27 months after The Federal Reserve started raising rates, the long and variable lags of monetary policy seem to have finally caught up and the much awaited slowdown is here.

As I mentioned in my article on October 20, 2023 and Jan 21, 2024, we have been and still are in a race against time. Does inflation come down before the economy slows down too much or will The Federal Reserve have to put the economy in a recession to get inflation back under 2%?

Shelter Inflation:

As I have been making the case for months now, inflation is already close to the Fed’s target of 2%, if not lower, if we take shelter out. Shelter makes up over 40% of CPI and the Federal Reserve is using an ancient way to collect this data called Owner’s Equivalent Rent, which is a survey asking homeowner’s how much they would have paid for their home if they were renting it instead of owning it. This is erroneous because:

It’s a survey, so it’s not hard data, it's how people feel about it.

It would be natural for most homeowners to have an inflated sense of the property they own.

There is no demand and supply deciding these rent prices, there is no market place, there is no demand side, there is no one on the other side of the trade, it’s just feelings. (WSJ: No One Pays Owners' Equivalent Rent)

In my October article, I shared details on how more high frequency rent data shows that:

If we take shelter out, then inflation is at 2% already.

Now Shelter inflation is dropping in CPI too, just like I predicted it would. It’s just math and some feelings :p

Link to source: U.S. Bureau of Labor Statistics (Click on All Items to un-select it and click on Shelter to select it)

Inflation has Stalled:

