Sectors & Stocks That Will Benefit The Most From Interest Rate Cuts

The next move by The Federal Reserve is going to be a cut, does it matter when?

In this article, I will share why the Fed’s next move is likely a rate cut and which sectors and stocks are likely to benefit most from it. I will be sharing specific tickers that I think can deliver Alpha over the next 1-2 years.

Nothing goes up in a straight line and nothing goes down in a straight line. After falling for a year, in the past few months, inflation has stopped going down. But the main story is still that the overall inflation trend is still down.

The components of inflation are noisy, some components are up in some months and those same components are down the month after and other components which were down in some months, are up in successive months. There is no clear signal for any component being too concerning or going up a lot at the moment.

Source: BLS (Interactive Chart - (You can click on individual line items and isolate their inflation)

A quick deep dive in the components shows us that:

Energy, electricity, gasoline and natural gas have stopped going down. Some are up marginally but nothing concerning.

Medical Care commodities have just now started going down recently (since Nov. 2023)

Medical Care Services is going up but it’s a relatively smaller weight compared to Shelter, which is the main story.

Shelter has finally started going down and that is the big news because Shelter makes up 42% of CPI, so it will have an outsized impact on CPI as it falls further. If you read my previous article about why I didn't expect the Fed to cut 6-7 times in 2024, I made the case that “Only inflation left is in shelter…”.

Shelter:

Source: BLS (Interactive Chart - (You can click on individual line items and isolate their inflation)

So because the immaculate disinflation did not continue into 2024, which is owing to the strength in the economy, the Fed can choose to take a little more time with rate cuts. The economy is holding up (for now) and there is no real rush to cut interest rates yet.

