What I Am Doing With My Nvidia Position

How to add, hold & sell $NVDA, all at the same time (almost)

It usually takes decadeS to come across a story like NVDA 0.00%↑.

Never in the history of the stock market has a company with this much market cap, delivered the magnitude of back to back beats that Nvidia delivered in Q2 and Q3 2023 (Reporting Q1 and Q2 2023 respectively).

Nvidia, once again, got cheaper than it was going into earnings.

In my last article, I didn’t say it in as many words but Barron’s did for me: “If you liked the stock then, you should still like it now.” And that is the story today too.

This is the math: Nvidia’s latest results, and particularly its outlook, were so good that analysts have significantly ramped up their forecasts for the company’s future earnings, which makes its forward P/E suddenly look much more attractive. As of July 31, the consensus call among analysts surveyed by FactSet was for earnings of $7.95 a share in fiscal 2024 and $11.53 in fiscal 2025.

By Friday morning, those EPS estimates had risen to $10.60 and $16.51 for 2024 and 2025, respectively. In turn, Nvidia’s forward P/E—the price relative to earnings expected over the next 12 months—has moved lower because the denominator in that ratio is much higher.

As a result, the stock looks cheaper. Much cheaper. Nvidia was trading at a forward P/E of 33.8 on Friday, down from above 43 before its earnings and at the lowest level since Jan. 5 (2023)

Link to Source: Barrons - Published: Aug 28, 2023

I did, however, stress upon the reliance on the ‘E’ in Earnings in my last article.

Essentially what I am saying is don't make decisions based on legacy P/E numbers and take into consideration that the E in P/E could be wrong/could change. It could be higher or lower. What we have is just an “estimate” based on analyst projections.

Link to Source: WealthWise - Published: May 30, 2023

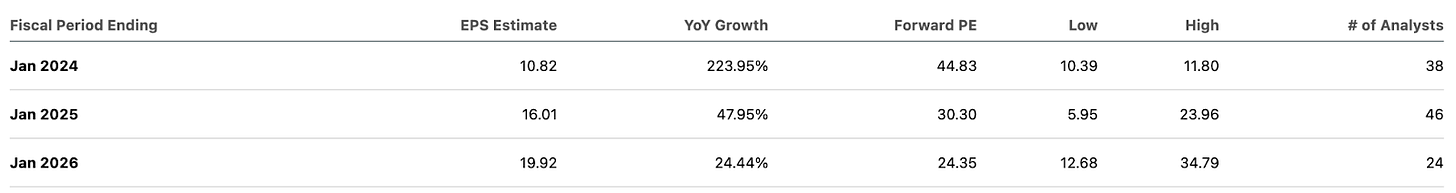

Current Valuation Estimates:

Source: Seeking Alpha - Sept 2, 2023

The Non-GAAP (FWD) PEG is 1.35. Not great but not as egregious as some believe. 1 or lower is usually excellent.

Why are GPUs superior to CPUs?

I want to take a moment and get into the benefits of GPUs a little bit more, as I have understood since the publication of the last article.

As covered in our Free Weekly Newsletter Alpha Coverage, GPUs can do parallel processing while CPUs can’t.

As reported by Kristina Partsinevelos on CNBC’s Halftime Report on Aug 24, 2023. It’s like waiting in line when you are using a CPU and things get processed one after the other, while a GPU can do parallel processing and can therefore do multiple things at once which makes it ideal for AI applications.

Links to the entire CNBC’s Halftime Report Episode (Audio):

(Most of the conversation takes place between From 10:36 to 23:55 mins):

You can also check out this 52 Sec clip where Josh Brown explains the same tech on What Are Your Thoughts on YouTube.

Risks - Manufacturing Capacity:

Taiwan Semiconductors is the only company that manufactures H100 chips and hence the dependency is something that concerns me. Nvidia can only sell a subset of what TSM 0.00%↑ manufacturers. And while it is in the interest of both companies to increase manufacturing, it does create dependency and that is a clear risk. The demand does not matter if Nvidia can’t supply.

I’m sure Nvidia leadership is fully aware and working to resolve this.

Risks - Competition & Hyperscalers

As covered in Alpha Coverage 10 on June 17th, 2023:

AMD noted that a full MI300 launch is scheduled for Q4'23.

In Alpha Coverage 14 on July 15, 2023, we highlighted an Seeking Alpha Opinion Piece by Wright's Research:

AMD has not been idle alongside Nvidia, developing programs such as HIPIFY, a tool that allows them to translate CUDA source code into HIP C++ so that it is compatible with AMD's own graphics cards.

