units this year, Tesla had to cut prices by ~16%, pressuring overall operating margins by 750 bps. It remains unclear if Tesla can further cut prices enough to drive sufficient demand elasticity without potentially becoming [free cash flow] negative," he wrote.

Link to Seeking Alpha News Article - Oct. 30, 2023

Pinterest jumps amid solid Q3 beat, with average revenues also gaining

Pinterest stock (NYSE:PINS) jumped 8% in early postmarket action after the company beat expectations on top and bottom lines with its third-quarter earnings.

Revenues hit unexpected double-digit growth to rise to $763M, about $20M better than expected, and global monthly active users rose by 8% to 482M, vs. 473.5M expected.

The company also beat profit expectations, swinging to a gain of $6.7M on a GAAP basis from a year-ago loss of $65.2M. On an adjusted basis, non-GAAP net income rose 153% to $193.3M from $76.5M.

“We continued to accelerate the business in Q3,” said Pinterest (PINS) CEO Bill Ready. “We are driving strong revenue performance, robust global MAU growth, and substantial margin expansion." He also said as the company leaned on its differentiators, it's finding the "best product/market fit in years."

Link to Seeking Alpha News Article - Oct. 30, 2023

Trex’s stock rises after quarterly earnings beat, higher guidance

Trex (NYSE:TREX) on Monday rose 2.9% in extended trading after the maker of deck materials reported third-quarter results that beat the average estimates among Wall Street analysts.

Net income more than quadrupled to $65.3 million, or $0.60 a share, in the quarter from $14.4 million, or $0.13 a share, a year earlier. Adjusted EPS of $0.57 beat the consensus estimate of $0.50.

Sales rose 61% from a year earlier to $303.8 million for the three-month period ended September 30, compared with the consensus estimate of $289.9 million.

The increase in net sales was substantially due to increased volume which resulted from strong secular trends and the non-recurrence of the channel inventory drawdown that occurred during the 2022 quarter. Trex Residential net sales in the year ago quarter were $178 million.

Management raised its year-end guidance to $1.09 billion from a previous range of $1.04 billion to $1.06 billion. Trex (TREX) also foresees a full-year adjusted ebitda margin of 29% to 29.5%, up from its prior guidance of 28% to 29%.

Link to Seeking Alpha News Article - Oct. 30, 2023

Link to Seeking Alpha News Article - Oct. 30, 2023

NVDA 0.00%↑ BABA 0.00%↑ BIDU 0.00%↑

U.S. chip curbs put Nvidia's $5B of China orders at risk - report

Alibaba (BABA), TikTok owner ByteDance (BDNCE) and Baidu (BIDU) had all made large orders for delivery in 2024, according to the sources cited by the report. Next-year orders from major Chinese firms are said to have exceeded $5B.

Nvidia (NVDA) is pursuing additional supply and plans to allocate its advanced AI computing systems, which use graphics chips impacted by the curbs, to customers in the U.S. and abroad, a company spokesperson said. It also stopped taking new AI chip orders from China.

The chipmaking giant does not expect a near-term meaningful impact on its results, given the worldwide demand for its products.

But analysts expect sales to be impacted over the long term. "... the broad-based license requirements in the gray area create more material uncertainty for a region driving 20%-25% of demand," Morgan Stanley had warned.

Link to Seeking Alpha News Article - Oct. 31, 2023

MSFT 0.00%↑ #Siemens

Microsoft, Siemens team up to bring generative AI to industries

The companies will introduce Siemens Industrial Copilot, an AI-powered jointly developed assistant aimed at improving human-machine collaboration in manufacturing.

The companies said they will also work together to build additional copilots for manufacturing, infrastructure, transportation, and healthcare industries.

In addition, the Siemens Teamcenter app for Microsoft Teams will be generally available in December.

The companies added that the integration between Siemens Teamcenter software for product lifecycle management and Microsoft Teams will pave the way to enable industrial metaverse.

Siemens noted that it will share more details on the Siemens Industrial Copilot at the SPS expo in Nuremberg, Germany, in November.