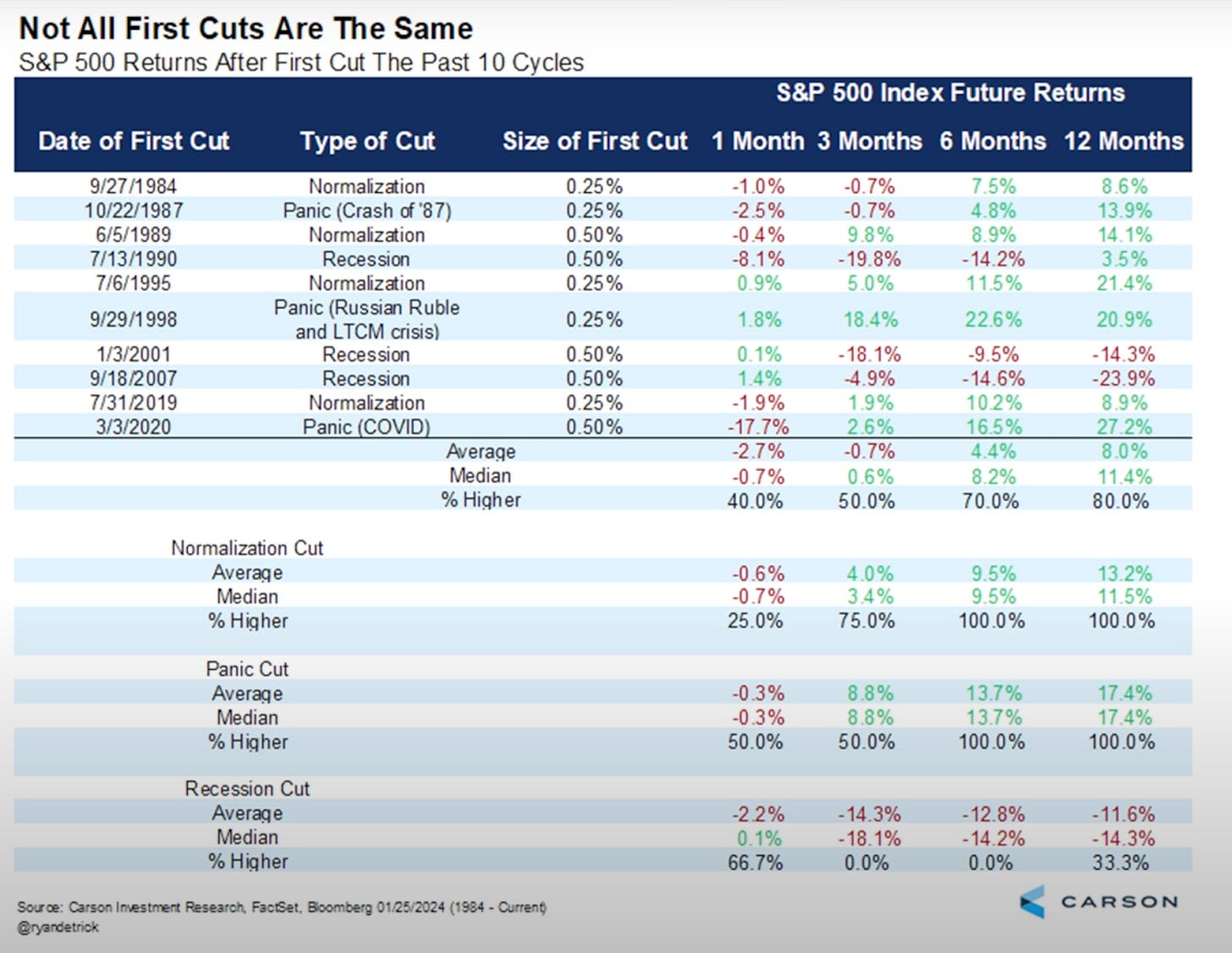

However, we do not want to get into a situation where the Fed has to cut because the economy is going to slip into a recession. We want a “normalization” rate cut and that will likely come well before we hit 2% inflation.

I still think the Fed will cut 3 times this year starting in May/June 2024. However, it is possible that we only get 2 cuts in 2024 because the 3rd cut slips into 2025.

It is also possible that in the upcoming FOMC (Next Week), the dot plot goes from 3 rate cuts to 2 rate cuts. That will not change my stance that we are getting 3 rate cuts this year because I believe that inflation will resume its downward trends, pushing up real rates, forcing the Fed to cut.

However I reserve the right to change my opinion if we see some components of Inflation start going up again sustainably.

In summary, disinflation is seeing some bumps (we should have all expected it to), looking deeper, the components are noisy, the only thing that stands out is Shelter going down (which is great news), I think inflation continues to trend lower in the next few months. The next move by the Fed is going to be a rate cut, even if it gets delayed a little bit or if the number of rate cuts go down.

Given this setup, I thought it would be a great time to highlight some sectors and stocks that I follow which are set up to do really well in an environment where borrowing becomes cheap again.

Real Estate:

Real estate was expected to be the worst hit sector by interest rate hikes but it was not. Prices go up and down based on the demand and supply. While interest rates went up, making the overall cost of home ownership go up, real estate prices have not really cooled off as some expected. This is owing to lack of supply. America has under-built homes for a decade and a half following the subprime crisis.

Source: Axios

Fannie Mae—According to estimates reported in October 2022, the U.S. housing market is underbuilt by approximately 4.4 million units. (Source)

Zillow—In a 2023 report, Senior Economist Orphe Divounguy estimated a housing unit deficit of 4.3 million units. (Source)

What makes this worse is that even existing homes are not coming on the market anymore because the people who own those houses have locked in low interest rates for 30 years, they don’t want to lose that amazing deal and have to buy a new house in this climate where there is lack of supply and total cost of home ownership is the highest it’s been in decades.

But even though Real Estate prices have not fallen in reality, real estate equities have. Not just that, real estate equities have gone down and they’ve even recovered almost half of what they lost because real estate prices actually did not go down as much as everyone expected owing to the demand/supply issue I shared above.

So whenever the Fed starts cutting interest rates, I think Real Estate will get a bump both in actual real estate prices and in equities.

In this sector I like VICI 0.00%↑ (Specialized REITs), ABR 0.00%↑ (Mortgage REITs) & MAA 0.00%↑ (Multi-Family Residential REITs).

(These tickers are part of my core portfolio, a trade is something that I could sell if it goes up 10-20%, A core position I would hold on to for the long term)

You can read more about these pick an article I wrote on May 8th, 2023 titled Real Estate Investment - Without The Baggage.

Real Estate Adjacent:

The next sector I like is adjacent to real estate, things that usually go up when real estate is going up. It’s obvious, if people are not buying new homes, they are not buying new appliances and that is where I think WHR 0.00%↑ is a good bet. Whirlpool is currently trading at a forward P/E of 7.8 with a 6.7% dividend yield.

Whenever the Fed starts cutting rates, home sales will go up, leading to people buying new appliances which would help Whirlpool do well. The margin of safety is very high and you get paid a hefty dividend to wait for the rate cuts to come.

