If you asked me to pick a direction in the market, I would pick bullish because markets go up 70% of the time. Therefore, I don’t particularly like shorting companies. I would rather wait for a pull back and take a bullish position instead of trying to be cute and short. Having said that, I do hedge tactically using broader indexes.

Since I am not trying to short the markets, I also don’t write bearish articles, it’s just not an opportunity I am focused on. But if a company happens to be my largest position and it is at some risk, then it is incumbent upon me to explore the risks associated with it.

My History with Google

Before I start getting into the depth of this article, I also want to share a little bit about myself which is essential to the context of the article. I worked with Google for over a decade primarily working as a Google Ads Performance Expert and later as a Digital Marketing Consultants for CMOs. I am no longer associated with Google and have taken up finance (and a few other businesses) as a full time career. Everything that I mention in this article is publicly available information and I am not going to share any of the internal knowhow that I have of Google’s management or internal issues. I try my best to not have any bias or any emotions when evaluating an investment but given the nature of the article, I thought it was necessary for me to disclose my past relationship with Google.

Not Bearish

This is not a bearish article on Google, it is a ‘relatively slower growth’ article.

I don’t think Google is a bad investment going forward, it is just likely not the best. I think Google is a cash generating machine and will continue to deliver cash flow for years, maybe even decades but at a diminishing rate of growth. It is also possible that Google rekindles its growth in the near future or in the far future and if that happens, I reserve the right to change my point of view but as things stand now, I think Google is past its peak.

Historical Performance

Let’s start with a grounding fact that Google has underperformed its mega cap peers in the last 10 years. Google has delivered a total return of 403.16%, Meta 524.06%, Amazon 669.14%, Apple 1,027.40%, Microsoft 1,111.29%.

Source: Seeking Alpha

And this underperformance is important because it is a pattern of behavior that investors need to focus on. The AI launch mishap(s) are a sign of how inefficient the company has gotten over the years. Google sat on AI for years and waited for someone else to come and get the breakout glory. And then they botched their own AI launch, twice.

Google’s Growth = Growth of the internet:

The world population is ~8.1 Billion, about 4.9 Billion of them are on the internet. That’s 60%. 62% based on the world population at the time the study was done. 92% of all those users use Google. So let’s assume Google’s market share is maxed out at 92%, any incremental growth would have to come from net new internet users, which would be the 38% of the world population that are currently not on the internet.

About 10% of the world population is over 65 years of age and about 25% of the world population is under 15 years of age. That makes up 35%.

Some of these children and folks over 65 actually use the internet and are part of the 62% that use the internet globally. However, I could not find hard numbers to exactly how many.

So to recap, 38% of the world population are currently not on the internet. A large chunk of that is made of children under 15 years of age, folks over 65 years of age and people outside those age groups who don’t have the resources to access the internet, yet.

As is clear, I am trying to make the case that Google is running out of runway for organic growth through growth of the internet and user growth.

Let’s make the case that half of the world population that are not on the internet (half of 38%), are indeed going to get on the internet in the next few years and are therefore the ideal target audience for Google. If Google maintains 92% market share, it is still a very tiny slice of net new customers that are yet to be tapped.

The world population is growing at ~1% per annum, but I don’t think that is going to hold a candle to the kind of growth Google has driven over the last 2 decades.

This section is a long winded way of saying that digitalization is reaching its limits, from being nowhere to being everywhere, almost and it is becoming more and more cyclical. I’ve made the case in the past and I will make it again, the first wave of internet companies are starting to slow down as the internet is now widely available in most parts of the world and most of the world that's going to be on it, is already on it.

There is, however, one silver lining for Google. While most of the people who will be on the internet, are already on the internet, not all of the ad spend is on digital yet. A lot of money that is still spent on TV ads and billboards will still move to digital and that will benefit Google. But this too is now growing slower than it did in the past. The past decade was the golden run for ad spend to move from offline to digital and Google was a monopolistic leader during that time, including the time before Facebook showed up and took most of Google’s display business. Now, with so many more competitors and slowing growth, can they really beat their performance from the last decade?