Link to Seeking Alpha News Article - Oct. 31, 2023

Riot Platforms, CleanSpark get Outperform rates at Bernstein

The miners, which have seen their stocks rally over 100% this year alongside bitcoin (BTC-USD), have a "strong operational edge (Self-mining model), low cost of production (low power cost), high liquidity and unlevered balance sheets," Bernstein analyst Gautam Chhugani wrote in a Monday note.

RIOT is Chhugani's top pick, given "the right combination of scale, low cost and clean balance sheet."

"For the 2024-27 cycle, we expect Bitcoin to rise to a cycle high of $150,000 (4.5x from today's price of ~$34,000) by mid 2025, implying a 1.5 times Bitcoin's marginal cost of production. Tactically, we expect BTC to rally into the ETF approvals and ETF initial response, some profit booking into halving in April 2024 and major inflection post halving, once miner risks clear."

Link to Seeking Alpha News Article - Oct. 31, 2023

SPY 0.00%↑ QQQ 0.00%↑ DIA 0.00%↑

BofA saw weekly equity outflows from its clients for the first time since July

Bank of America’s global research team indicated on Tuesday that it observed weekly U.S. equity outflows from its clients for the first time since July. Last week, when the S&P 500 (SP500) fell 2.5%, BofA clients retracted $400M, which was seen across both single stocks and exchange traded funds.

The outflow charge was led by institutional clients while both retail clients and hedge fund clients were net buyers for the sixth and fifth consecutive weeks, respectively.

In single stock, BofA’s clients were net sellers in 7 of the 11 S&P sectors with outflows led by the Info IT and Communication Services, inflow led by Real Estate, observing its sixth straight week of net new capital.

In ETFs, clients of BofA sold assets in blended and large cap broad market funds like DIA, SPY, QQQ, while remaining net buyers of both growth and value ETFs.

Majority of sector focused funds experienced outflows on the week led by Industrial ETFs. Financial ETFs were the weekly leaders.

Link to Seeking Alpha News Article - Oct. 31, 2023

CRISPR, Vertex sickle cell disease gene editing therapy gets warm response from FDA panel

The meeting of the FDA's Cellular, Tissue, and Gene Therapies Advisory Committee was unusual in that it didn't actually ask members to vote on whether the therapy's benefits outweigh the risks. Instead, they were asked to discuss if enough research had been done to see exa-cel could be impacted by off-target editing -- essentially editing errors causing unintended genomic changes and, therefore, potential side effects. FDA reviewers flagged the editing and potential side effects in briefing documents.

Although several members indicated more studies might be helpful, as a whole, they seemed to back exa-cel and didn't see off-target concerns as holding the treatment back.

The briefing documents also indicated that efficacy of exa-cel doesn't appear to be a concern. "Given the strongly positive results, FDA does not believe that the study design limitations call the efficacy of exa-cel into question."

While the FDA is not bound to the recommendations of its advisory committees, it generally follows them before taking a final decision, which, in the case of exa-cel, is expected by Dec. 8.

If approved, exa-cel cost cost as much as $2M per patient.

Link to Seeking Alpha News Article - Oct. 31, 2023

NVDA 0.00%↑ MU 0.00%↑ AVGO 0.00%↑

[Blog Exclusive] Nvidia, Micron, Broadcom stay among UBS's top chip picks as September sales jump

Investment firm UBS said on Wednesday that semiconductor revenue for the month rose 13% month-over-month, roughly 400 basis points above the 10-year average and around 650 basis points above the 5-year seasonal average.

Memory has continued to see a recovery, thanks to continued strength in dynamic random access memory, while NAND growth moderated in the third-quarter, UBS said. DRAM revenue "almost doubled," while NAND revenue rose 10.1% month-over-month, both above seasonality.

The investment firm still thinks areas such as compute and memory, cloud and infrastructure, semiconductor production equipment and analog are the top places to be for investors. Inside these areas, Nvidia (NASDAQ:NVDA), Micron (NASDAQ:MU), Broadcom (NASDAQ:AVGO), Marvell Technology (MRVL), Lam Research (LRCX), Teradyne (TER) and Analog Devices (ADI) are its top picks.