(Whirlpool is a trade for me. It will not be included in WealthWise Quarterly Performance Report)

Here are some quick notes on other Real Estate Adjacent stocks I thought about:

Furniture: Furniture stocks could have the same risk/reward setup as appliances. However, I am not following any furniture related stock in particular. So no tickers.

Home Improvement: Both Home Depot and Lowe’s are trading quite well and not too far away from their all time highs. This makes sense because if people can’t buy new homes, they are likely to remodel their existing homes which is also good for HD 0.00%↑ & LOW 0.00%↑ They are not particularly cheap.

Decking: I like AZEK 0.00%↑, known for using renewable materials for decking. $AZEK too is near its all time high and there is not much recovery to be had but is a good long term pick to keep an eye on.

Software: I took a position in Zillow after it crashed down below $45. However, Z 0.00%↑ has specific issues it’s dealing with - the National Association of Realtors settlement.

Renewable Energy:

Renewable Energy is one of the worst hit sectors owing to interest rate hikes (with the exception of regional banks I suppose). Just when the Solar and Wind space started to take over the world, the cost of borrowing went up drastically making it expensive for businesses as well as residentials to install renewable solutions. Installing Solar Panels at your home is very expensive and a lot of people would finance that cost but it just doesn’t make sense to do it right now, when in a year from now, you could get interest rates much lower than we have now, leading to a much cheaper installation. As such I think the renewable sector is primed to benefit from interest rate cuts. I think this sector could go up 2x, maybe even 3x, a couple of years after the Fed starts cutting.

I have written about Renewable Energy extensively. My top pick in this space is ENPH 0.00%↑. I’ve written about it here & here.

You can also consider TAN 0.00%↑ (Solar Energy ETF) and FAN 0.00%↑ (Wind Energy ETF) for a more diversified exposure. I am reevaluating my stance on FSLR 0.00%↑ after I saw the following chart on FT Climate:

Source: FT Climate (Instagram)

First Solar CEO has also made multiple comments about China Imports recently here and here.

(Enphase Energy is a core position)

Regional Banks:

Everyone knows about the Regional Bank crisis that came to light in March 2023 and for a moment, threatened to derail this market but the Fed came to the rescue. The Regional Banks have ~38% of their loan portfolios in Commercial Real Estate, which is the scariest place you can be in right now, owing to high interest rates as well as the once in a century trend change to work from home.

The longer the interest rates stay higher, the worse it is for Regional Bank as Commercial real estate loans due this year will swell to $929B.

I use DPST 0.00%↑ to trade the Regional Banks, it gives me 3X exposure to S&P Regional Banks Select Industry Index. It is rebalanced daily leading to daily decay. It is not recommended to hold leveraged ETFs for a longer period of time.

A less risky way to get exposure to regional banks but without the 3x kicker would be KRE 0.00%↑.

($DPST is a trade for me. It will not be included in WealthWise Quarterly Performance Report)

Small Caps/Non Profitable Tech:

With all the sector rotation talk, I often think to myself that this market is not about sector rotation, it is about cap size. Larger companies, regardless of sector have outperformed their mid and small cap counterparts. And this comes down to the core of higher interest rates, the inability to borrow, finance your business and in some cases run out of money and go out of business. This risk is real, making the potential upside also real.

There are some gems in small caps today that will go on to give 10x-100x returns over the next decade. It is hard to figure out which ones, obviously. If you have followed my work for a while, you will notice that I lean towards small caps. Approximately 50%+ of my exposure is in small caps. So I am very well positioned for this rotation in the market and those are my core positions that I intend to hold.

In order to trade the interest rate cuts using small caps, my preferred vehicle is TNA 0.00%↑ . It gives me 3x exposure to the Russell 2000 Index. Again owing to daily rebalancing and decay, it is not recommended to hold leveraged ETFs for a longer period of time.

You can also use IWM 0.00%↑ to get exposure to the Russell 2000 Index without the risk of leverage decay but also without the 3x kicker.

($TNA is a trade for me. It will not be included in WealthWise Quarterly Performance Report)

Borrowed Conviction Rarely Works

Past performance is no guarantee of future results.

The ideas discussed in this article should not be constituted as investment advice.

I reserve the right to change my mind if the facts change.

Disclosure: We own positions in some/all of the tickers mentioned in this article.