Google Competitive Landscape:

Google is at the center of many competitive threats right now, that is overwhelming to even think about. The issue that Google faces is that most of its core businesses face competitors but in each business the competitor is different and the competitive threat is different. Multiple businesses are challenging Google, across a few of its core businesses, all at the same time. A deep dive follows:

1a. Google Search Ads ROI/Competitor:

One of my primary risks for Google Search is exactly what makes me bullish on Amazon. Google search makes money when someone makes a search on Google and then they BUY SOMETHING. When users make a search and don’t buy anything or don’t book an appointment for a service, that is not accretive to Google in any way. It is very important you understand this. Google Search works because of Google Ads and businesses will continue to pay Google and fund Google Search as long as Google Ads can continue to help them find new customers and help them sell ‘products’ and ‘services’. That is the only substantial way Google makes money from Search which accounted for 57.1% of Google’s Q2, 2023 revenue.

Google has faced several threats for the service side of things and none of them have really stuck the landing. A couple of examples are Yelp & TaskRabbit. People still find these service providers using Google, so Google is still the gatekeeper and gets to keep a cut when users click on an ad run by Yelp on Google. Not to mention the cut they take from all Android payments processed through their Android apps. More on this in the Apps section below.

However, the product ecosystem is evolving rapidly. If people don't start their buying journey for things/products on Google search then businesses will see less sales from their Google Search Ads budget because users with ‘purchase intent’ are not coming to Google and instead starting their buying journey somewhere else. When this happens, it hits Google’s biggest profit channel and therefore has a major impact on the bottomline.

Purchase intent is what makes Google Ads as good as it is. Users come and tell you what they are looking for, making it the best tool ever built for marketers and advertisers to reach customers.

However, I think users on Amazon have stronger purchase intent than users on Google, simply because the only reason to be on Amazon is to buy stuff whereas users on Google come to Google for all sorts of things.

Here is my buying behavior: Whenever I am trying to buy something that I don’t think I need to do a lot of research for (and in some cases even if I have to do some research, often looking for lower priced items), I go directly to Amazon, Google is not in that equation. And I believe that millions of Amercian’s either already have this behavior or are building this behavior either with Amazon or some other brand/retailer.

So the goose that laid the golden eggs is under a lot of pressure from Amazon which may drive higher return on ad spend ROAS for advertisers. And even if it does not drive higher ROAS yet, it is at the very least a formidable competitor.

Advertisers, for the first time ever, have a real alternative to Google Search when it comes to selling products, an alternative that also has ‘purchase intent’ and can match Google’s scale.

However, I have more than one reason to be concerned about Google Search’s future.

1b. Search Behavior & Generational Switch:

GenZ thinks of Google as old and prefers to get their answers from TikTok. Google was created before a lot of these young kids were even born. So apart from buying behavior changing, search behavior is also changing. If you can have someone explain something to you in a 60 second audio visual format, then why would you go through the trouble of reading? That’s how I think the current generation thinks of Google. When I was a teenager, my parents used to check the newspaper for all sorts of details, news, weather, TV schedule and so on. It wasn’t until a few years ago that my dad stopped getting the newspaper subscription. I have not held a newspaper in my hand for over a decade now. Google is old tech to GenZ.

However, Google Search is still just too good and that is why I don’t think this exodus is going to happen overnight. However, the risk is on the horizon.

1c. Google Search Alternatives:

The elephant in the room: AI and ChatGPT. I have observed my search behavior change since the launch of ChatGPT. Google is still my default search engine but I find myself going to ChatGPT when I am looking for more nuanced answers. For example, if I was seeking a trip itinerary or if I had a philosophical question, I’d go to ChatGPT. I go to BARD (which is a terrible name for a company’s headliner product) for questions that have a more definitive answer, where there is less ambiguity. Bard to me still feels too Google-like because it is still very fact focused and feels less personal whereas ChatGPT comes across to me as more creative and dare I say, more human.

So this trend is definitely not helping Google. Google has 92% market share which, seen pessimistically, is a lot of room to lose market share and not a lot left to gain.

2. Meta owns the Upper Funnel Segment:

In a sales funnel, a customer with ‘purchase intent’ is lower down the funnel which means they are closer to making a purchase. This is often the segment that would produce the highest ROAS for advertisers. Customers can also be in the awareness/research/consideration phase of their buying journey. A good marketing platform/strategy needs to be able to provide a full funnel solution, so you have solutions that capture users who are higher in the funnel (don’t know exactly what they are looking for, still in the discovery phase) as well as users who are lower in the funnel (about to buy, higher purchase intent).

