My primary reason to write this short note is to refute the 6-7 rate cut narrative and provide the bullish point of view.

On October 20th, I wrote an article where I visualized the rolling recession we had just been through and made the case that we are likely in a new bull market

I’d say that based on this analysis, the parts of the recession ended early this year (2023) and that we are very close to the end of this rolling recession and likely in a new bull market.

Source: WealthWise, Section: Bottomline

If you had purchased the S&P 500 at the open on October 20th, 2023 (opened at $425.98), you would be up 13.2% (53% annualized) today (closed on Friday at $482.43).

I also made the prediction that the Fed will likely cut in 9 months because of slowing inflation:

We are now re-accelerating with earnings expectations going back up and expectations that inflation is going to continue to come down and the Fed will cut rates in the next 9 months because of inflation coming down and not because the economy is weak.

Source: WealthWise, Section: Quick Timeline of how the bear market unfolded over the last 2.5 years

Following this, in December 2023, The Federal Reserve released its dot plots showing they expect to cut 3 times in 2024.

Real Rates and Fed’s Balance Sheet:

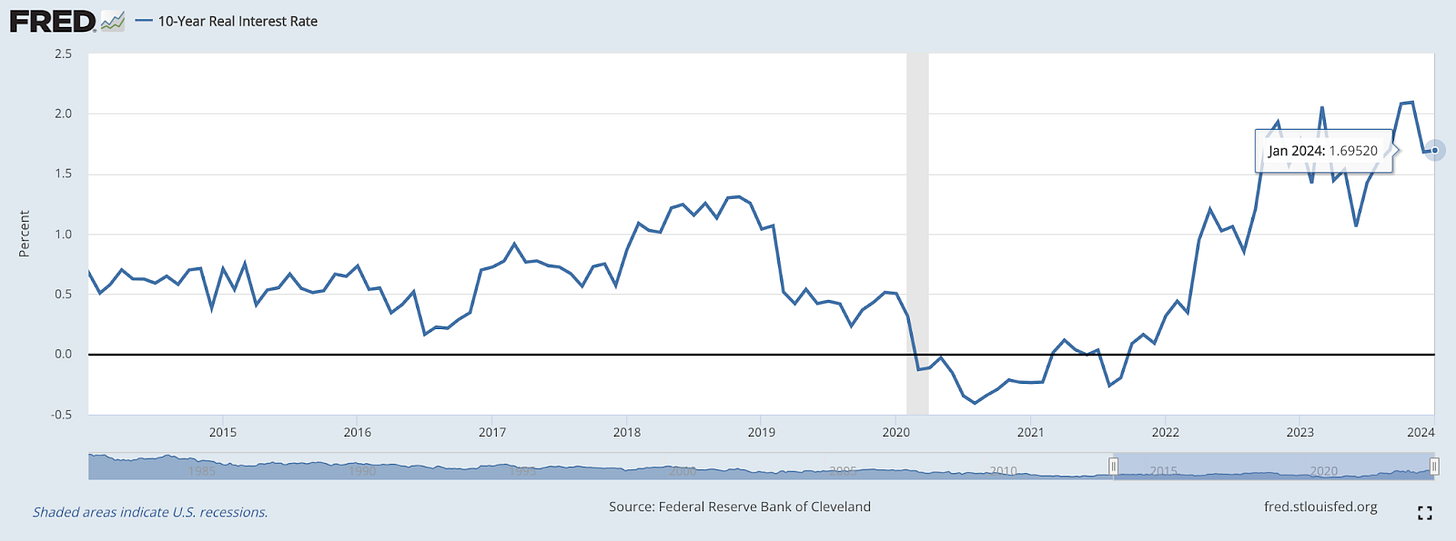

However after the Federal Reserve made this announcement, the Fed Fund rates pulled back and there has been significant easing in real interest rate which was at 2.09% in November 2023 and dropped to 1.7% in January 2024.

Link to source

Having said that, the Federal Reserve has continued to reduce its balance sheet which now stands at $7.7 Trillion, down from $7.9 Trillion in October 2023, delivering a tightening at the same time when the rates were coming down.