Globally, the firm likes BE Semiconductor, Infineon (OTCQX:IFNNY) (OTCQX:IFNNF), ASML Holding (ASML), ASMPT, Eugene Tech, Maxscend, MediaTek, Realtek, Samsung (OTCPK:SSNLF), SEMCO, SK Hynix, Sony (SONY), StarPower, Sunny Optical, Tokyo Electron and Taiwan Semiconductor (TSM).

Link to Seeking Alpha News Article - Nov. 01, 2023

Occidental to sell direct air capture carbon removal credits to TD Bank

TD Bank will buy 27.5K metric tons of direct air capture carbon dioxide removal credits from Occidental's (OXY) 1PointFive carbon capture, utilization and sequestration unit, which is building a direct air capture (DAC) plant in Texas.

1PointFive's Stratos facility has been designed to be the world's first large scale commercial deployment of DAC technology, with the potential to capture and remove as much as 500K metric tons/year of CO2 from the atmosphere for long-term storage in geologic formations.

The companies said the deal represents one of the largest DAC credit purchases by a financial institution, and TD plans to use some of the credits to offset its own operational emissions.

Link to Seeking Alpha News Article - Nov. 01, 2023

AMD's weak guidance gets pass as Wall Street looks to AI sales ramp

On the earnings call, Chief Executive Dr. Lisa Su said the company expects more than $2B in revenue next year from its MI300 chip.

"This growth would make MI300 the fastest product to ramp to $1 billion in sales in AMD history," Dr. Su said on the call. She added the company will have more to say about the chip at its event in December.

Citi analyst Christopher Danely, who reiterated his buy rating and $136 price target on AMD (AMD) after the results, called the visibility into the MI300 ramp a "Halloween treat."

Baird analyst Tristan Gerra said the company is "on the right track" with its AI ramp and further share gains likely due to its software ecosystem.

Morgan Stanley analyst Joseph Moore kept its overweight rating, though it tweaked its price target to $128 from $138.

Bank of America analysts, led by Vivek Arya, reiterated their neutral rating and $120 price target.

"AMD stock is now trading 28x/24x our/consensus pf-PE for CY24E, which is at or above NVDA’s 24x PE, despite the latter’s faster growth prospects," the analysts wrote.

Link to Seeking Alpha News Article - Nov. 01, 2023

Netflix reports 15M ad-plan users after one year in action

Netflix (NASDAQ:NFLX) is marking the one-year anniversary of its advertising-supported service by noting the product now reaches 15M global monthly active users.

Netflix's (NFLX) ad operation has been the subject of scrutiny after slower than expected growth in ad sales and ad-supported subscriber numbers.

But Amy Reinhard, President of Advertising at Netflix touted the accomplishments of the first year, including boosting measurement (including third-party verification), new products and features (adding 10-second, 20-second and 60-second ads to its original 15-second and 30-second offerings; adding new business categories and additional targeting), and an upgraded member experience on the ad plan, including higher resolution 1080p (From 720p), two concurrent streams, and downloads to become available by the end of this week, becoming the first streamer to offer downloads to ad-tier subscribers.

Sponsorships are now available in the US and will expand globally in 2024, with Title (Ig: Love is Blind presented by Smartfood), Moment (cultural moments for advertisers to tap into like local holidays), and Live Sponsorships (Ig: T-Mobile, Nespresso, and others will be the presenting Live Sponsors for The Netflix Cup).

Link to Seeking Alpha News Article - Nov. 01, 2023

Link to Netflix Press Release - Nov. 01, 2023

[Blog Exclusive] Microsoft's LinkedIn hits 1 bln members; announces new AI features for paying customers

Microsoft's (NASDAQ:MSFT) business-focussed social network LinkedIn Wednesday said that the platform now has over a billion members and announced the addition of certain generative AI tools for its paying members.