As mentioned earlier, Google rules purchase intent and hence, the lower funnel but Google over the years, has tried very hard to make the upper funnel work with Display Ads but never quite managed to. Google Display Network consists of 90% of the internet (or at least that’s what the sales pitch at Google was). They show you ads about products you may have browsed through in the past but didn't end up buying, they follow you around to remind you to complete buying, this is called ‘Remarketing’. Remarketing is one of the most successful strategies because again, by going to the product, the user has displayed ‘purchase intent’. How strong the intent is depends on how often the user visits that product or other actions like did they add it to their cart and things like that. So Meta (Facebook then), really delivered with the upper funnel whereas Google could not.

Google’s relationship with its users is, in a way, very transactional. One of Google’s goals for search is to make sure the user leaves Google search as quickly as possible, after they ask a question (which means they delivered the answer efficiently and correctly). Apart from YouTube, most of Google’s consumer-facing products like Maps, Gmail are very task oriented.

Facebook on the contrary is somewhere people go to hang, to chill, to relax, to get entertained and they stay on the platform for hours. And usually, that relaxed state of being is a much better mindset to shop than it is when you are trying to get to the airport (Google Search is different because of the intent but Maps and Gmail face this issue). So given that people are spending hours on Instagram and Facebook and could easily take a few minutes to check out something shiny that they want to loosen their purses for, Instagram and Facebook became leaders of what Google calls Display Advertising. Show ads to people who are NOT actively looking for a specific product but the ads are matched to the overall personality of the users instead of a specific query like it happens in Google Ads. So for example, a photographer could see an ad for a new lens even if he is on a financial news website (The content he is looking at is totally unrelated to the ad, but is instead matched to his interests and hobbies).

Upper funnel tactics are essential for businesses to grow because it brings in net new customers, who were either not thinking about the product you sell at all or were using a different brand and might switch. This is why Instagram is so popular with brands and dropshipping companies who don’t have an established brand or might have a unique product that the world does not even know about yet.

Google never owned the upper funnel market, it still does not.

3a. YouTube:

YouTube, I am very bullish on. I think the world economy is moving towards a creator/influencer driven economy where one will rarely see ads from big celebrities. Instead companies would hire an army of influencers to drive advertising and marketing to create buzz around launches and target smaller groups of people. I don’t think people relate to celebrities in ads the same way they did a decade ago, smaller, more intimate circles will drive deeper brand connections.

Owing to this assumption, I also think the creator economy will flourish as it is those same creators on YouTube and Instagram that are brand influencers. Consumption patterns have been changing for years now and as more and more digital replaces cable television, the more YouTube will continue to gain prominence.