Link to source

The interest rate hikes have not even hit the economy yet:

Monetary policies “operate with a long lag and with a lag that varies widely from time to time.”

Milton Friedman (to Congress in 1959)

This quote is more true today than ever before. After a decade of near zero interest rate policy, households and corporations have locked in low interest rates for years and in most cases, decades.

So while some believe that we’ve seen the impact of interest rate hikes already, I think we have just started to feel the impact of interest rates and that most of the lag is yet to hit. Even though households and corporations have locked in low interest rates in the past, the high interest rates today are having a detrimental impact on new investments which will lead to slower growth in the future.

We are, therefore, still in a race against time and it is very important that the Fed slay the inflation dragon leading to interest rates cuts before that lag really starts taking a toll on the economy.

What Inflation?:

There is no inflation. Only inflation left is in shelter, medical care commodities and food away from home. Everything else is either below the feds target or at it.

Source: U.S. Bureau of Labor Statistics (You can click on individual line items and isolate their inflation)

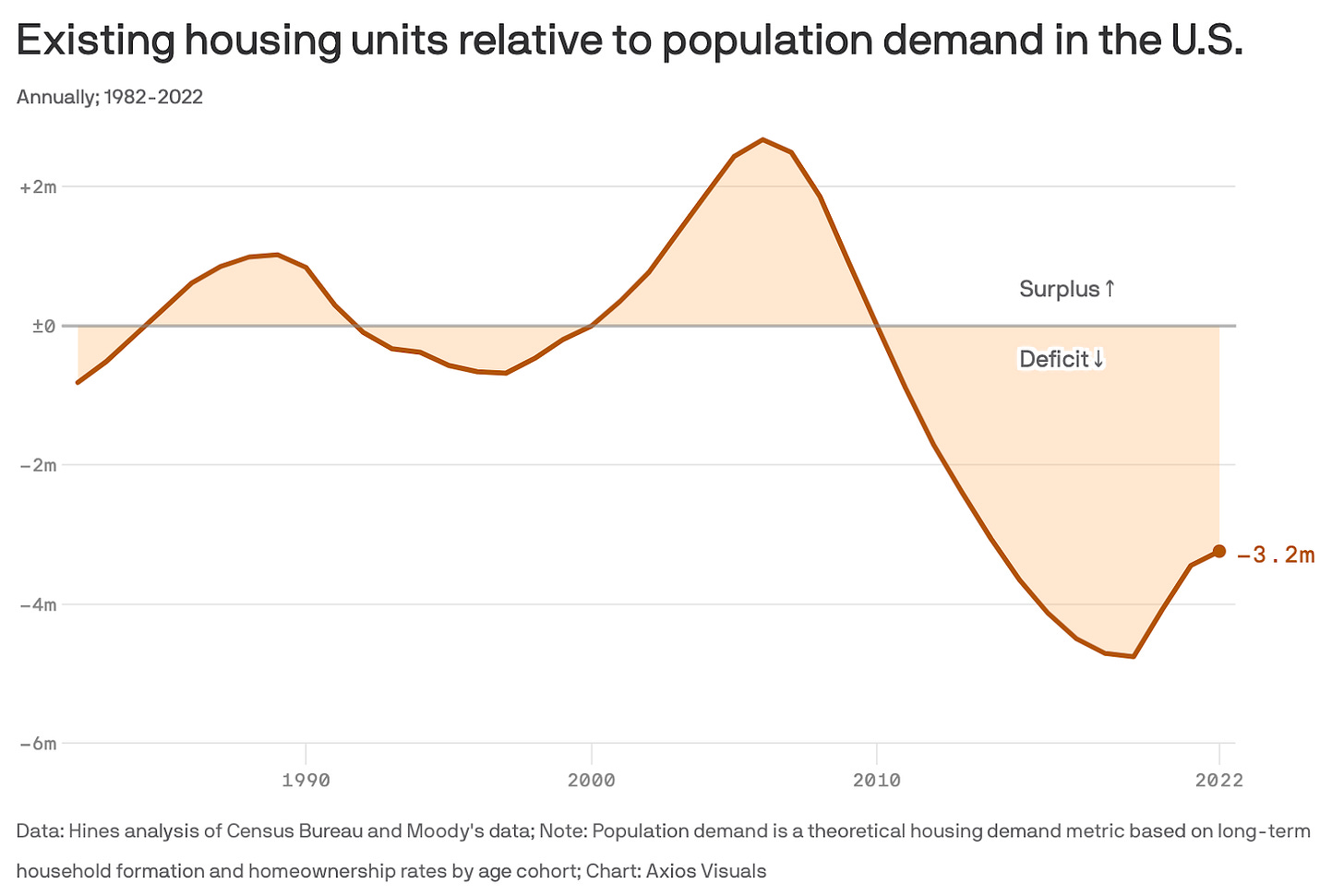

Shelter makes up 42% of CPI. So that is really what is holding CPI high. The Fed will not kill the economy if the inflation is only in shelter.

Shelter is all demand/supply.

Source: Axios

I actually think a large part of inflation was indeed transitory owing to the Covid stop and start which caused global demand supply issues which was further fueled by Russia’s invasion of Ukraine.

The lack of supply in shelter is something that the Fed can do little about. The only thing the Fed can do to bring down Shelter inflation is break the economy and that will definitely bring down affordability and therefore real estate prices. But remember the Fed has a dual mandate of low and stable inflation & maximum-employment. So while the Fed does want to see some softening in the labor market (which can also be debated, given inflation has come down so much while the unemployment rate is still at 3.7%), they don’t want to break the economy.

Bottomline:

The Fed and interest rates are not likely to be relevant to the market in 2024, until something breaks. Interest rates are not the most important thing governing the direction of the market anymore. Earnings and profit margins are (provided inflation keeps coming down). The Producer Price Index (PPI) is coming down faster than the Consumer Price Index (CPI) giving corporations some margin buffer which could lead to EPS surprises. However, top line revenue could continue to slow down for a while.