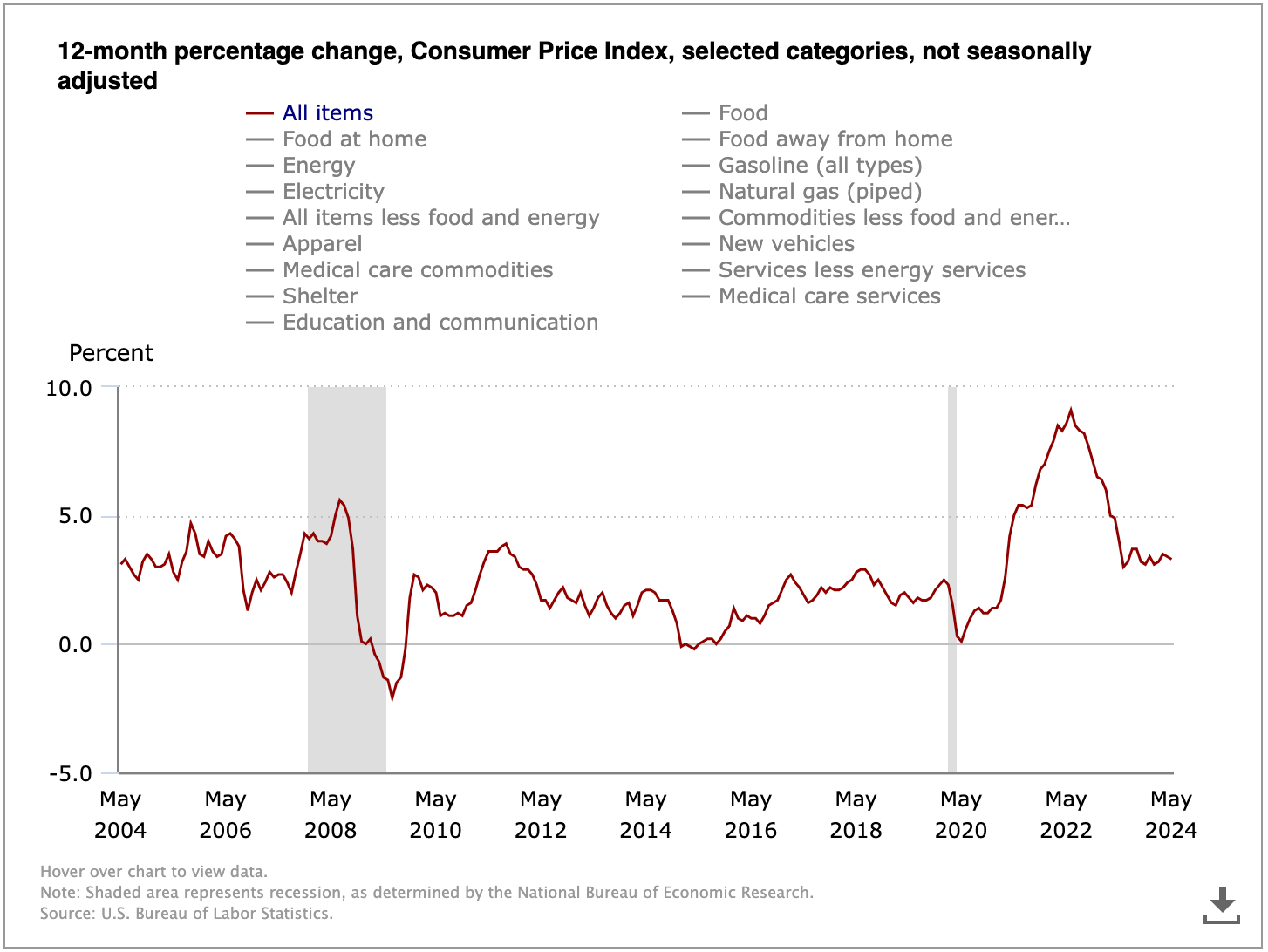

But while Shelter is now finally going in the right direction, headline CPI seems to have stalled.

Link to source: U.S. Bureau of Labor Statistics

Energy, Electricity, Gasoline, Natural Gas and Medical Care Services are putting upward pressure on inflation. So let’s break this down.

Oil prices just can’t seem to go higher. Even as OPEC+ is cutting output, lower supply should lead to higher prices but oil prices are not going higher, no matter how much OPEC+ cuts. And even though not many people are talking about this yet, I think renewable energy is starting to put some pressure on fossil fuels as discussed in my article “The end of Fossil Fuels & rise of Renewables'', where based on my math, the absolute amount of fossil fuel consumed by humans will start going down somewhere between 2030 & 2034. So I expect oil to stay contained.

Here is a recent note from IEA, confirming the same:

Global oil demand is expected to slow in the coming years as energy transitions advance, resulting in a "major surplus" by 2030, the International Energy Agency (IEA) said in an annual report published Wednesday.

Source: Seeking Alpha/IEA

Energy and Electricity are trickier, thanks to AI and Data Center demand, this is a headwind in the short term as the world races to develop new energy infrastructure (which is very very bullish for renewable energy btw). In the long run, I would expect the cost of energy to continue to come down as it becomes even more commoditized. But in the short run, this is a headwind which complicates things.

Where do Interest rates go from here?

I don’t envy The Federal Reserve to be in this position; on one hand you have inflation that has stalled and stopped going down and on the other hand, economic data is starting to weaken. What took 27 months to start showing effect will likely also take some time to start reversing, meaning if The Federal Reserve was to cut today, the economy might not feel the impact of those rate cuts well in 2025, meanwhile there could be enough disinflation already in the pipeline to bring the inflation to the Fed’s target of 2%.

But this is exactly what a soft landing looks like. How else would it have played out? The only way to get a soft landing is for both inflation to come down slowly and for the economy to slow down but not too rapidly. We are getting mixed data because things are kind of crossfading (race against time). At some point, it’ll be enough, but when?

The only part of the soft landing that is yet to play out is for the Fed to declare victory and start normalizing interest rates.

In October 2023, I made the prediction:

We are now re-accelerating with earnings expectations going back up and expectations that inflation is going to continue to come down and the Fed will cut rates in the next 9 months because of inflation coming down and not because the economy is weak.

Source: WealthWise, Section: Quick Timeline of how the bear market unfolded over the last 2.5 years

That would make July 2024 the final month for the Fed to cut interest rates for my 9 month prediction to come true. And I do still think that The Federal Reserve should cut in July. But will they?

Yesterday the FOMC dot plots showed that the Federal Reserve collectively now expects to cut interest rates only once in 2024 as opposed to 3 cuts that were priced in, in April 2024. This almost certainly prices out any chances of a July rate cut. But, inflation, after being strong in the first quarter of 2024, has weakened in April and May. According to DoubleLine Capital CEO Jeffrey Gundlach, even though CPI is seasonality adjusted, CPI tends to be strongest in the beginning of the year and tends to keep falling as we go through the year. Given that context, CPI is likely to continue to come down, and the economy is likely to continue to weaken. So the Fed will have to pre-empt that cut at some point, well before recession becomes unavoidable to deliver the final phase of the soft landing.