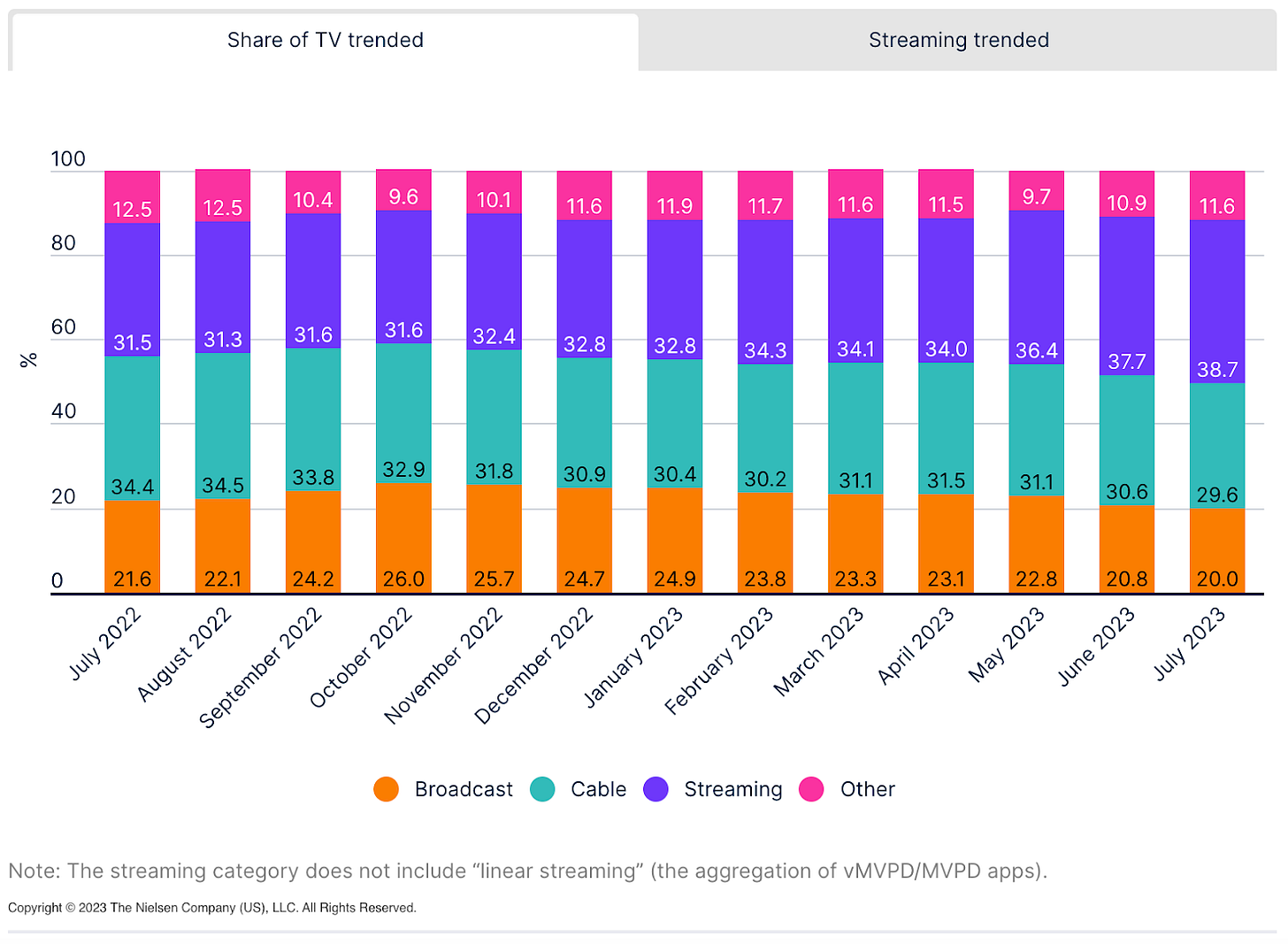

Streaming is continuously taking market share from Cable and Broadcast.

Source: Nielsen

YouTube has been gaining market share compared to other streamers lately.

Source: Nielsen

Add to this the YouTube Music bundled with YouTube with a subscription model, the benefits for YouTube multiplies.

So, YouTube is doing quite well in a space that is also doing well. I am very bullish on YouTube and Netflix to be our primary source of entertainment in the future. I think some others will make the cut but these two should lead. Netflix for more tailored/produced content and YouTube for more independent content creators.

3b. YouTube Ads/Revenue:

However, I am not that bullish on YouTube Ads.

First thing we need to understand is that YouTube will likely never be as profitable as Google Search simply because of the lack of purchase intent. Even though people on YouTube can and do search for things, that is not the only way people discover content, that does not make up the vast majority of YouTube users. Most people who come to YouTube specifically to consume content and a lot of those people also browse YouTube instead of searching for specific content.

So users browse as well as search on YouTube to watch content and most of them are there for the content vs with a specific intent to buy something.

So people watching YouTube Videos for content are far less likely to stop what they are watching to make a purchase based on an ad that just interrupted their video. This behavior is totally different from Google Search where there is a clear search intent or on Instagram where one is usually just casually scrolling when they are free or bored (vs in the middle of an exciting video).

So I need to draw that distinction that YouTube will likely never be as profitable for the advertiser, which is why it will have relatively lower ROI or ROAS compared to search, hence advertisers will only allocate upper funnel budgets and branding budget to YouTube. Which means the TV spend will just get distributed amongst YouTube AND all other streaming platforms.

Similar to the point I made earlier, YouTube introduced ads in 2005. At that time, Netflix was not digital, Disney+, Hulu, Amazon Prime and AppleTV+ did not exist, nor did any of the other streaming apps. YouTube was the only game in town. And it remained that way for over 15 years.

But now everyone has a streaming platform and everyone has an ad-tier. Which means the market is flooded with inventory. This HollyWood Reporter article uses minutes viewed as their metric and compares across streaming and cable.

Here’s how platforms/channels measured outlets rank in minutes viewed (September 2021 to August 2022):

1. Netflix, 1.334 trillion minutes viewed

2. CBS, 752.8 billion

3. NBC, 596.7 billion

4. ABC, 471.9 billion

5. Fox, 323.1 billion

6. Disney+, 245.4 billion

7. Prime Video, 173.7 billion

8. Hulu, 128.1 billion

9. Apple TV+, 21.7 billion

What I don’t like about this stat is that it does not include YouTube. But looking at our Nielsen graph above, we can see that YouTube has 9.2% share of watch time vs 8.1% for Netflix.