It might take the market a while to realize this but that is what I think will happen this year. We are likely to still see market volatility when rates move up or down on a short term basis but at the end of the year, when we look back, we are likely to have forgotten about interest rates, and realize that the entire 2024 move was earnings driven. If earnings don’t do well, then that move could be negative too.

I am tired of listening to people come on TV and harp on the 6 or 7 rate cuts. No bull believes that. Only people who think the Fed will cut 6-7 times in 2024 are the bears. It is what is “priced in” and hence I am inclined to believe that the overall market is still betting on a recession in 2024. And that tells me that positioning is still bearish and that there is ample money on the sidelines waiting to come into the market.

I think the Fed will cut 2-3 times this year starting in May/June 2024 and that is the bullish take.

How much they cut will be data dependent. If inflation falls a lot, then the Fed will cut a lot. And this scenario could be both bullish and bearish. The bearish take is that inflation is falling because the economy is tanking. The bullish take is that inflation is falling because supply chain disruptions are easing and wars have been contained.

If inflation does not fall a lot, the Fed is likely to take its time and cut more slowly.

In the last couple of weeks we’ve seen a resurgence of the Mag7 and the rest of the market has kind of fallen back. This is owing to interest rate fears and market pricing out a rate cut in March 2024. But as the market comes to the realization that we might indeed get a rate cut in May/June, the rest of the market is likely to have a vicious rally to catch up to the Mag7 (similar to the one we saw in December 2023).

We could see some weakness in the markets until it is obvious when the rate cuts are coming. For long term investors this is a buy the dip market.

Large cap tech and Mag7 are not a monolith anymore. I think we see some dispersion and winners and losers might appear. I am relatively bearish on Google as compared to other large cap tech companies. And I have never been bullish on Meta.

Last thing I want to call out is Geopolitics. The world has not been this unstable for a very long time. We have all enjoyed the peace dividend for decades now. Even though I don’t think this will happen, things could spin out of control and that is a tail risk that is worth keeping an eye on.

Borrowed Conviction Rarely Works

Past performance is no guarantee of future results.

The ideas discussed in this article should not be constituted as investment advice.

I reserve the right to change my mind if the facts change.

Disclosure: We own positions in some/all of the tickers mentioned in this article.