Amazon also recently started considering AMD's new MI300 AI chips for its cloud unit, which we'll talk about in a moment. Even Microsoft has been working closely with AMD to train models that work with AMD GPUs that support ROCm and their MI100/MI200 accelerators.

The MI300X is said to have 153B transistors compared to the H100 with 80B transistors, with the MI300x at 750W consuming slightly more power than the H100 at 700W. The MI300X also has 192GB of high-bandwidth memory (HBM) compared to Nvidia's H100 with 80GB HBM. MosaicML recently compared the A100 40GB and 80GB versions to the already available MI250 and saw that they were 80% and 73% as fast as the A100 versions, respectively. While many market players are quick to point out Nvidia's lead, we think AMD is not too far behind and certainly remains the worthy underdog that is not currently receiving much attention.

The other big risk is Hyperscalers like Google, Amazon and Microsoft investing in their own chips. Given that this is a major expense for these companies and that they have the scale & resources to design their own chips, it makes sense for them to invest in a home grown chip that does specific tasks really well based on specific business needs.

But Nvidia’s GPUs will likely stay superior as a package for a while.

I have been adding to AMD 0.00%↑ which is speculative, given we don’t really know how the markets will respond and with Nvidia’s next gen chip expected next year (more on this below).

I am also adding to AVGO 0.00%↑ (Broadcom) which helps hyperscalers with building their own chips. Broadcom is also trading at a forward multiple of 20.70 making it a relatively cheaper way to get exposure to AI. Broadcom is expected to see revenue exposure to AI climb from 10% to 25% next year. That is a big jump.

GH200 Grace Hopper Superchip Platform

On Aug 8th, 2023, Nvidia announced their next generation GH200 Grace Hopper Superchip Platform. The company noted leading system manufacturers are expected to deliver systems based on the platform in Q2 of 2024.

The dual configuration — which delivers up to 3.5x more memory capacity and 3x more bandwidth than the current generation — consists a single server with 144 Arm Neoverse cores, 8 petaflops of AI performance and 282GB of the latest HBM3e memory technology.

HBM3e memory, which is 50% faster than current HBM3, delivers a total of 10TB/sec of combined bandwidth, allowing the new platform to run models 3.5x larger than the previous version, while improving performance with 3x faster memory bandwidth.

Link to Seeking Alpha News Article

Watch Huang’s SIGGRAPH keynote address on demand to learn more about Grace Hopper.

This is as cutting edge as cutting edge gets. Microchips are akin to Oil, it drives the entire digital economy. And no one is sitting idle. We are in the first year of a multi-decade story.

Technicals & Positioning:

Technically, Nvidia looks overbought on 5 Years and longer charts. But the 1 year chart shows there is room to go further.

I think NVDA 0.00%↑ and TSLA 0.00%↑ are two of the most important companies of our lifetime (amongst others) and could beome multi-trillion dollar market cap companies within 5 years. Having said that, Nvidia is not cheap today compared to the sector or the market.

But Nvidia has never been cheap.

And relative to its own history, it is cheap today! (Previous Article)

I have no clue what new competitors will come in and how it will affect Nvidia’s dominance. I also don’t know if Nvidia will continue to go higher or pull back. I think it will go higher but I don’t know.

What I do know however, is what I am here to do, which is to make money. Don’t fall in love with a stock. It’s a means to an end. I also know markets don’t go up in a straight line, so rebalancing and taking distributions is a good idea.

As such, I am being extremely disciplined. I am at 72% to target on my Nvidia allocation based on equity (I don’t look at principal invested once I am up more than 100% in a stock). After the most recent earnings pop, I sold less than 5% of my Nvidia position.

I am continuing to dollar cost average into Nvidia below $479 (Based on 1 month 50 DMA) with very tiny amounts and will add more aggressively if it pulls back close to or below $450 (Based on 3 month & 1 year 50 DMA).

I will continue to look for opportunities to sell Nvidia slowly, as it climbs. I am pacing my selling in such a way that if Nvidia ever gets to $1000 price (which some of the price targets on the street suggest it will get to), I will be at 100% allocation goal and would have taken out my principal completely (with a decent profit), if and when that happens!

On the flip side, if Nvidia keeps dropping, I will continue to dollar cost average and get to my allocation target by buying more units and then start rebalancing once I’m above my target.

I reserve the right to change my mind if the facts change.

I am currently using limit sells to book profit. Might use trailing limit orders if the macro cools down a little bit more and we get clarity beyond a couple of months.

Borrowed Conviction Rarely Works

Past performance is no guarantee of future results.

The ideas discussed in this article should not be constituted as investment advice.

Disclosure: We own positions in some/all of the tickers mentioned in this article.