So, therefore, we can assume that YouTube leads minutes watched, closely followed by Netflix but CBS & NBC combined don’t have as many minutes as viewed on YouTube and just beats Netflix. Netflix and YouTube are top dogs in streaming but completion is coming.

YouTube is one of the brighter spots in the Google story, and while it is a great business and will do well, including ads, it is no Google Search.

Another thing I want to point out is how YouTube Premium, which is YouTube’s paid subscription, cannibalizes its ad revenue. YouTube introduced paid subscription with no ads in 2014 as YouTube Red. However, Google makes a lot more money from ads, than it does from subscriptions (I captured this idea in my Netflix article here). While I think the world is moving towards a paid subscription model instead of the free-with-ads model, this is not good for YouTube’s revenue and profits in the short term.

4. Apps/Play Store:

The Android App Play Store is a Duopoly along with Apple’s IOS. Having a 30% tax as gatekeepers for apps, where essentially most business on the internet happens these days is an insane business and if not clamped down it has the potential to be an even bigger business than Google Search.

However, Google lost its lawsuit with Epic Games on December 12th, 2023. So I am not sure how long this gravy train is going to keep going around. It is very surprising to me that Google lost the same lawsuit against Epic that Apple won. Says something about the management.

Google for its part intends to appeal the verdict.

I think a 30% tax on all businesses that have an app is unacceptable and businesses should be allowed to accept payments outside the Play store.

As things stand now Apps/Play Store is another bright spot for Google but depending on regulatory pressures, this too could be at the risk of becoming less profitable.

Here is a note from Bank of America, echoing some of the same threats to Google as I mentioned above.

“BofA also highlighted the risks the sector could face in 2024 due to Google (GOOGL)(GOOG) phasing out cookies and implementing privacy sandbox, emerging competition from ecommerce platforms, streaming platforms, and TikTok.”

5. Cloud and AI:

Having said all of this, Cloud & AI is one of Google’s big bets and one of three things that I am still bullish on (other two being YouTube & Apps).