"Our new AI-powered experience will analyze your feed’s posts (from the commentary to the article to the conversation) and reveal the key takeaways," the company said in a press release.

In a separate Reuters report, LinkedIn also noted that about 80% of its recent members are signing up from outside of the United States.

Additionally, LinkedIn said its new "job seeker" experience would not only assess if a particular job is a good fit but would also aid users by engaging with hiring managers using AI-powered messaging suggesting that are aimed at capturing attention and interest.

Link to Seeking Alpha News Article - Nov. 01, 2023

Antitrust suit against Google making Barclays 'increasingly concerned'

“We’ve tracked the DoJ trial closely over the past several weeks and are growing increasingly concerned about the strength of the case against Google,” analysts led by Ross Sandler wrote in a note.

“When you see Google paying billions and billions and billions, there has to be a reason,” Massachusetts Institute of Technology professor and economist Michael Whinston said during his testimony. “That’s the first thing that, as an economist, slaps me in the face.”

One of the government’s strongest pieces of evidence is a letter sent by a former general counsel at Google (GOOG) (GOOGL) to Microsoft (MSFT) in 2005 saying that the act of making MSN search the default on Internet Explorer was a “possible antitrust violation.”

That’s “sort of the same argument the DoJ is making today,” Barclays added.

“It's looking increasingly likely to us that if the DoJ wins, choice screens could be implemented, which in our view would be a nice positive development for GOOG shareholders,” the bank said.

Link to Seeking Alpha News Article - Nov. 01, 2023

Apple sees highest ever phone shipments to India, research firm says

Apple (AAPL) recorded growth of 34% year-over-year in the third quarter. It was the best quarter for the company's shipments in the country, which crossed 2.5 million units (China is close to 10 million units).

"Premiumization has started in the world’s second largest smartphone market and Apple has again got the timing right to benefit from this trend through its devices and financing offers," Counterpoint senior research Analyst Shilpi Jain said.

"India’s smartphone market will experience growth in the coming quarter due to pent-up demand, elongated festive season and faster 5G upgrades,” Jain added.

Counterpoint did not disclose Apple's market share, though it added that Samsung (OTCPK:SSNLF) is tops, owning 17.6% of the market, thanks to better incentives.

Cupertino, California-based Apple (AAPL) is looking to India to increase sales as the country boasts the largest population in the world, overtaking China earlier this year.

Link to Seeking Alpha News Article - Nov. 01, 2023

SPY 0.00%↑ DIA 0.00%↑ QQQ 0.00%↑

[Blog Exclusive] Deeper dive: Why did markets rally after Powell's presser?

"We're not confident that we haven't, but we're not confident that we have." That statement can sum up the entirety of Fed Chair Jay Powell's press conference on Wednesday, which outlined that the central bank is still not sure whether it is done with a hiking cycle to "sufficiently bring down inflation to 2% over time."

In its last set of economic projections, the Fed implied one more hike for the remainder of 2023. While Powell tried to distance himself from any conclusions drawn from that dot plot, the fact that it's now being called into question signals a more dovish turn for the central bank, charging up investor hopes that the hiking cycle is over.

There was additional good news for the economy, with Powell explaining why a recession is no longer indicative in the near term and why recent strong-than-expected data is not problematic.

"There are really two processes at work here," Powell added. "One of which is the unwinding of the distortions to both supply and demand from the pandemic and the response to the pandemic, and the other is restrictive monetary policy, which is moderating demand and giving the supply side time and space to recover. A significant increase in the size of the labor market now, both from labor-force participation and from immigration, that's a big supply-side gain that is really helping the economy. And it's part of why GDP is so high, because we’re getting that supply. So we welcome that. But I think those things will run their course, and we're probably still going to be left with some ground to cover to get back to full price stability. And that's where monetary policy and what we do with demand is still going to be important."

Link to Seeking Alpha News Article - Nov. 02, 2023

Super Micro erases gains despite strong outlook

CEO, Charles Liang said the company is working "diligently" to address GPU supply constraint challenges, mostly from Nvidia (NVDA) and its artificial intelligence inference processors.