The market is currently pricing in a 8.3% probability of a 25 basis point rate in July 2024 and a 56.7% chance of a rate cut in September 2024. These numbers can change drastically based on new economic data.

I would actually place my bet on a September rate cut too if we didn’t have elections 2 months following that. In my opinion, September is too close to the elections but The Federal Reserve will tell you that monetary policy is not affected by politics and I, for the most part, believe them but can’t help but think that The Fed Chair would want to avoid any doubts on The Federal Reserve's independence. If we get rate cuts too close to the electionI think that politicians will cry “elections interfere”, given the kind of political climate we are in, which is bound to play on the mind of the Fed chair. But he seems unfazed so far, even though I think the Fed should cut in July, there is a higher likelihood that they'll cut in September. And that might not be a bad thing.

Relationship between interest rates and stocks:

The market does not always go up when interest rates are falling and does not always fall when interest rates rise. It really depends on why the yields are moving and by how much.

Both rates rising dramatically and falling drastically are bad for stocks. If rates are rising rapidly because the Fed is trying to contain inflation and trying to slow down the economy, making borrowing harder and more expensive, liquidity dries out, then that could have a negative impact on equity prices. And when rates are going down quickly, it’s often because the economy is in shambles or at the risk of going into one and the Fed is cutting rates to help the economy recover.

However if the rates are going up because we have a strong economy and growth is good, then that is not that bad. And if the rate cuts are happening simply to normalize interest rates after a historic bout of inflation, then that is not bad either. I discussed this in more detail in my January 2024 article.

Here is an old CNBC article where Ryan Detrick shares some historical stats on stocks performing well in a rising interest rate environment.

Even during the current rate hiking cycle, markets took a beating just after the Federal Reserve started raising interest rates in March 2022.

Going into the summer of 2022, as the Fed increased the pace of rate hikes from 25 basis points to 50 basis points to 4 back-to-back 75 basis point hikes, the market crumbled as the rate of change spiked.

S&P 500 bottomed in October 2022 as the Federal Reserve dropped back to 50 basis points hike (easing from 75 basis point hikes) in December 2022.

The Federal Reserve followed that with four 25 basis point hikes ending in July 2023. This brought down interest rate volatility, allowing markets to stabilize.

In October 2023, it became clear that the Fed is done raising rates and that rates have stabilized, albeit at a higher level. But since it is now more stable, businesses can plan and make investments and the markets are at all time highs.

In Summary:

We saw a drop in equity prices as rates went up rapidly.

Markets started recovering as it was clear that the interest rate volatility would go down, even though interest rates were still going up.

Markets have delivered a strong bull market since October 2023, even in a high interest rate environment.

Conclusion:

We are likely to experience a normalized interest rate environment and not a low (near zero) interest rate environment we saw after The Great Financial Crisis. Low interest rate environments prop up zombie companies that should not exist, impacting other, competent businesses who would flourish in a normal interest rate environment.

I think The Federal Reserve will cut 1 or 2 times in 2024 starting in September 2024 (even though I think they should cut in July 2024). We are likely to see a few rate cuts in this normalization cycle but not likely to see ultra low interest rate environment we came from.

Growth and inflation remaining above expectations is preventing the Fed from cutting rates and holding rates steady is actually good for the stock market based on historical data. And even when the Fed starts cutting, it will be even more bullish if they are cutting into strength (as opposed to weakness), to normalize interest rates.

As I stated in January, I don’t think this market is trading on interest rates in 2024, even though it might seem so. I think the market is trading on earnings and earnings expectations. As long as interest rates don’t change drastically (up or down), markets are likely to continue to focus on the fundamentals and the macro will fade into the background, like it should. We are normalizing, we are returning to normal markets where stocks are trading based on their merits.

Small caps and some other interest sensitive sectors have been impacted more severely and still remain under water. That will likely change before the end of year.