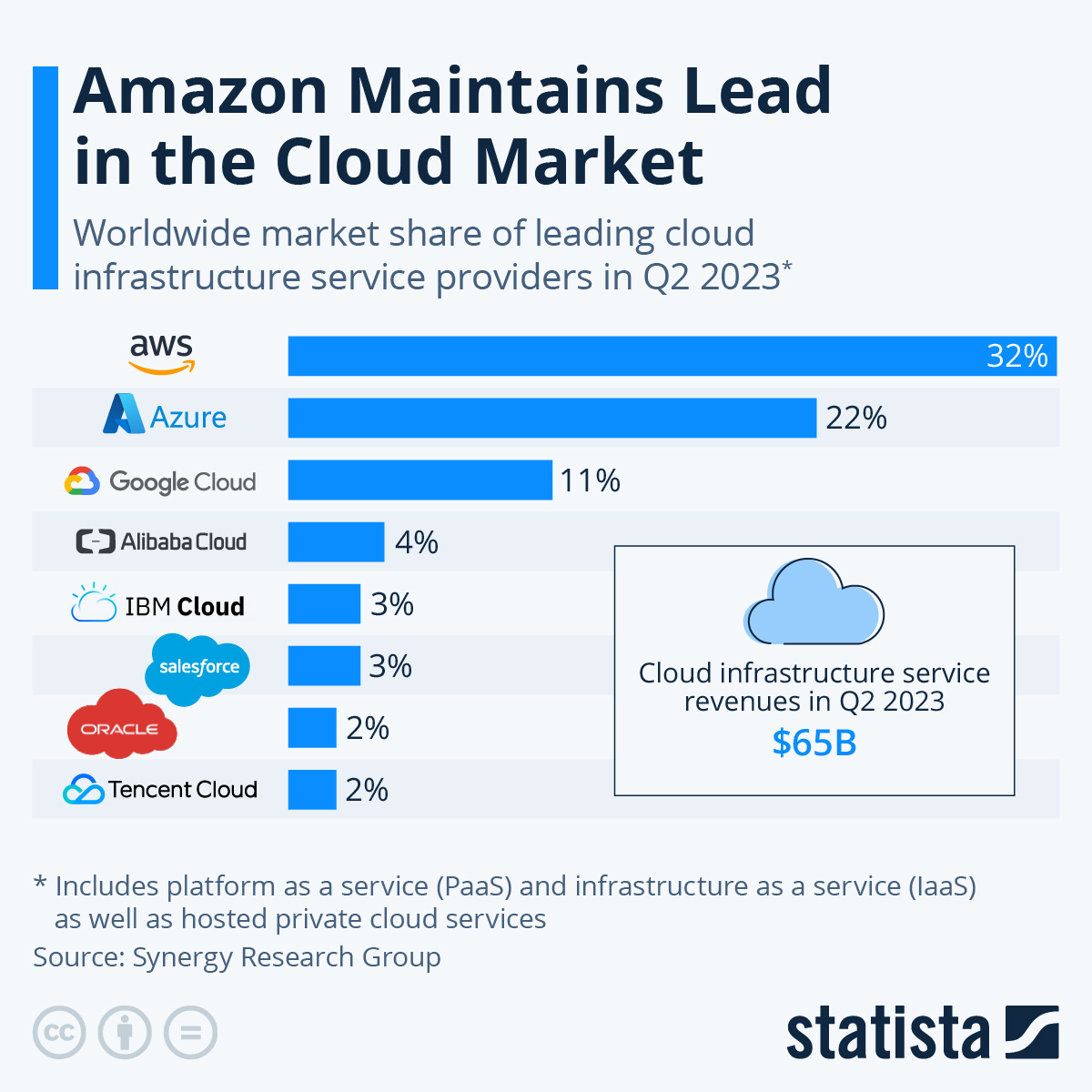

Google is currently 3rd in cloud market share making up 11% of the market share, AWS is 32% and Azure is 22%.

It remains to be seen if Google will be able to catch up to AWS and Azure and I am still willing to give Google another few years to prove it can take market share from AWS and Azure. Even with all the screw ups with AI, Google is still a formidable competitor in the space and the cloud bit really is a wait and see.

6. Homegrown AI Chips:

With the AI race taking off and Google having declared itself AI first in 2017, its home grown Google Cloud TPUs which are custom-designed AI accelerators could be one other, less explored, bright spots for Google.

Google Cloud TPUs are in their 5th generation now and Jim Breyer said on CNBC in June 2023 that “Perhaps Google’s chipset is closest” (to Nvidia).

Semiconductors are the underlying technology that powers our world today and it will continue to become more and more important and if Google can become a leader in this space, it can be a very big profit generator for Google. If Google can design home grown chips and does not have to pay Nvidia for their oh so expensive H100 chips, then that will go to Google’s Cloud and AI margin, dropping to the bottom line, pushing up the EPS.

So there is some real potential here but I don’t think Google’s chips are going to be competitive against Nvidia H200. The soon-to-be older H100, likely only underforms Google’s chips in some specific operations for which Google’s chips is custom built.

7. Other Bets including Self Driving

Alphabet also has a wild card up its sleeve which is its other bets division including Waymo, their self driving unit. This division works on 10x ideas or ‘Moonshots’. Ideas that push the boundaries of what is possible. Ideas that if solved, can disrupt entire industries. While this segment of the business so far has not delivered any products that have driven meaningful revenue for Alphabet yet, it remains a wild card.

Now, moving away from specific products, let’s look into some other broader risks that Google faces.

1. Regulatory/Monopoly Risk:

The Justice Department and 38 states and territories have called out Google for being a monopoly and lawsuit is underway. I wrote an article about this a few weeks ago and here is a snippet from that article:

“I think this lawsuit can really wreck Google’s search business and therefore, most of its profits. The stock price faces a potential cliff.”

If a choice screen is implemented as a result of this, I think this is an opportunity for Apple to launch Apple Search and that would be catastrophic for Google. Read more here.

2. Everyone has an advertising business now:

In the past a lot of the publishers did not have a great platform or technology to sell and run ads but now they do, everyone does. Companies like The Trade Desk are operating outside the walled gardens of Google and Meta which will continue to democratize digital ad tech. While this is great for the industry, it is not particularly great for the incumbents. Here is a note from Goldman Sachs echoing the same feeling:

The lines between traditional advertising and ecommerce business models are blurring with retail media capturing more Amazon (AMZN), Google (GOOG) (GOOGL) and Meta (META) budgets as traditional ecommerce platforms continue to build out their advertising offerings and digital advertising platforms continue to innovate around social commerce. Set to benefit: Pinterest (PINS), DoorDash (DASH), Uber (UBER) and Instacard (CART).

https://seekingalpha.com/news/4045118-goldman-sachs-2024-predictions-in-tech-amazon-google

Buy backs:

On the positive side, Google has recently adopted Apple’s playbook and has started buying back a ton of shares. The buybacks will continue to support the share price going forward. As I mentioned earlier, Google is a cash generating machine and will continue to do so at a reduced growth rate into the near future. So this is definitely a bright spot.