"By the coming March quarter, we expect to complete a dedicated capacity for manufacturing 100 kilowatt racks with liquid-cooling capabilities, that will further expand our total rack production capacity to 5,000 racks per month in full-speed mass production."

He added: "The increased AI business also includes our new inferencing platforms and telco-optimized edge products based on the L40S, L40 and L4 and for sure H100 as well, AI product lines. Furthermore, the upcoming Grace Hopper Superchip-based MGX products for both generative AI and inferencing AI are just ready for volume production."

Liang added that the company's broadest AI solution portfolio also includes Intel's (INTC) Gaudi 2 and AMD's (AMD) MI250, MI300X and MI300A based platforms.

"We fully expect many of these products to gain broad adoption and expand our share in the accelerated compute market," he explained.

San Jose, Calif.-based Super Micro (SMCI) makes products such as rackmount servers and GPU servers, motherboards and chassis, and ethernet switches and adapters.

Link to Seeking Alpha News Article - Nov. 02, 2023

#SpaceX #Starlink

Elon Musk says Starlink service hits 'breakeven cash flow' ahead of possible IPO

"Excited to announce that SpaceX Starlink has achieved breakeven cash flow!" Musk posted to X, formerly known as Twitter, on Thursday. "Excellent work by a great team."

Musk added that Starlink is now a "majority" of all active satellites and will have launched a majority of all satellites coming from Earth by next year.

SpaceX, which is still privately held, reportedly turned a profit in the first three months of 2023, after annual losses in the previous two years.

Musk has said in the past SpaceX (SPACE) would take Starlink public once it reaches "reasonably predictable" revenue. He expanded on that thought last year, when he said a Starlink initial public offering would not happen for at least another three or four years, but that he was "just guessing."

Link to Seeking Alpha News Article - Nov. 02, 2023

MSFT 0.00%↑ GOOG 0.00%↑ GOOGL 0.00%↑ META 0.00%↑ AMZN 0.00%↑

World leaders and major AI organizations sign landmark agreement for safe testing of frontier AI models

This includes collaborating on testing next-generation AI models against potentially harmful capabilities (social and national security risks), and governments playing a role in ensuring external safety testing of frontier AI models - and not just companies.

The deal was signed by senior representatives from countries including the U.S., France, Japan, and even China. Musk insisted that China's participation was important, otherwise "they would just jump into the lead and exceed us all."

Companies that inked the pledge included OpenAI, Google (GOOG) (GOOGL) DeepMind, Anthropic, Meta (META), Amazon (AMZN), and Microsoft (MSFT).

Elon Musk supported the pledge, saying, "We've learned over the years that having a referee is a good thing."

"There will come a point where no job is needed," Musk told the U.K. Prime Minister Rishi Sunak at an event at Lancaster House.

Link to Seeking Alpha News Article - Nov. 02, 2023

China to welcome Micron's expansion as relations with US ease - report

China's commerce minister suggested that the Asian country is open to U.S. semiconductor company Micron Technology (NASDAQ:MU) expanding its presence in the Chinese market, Reuters reported.

The move indicates a sign of easing relations between the two countries amid the U.S. bringing export restrictions on China in key technologies areas, including artificial intelligence, or AI.

"We welcome Micron Technology to continue to take root in the Chinese market and achieve better development under the premise of complying with Chinese laws and regulations," China's Commerce Minister Wang Wentao said in a meeting on Wednesday.

The meeting is also in line with recent easing of relations between the world's two largest economies, as U.S. President Joe Biden is slated to meet with China's President Xi Jinping in the coming weeks at an economic summit in San Francisco.

Link to Seeking Alpha News Article - Nov. 03, 2023

#X

Elon Musk says xAI to release first AI model tomorrow

Elon Musk said that his artificial intelligence startup xAI will release its initial AI model on Saturday, adding that in "some important respects, it is the best that currently exists."

The AI model will be launched to a "select group," Musk added in a post to X.

He has previously been critical of other AI models, including OpenAI's ChatGPT, which he co-founded several years ago, but stepped down from in 2018.

Link to Seeking Alpha News Article - Nov. 03, 2023

Alibaba unveils open-source RISC-V tech chip for use in AI, cloud data centers - South China Morning Post

At its annual Apsara cloud computing conference on Tuesday, Alibaba unveiled Zhenyue 510, a controller integrated circuit, or IC, for enterprise solid-state drives, or SSDs.

Zhenyue 510 will initially be deployed in Alibaba Cloud's data centers, providing support for applications such as AI training, online transactions and big data analysis, noted the South China Morning Post which is owned by Alibaba.

Alibaba Cloud noted that the chip provides a 30% lower latency for input and output operations versus other ICs on the market.

RISC-V, pronounced as "risk five," is an open-source instruction set architecture which can be used to develop custom processors for several applications, including artificial intelligence, or AI.

RISC-V technology has become the new hope for China in reducing dependence on foreign IP amid a tech tussle with the U.S. The RISC-V technology competes with costly proprietary technology from Arm Holdings (ARM) and Intel (INTC).

Link to Seeking Alpha News Article - Nov. 03, 2023

Linde proposes $1B Arizona hydrogen project

Linde (LIN) and NextEra Energy (NEE) unveiled plans to partner in developing a $1B hydrogen facility in Arizona, the Phoenix Business Journal reported this week.

The new Gila Hydrogen Facility is expected to produce as much as 120 metric tons/day of liquid hydrogen for alternative energy uses such as corporate fleets.

Hydrogen produced from the facility could power up to 3K trucks and help reduce reliance on diesel, the companies reportedly said.

Link to Seeking Alpha News Article - Nov. 03, 2023

Opinion Pieces - Facts & Opinions - Long Reads

Arbor Realty Trust: 13.7% Yield, Brutal Market

The selloff post-earnings makes little sense against dual beats and distributable EPS of $0.55 which covered the dividend by 128%, a roughly 78% payout ratio.

Critically, book value at the end of the third quarter came in at $12.73 a share, up 2% versus the end of the prior fiscal year with Arbor seeing steady book value growth over the last three years despite it being a period highly defined by disruption and volatility.

Arbor has rarely ever traded hands at a discount to book value. The current 13 cents per share discount to book is rare but could of course move deeper as it did during the early 2020 pandemic collapse.

Arbor is one of the few tickers in the mREIT space where book value has trended upwards, partially owing to a history of consistent earnings above its dividend.

Link to Seeking Alpha Opinion Piece - Oct. 30, 2023

Cameco's Promising Outlook: Riding The Wave Of The Uranium Resurgence

What I find ironic is that the energy transition is taking hold right before our eyes, and so few investors appear cognizant of this fact. The most illustrative insight to support this contention is that we are far from the $100 WTI prices (CL1:COM) of last year, while uranium prices are now at a 12-year high. A massive contrast.

Meanwhile, as you'll see, Cameco's prospects remain very strong, and the stock is still very attractively priced at 17x next year's EPS.

As countries seek (forced?) to reduce their reliance on fossil fuels, nuclear energy emerges as a dependable source of base load power, providing a consistent electricity supply without generating greenhouse gas emissions.

Its capability to operate continuously, irrespective of weather conditions, makes it an ideal complement to intermittent renewable energy sources like wind and solar.

Link to Seeking Alpha Opinion Piece - Oct. 31, 2023

YouTube/Charts:

The Compound with WisdomTree’s CIO Jeremy Schwartz

Jeremy Schwartz is the co-author of the book Stocks for the Long Run (along with Jeremy Siegel, Professor of Finance at the Wharton School). The book is still lying on my desk and I still need to get to it. However, there are two charts that Schwartz pulls out which I want to call out. As always, I recommend checking out the full video (Oct 26, 2023)

Total Real Return Indexes - Clip

Fair Multiple Today Is Closer to 20 - Clip (This is also in line with an article I published in August 2023 where I was making the case that S&P 500 Fair Value Should Be Higher Than Historical Average)