Who is Responsible? Leadership and Balls:

I think Google has been on a decline for almost a decade now and in my opinion, it all started with the Founders leaving, who kinda disappeared (until very recently when Sergey seems to have found religion again). Here is a quick timeline of how things transpired:

While Larry Page departed as Google CEO and Sundar Pichai replaced him in 2015, Google’s downfall may have started a year earlier when Nikesh Arora who was then Google’s Chief Business Officer left Google. Nikesh is now CEO at Palo Alto Networks which I would argue is doing quite well after a strategic turnaround orchestrated by Nikesh over the last few years.

I was only a few years into my Google journey and remember bumping into Nikesh once in Google’s Mountain View Quad Campus. I looked up to Nikesh and thought he would make a great CEO. It was sad for a lot of Googlers to see Nikesh depart Google.

I’ll go so far as to say that Nikesh Arora was the missed opportunity and a turning point for Google, Nikesh has Satya Nadella level caliber.

In 2015, Google also bought Ruth Porat, a Wall Street veteran having worked at Morgan Stanley. While Wall Street cheered Ruth’s cost cutting initiatives, overtime, I think it has taken its toll on Google’s culture.

In 2015, Sundar was also named CEO. You might not believe me but I kind of expected this to happen and I therefore, got a picture with Sundar in 2014, anticipating he was going to be the next CEO (even though I thought Nikesh was the better choice).

Clicked in Google’s Charlie’s Cafe in Mountain View California in June 2014. Sorry for the bad quality.

I’ve always had a lot of respect for Sundar and still do. I think he a very calm and collected leader and I remember praising him for his ability to bring a sense of calm every time I heard him speak

But I feel Google is in a different place in its journey now and needs a more dynamic leader, who is less calm and more action. Someone like Satya Nadella, someone like Nikesh Arora.

Then in 2017 Google sold Boston Dynamics to Softbank and that signaled to me ‘lack of balls’. Extrapolating the selling of Boston Dynamics to the failure of AI and consequent rise of ChatGPT + Microsoft, tells a story of a company that does not have its head in the right place. It lacks motivation, courage, foresight and leadership.

In July 2022, A Google engineer claimed that Google’s AI Chatbot is sentient. Which tells me that at the very least, Google had a ChatGPT style bot in summer of 2022 (and likely before that) but Google’s leadership just sat on it owing to two risks 1. Cannibalization of search revenue. 2. Inability to figure out the right go to market strategy owing to the chatbot not being ready since it was still giving erroneous answers sometimes. The second issue is also a reflection of Google’s size, which limits its risk taking ability.

I understand not wanting to launch a product which gives wrong answers from time to time from a company that has made a living out of providing quick and accurate answers. OpenAI had a distinct advantage here, which they took advantage of, which is their size. No reputation to spoil.

However, for the ad cannibalization issue, I hold the leadership responsible. They were just too slow, or too uninterested or lacked capacity to come up with a solution which left the door open for ChatGPT.

Google’s Biggest Failure is Marketing:

At its heart, Google is a software engineering company. I would argue to this day, Google engineering talent is top notch and therefore many of Google’s products are by far the best in the industry - Search, Maps, YouTube, Gmail, Google Calendar, Google Photos, I can go on. But Google absolutely sucks at its ability to market these products. These products have done exceptionally well because they are great products which grew by word of mouth, for the most part. Google marketing deserves zero credit for the success of products I’ve mentioned above. Their duopoly of the phone operating system market is more responsible for the success of Google’s products than Google’s marketing team.

Sundar announced Google as an AI first company in 2017 to a bunch of engineers at a developer conference I/O. While that is important, Google did not do anything to market its AI prowess to the masses in the following 6 years. Google fails to realize that they have to market AI and its leadership in the field to your customers and your investors too.

Google is also a B2B company first, so one could argue that in its early days, it didn't do as much marketing as a consumer company like Microsoft and Apple had to. But in recent years Google has had to focus marketing efforts on B2C efforts ith Pixel, YouTube, YouTube TV.

1. Google’s Marketing Strategy:

Google’s ads often follow one of two themes. They are either “emotional” or they are “happy”. Both working on fundamental human feelings which I think is great. But a company trying to sell so many different products needs to be able to exhibit other sides of its personality beyond just emotions and happiness.

Google’s marketing strategy feels like a child that never grew up.