Charts & Technicals

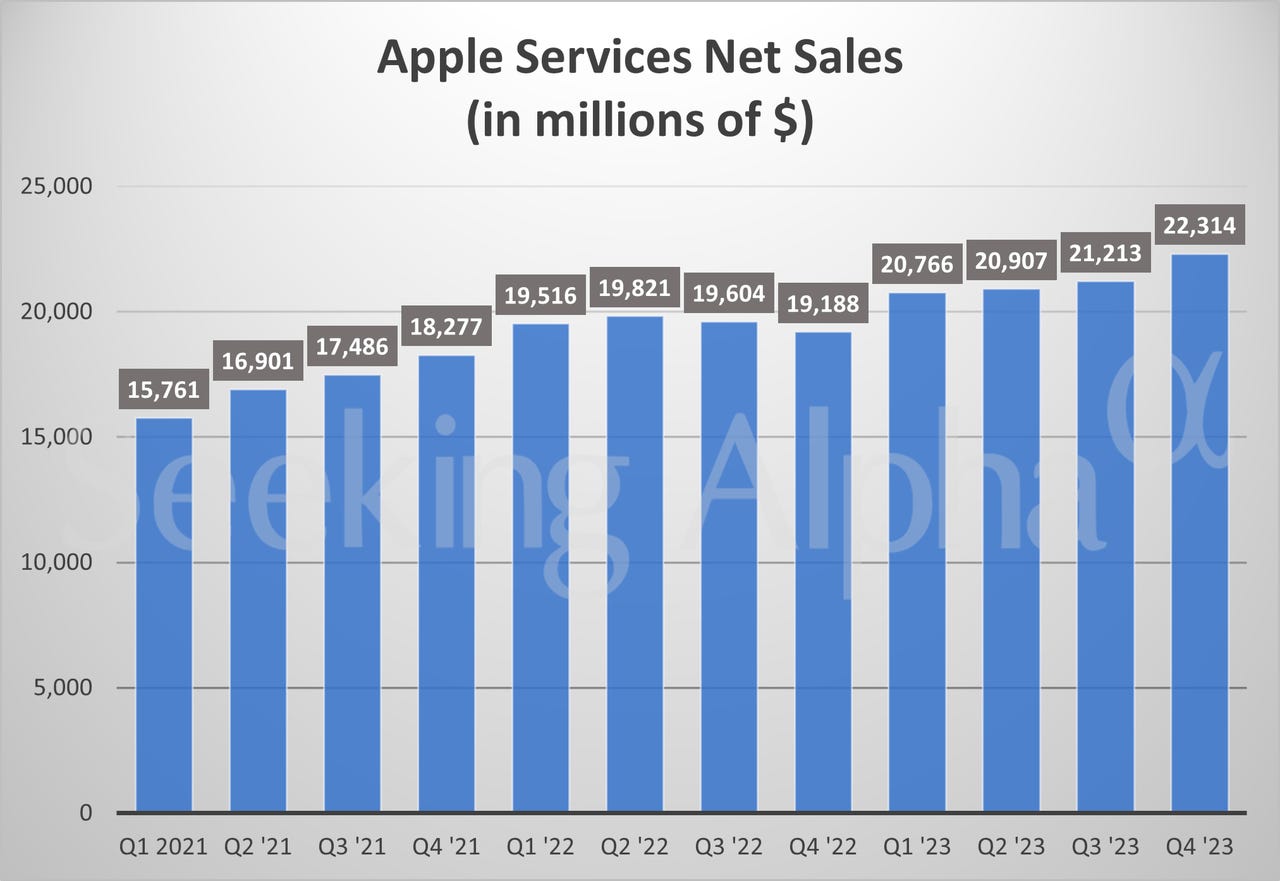

Apple Services Net Sales Chart

Link to Seeking Alpha Opinion Piece - Nov. 02, 2023

Link to Seeking Alpha Opinion Piece - Nov. 03, 2023

Disclosure: We own positions in some/all of the tickers mentioned in this article.