Apple’s primary marketing strategy is ‘Privacy’ which is not just a core human value but also happens to be Google's Achilles heel. While Apple’s marketing strategy centers around Privacy, Apple’s ads often manage to do multiple things at once. It comes across as cool, young, sexy and privacy centered.

In recent years, Google has taken up a slightly more edgy strategy, for example their most recent Pixel ad where they show a Pixel device talking to an Apple device and highlighting Pixel’s features. As much as I applaud Google’s marketing team’s courage to go down this route, the execution is lazy and comes across as immature. A child with a ChatGPT could have written a better script. If you are going to take on a competitor like Apple head on, stop being nice and go on the offensive.

Essentially what’s missing is a marketing strategy that is edgy, sexy and desirable. I am thinking of this primarily from Pixel’s perspective. Somehow, Apple does this really well and without even trying too hard.

2. AI Launch Failure

The elephant in the room of failed marketing efforts is Google’s AI launch where it failed, twice. First of all, what is Bard? Is that the best name Google could come up with for a futuristic product that is supposed to appeal to the next generation? Brad HAS TO BE top of the list of Google's history of giving their products horrendous names.

In terms of the AI launch, the first marketing failure was when they released a GIF on X where Bard was asked a question about space, more specifically about JWST and one of three bullet points Bard had in its answer was incorrect. It’d be a lot more accommodating of this if it were a live demo but no, it was a GIF on X. So it was pre-planned, multiple layers of leadership and partner teams likely signed off on this and no one thought it would be a good idea to fact check what could have been the most important messaging for the company in the last decade.

The second screw up is even more egregious and desperate. In launching Gemini, Google’s most powerful, multi-modal LLM, Google’s marketing team failed to inform the audience that the video was sped up (it was mentioned in the description of the YouTube video but like people read that) and that the voice in the demo was reading out human-made prompts they’d made to Gemini:

“In reality, the demo also wasn’t carried out in real time or in voice. When asked about the video by Bloomberg Opinion, a Google spokesperson said it was made by “using still image frames from the footage, and prompting via text,” and they pointed to a site showing how others could interact with Gemini with photos of their hands, or of drawings or other objects. In other words, the voice in the demo was reading out human-made prompts they’d made to Gemini, and showing them still images. That’s quite different from what Google seemed to be suggesting: that a person could have a smooth voice conversation with Gemini as it watched and responded in real time to the world around it.”

Source: Bloomberg

3. Marketing Leadership:

Lorraine Twohill has been Google’s CMO since 2009 and I have rarely been impressed by Google ads, except a few emotional ads (this one in particular). There is nothing wrong with this strategy, I think Google is exceptionally good at making such ads, but needs to show more personality, more color, and growth.

Google also needs to come off its high horse and implement marketing strategies that work and are competitive with other brands.

Conclusion:

Google, once a company that was challenging the status quo and killing old industries, finds itself stuck in the same rut. A tech giant, sitting on the next gen tech but not releasing it for the fear of losing advertising dollars on search.

Alphabet may have become too big for its own good and, therefore, too scared to break things, limiting its ability to move fast.

I really do think breaking up Alphabet would unleash a lot of value because those smaller organizations will be nimble and have a more diverse set of leadership which would be better for the overall performance and lead to higher shareholder value.

As mentioned earlier, this is not a bearish article on Alphabet, instead it is one of ‘relatively slower growth’. Big tech is not likely to remain a monolith like it did in the past decade and the first signs of winners and losers are now starting to emerge.

Recent weakness in stock and technicals:

I wanted to write this article as a warning to Alphabet shareholders that Alphabet’s shares will face resistance around $145. Unlike Apple and Microsoft, Alphabet is still below its all time highs near $150. However, this resistance has already played out. Alphabet has been consolidating near $144 for nearly 4 months now. I think Alphabet breaks out of $145 soon and my 2024 year end target for Alphabet shares is $160.

My Positioning:

Even though I expect Alphabet shares to go up 10% next year, I am still going to continue to sell out of Alphabet because I think I am over exposed to the stock. I have sold over 80% of my Alphabet position over the last 3 years and intend to continue to sell further until I bring my Alphabet position in line with my other investments. I don’t hold more than 5% of my total net worth in any one stock and Alphabet was an exception to that. Not any more.

Borrowed Conviction Rarely Works

Past performance is no guarantee of future results.

The ideas discussed in this article should not be constituted as investment advice.

I reserve the right to change my mind if the facts change.

Disclosure: We own positions in some/all of the tickers mentioned in this article.